-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Yields Retreat Into Month End

- Treasury futures extend late session highs ahead month end, data risk.

- Balanced Fed speak, Atlanta Fed President Bostic remains "comfortable" with a patient Fed strategy

- New York Fed President Williams sees three rate cuts in 2024 a reasonable starting point

US TSYS Extending Late Session Highs Ahead Month End

- Treasury futures continued to drift higher in late trade, just off the top end of the range after the bell. Tsys curves hold steeper (2s10s +1.210 at -37.994), while trading desks noted a surge in short end Dec'23 SOFR futures, appr 200k in the minutes leading up to the bell - potential month-end funding risk related.

- Treasuries supported following a flurry of balanced Fed speak:

- While Atlanta Fed President Bostic remains "comfortable" with a patient Fed strategy to address inflation, he still expects the first rate cut this summer.

- More cautiously, NY Fed President Williams reiterated the Fed has a "ways to go to sustained 2% inflation", while Boston Fed President Collins wants greater confidence in disinflation before soften policy.

- Nevertheless, projected rate cut pricing looking steady to mildly higher at midyear vs. this morning's read: March 2024 chance of 25bp rate cut currently -2.7% w/ cumulative of -0.07bp at 5.322%; May 2024 steady at -18.4% w/ cumulative -5.3bp at 5.276%; June 2024 -55.5% from -54.5% earlier w/ cumulative cut -19.2bp at 5.137%. First full cut priced in at July w/cumulative -33.4bp at 4.995%. Fed terminal at 5.327% in Mar'24.

- Tsy Jun'24 10Y futures are trading +10.5 at 110-12, inside technicals: resistance above at 110-28+ (20-day EMA) vs. support at 109-25+ (Low Feb 23).

- Focus on tomorrow's core PCE print for January, consensus sits at 0.4% M/M and the below unrounded analyst estimates average very close to that at 0.39. Supercore PCE could come in even stronger, with two eyeing a 0.55% increase.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00067 to 5.32559 (+0.00146/wk)

- 3M -0.00191 to 5.34125 (+0.01068/wk)

- 6M -0.00562 to 5.28687 (+0.01336/wk)

- 12M -0.00052 to 5.09332 (+0.02089/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.741T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $664B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $652B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $278B

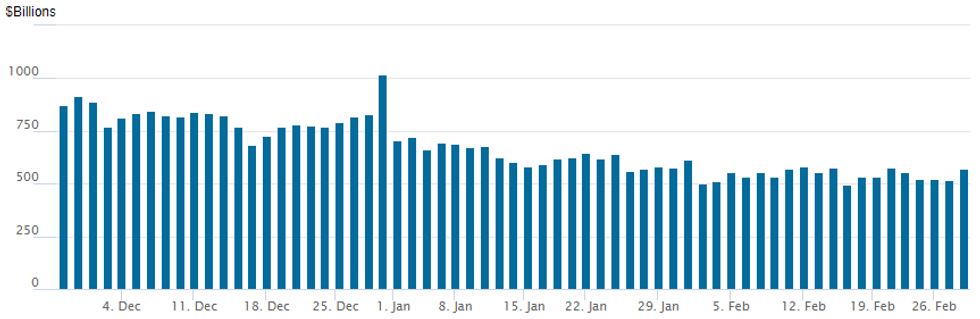

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $569.855B vs. 519.725B Tuesday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties at 87 from 84 Tuesday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

With few exceptions, SOFR option trade continued to revolve around upside call positioning for rate cuts in the latte half of the year. Lighter Treasury option volumes favored puts in 5s and 10s. Projected rate cut pricing looking steady to mildly higher at midyear vs. this morning's read: March 2024 chance of 25bp rate cut currently -2.7% w/ cumulative of -0.07bp at 5.322%; May 2024 steady at -18.4% w/ cumulative -5.3bp at 5.276%; June 2024 -55.5% from -54.5% earlier w/ cumulative cut -19.2bp at 5.137%. First full cut priced in at July w/cumulative -33.4bp at 4.995%. Fed terminal at 5.327% in Mar'24.

SOFR Options:

Block, 5,000 SFRM4 95.75/95.87 call spds, 0.5 vs. 94.91/0.05%

Block, 5,000 SFRM4 95.75/96.00 call spds, 0.5

Block, +30,000 SFRJ 94.56/94.81 put spds, 4.5 ref 94.89

+3,000 SFRM4 95.50 calls, 3.25

-7,000 0QH4 95.75 puts, 12.5 vs. 95.76/0.50%

+2,000 SFRZ4 96.00/96.50/97.00 call flys, 4.0

Block, 6,000 SFRH4 94.62 puts, 0.5 ref 94.6825

2,500 0QH4 96.12/96.25 2x3 call spds ref 95.75 to -.745

2,500 SFRM4 95.25/95.50/95.75/96.50 1x3x4x3 broken call condor ref 94.87

+5,750 SFRZ4 95.50/95.18 put spds 3x vs SFRZ4 96.00/96.75 call spds 1x 36.0 net db

