-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

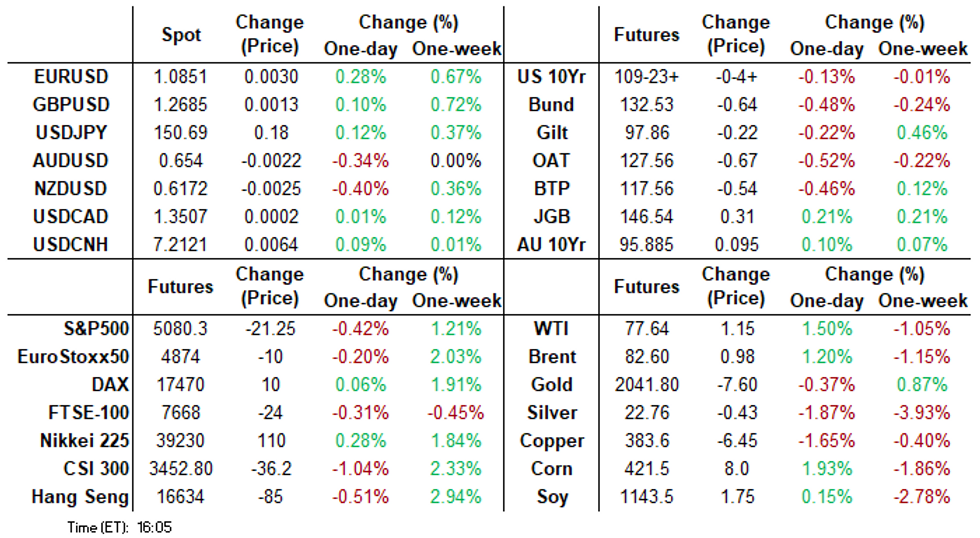

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Ylds Higher, Issuance Surge

- Treasuries under pressure all day as corporate bond issuance remains heavy

- Treasury 2Y and 5Y Note auctions both tailed

- US New Home Sales weaker than expected

US TSYS Pressured By Heavy Corporate Issuance, 2Y, 5Y Auctions Both Tailed

- Tsys holding near session lows after the bell, under pressure amid a flood of new corporate bond issuance, two Treasury coupon auctions that both tailed and mixed data.

- Treasury futures holding near recent lows after lower than expected New Home Sales (661k vs 684k est, 664k prior); MoM (1.5% vs. 3.0% est, prior down revised to 7.25 from 8.0%). There were some wild moves regionally that makes it hard to get a sense of underlying trends: northeast (72%, smallest segment), west (39%), midwest (8%), south (-16%, easily largest segment).

- Tsy futures extended lows (TYH4 -12 at 109-16) after the $64B 5Y note auction (91282CKD2) tailed: drawing 4.320% high yield vs. 4.312% WI; 2.41x bid-to-cover vs. 2.31x prior. This after after the $63B 2Y note auction (91282CKB6) drew 4.691% high yield vs. 4.687% WI; 2.49x bid-to-cover vs. 2.57x prior.

- Corporate debt issuance remained heavy with over $22B expected to price Monday.

- Mar'24 10Y currently -6 at 109-222, 10Y yield 4.2815% +.0335, curves mildly steeper vs. Fri close: 2s10s +.245 at -44.245.

- The trend direction in Treasuries remains down and the contract is trading closer to its recent lows. Price has pierced 109-17, 50.0% of the Oct - Dec bull cycle. A clear break of this retracement would strengthen the bearish condition and signal scope for an extension towards 108-19+, the 61.8% Fibonacci level.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00439 to 5.32852 (+0.00828 total last wk)

- 3M +0.00724 to 5.33781 (+0.01655 total last wk)

- 6M +0.00545 to 5.27896 (+0.04235 total last wk)

- 12M -0.00145 to 5.07098 (+0.09453 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.01), volume: $1.736T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $681B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $672B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $103B

