-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: UK Mini-Budget Reversal

HIGHLIGHTS

- MNI: LIZ TRUSS ISN'T RESIGNING AS PRIME MINISTER: SPOKESMAN BLAIN

- CHINA DELAYS 3Q GDP DATA RELEASE; GIVES NO NEW SCHEDULE, Bbg

- GERMANY TO EXTEND LIFETIME OF ALL THREE NUCLEAR POWER PLANTS, Bbg

- Credit Suisse Is Said to Begin Sale of US Asset Management Arm, Bbg

US TSYS: Bonds Reverse Early UK-Tied Support

Tsy yield curves running steeper after the bell, short end outperforming, long end finishing near late session lows on modest volumes (TYZ2<1M). Market continues to weigh impact of reversal nearly all measures from UK 23 September mini-budget this morning.

- Officials say that PM Truss is not resigning and that there are 'no plans' to change the windfall tax on energy. Comes as four Conservative MPs have now openly called for Truss to go.

- Bonds lead the reversal off early session highs - no obvious headline driver. Any react to weaker-than-expected headline Empire number (-9.1 vs -4.3 survey and -1.5 prior) lost in the early morning shuffle.

- Data focus turns to IP/Cap-U, Net TIC flows on tap Tuesday.

- US Tsy auctions: No supply Tuesday.

- Fed speakers resume Tuesday:

- Atlanta Fed Bostic, mediated virtual discussion, no text at 1400ET

- MN Fed Kashkari on economy, moderated Q&A at 1730ET

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00528 to 3.06086% (-0.01043 total last wk)

- 1M +0.03686 to 3.47986% (+0.12943 total last wk)

- 3M +0.03286 to 4.22657% (+0.28814 total last wk) * / **

- 6M -0.01158 to 4.67371% (+0.30058 total last wk)

- 12M +0.02930 to 5.31244% (+0.28685 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.19371% on 10/14/22

- Daily Effective Fed Funds Rate: 3.08% volume: $110B

- Daily Overnight Bank Funding Rate: 3.07% volume: $287B

- Secured Overnight Financing Rate (SOFR): 3.04%, $958B

- Broad General Collateral Rate (BGCR): 3.00%, $387B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $370B

- (rate, volume levels reflect prior session)

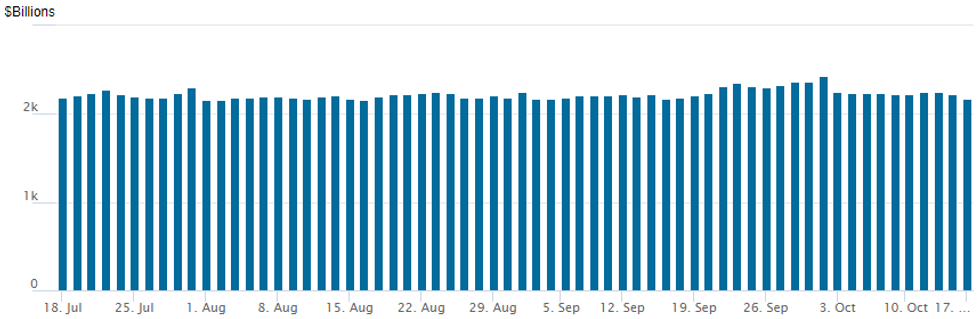

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,172.301B w/ 98 counterparties vs. $2,222.052B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option trade petered out in the second half, overall trade mixed/consolidative as support in long end underlying evaporated. Notable vol structure in SOFR options included large March/June/Sep strangle spd strip

- SOFR Options:

- Large strangle Block package:

- -10,000 SFRH3 94.75/95.75 strangles, 30.0

- +10,000 SFRH3 94.50/95.50 strangles, 29.0

- -10,000 SFRM3 94.75/95.75 strangles, 55.0

- +10,400 SFRM3 94.50/95.50 strangles, 54.5, 0.5 cr

- -10,000 SFRU3 94.25/95.75 strangles, 64.0 vs

- +10,000 SFRU3 94.50/96.00 strangles, 63.5, 0.5 cr

- Block, 10,000 SFRH3 96.25 calls, 6.0 ref 95.12

- 20,000 SFRH3 96.25/96.75 put spds

- +15,000 SFRZ2 95.62 calls, 5 vs. 95.35/0.22%

- Block, 6,000 SFRF3 94.75/95.00/95.25 put flys, 4.25 net

- 7,500 short Nov 96.25/96.75/97.00 broken call flys vs.

- short Jan 96.50/97.50/98.00 broken call flys

- Block, 8,000 SFRX2 95.25/95.50 put spds, 13.5

- Eurodollar Options:

- 20,000 Mar 96.25/96.75 Put spds

- Treasury Options:

- +2,500

- Block, 7,500 TYX2 109.25 puts, 7, 5k more on screen

EGBs-GILTS CASH CLOSE: Rally As UK Gov't Follows Through With U-Turn

The UK curve saw massive bull flattening Monday, with Gilts easily outperforming their global counterparts as the government followed through with the anticipated "U-turn" on its fiscal programme.

- 10Y Gilt yields saw the 2nd biggest drop since 1992 (only September 28th's 49bp drop surpassed it).

