-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Ylds Surge, Strong Retail Sales

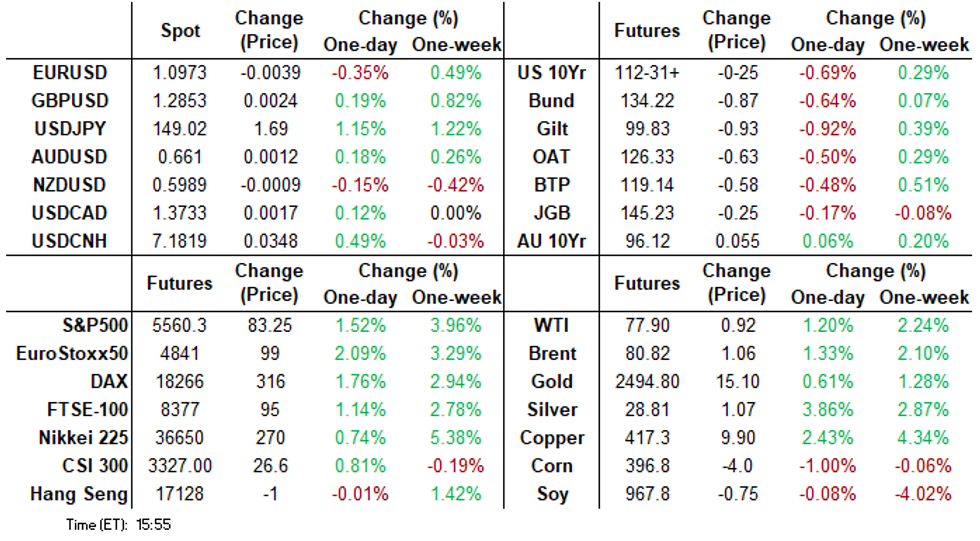

- Treasuries reset to lower levels following Thursday morning's better than expected Retail Sales data.

- Additional off-consensus data included weaker than expected weekly jobless claims, a drop in Philly Fed Business Outlook, higher Import/Export prices and lower than expected Industrial production.

- Yields maintained a narrow range after gapping higher, curves bear steepened as rate cut projections receded.

- Equities took the whole of the data positively, S&P Eminis climbing back to early August levels.

US TSYS Retail Sales Pickup Tempers Rate Cut Projections

- Treasuries gapped lower following better than expected Retail Sales this morning, trading sideways near lows through the balance of the session as markets digested the flood of additional data.

- Decent volumes (TYU4 >2M, FVU4 >1.5M) as Sep'10Y futures trade 113-00 (-25) vs. 112-25.5 low, above technical support of 112-11 (20-Day EMA); curves bear flattened 2s10s -5.320 at -18.007.

- Projected rate cuts through year end moderated vs. earlier pre-data levels (*): Sep'24 cumulative -31.8bp (-35.2bp), Nov'24 cumulative -62.0bp (-69.6bp), Dec'24 -93.5bp (-104.1bp).

- July's advance retail sales report showed that the recent unexpected pickup in consumer momentum continues. June retail sales came in well above expectations at 1.0% M/M (0.4% expected, -0.2% prior rev from 0.0%).

- Initial jobless claims surprised lower for the second consecutive week with a seasonally adjusted 227k (cons 235k) in the week to Aug 10 after a marginally upward revised 234k (initial 233k).

- Import prices were stronger than expected in July as they increased 0.1% M/M (cons -0.1) after 0.0%, with non-oil import prices also a little stronger than expected at 0.2% M/M (cons 0.1).