+5,000 SFRJ4 94.75/94.87/94.93/95.18 call condor 2.5

Treasury Options:

-3,000 TYM4 110 straddles, 259

over 13,800 TYJ4 108 puts, 10 ref 110-05 to -05.5

5,000 TYM4 114 calls, 21 ref 110-05.5

8,800 FVM4 104 puts ref 106-25.75

-5,000 TYM4 108 puts 44

-5,000 TYJ4 110/111 strangles 108

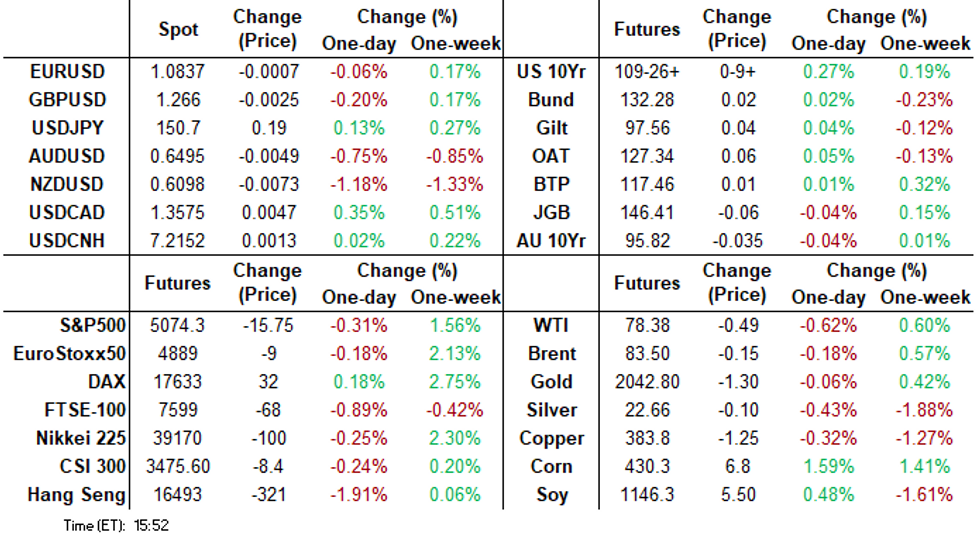

FOREX NZD Consolidates Sharp RBNZ-Inspired Losses, Greenback Pares Gains

- Wednesday’s currency moves have been dominated by the overnight decline for the New Zealand dollar, falling sharply on the back of a dovish RBNZ decision. These losses gradually extended throughout the course of the day, with NZDUSD consolidating around 1.25% lower as we approach the APAC crossover.

- The main change from the RBNZ was the more neutral tone to the meeting assessment with November’s more hawkish elements removed. The tone suggested that the RBNZ is happy with where rates are for now. Pre RBNZ the market had attached a 29% chance of a 25bp hike at today’s meeting.

- NZDUSD has breached the 0.6100 handle and traded as low as 0.6082 and could set the tone for further weakness towards the mid Feb lows near 0.6050.

- In sympathy, AUDUSD has been dragged lower by its antipodean counterpart move and the generally softer equity tone across the first half of Tuesday’s session. AUDUSD is down 0.72% to 0.6495, close to session lows and notably piercing initial support at 0.6496. An additional headwind for the AUD was the lower-than-expected January CPI outcome which came in unchanged at 3.4% y/y. With kiwi underperforming, AUDNZD is 0.55% higher at 1.0660.

- Overall, the early weakness for major equity benchmarks on Tuesday supported the USD index to the best levels of the week at 1.0424. However, as US yields edged lower throughout the session and equities recovered, the greenback has been steadily paring its gains as we approach the APAC crossover.

- The January PCE deflator (out Thursday) will be the last reading of the Fed's preferred inflation gauge before the March FOMC meeting. Before this, Australian retail sales is scheduled overnight, ahead of regional inflation data from the Eurozone, including Germany, Spain and France.

Late Equities Roundup: Narrow Lower Range Ahead Data Risk, Month End

- Stocks remain weaker, inside the session range in late Wednesday trade, cautious trade ahead Thursday's PCE data risk and month end positioning. DJIA down 136.51 points (-0.35%) at 38835.96, S&P E-Minis down 15.5 points (-0.3%) at 5074.75, Nasdaq down 93.5 points (-0.6%) at 15942.25.

- Laggers: Communication Services and Health Care sectors continue to underperform in late trade, interactive media and entertainment weighing on the former: Google -2.23%, Interpublic Group -2.21%, Match -1.77%. Equipment and services shares weighed on the Health Care sector: United Health -4.93% amid reports the Justice Dept has initiated an antitrust investigation in the company late Tuesday. Meanwhile, ResMed trades -4.17%, Align Technology -3.14%.

