-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Ylds Firm Ahead FOMC, NFP, Tsy Ref

- MNI US: Border Security Text To Be Released Next Week, No Clear Path In Congress

- MNI US-CHINA: Sullivan And Wang To Discuss Red Sea Security In Bangkok Meeting

- MNI NORTH KOREA: Talks Held w/Chinese MoFA Amid Rising Regional Tensions

- MNI SECURITY: US State Department Approval For Turkish F16 Deal Could Come Today

- MNI ISRAEL: ICJ Ruling Could Complicate Diplomatic Landscape

- US warship downs incoming missile fired from Yemen, AFP

Key Links:MNI UST Issuance Deep Dive: Feb 2024 - Refunding Preview / MNI ECB Review - January 2024: Inching Closer To Cutting Rates / MNI INTERVIEW: Peaking BOC Rate Rekindles Housing-Royal LePage / MNI INTERVIEW: LNG Export Delay To Chill Investment - Ex-FERC / MNI US EARNINGS SCHEDULE - Busiest Week of the Quarter / MNI TV: Key Exclusive Highlights For Week 04 /

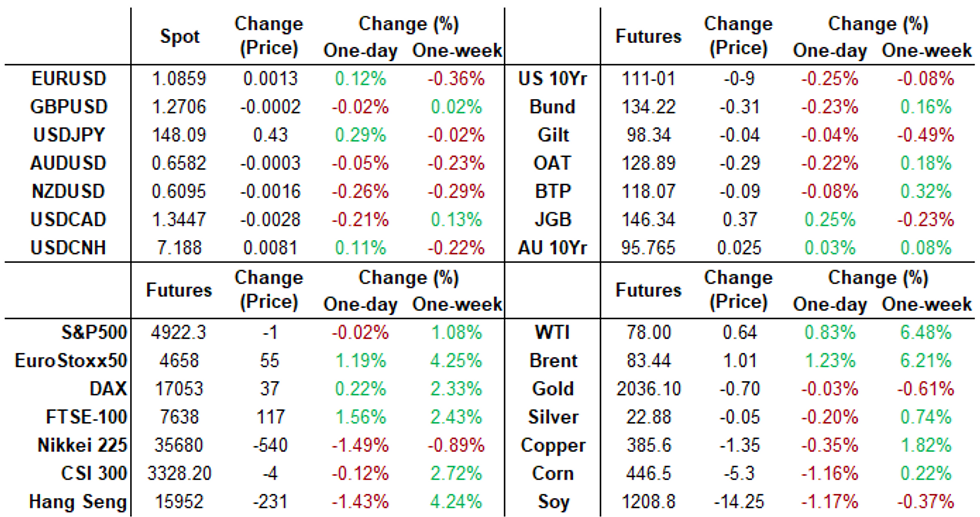

Personal Spending, Pending Home Sales Higher Than Expected

Tsys looking weaker after the bell, but off late session lows, Mar'24 10Y futures currently -7 at 111-03 vs. 111-00 low, yield at 4.0523% (+.0540). Curves bear flattened on the day: 2s10s -3.150 at -21.048 vs. -17.415 high.

- Busy session to end the week with Tsys extending lows after PCE and Personal Spending data:

- PCE Deflator MoM (0.2% vs. 0.2% est, -0.1% prior), YoY (2.6% vs. 2.6% est)

- PCE Core Deflator MoM (0.2% vs. 0.2% est), YoY (2.9% vs. 3.0% est).

- Personal Spending higher than expected w/ up-revisions to prior: 0.7% vs. 0.5% est, prior upped to 0.4% from 0.2%; Real Personal Spending: 0.5% vs. 0.3% est.

- Tsys extended lows yet again after higher than expected Pending Home Sales MoM a whopping 8.3% increase vs. 2.0% est (prior down-revised to -0.3% from 0.0%), YoY: -1.0% vs -4.3% est, while prior down revised to -5.5% from -5.1%.

- Looking ahead: focus is on the FOMC policy annc on Wednesday, followed by employment data for January on Friday. Treasury’s Quarterly Refunding process for the Feb-Apr quarter also begins with borrowing estimates released on Mon Jan 29 (0830ET), followed by the refunding announcement itself on Wed Jan 31 (also 0830ET).