- Industrial production fell by more than expected in July, at -0.64% M/M (cons -0.3) along with a downward revised 0.3% (initial 0.6) in June and 0.8% (initial 0.9) in May.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00293 to 5.34157 (+0.00805/wk)

- 3M +0.00602 to 5.10155 (-0.01114/wk)

- 6M +0.00234 to 4.78062 (-0.02535/wk)

- 12M -0.01283 to 4.28661 (-0.06947/Wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (-0.01), volume: $2.108T

- Broad General Collateral Rate (BGCR): 5.32% (-0.02), volume: $801B

- Tri-Party General Collateral Rate (TGCR): 5.32% (-0.02), volume: $781B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $99B

- Daily Overnight Bank Funding Rate: 5.32% (-0.01), volume: $247B

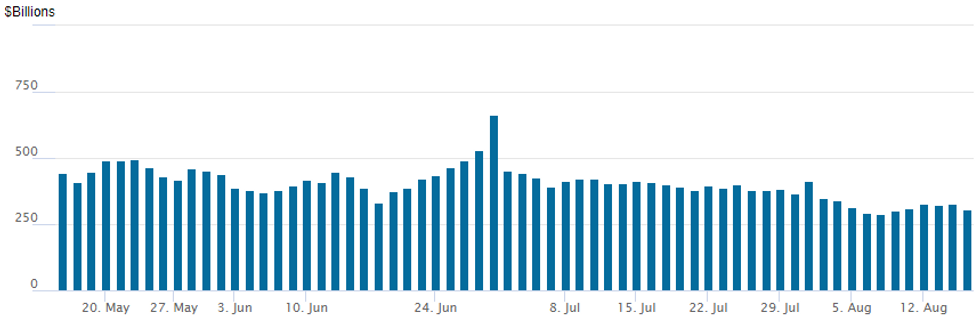

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes up to $307.141B from $328.472B Wednesday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties slip to 63 from 66 prior.

US SOFR/TREASURY OPTION SUMMARY

Heavy SOFR/Treasury option volume in downside puts reported Thursday as underlying futures reset lower after flood of economic data, focus on better than expected Retail Sales. Tsy curves bear flattened while projected rate cuts recede vs. earlier pre-data levels (*): Sep'24 cumulative -31.8bp (-35.2bp), Nov'24 cumulative -62.0bp (-69.6bp), Dec'24 -93.5bp (-104.1bp).

- SOFR Options:

- +4,000 SFRZ4 95.12/95.25/95.50/95.56 put condor 2.0 ref 95.665

- +10,000 SFRZ4 96.50/96.62/96.75 call flys 0.625 ref 95.665

- -4,000 SFRU4 95.12/95.18/95.25/95.31 call condors, 0.75 ref 95.055

- +12,000 SFRZ4 95.62/95.75/95.87 call flys 1.0 ref 95.67

- Block, 5,500 SFRZ4 95.87/96.00 call spds, 2.5

- -5,000 SFRQ4 95.06 puts 2.25 ref 95.045

- -5,000 SFRU4 94.87/95.00 put spds 3.0 ref 95.05

- -5,000 SFRZ4 95.50 calls 26.0-25.5 ref 95.655

- +3,000 2QX4 97.25/97.75 2x3 call spds 10.0 ref 96.80

- -5,000 SFRZ4 9537/9550 2x1 put spds 1.0 ref 95.68

- +6,000 SFRU4 95.50 calls vs SFRZ4 97.00/98.00 call spds 1

- +20,000 SFRZ4 95.50/95.62/95.75 call flys, .62 ref 95.67 to -.665

- BLOCKs 27,500 SFRU4 95.12/95.25 call spds 2.5 ref 95.11 -- open interest over 310k in both of the strikes

- -20,000 SFRZ4 96.00/96.50/97.00/97.50 call condors, 6.5 ref 95.79

- Block, 15,000 SFRX4 95.06/95.18 put spds, 0.5 ref 95.79

- Block/screen over 10,800 SFRQ4 95.06 puts, .75 last

- 3,000 0QQ4 96.56/96.62 put spds ref 96.755

- 3,000 SFRX4 96.00/96.18/96.37 call flys

- 6,200 0QZ4/3QZ4 96.75 put spds, 4.0-4.5

- 4,100 SFRZ4 95.81 calls

- 2,700 SFRZ4 95.31/95.43/95.56 put flys

- over 8,100 SFRZ4 95.62 puts ref 95.785

- 4,000 SFRZ4 95.43 puts, 0.5 ref 95.785

- 2,000 SFRU4 95.18/95.31/95.43 call flys ref 95.105

- 6,000 SFRU4 95.12/95.25 call spds

- Treasury Options:

