-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Wkly Claims Sets Stage for Fri PCE

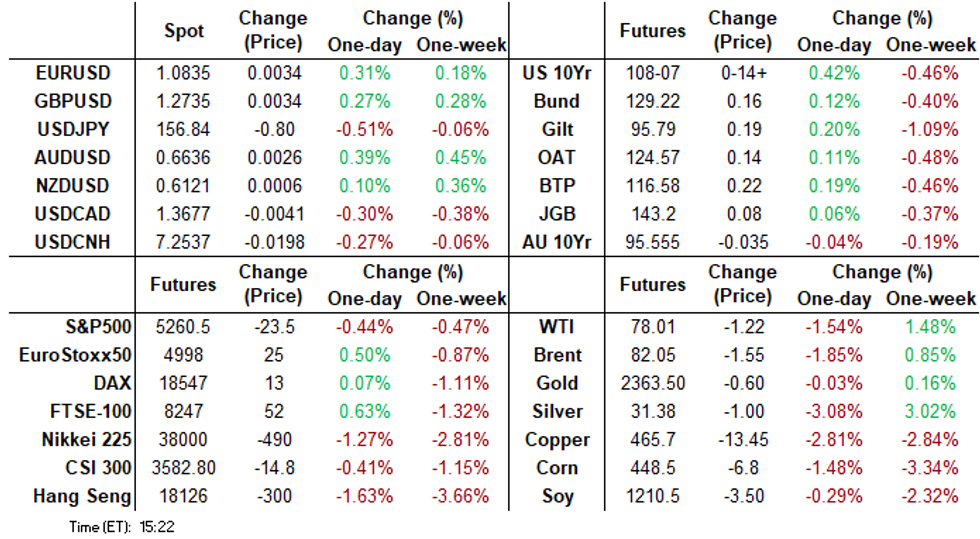

- Treasuries finish higher Thursday, near highs after higher than expected weekly jobless claims triggered rebound off midweek lows.

- Position squaring ahead Friday's key PCE data reported while month end duration extension expected to lend further support on Friday.

- Fed-speak leaned dovish as Atlanta Fed President Bostic (unscheduled) expects the pace of economic growth to slow, while a rate hike isn't necessary to reach 2Y goal.

US TSYS Off Midweek Lows, Higher Weekly Claims Sets Stage for Friday PCE

- Treasuries finish higher Thursday, near highs after higher than expected weekly jobless claims triggered rebound off midweek lows.

- Treasury futures extend gains after weekly claims comes out a little higher than expected at 218k vs. 217k est (prior revised to 216k from 215k), continuing claims lower than expected at 1.791M vs. 1.796M est (prior down-revised to 1.797M from 1.794M). GDP in-line at 1.3% while Personal Consumption slips to 2.0% from 2.5% prior (2.2% est).

- Treasury futures holding near early session highs after weaker than expected Pending Home Sales: MoM -7.7% vs. -1.0 est (3.4% prior revised to 3.6%), YoY -0.8% vs. -2.0% est (-4.5% revised to -4.4%).

- Fed-speak leaned dovish as Atlanta Fed President Bostic (unscheduled) expects the pace of economic growth to slow, while a rate hike isn't necessary to reach 2Y goal.

- Sep'24 10Y trades 108-17 last (+15) vs. 108-19 high -- initial technical resistance at 108-19 (High May 29). Curves remain flatter, inside session range: 2s10s -1.202 at -37.498.

- Look ahead to Friday's data calendar: focus on PCE, Personal Income/Spending and MNI's Chicago PMI.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00002 to 5.32918 (+0.00140/wk)

- 3M -0.00126 to 5.34608 (+0.00320/wk)

- 6M -0.00029 to 5.32565 (+0.00931/wk)

- 12M +0.01475 to 5.22801 (+0.02772/Wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.01), volume: $1.807T

- Broad General Collateral Rate (BGCR): 5.32% (+0.01), volume: $736B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.01), volume: $719B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $271B