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00012 to 5.33647 (+0.00053/wk)

- 3M -0.00216 to 5.31743 (+0.00225/wk)

- 6M -0.01485 to 5.15740 (-0.00193/wk)

- 12M -0.02070 to 4.79898 (+0.00049/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.768T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $667B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $662B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $101B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $271B

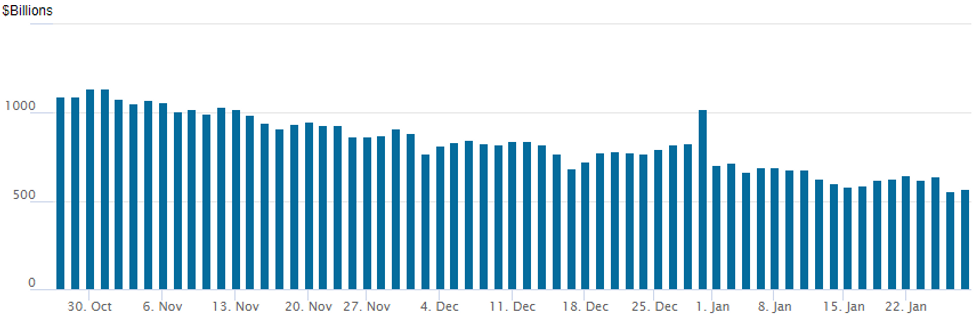

FED Reverse Repo Operation:

NY Federal Reserve/MNI

- After falling to new cycle low of $557.687B on Thursday, RRP usage climbs to $570.828B Friday. Compares to $583.103B on Tuesday, January 16 - prior lowest level since mid-June 2021.

- Meanwhile, the number of counterparties recedes to 77 vs. 82 on Thursday (65 Tuesday last Tuesday, the lowest since July 7, 2021)

SOFR/TREASURY OPTION SUMMARY

Better 5- and 10Y Call option trade reported overnight. Meanwhile, SOFR options followed suit with better upside rate structures by midmorning discounting gradually weaker underlying futures from midmorning on. Projected rate cuts in H1 2024: January 2024 cumulative -.6bp at 5.323%, March 2024 chance of 25bp rate cut -45.5% vs. -49.4 on the open w/ cumulative of -12.0bp at 5.209%, May 2024 at -81.1% vs -83.4% earlier w/ cumulative -32.3bp at 5.006%, June 2024 -97.4% w/ cumulative -56.6bp at 4.763%. Fed terminal at 5.325% in Feb'24.

- SOFR Options:

- Block, 35,000 SFRH4 94.81/84.75 put spds 1.5 over SFRH4 95.12 calls ref 94.865/0.03%

- Block, +5,000 SFRM4 97.00 calls, 2.0 ref 94.68

- -2,000 0QM4 97.00/97.50/97.75 broken call flys, 6.5/wings over

- +4,000 0QM4 95.56/95.81/96.25/96.50 2x2x1x1 put condor, 4.5

- +20,000 SFRU4 95.25/95.37/95.75/95.87 call condors vs. SFRU4 95.00/95.12 put spread, 0.75 net

- Block, 5,000 SFRZ4 96.50/97.25/98.50 broken call flys on 2x3x1 ratio, 22.0 net, ref 96.095

- 2,000 SFRU4 95.75/95.87/96.00/96.12 call condors ref 95.74

- 2,500 SFRU4 95.87/96.12/96.37 call flys ref 95.75

- 2,000 SFRJ4 95.00 puts, 4.25 last

- 1,750 SFRH4 94.87/95.25 call spds

- Block, SFRU4 95.50/95.75 4x5 call spds vs. 94.75 puts x4

- Block 4,000 0QJ4 95.93/96.25/96.50 broken put flys, ref 96.56

- 2,000 SFRM4 95.75/96.06 call spds ref 95.315

- Treasury Options:

- 2,000 TYM4 109.5/114.5 strangles ref 111-23

- 1,700 FVH4 108.75/109.75 call spds

- over 10,500 TYG4 111.75 calls

- over 11,600 TYG4 112 calls

- over 13,000 TYH4 112.5 calls, 24 last

- over 6,500 FVG4 108.25 calls, 1.5 last

- over 3,000 FVG4 108 calls, 4.5 last

- Block 5,000 TYJ4 116/117.5 call spds, 5 ref 112-02.5/0.05%

EGBs-GILTS CASH CLOSE: Constructive Start Fades With BoE / Fed In View

Gilts gained while Bunds weakened Friday.