- 5,000 TYU4 112/112.5 put spds, 8 ref 112-30

- 2,000 TYV4 109/111/113 put flys ref 113-13

- over 55,000 TYV4 113.5 puts 58 ref 113-17.5

- +15,000 wk3 TY 113.75 calls, 12

- 3,000 FVU4 109.5/110.5 call spds vs. 108.5 puts ref 109-05.75

- 1,500 TYX4 111/112.5/114 put flys ref 114-05.5

- 4,800 TYU4 114.75 calls ref 113-19.5

- 6,000 TYV4 112.5 puts, 20 ref 114-05.5

- 4,400 TYU4 115 calls, 4 ref 113-20.5

EGBs-GILTS CASH CLOSE: Robust US Data Sees Bund/Gilt Yields Jump

European yields jumped Thursday after strong US economic data cast fresh doubt on the global rate cut narrative.

- The session started in relatively subdued fashion, with modest overnight weakness in futures, interrupted by a slight uptick after a broadly in-line UK GDP release with softer underlying details.

- The Assumption Day holiday limited EGB trading volumes.

- But Bunds and Gilts turned sharply lower in early afternoon trade on stronger-than-expected US retail sales and jobless claims data, pushing yields higher across the curves and reducing 2024 implied ECB/BoE rate cuts by a few basis points.

- The German curve bear flattened, with the UK's more mixed with underperformance in the belly. Periphery EGB spreads tightened slightly on the day, as equities rallied (Eurostoxx futures +2%).

- A busy week in UK data concludes Friday with Retail Sales, while the Eurozone calendar remains light.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 10.6bps at 2.46%, 5-Yr is up 10.3bps at 2.195%, 10-Yr is up 8.3bps at 2.263%, and 30-Yr is up 5.9bps at 2.482%.

- UK: The 2-Yr yield is up 8.7bps at 3.653%, 5-Yr is up 10.1bps at 3.718%, 10-Yr is up 9.8bps at 3.923%, and 30-Yr is up 7.8bps at 4.48%.

- Italian BTP spread down 1.5bps at 136.9bps / Spanish down 1.3bps at 82.7bps

EGB Options Many Sonia Call Flies Bought Thursday

Thursday's Europe rates/bond options flow included:

- RXU4 134/133.50ps, bought for 7 in 7k

- RXV4 131.5/130ps, bought for 15 in 1.5k

- ERH5 97.75/98.00cs, bought for 4.25 in 5k

- SFIQ4 95.15/95.25/95.35c fly, trades for 6 in 5k.

- SFIX4 95.30/95.50/95.70c fly, bought for 6.25 in 2k

- SFIX4 95.50/95.60/95.70c fly, bought for 1 in 2k

- SFIX4 95.40/95.55/95.70c fly, bought for 3.5 in 2k

FOREX USDJPY Rises Above Pre-NFP Levels Amid Higher Yields/Equities

- Better-than-expected US retail sales and jobless claims data provided a strong boost to global equity benchmarks on Thursday. Furthermore, higher core yields as Fed easing bets were trimmed weighed heavily on the Japanese Yen, with USDJPY erasing the entire post-NFP inspired sell-off.

- USDJPY has risen 1.15% on the session and in the process, bridged the gap to 149.01, levels last traded before US employment data on August 02. This extends the pair’s recovery to around 5.15% as the market prices out the likelihood of a 50bp FOMC cut in September.

- The strong risk-on impulse was most notable for crosses such as GBPJPY and AUDJPY, that are nearing 1.5% advances on the day. In similar vein, EURJPY has risen 0.85%, and a close at current or higher levels would mark a breach of key resistance at the 20-day EMA (163.59) and narrows the gap with 164.11 - the 200-dma which has acted as solid support/resistance on several sessions in recent history - most notably across November and December last year.

- Elsewhere, similar dynamics filtered through to Swiss Franc weakness, with USDCHF rising 0.85% and also bridging the gap to pre-NFP levels.

- For major pairs, GBPUSD’s climb undermines the recent bearish theme and price remains above the 20-day EMA - at 1.2807. A continuation higher would highlight a stronger reversal and signal scope for a climb towards 1.2955, a Fibonacci retracement. Key support has been defined at 1.2665, the Aug 8 low, where a break is required to once again resume recent bearish activity.

