-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Yields and USD Climb With Powell Eyed

- Treasuries more than unwind an early rally on spillover from softer than expected German regional inflation with the realisation that EU harmonised inflation was more stubborn along with sizeable corporate issuance.

- In FX space, the CNH looks set to post strong 1.5% gains as China’s health authorities announced the country will fast-track vaccination of the elderly and implement more precise measures to control outbreaks. The greenback gained through US trade as global equity indices continued their grind lower.

- Chinese Manufacturing and non-manu PMIs first in focus before the key Eurozone CPI and core CPI Flash Estimates ahead of the Dec 15 ECB meeting. Fed Chair Powell headlines the US session, but with the docket also including the second reading of GDP plus ADP employment, JOLTS job openings and the MNI Chicago PMI.

US TSYS: Resumption of Selling Pressure With Powell Eyed Tomorrow

- Treasuries have more than unwound an early rally on spillover from softer than expected German regional CPI inflation, reversing as the harmonised measure was more stubborn than the national CPI equivalent suggested. This was followed by heavier corporate issuance, the highlight being Amazon kicking off a five-part dollar bond sale, which helped set the trend for the much of the session, a few gyrations aside.

- Treasuries see an extension of selling pressure late on, with cash yields 3.5-8bps higher on the day, with the long end leading the move cheaper.

- TYH3 sits at 112-30 (-9+ ticks on the day) having touched new session lows of 112-28 to come close to testing support at the 50-day EMA of 112-24.

- A return to a heavier docket tomorrow, headlined by Powell but also with GDP, ADP and MNI Chicago PMI plus additional Fedspeak from Governors Bowman and Cook.

FOREX: CNH Advances Following Covid Press Conference, Greenback Recovers

- The offshore Yuan looks set to post strong 1.5% gains on Tuesday as China's health authorities announced that the country will fast-track the vaccination of the elderly and implement more precise measures to control outbreaks. Furthermore, officials said they will resolve the reasonable demands of the masses, underpinning the Yuan’s strength throughout the trading session.

- With a slight downtick in Covid cases and no escalation in social unrest USDCNH has erased the previous two sessions advance and now narrows the gap with last weeks lows around 7.12.

- Initially, the more optimistic risk backdrop weighed on the greenback and high beta plays across G10 such as AUD, NZD and NOK led the moves higher.

- However, as global equity indices continued their grind lower amid a grind higher in core yields, the greenback steadily gained through US trade and is clocking at best levels approaching the APAC crossover.

- The price action has weighed on the single currency with some below estimate German CPI reads also providing a marginal headwind for the Euro. EURUSD’s weak close Monday is a potential bearish development that points to a possible top. In pattern terms, Monday is a shooting star candle - a reversal signal. An extension lower would expose key support at 1.0223, Nov 21 low. Clearance of this level would confirm a reversal and signal scope for a deeper pullback. A break of 1.0497, yesterday’s high, is required to resume recent bullish price action.

- Particular weakness was seen in the likes of CAD (-0.67%) and CHF (-0.51%), that had failed to capitalise on the early bout of greenback pessimism.

- Chinese Manufacturing and non-manu PMIs overnight before the key Eurozone CPI and core CPI Flash Estimates ahead of the Dec 15 ECB meeting.

- In the US, second reading of GDP follows ADP employment as well as JOLTS job openings. Fed Chair Powell is due to speak about the economic outlook, inflation, and the labor market at the Brooking Institution.

EGBs-GILTS CASH CLOSE: Early Inflation Relief Rally Fades

Core Europe FI strengthened Tuesday, with Bunds outperforming Gilts, and some bull steepening in both the German and UK curves.

- The German short end rallied early on softer-than-expected German state and Spanish inflation data diminishing ECB hike expectations (50bp is back to being the base case for Dec's meeting, with 75% implied probability).

- Gains partially reversed in the afternoon. There was a negative reaction to the German HICP print which didn't confirm the weakness in State CPI, with heavy US corporate supply also weighing.

- Wednesday's focus will be the Eurozone Nov flash inflation print.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 8.7bps at 2.106%, 5-Yr is down 8.5bps at 1.925%, 10-Yr is down 7bps at 1.922%, and 30-Yr is down 7bps at 1.822%.

- UK: The 2-Yr yield is down 3.4bps at 3.253%, 5-Yr is down 4.4bps at 3.224%, 10-Yr is down 2.6bps at 3.1%, and 30-Yr is down 0.4bps at 3.358%.