- Daily Overnight Bank Funding Rate: 5.31% (-0.01), volume: $279B

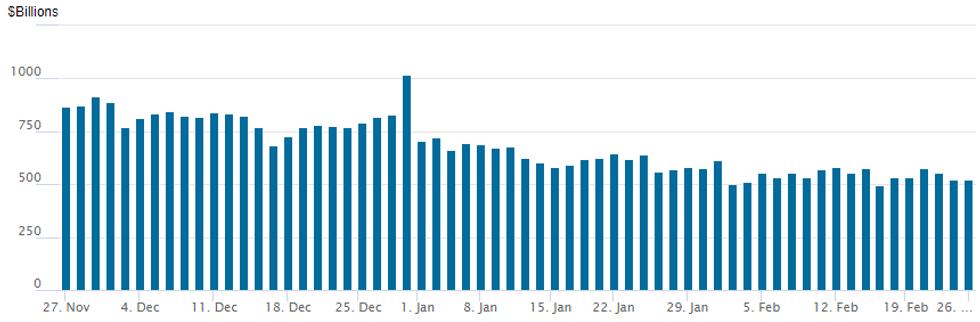

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage back up to $524.959B vs. 520.107B Friday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties at 81 from 79 Friday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

SOFR options rotated around low delta put structures Monday as underlying futures traded weaker in the short end, projected rate cut pricing receded: March 2024 chance of 25bp rate cut currently -2.0% w/ cumulative of -0.5bp at 5.324%; May 2024 at -15.0% vs. -21.2% late Friday w/ cumulative -4.2bp at 5.286%; June 2024 -53.9% from -62.6% late Friday w/ cumulative cut -17.7bp at 5.152%. Fed terminal at 5.33% in Feb'24.

- SOFR Options

- +10,000 SRU4 96.50/97.87 call spd vs 2QU4 97.37/97.75 call spd 1.75

- Block, +20,000 SFRU4 94.62/94.87/95.00/95.25 put condors, 6.75

- Block, +5,000 SFRM4 94.81/95.00 put spds 11.0 vs. 94.88/0.24%

- +5,000 SRU4 94.50/94.75/95.00 put fly 5.0

- -10,000 SFRJ4 94.68/94.87/95.37 put flys, 34.75 ref 94.88

- Block, 5,000 SFRJ4 94.56/94.75/94.94 put flys, 7.0

- Block, 5,000 SFRZ4 SFRZ4 94.87/95.12 put spds vs. SFRZ4 95.56/95.81 call spds 0.0

- Block, 10,000 SFRJ4 95.06/95.18/96.25 call trees, 1.0 net ref 94.90 (adds to 5k on Friday)

- Block, 5,000 SFRK4 94.81/94.93/95.06/95.25 call condors, cab

- 5,000 0QM4 97.00 calls ref 96.045

- Block, 2,500 SFRM4 95.25/0QM4 97.00 1x2 call spds, 6.0 vs.

- Block, 2,500 SFRU4 95.68/95.75/96.75 1x1x1 call flys, 9.5

- +5,000 SFRK4 94.81/94.93/95.06/95.25 call condor 3.25

- +5,000 2QU4 97.00/97.375 call spd, 6.75/splits

- Treasury Options:

- +5,000 TY Wk1 111.25 calls 8

- +5,000 TY Wk1 109.5/111.25 call over risk reversal, 5

- +5,000 TY Wk2 109.25/109.75/110.25 put tree, 1

- +3,000 TYJ4 110.5/111.5 call spd v 109.5 put, 2

EGBs-GILTS CASH CLOSE: Steady Sell-Off To Start The Week

Bund and Gilt yields rose steadily throughout Mondays session to finish sharply higher, reversing Friday's drop.

- In trading reminiscent of late last week, there was little evident catalyst that could be identified for the upward yield move, which was in orderly fashion intraday but decidedly bearish.

- With little new on the central bank speaker front (Lagarde reiterated January's guidance; dove Stournaras again eyed June for first cut), and no important data, focus appeared to be on issuance dynamics including French and Slovak syndication announcements, and a front-loaded US Treasury auction calendar.

- End-2024 implied ECB and BoE rates rose by 7bp on the day (now implying 93bp of cuts) and 6bp (64bp of cuts), respectively.

- Bunds underperformed their UK counterparts, though 10Y Gilt yields closed at their highest since early December. Periphery spreads closed marginally wider to Bunds.