- RBA and RBNZ Governors may speak overnight before UK retail sales data is due Friday. In the US, building permits and UMich sentiment data will close out the week.

Late Equities Roundup: Extending Session Highs

- Stocks continued to march higher late Thursday, led by strong gains in Consumer Discretionary and Information Technology sector shares following this morning's better than expected Retail Sales data.

- Currently, the DJIA trades up 531.71 points (1.33%) at 40540.67, S&P E-Minis up 90 points (1.64%) at 5566.25, Nasdaq up 399.2 points (2.3%) at 17591.49.

- Rebounding from midweek selling, autos, broadline retailers and apparel stocks continued to buoy the Consumer Discretionary sector in lat etrade: Ulta Beauty +12.17% after Berkshire Hathaway announced a new stake in the company, Tesla +6.28%, Lululemon +6.94%. Of note, Walmart surged 7.0% after beating earnings estimates, climbing to a new highs over 76.60.

- Semiconductor makers continued to support the IT sector: ON Semiconductor +7.5%, Micron +7.14%, Enphase +6.91%, with a broad swath of stocks from Applied Materials to Qualcomm +3.5-5% after noon.

- On the flipside, Utilities and Real Estate sector shares continued to underperform in late trade, electricity/multi-energy shares weighing on the former: Eversource -2.23%, Consolidated Edison -1.55%, Evergy -0.91%. Specialized and health care REITs weighed on the Real Estate sector: American Tower -2.20%, Welltower -1.22%, Equinix -1.21%.

E-MINI S&P: (U4) Trades Through The 50-Day EMA

- RES 4: 5721.25 High Jul 16 and Key resistance

- RES 3: 5664.00 High Jul 18

- RES 2: 5579.35 76.4% retracement of the Jul 16 - Aug 5 bear leg

- RES 1: 5567.25 Intraday high

- PRICE: 5566.75 @ 1435 ET Aug 15

- SUP 1: 5319.50 Low Aug 9

- SUP 2: 5182.0/5120.00 Low Aug 8 / 5 and the bear trigger

- SUP 3: 5092.00 Low May 2

- SUP 4: 5020 Low Apr 19 and a key support

Short-term gains in S&P E-Minis are - for now - considered corrective. However, Tuesday’s strong rally delivered a print above the 50-day EMA, at 5454.71. A clear break of this average would undermine the recent bearish theme and instead signal scope for a stronger recovery. This would open 5579.35, a Fibonacci retracement. A reversal lower would refocus attention on the bear trigger at 5120.00, the Aug 5 low.

COMMODITIES: Crude Futures Rebound, Gold Edges Back Towards Bull Trigger

- Crude prices have risen on Thursday, with WTI futures roughly 1.5% higher on the session. The gains eat into a solid chunk of yesterday’s decline, driven by an unexpected US crude inventory build. A lack of progress in Gaza ceasefire talks, and gains in US equities have further supported the recovery.

- A continuation higher would signal scope for a climb towards $80.77, a Fibonacci retracement. Clearance of this level would open $83.58, the Jul 5 high.

- For natural gas, Henry Hub has reversed course and moved into losses, erasing its earlier spike following EIA data showing the first summer draw in gas inventories in eight years.

- In precious metals, the broad dollar strength in the aftermath of stronger US data had a very brief negative impact on the yellow metal. Spot gold swiftly recovered and is moderately higher on the session.

- Attention remains on $2483.7, the Jul 17 high and a bull trigger. Clearance of this hurdle would resume the technical uptrend.

- Elsewhere, Iron ore futures rose 1.5% after previously hitting the lowest level since 2022 on concern that global supply is running ahead of demand, with China’s steelmakers mired in a crisis and cutting output just as major miners boost exports. Futures had sunk for four consecutive days in Singapore, falling below $94 a ton, as data from China showed mills reduced steel production to about 83 million tons last month, 9% lower than a year earlier.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/08/2024 | 0600/0700 | *** |  | UK | Retail Sales |

| 16/08/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 16/08/2024 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/08/2024 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/08/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/08/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 16/08/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 16/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.