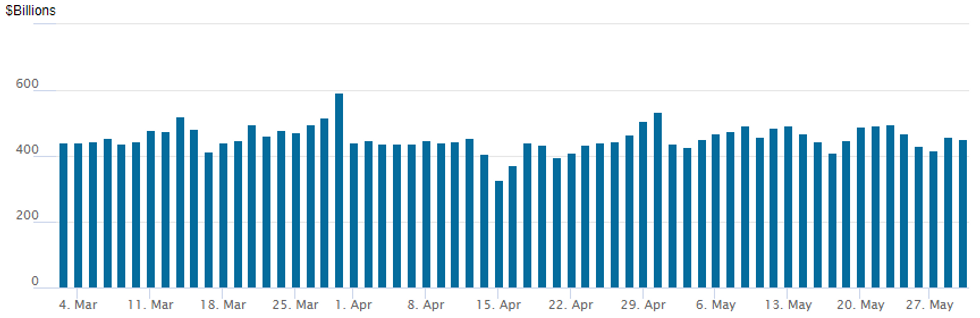

FED Reverse Repo Operation

- RRP usage recedes to $452.034B from $459.314B prior; number of counterparties 77. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury option trade segued from mixed to including better upside calls as underlying futures retain post data gains. Rate cut projections are a little off midmorning lows (*) but remain improved vs. late Wednesday: June 2024 at -0% w/ cumulative rate cut 0.0bp at 5.328%, July'24 at -12% (-14%) w/ cumulative at -3bp (-3.5bp) at 5.298%, Sep'24 cumulative -14.1bp (-14.7bp), Nov'24 cumulative -21.2bp (-21.6bp), Dec'24 -34.8bp (-35.3bp).

- SOFR Options:

- -5,000 3QU4 96.25 calls, 13.5 vs. 96.08/0.35%

- +4,000 0QU4 96.00/96.50 call spds vs. 3QU4 96.50/96.87 call spds, 3.5 net

- 5,000 0QU4 95.75/96.25 call spds, 12.37 synth

- +4,000 SFRM4 94.50/95.00 strangles, 0.5 ref 94.665

- Block, 10,000 SFRM4 94.56 puts, 0.25 ref 94.6625

- -4,000 SFRZ4 94.56/94.68/95.37/95.50 iron condor 4.0-4.25 ref 95.015

- +5,000 0QM4 95.81 calls, 1.5 vs. 95.395/0.10%

- -1,000 SFRH5 95.50 straddles, 73.5 ref 95.21

- 4,000 SFRM4 94.68/94.75 call spds vs. SFRU4 94.68/94.75/94.81/94.87 put condors

- +7,000 SFRU4 94.75/94.81/94.87 put flys, .25

- Block/screen +7,500 SFRU4 94.81/94.87/94.93/95.00 call condors 1.25

- +5,000 SFRZ4 96.00 calls, 5.0 ref 94.985

- Treasury Options:

- 11,870 TYN4 109.75 calls 8 vs. 108-05/0.21%

- 4,000 TYQ4 110.5 calls, 18 ref 108-18

- Block, 15,000 TYN4 110 calls, 11 vs. 108-20/0.10%

- Block, +4,035 UXYN4 113.5 calls, 15 vs. 111-24/0.19%

- 1,600 TYQ4 112/113/114 call flys

- 2,000 FVN4 105.5 straddles ref 105-14.5

- +10,000 TYN4 109/109.5 call spds 9 ref 108-08

- Block, 10,000 TYN4 108/108.25 put strip, 1-22 vs. 108-03.5/100%

- 4,800 TYN4 107.25/108 2x1 put spds, 3-2 ref 108-02.5

FOREX Yield Reversal Prompts Greenback Weakness, CHF Maintains Outperformance

- Lower revisions to US core PCE price index data and softer personal consumption reinforced the partial retracement lower for US yields on Thursday, weighing on the USD index as we approach the key PCE deflator data tomorrow.

- Overnight comments from SNB Chair Jordan leave CHF as the G10 FX outperformer. Jordan identified a “small” upward risk to the SNB’s inflation forecast, while noting that there are reasons to believe that the natural rate of interest has increased somewhat or might rise over the coming years. As such USDCHF sits over 1% lower on the session, although the Swiss franc strength appears corrective at this juncture.

- EUR/CHF has broken below the 20-day EMA. The next support to watch lies at the 50-day EMA (0.9772). A clear break of this average would signal potential for a deeper retracement and expose the May 3 low (0.9730).

- USD/CHF is approaching support at the 50-day EMA (0.9055). A break here would expose short-term pivot support at the May 16 low (0.8988).

- With historical safe havens receiving support on Thursday, USDJPY has also tilted lower and has consolidated back below the 157.00 mark. Moves have concurred with rates markets fading somewhat after the sharp run higher in US yields since the beginning of the week.

- With that said, USDJPY remains just 0.65% off the Wednesday highs and the moves are deemed to be very much corrective at this juncture. As a reminder, Credit Agricole see equity market moves as suggesting month-end portfolio-rebalancing flows are likely to be moderate USD selling across the board, with the strongest sell signal in the case of USD/JPY.

- In emerging markets, heightened uncertainty around post-election coalition scenarios put pressure on the South African rand, comfortably the worst performer globally, down 1.35% against the dollar.

- Chinese PMIs highlight the APAC docket on Friday, alongside Tokyo CPI figures. Eurozone CPI figures will be the focus of the European session before US April PCE deflator and Canadian GDP round off the week’s calendar.