- Tuesday sees an appearance by BoE's Ramsden, with ECB money supply data out as well. The focus of the week will be February flash inflation on Thursday-Friday - MNI's preview was published today (PDF here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.1bps at 2.924%, 5-Yr is up 8.1bps at 2.454%, 10-Yr is up 7.8bps at 2.441%, and 30-Yr is up 8.2bps at 2.575%.

- UK: The 2-Yr yield is up 5.6bps at 4.312%, 5-Yr is up 6.4bps at 4.044%, 10-Yr is up 5.7bps at 4.162%, and 30-Yr is up 3.8bps at 4.637%.

- Italian BTP spread up 1.5bps at 145.2bps / Spanish bond spread up 0.4bps at 89.3bps

EGB Options: Mostly Upside Structures Favoured Monday

Monday's Europe rates/bond options flow included:

- RXJ4 132.5/131.00ps vs 133.50/135.00cs, sold the ps at 26 in 1.8k

- ERJ4 96.50/96.75/96.87c fly 1x3x2 sold at 1.75 in 5k

- ERM4 96.50/96.62/96.75/96.87 call condor vs 96.00 puts. Paid 0.25 for the package (buying the call condor and selling the puts). Done in 20K

- ERM4 96.50/96.62 call spread 15K given at 2.5

- ERM4 96.50/6.75/97.00c fly, bought for 2.5 in 3k

- ERM4 96.37/50/62 call fly paper paid 1.25 on 13K

- ERM4 96.50/96.75cs 1x2, bought the 1 for 0.75 in 2.5k

- ERU4 96.87/97.25/97.37/97.75c condor vs 96.50p, bought the put for 8.75 in 16.5k

- ERZ4 97.25/97.37cs vs 96.62/96.50ps, bought the cs for 0.75 in 10k

- 0RM4 97.62/97.87/98.12c ladder, bought for 1.75 in 5k

FOREX USD Losses Trimmed, USDJPY Stops Short Of 2024 High With Japan CPI Eyed

- The USD has seen a day of two halves, slipping through European hours and into the early part of the US session, before a EGBs-led climb in Treasury yields helped support the USD index to limit the day’s losses to -0.1%.

- AUD and NZD are clearly bottom of the G10 FX pack today, pulling back after last week’s gains, and especially so NZD as focus turns to the Feb 28 RBNZ decision.

- JPY has also come under pressure amidst that yield backdrop, but USDJPY topped out at 150.84 as it met resistance at the 2024 high of 150.89. Our technical analyst has noted that the trend outlook for the pair remains bullish and the latest pause appears to be a bull flag formation. A break of the early '24 peak would expose the Nov '23 highs and increase the risk of intervention out of Tokyo. Recent moves have triggered increased vigilance and comments on the part of the Japanese authorities.

- At the other end of the spectrum sits the EUR, owing to the larger sell-off in EGBs, and by extension SEK, the latter holding up well considering the reversal of earlier strength in equity futures.

- Ahead, Japan CPI headlines the Asia Pac session whilst KC Fed’s Schmid (’25 voter) is still to come for potentially his first monetary policy relevant comments since being appointed in August. After that, US durable goods orders land before the Conference Board’s consumer survey including its closely watched labor differential after it increased strongly ahead of the January blowout payrolls report.

EXPIRY

- FX OPTION EXPIRY for Tuesday 27th February

- EURUSD: 1.0800 (1.14bn), 1.0805 (507mln), 1.0810 (396mln), 1.0840 (642mln), 1.0850 (594mln), 1.0855 (372mln), 1.0875 (241mln), 1.0900 (312mln), 1.0910 (687mln), 1.0925 (731mln).

- GBPUSD: 1.2645 (275mln), 1.2650 (1.01bn).

- USDJPY: 150.00 (1.2bn), 150.20 (696mln), 151.00 (782mln).

- USDCAD: 1.3550 (500mln).

- AUDUSD: 0.6545 (257mln), 0.6550 (501mln), 0.6595 (889mln), 0.6600 (2.12bn).