- Leading Gainers: Real Estate and Consumer Discretionary sectors lead gainers in late trade, hotel and specialized investment trusts supporting the former: Digital Realty +3.53%, Weyerhaeuser +3.4% while Host Hotels gained +1.93%. Meanwhile auto makers buoyed the Consumer Discretionary sector: Ford +3.08% and GM +1.94% outpacing Tesla for once, the latter +1.56%.

- Looking ahead: corporate earnings after the close include: Paramount Global, Salesforce, HP Inc, AMC Entertainment, Jazz Pharmaceuticals and Monster Beverage.

E-MINI S&P TECHS: (H4) Trend Needle Points North

- RES 4: 5183.75 3.0% Bollinger Band

- RES 3: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5142.10 2.0% 10-dma envelope

- RES 1: 5123.50 High Feb 23 and bull trigger

- PRICE: 5079.50 @ 15:40 ET Feb 28

- SUP 1: 5009.39 20-day EMA

- SUP 2: 4936.50 Low Feb 13

- SUP 3: 4896.88/4866.000 50-day EMA / Low Jan 31 and key support

- SUP 4: 4808.50 Low Jan 19

The trend condition in S&P E-Minis remains bullish and the contract is trading closer to its recent highs. The move higher continues to highlight the fact that corrections remain shallow - a bullish signal. Support to watch is 5009.39, the 20-day EMA. A clear break of this average would signal potential for a deeper retracement towards the 4936.50 support, the Feb 13 low. A resumption of gains would open vol-band based resistance at 5142.10.

COMMODITIES WTI Hindered By Stock Build, Gold Keeps Within Directional Triggers

- WTI has softened further during US hours despite a brief rebound back into positive territory. Pressure has come from another crude build in today’s EIA data.

- EIA Weekly US Petroleum Summary - w/w change week ending Feb 23: Crude stocks +4,199 vs Exp +2,563, Crude production 0, SPR stocks +743, Cushing stocks +1,458

- China’s oil demand is expected to grow by 1% this year to 764mn tons, according to a CNPC report.

- OPEC+ is expected to extend the current crude production cuts beyond 1 April according to refining industry participants in South Korea and Japan surveyed by S&P.

- Russia’s Deputy PM Alexander Novak said that it was too soon to speak on whether voluntary output cuts would be extended beyond Q1.

- WTI is -0.6% at $78.42 off a high of $79.62 which forms initial resistance before $81.70 (Fibo retrace of Sep 19 – Dec 13 bear cycle).

- Brent is -0.3% at $83.41, off a high of $84.31 which marked a short-lived step closer to resistance at $85.03 (Nov 6 high).

- Gold is +0.1% at $2032.19, recovering off earlier lows of $2024.59 as the USD has given up earlier gains along with a growing rally in Treasuries. Recent price activity has defined key resistance at $2065.5, the Feb 1 high, and key support at $1984.3, the Feb 14 low - both levels represent important short-term directional triggers.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/02/2024 | 0030/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 29/02/2024 | 0030/1130 | ** |  | AU | Retail Trade |

| 29/02/2024 | 0700/0800 | ** |  | DE | Retail Sales |

| 29/02/2024 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/02/2024 | 0700/0800 | *** |  | SE | GDP |

| 29/02/2024 | 0745/0845 | *** |  | FR | GDP (f) |

| 29/02/2024 | 0745/0845 | ** |  | FR | Consumer Spending |

| 29/02/2024 | 0745/0845 | *** |  | FR | HICP (p) |

| 29/02/2024 | 0745/0845 | ** |  | FR | PPI |

| 29/02/2024 | 0800/0900 | *** |  | ES | HICP (p) |

| 29/02/2024 | 0800/0900 | ** |  | CH | KOF Economic Barometer |

| 29/02/2024 | 0800/0900 | *** |  | CH | GDP |

| 29/02/2024 | 0855/0955 | ** |  | DE | Unemployment |

| 29/02/2024 | 0900/1000 | *** |  | DE | North Rhine Westphalia CPI |

| 29/02/2024 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 29/02/2024 | 0930/0930 | ** |  | UK | BOE M4 |

| 29/02/2024 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/02/2024 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 29/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 29/02/2024 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 29/02/2024 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/02/2024 | 1330/0830 | *** |  | CA | CA GDP by Industry & Economic Accounts Combined |

| 29/02/2024 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 29/02/2024 | 1445/0945 | *** |  | US | MNI Chicago PMI |

| 29/02/2024 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 29/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 29/02/2024 | 1550/1050 |  | US | Atlanta Fed's Raphael Bostic | |

| 29/02/2024 | 1600/1100 |  | US | Chicago Fed's Austan Goolsbee | |

| 29/02/2024 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 29/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/02/2024 | 1815/1315 |  | US | Cleveland Fed's Loretta Mester | |

| 01/03/2024 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 2330/0830 | * |  | JP | labor forcer survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.