- Italian BTP spread down 2.3bps at 189.9bps / Greek up 1bps at 224bps

STOCKS: Off Session Lows But Still Weary Ahead Of Powell Tomorrow

- ESA hit session lows of 3941.25 (-0.7%) after the largest sell program of the day (1111 names) before pulling back to 3955 at typing (-0.3%).

- Apple has weighed today, falling more than 2.5% to its lowest since Nov 10, seemingly on unconfirmed reports on lower than expected iPhone shipments.

- Headlines a short time before that China’s Zhengzhou city (iPhone City) will return to normal Covid control measures Nov 30 provided no notable boost.

- The move lower has brought support at 3928.73 (20-day EMA) closer to play, clearance of which would open stronger support at 3887.17 (50-day EMA).

COMMODITIES: Oil Buoyed By Hopes Of Looser China Covid Curbs

- Crude oil has on balance pushed higher today, buoyed by optimism that China will relax some Covid restrictions before pulling back on reports that OPEC+ will on Sunday keep to its current output levels after agreeing to a 2mbpd cut in October as opposed to any further cuts.

- There was some late confusion on headlines that Iraq saying OPEC+ plans to cut output by 2mbpd this month but prices have largely unwound the subsequent small rise with no further context for the headline. In other news, the White House is looking for a “consistent” $70/bbl oil price to fill the SPR.

- WTI is +1.6% at $78.45, sitting close to resistance at $79.9 (Nov 25 high).

- Brent is +0.3% at $83.4, with an earlier session high of $86.00 coming closer to resistance at $86.87 (Nov 25 high).

- Gold is +0.5% at $1749.5, with trend conditions remaining bullish but not materially progress made towards the bull trigger at $1786.5 (Nov 15 high).

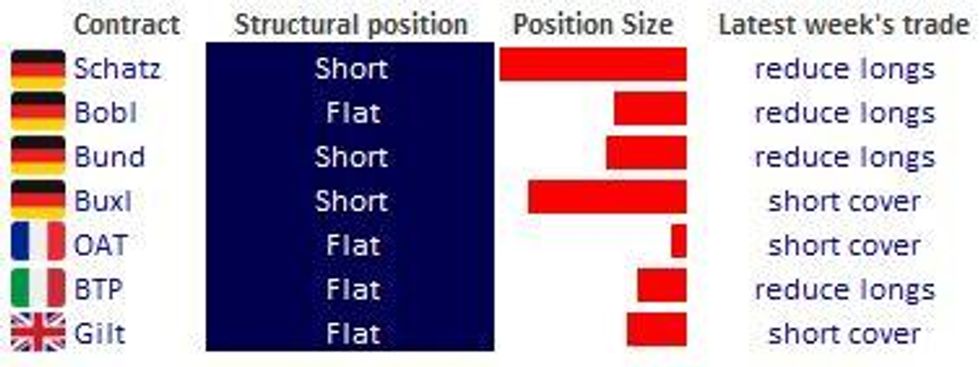

MNI Europe Pi (Positioning Indicator): Faded Shorts

Overall European bond futures positioning remains short/flat, though the prevailing theme over the past couple of weeks has been an edging away from extreme shorts.

- Indeed, outside of Germany, there is no structural short positioning.

- The most recent week of trade saw short cover and long reduction across contracts.

- For full PDF analysis click here

US DATA: Conference Board Labour Differential Pauses After October Slip

- Conference Board consumer confidence cooled as expected in November, falling from 102.2 to 100.2, still the lowest since July.

- Within the survey and with an eye on Friday’s payrolls, the labour differential (jobs plentiful minus jobs hard to get) ticked higher after October saw the largest decline since Dec’20 and before that Apr’20.

- The increase came in jobs plentiful with no change in the perception of jobs being hard to get.

- The differential is clearly trending lower, with the net 32.8 nudging up 1pt after what had been the lowest since Apr’21, but at a level that remains historically elevated at still close to the 2019 average and pre-pandemic highs.

CANADA DATA: GDP Beats But Domestic Demand Hits A Sour Note

- Real GDP was notably stronger than expected in Q3, rising 2.9% annualized vs the 1.5% expected by both the BoC and analysts, for almost no slowdown from the 3.2% in Q2.

- However, details were weaker than expected, with final domestic demand falling -0.6% annualized from weakness in both consumption and investment, and imports also falling off albeit after a stellar rise in Q2.

- The BoC expects growth to stall in the Q4-1H23 with broadly equal odds or a small contraction or small increase, but a decline in domestic demand already in Q3 is likely softer than it will have been expecting.

- USDCAD has extended session highs by increasing 50 pips to 1.3555 although the reaction has been more muted in GoCs.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.