- Terminal BoE pricing fell by over 50bp (now seen around 5.1-5.2% in mid-2023, vs 100bp above that as recently as late September).

- German yields saw a solid drop with bull flattening as well, but unremarkable in comparison with the UK move.

- Periphery EGB spreads mostly narrowed in a risk-on session.

- ECB's Nagel speaks after the market close.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 0.2bps at 1.954%, 5-Yr is down 3.4bps at 2.08%, 10-Yr is down 7.7bps at 2.269%, and 30-Yr is down 10.5bps at 2.294%.

- UK: The 2-Yr yield is down 32.7bps at 3.589%, 5-Yr is down 37.6bps at 3.942%, 10-Yr is down 35.8bps at 3.977%, and 30-Yr is down 40.6bps at 4.378%.

- Italian BTP spread down 5.6bps at 238.8bps / Greek up 6.9bps at 267bps

EGB Options: Mixed German Trade To Start The Week

Monday's Europe rates / bond options flow included:

- OEZ2 117.0/114.5 1x2 put spread vs OEX2 118.5 put bought for 7.5/8 in 2.3k

- OEZ2 117.50/115.50 put spread in 3.5k sold at 40/40.5/42.5

- RXZ2 137/134 put spread vs 143 call bought for 30 in 1.25k

Late Equity Roundup, Holding Late Session Highs

US stocks finishing near late session highs, holding relatively narrow range since midmorning while Tsy futures trade mixed/near session lows. Consumer Discretionary and Consumer Services sectors leading the rally. Currently, SPX eminis trade +89.5 (2.49%) at 3687; DJIA +538.23 (1.82%) at 30174.27; Nasdaq +333.8 (3.2%) at 10655.82.

- SPX leading/lagging sectors: Consumer Discretionary (+4.32%) leads w/ auto-makers outperforming: Tesla (+6.77%) bouncing back from heavy selling last Friday, GM (+2.25%); Communication Services follow (+3.82%) as media & entertainment outperform telecom services. Laggers: Consumer Staples (+1.36%), Health Care (+1.68%) and Energy (+1.55%) underperformed.

- Dow Industrials Leaders/Laggers: Microsoft (MSFT) more than makes up for Fri's sell-off , trades +9.26 at 237.82; Goldman Sachs (GS) announces earnings tomorrow +5.96 at 305.95, United Health (UNH) +7.47 at 520.60. Laggers: Walgreens Boots (-0.08) at 33.16. Dow Inc (+0.39) at 45.50; Intel (INTC) +0.51 at 26.42.

E-MINI S&P (Z2): Remains Above Last Week’s Low

- RES 4: 4023.44 61.8% retracement of the Aug 16 - Oct 13 downleg

- RES 3: 3923.88 50.0% retracement of the Aug 16 - Oct 13 downleg

- RES 2: 3856.33 50-day EMA

- RES 1: 3724.56/3820.00 20-day EMA / High Oct 5

- PRICE: 3656.75 @ 14:23 BST Oct 17

- SUP 1: 3502.00 Low Oct 13 and the bear trigger

- SUP 2: 3491.13 50.0% retracement of the 2020 - 2022 bull cycle

- SUP 3: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3388.70 1.764 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis are firmer today. A volatile session last Thursday resulted in a strong bounce from the day low as well as the trend low of 3502.00. The recovery suggests that the contract has entered a corrective phase and if correct, this will allow an oversold trend condition to unwind. Attention is on 3724.56, the 20-day EMA. A break would reinforce a bullish theme and open 3820.00, the Oct 5 high. Key support and the bear trigger lies at 3502.00.

COMMODITIES: Oil Consolidates Whilst Gas Slides As EU Looks At Crisis Measures

- Crude oil dips in what is broad consolidation of Friday’s sharper slide on demand fears.

- Germany is extending the life of its remaining nuclear plants, both the EU and White House don’t expect an Iran nuclear deal coming soon, a survey from law firm Haynes & Boone notes banks are less eager to lend to oil companies than six months ago and President Bolsonaro has said Brazil should refine oil for its self sufficiency in five to six years.

- WTI is -0.5% at $85.20 having fleetingly cleared support at $84.94 (50% retrace of Sep 26 – Oct 10 rally) to open $82.89 (61.8% retrace).

- Brent is -0.4% at $91.29 having also fleetingly cleared support at $91.08 (Oct 13 low) to next open $90.59.

- Gold is +0.44% at $1651.77 with support remaining at $1640.2 (Oct 14 low) and resistance at $1684.0 (Oct 11 high).

- EU natural gas prices meanwhile fell -10% as the EU prepares measures to curb volatility with additional help from mild weather, a steady inflow of liquefied natural gas and high winter stockpiles.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/10/2022 | 0030/1130 |  | AU | RBA policy meeting minutes | |

| 18/10/2022 | 0800/1000 |  | IT | Trade Balance | |

| 18/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/10/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/10/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 18/10/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/10/2022 | 1600/1800 |  | EU | ECB Schnabel Alumni Event at Uni Mannheim | |

| 18/10/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/10/2022 | 2000/1600 | ** |  | US | TICS |

| 18/10/2022 | 2130/1730 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.