FX OPTIONS: Expiries for May31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0799-00(E603mln), $1.0845-65(E1.6bln), $1.0875-80(E1.5bln), $1.0900(E852mln)

- USD/JPY: Y155.00($584mln), Y156.00-05($613mln), Y156.75-80($750mln), Y157.00-10($850mln), Y158.00($891mln)

- AUD/USD: $0.6600(A$975mln), $0.6700(A$507mln)

- USD/CAD: C$1.3745-50($870mln), C$1.3900($832mln)

Late Equities Roundup: Software, Interactive Media Underperforming

- Stocks remain weaker in late trade after attempting to reverse losses earlier in the second half. Generally quiet two-way positioning ahead of Friday's key PCE data and month end rebalancing. Currently, the DJIA is down 307 points (-0.8%) at 38134.52, S&P E-Minis down 20.5 points (-0.39%) at 5263.5, Nasdaq down 118.6 points (-0.7%) at 16801.3.

- Information Technology and Communication Services sectors continued to underperform in late trade, software and services weighing on the former: Salesforce hammered -21.45% after yesterday's earnings spurred multiple downgrades this morning, ServiceNow Inc -11.47%, Adobe -5.65% and Intuit -5.30%.

- Interactive media and entertainment shares weighed on Communication Services: Google -1.79%, Meta -1.17%, Electronic Arts -0.95%.

- Meanwhile, Real Estate and Utility sectors outperformed in late trade, real estate investment trusts, particularly industrial and health care REITs: Prologis +1.90%, Ventas +3.37%, Healthpeak Properties +2.00%.

- Independent power providers outpaced airfreight and logistics shares earlier, AES +2.66%, Constellation Energy and Xcel Energy both +1.35%.

E-MINI S&P TECHS: (M4) Pullback Exposes Support At The 50-Day EMA

- RES 4: 5417.75 2.00 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5400.00 Round number resistance

- RES 2: 5372.73 1.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5368.25 High May 23 and the bull trigger

- PRICE: 5265.00 @ 1500 ET May 30

- SUP 1: 5250.50 Intraday low

- SUP 2: 5208.12 50-day EMA

- SUP 3: 5099.25 Low May 3

- SUP 4: 5036.25 Low May 2

The uptrend in S&P E-Minis remains intact, however, a corrective cycle has resulted in a pullback from the recent high of 5368.25 (May 23). The contract has traded through the 20-day EMA and this exposes a firmer support at 5208.12, the 50-day EMA. A clear break of this average would signal scope for a deeper retracement. On the upside, a resumption of gains and a break of 5368.25, would confirm a resumption of the uptrend.

COMMODITIES WTI Futures Slide 1.6%, Copper Extends Pull Lower

- Crude markets are falling today despite a larger than expected draw in US stocks, coupled with expectations of OPEC+ rolling over its voluntary cuts. Pressure comes from a bleaker demand outlook, emphasised by the ongoing backdrop of likely delays in Fed interest rate cuts.

- Markets are looking ahead to the OPEC+ meeting June 2 where the group are widely expected to rollover current cuts into the second half of the year. OPEC+ members who have agreed to voluntary cuts totalling 2.2m b/d are discussing extending them until year-end, Reuters said, citing sources within the bloc.

- WTI JUL 24 is down 1.6% at 77.99$/bbl at typing. The trend direction remains down, and the recovery from earlier in the week appears to be a correction - for now. A resumption of weakness would signal scope for a move towards $75.64, the Mar 11 low. Initial firm resistance to watch is at $83.63, the Apr 26 high.

- A mixed picture for precious metals, whereby spot silver has declined 2.35%, once again unable to hold above the psychological $32 mark which has provided resistance across much of May. Gold is clinging on to a modest uptick on the session as the medium-term trend structure is bullish and the recent move down appears to be a correction that is allowing an overbought condition to unwind. Moving average studies are in a bull-mode position, highlighting an uptrend.

- Copper futures are extending the most recent strong reversal lower, declining 2.85% on Thursday and taking the late May reversal off the highs to near 10.5%. The contract has traded through the 20-day EMA, and this exposes the firmer support at 453.60, the 50-day EMA. A clear break of this average would suggest potential for a deeper retracement.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/05/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 31/05/2024 | 2330/0830 | * |  | JP | Labor Force Survey |

| 31/05/2024 | 2350/0850 | * |  | JP | Retail Sales (p) |

| 31/05/2024 | 2350/0850 | ** |  | JP | Industrial Production |

| 31/05/2024 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/05/2024 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/05/2024 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/05/2024 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 31/05/2024 | 0600/0700 | * |  | UK | Nationwide House Price Index |

| 31/05/2024 | 0630/0730 |  | UK | DMO to release FQ2 (Jul-Sep) gilt operations calendar | |

| 31/05/2024 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/05/2024 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/05/2024 | 0645/0845 | ** |  | FR | PPI |

| 31/05/2024 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/05/2024 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/05/2024 | 0800/1000 | *** |  | IT | GDP (f) |

| 31/05/2024 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/05/2024 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/05/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/05/2024 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/05/2024 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/05/2024 | 1230/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 31/05/2024 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/05/2024 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/05/2024 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 31/05/2024 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/05/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 31/05/2024 | 2215/1815 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.