- Of note:

- AUDUSD 3bn at 0.6595/0.6600 (Tue)

- USDJPY 1.2bn at 150.00 (Tue)

- GBPUSD 1.28bn at 1.2645/1.2650 (Tue)

- EURUSD 4.53bn at 1.0850/1.0865 (Wed)

- USDJPY 1.79bn at 151.00 (Wed)

- USDCNY 1.48bn at 7.2000 (Thu)

Late Equity Roundup: Nasdaq Holds Modest Bid

- Off second half lows, stocks are looking mildly weaker for the most part, Nasdaq still outperforming: Nasdaq up 12.8 points (0.1%) at 16009.48, DJIA down 19.13 points (-0.05%) at 39112.1; S&P E-Minis down 11.75 points (-0.23%) at 5089.5.

- Leading Gainers: Information Technology and Consumer Discretionary sectors continued to outperform in late trade, chip stocks supported the IT sector as they rebounded from Friday sell pressure: Micron +5.3%, Applied Materials +2.96%, KLA Corp +2.4%. Auto makers buoyed the Consumer Discretionary sector: Tesla +4.07%, while GM gained +0.63%.

- Laggers: Utilities and Communication Services sectors underperformed in late trade, multi- and independent energy providers weighed the former: PG&E -3.55%, Dominion Energy -3.26%, Alliant Energy -3.06%. Interactive media and entertainment shares weighed on the Communication sector: Google -3.76%, Live Nation -2.94%, Charter Communications -2.47%.

- Looking ahead: corporate earnings after the close include: AES, SBA Communications, iRobot, Zoom Video and Everbridge Inc.

E-MINI S&P TECHS: (H4) Northbound

- RES 4: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5163.51 3.0% Bollinger Band

- RES 2: 5133.43 2.0% 10-dma envelope

- RES 1: 5123.50 High Feb 23 and bull trigger

- PRICE: 5088.25 @ 1500 ET Feb 26

- SUP 1: 4992.55 20-day EMA

- SUP 2: 4881.14/4866.000 50-day EMA / Low Jan 31 and key support

- SUP 3: 4702.00 Low Jan 5

- SUP 4: 4594.00 Low Nov 30

The trend condition in S&P E-Minis remains bullish following last week’s gains. The move higher continues to highlight the fact that corrections remain shallow - a bullish signal. Support to watch is 4992.55, the 20-day EMA. A clear break of this EMA would signal potential for a deeper retracement towards the 4866.00 key support, Jan 31 low. A resumption of gains would open vol-band based resistance at 5133.43.

COMMODITIES: WTI Eats Into Friday’s Slide, Gold Sits Between Important Directional Triggers

- WTI has seen robust gains during US hours as it continued to claw back the steep losses on Friday. Further Houthi attacks in the Red Sea, coupled with a strong physical market in the US and earlier disruption in Libya have added support during the day.

- Venezuela’s reversal in its rapprochement with the US – which had brought sanctions relief on the oil industry– is driven by faltering domestic support for Maduro, Reuters said.

- The US flagged, owned and operated oil/chemical tanker M/V Torm Thor was targeted by the Houthi's on February 24.

- Libya’s ~45kbd Wafa field has resumed shipments following a short halt on Sunday after staff demanded better pay according to a Bloomberg source.

- The US Energy Department is seeking 3m bbl of sour crude for the SPR for August delivery, according to a notice Feb. 26.

- WTI is +1.5% at $77.63 and Brent is +1.2% at $82.59, both retracing a large part of Friday’s slide having remained above support at $75.25 and 80.53 respectively (both 50-day EMAs).

- Gold is -0.3% at $2029.25, pulling further back from Friday’s spike to $2041.37 despite net USD index weakness on the day. Recent price activity has defined key resistance at $2065.5, the Feb 1 high, and key support at $1984.3, the Feb 14 low - both levels represent important short-term directional triggers.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/02/2024 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 26/02/2024 | 0040/1940 |  | US | Kansas City Fed's Jeff Schmid | |

| 27/02/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 27/02/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/02/2024 | 0900/1000 | ** |  | EU | M3 |

| 27/02/2024 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/02/2024 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 27/02/2024 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 27/02/2024 | 1340/1340 |  | UK | BOE's Ramsden at Association for Financial Markets | |

| 27/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/02/2024 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/02/2024 | 1405/0905 |  | US | Fed Vice Chair Michael Barr | |

| 27/02/2024 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/02/2024 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 27/02/2024 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 27/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.