- European bonds enjoyed a constructive start to the session, with softer-than-expected Japanese inflation data setting the tone overnight.

- A Reuters post-ECB meeting sources pieces indicated the possibility of a dovish tweak in language at the March meeting, but the associated bid faded as most subsequent speakers came from the more hawkish end of the Governing Council spectrum.

- Global core FI fell in the afternoon following US data which showed the PCE price index roughly in line, alongside consumption strength. Bunds continued to fade into the close, while Gilts eventually recovered from near session lows.

- The German curve finished slightly bear flatter, with the UK's bull steepening, though there were few obvious headline/macro drivers to the latter's performance - with perhaps an eye to the Bank of England meeting next week.

- Periphery EGB performance was mixed, with BTP spreads tightening and Greek widening.

- Next week's schedule is very busy, including the BoE decision Thursday following the Federal Reserve's Wednesday, and flash January Eurozone inflation data alongside.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.6bps at 2.633%, 5-Yr is up 1.1bps at 2.198%, 10-Yr is up 0.9bps at 2.299%, and 30-Yr is up 1.5bps at 2.514%.

- UK: The 2-Yr yield is down 3.3bps at 4.352%, 5-Yr is down 2.2bps at 3.894%, 10-Yr is down 1.9bps at 3.964%, and 30-Yr is down 0.6bps at 4.588%.

- Italian BTP spread down 1.3bps at 152.4bps / Greek up 1.9bps at 102.1bps

EGB Options: Leaning Toward Upside In German Short End Friday

Friday's Europe rates/bond options flow included:

- DUH4 106.40/106.50/106.70/106.80 call condor paper paid 1.25 on 10K

- DUH4 105.90/106.10, bought for 11 in 10k.

- DUH4 106.70/107.10/107.40c fly, bought for 2 in 4k

- ERH4 96.375/50/625 call fly paper paid 1 on 7K (vs. 19)

- ERM4 96.62/96.75/96.87c fly, bought for 1.5 in 5.5k

FOREX USDJPY Tracks US Yields Higher, Set to Close Back Above 148.00

- Mixed data in the US this week gave markets little further clarity on the potential path for Fed policy and as such the USD index stands very modestly higher on the week. Early gains however, did see the DXY print a fresh six-week high, keeping short-term momentum bullish at this juncture.

- It was a volatile week for USDJPY following the Bank of Japan decision, and despite briefly trading down to 146.66, the pair looks set to close back above the 148.00 handle, broadly unchanged for the week. On Friday, some well behaved inflation data from the US saw a very brief selloff to 147.46 lows before a grind higher ensued into the close.

- The USDJPY trend outlook remains bullish, and sights are on 149.16 next, a Fibonacci retracement. Initial firm support to watch lies at 146.00, the 50-day EMA.

- The January ECB was unable to garner any significant momentum for the Euro, with EURUSD largely respecting the 1.0820/0920 range, leaving both major pairs to await the FOMC meeting and next week’s US employment data.

- EURUSD’s bearish theme remains in play for now. A clear break of 1.0822 support would resume the current downtrend, opening 1.0793, a Fibonacci retracement. On the upside, a break of 1.0932 would instead signal scope for a stronger recovery and expose key short-term resistance at 1.0998, the Jan 5 high and a reversal trigger.

- As well as the aforementioned event risk, the Bank of England meet next week which could test GBP’s relative resilience this year. A clear break of 1.2827 would resume the uptrend and open 1.2881, a Fibonacci retracement. For bears, clearance of 1.2597 would highlight a S/T reversal and signal scope for weakness towards the 1.2500 handle, the Dec 13 low.

Late Equities Roundup: IT, REITS Underperforming

- Stocks are mixed in late Friday trade, DJIA shares outperforming at the moment, SPX mildly weaker after topping the midweek contract high $1 to 4934.25, Nasdaq underperforming. Currently, DJIA is up 45.54 points (0.12%) at 38094.93, S&P E-Mini future are down 4 points (-0.08%) at 4919.5, Nasdaq down 39.8 points (-0.3%) at 15471.21.

- Laggers: Information Technology and Real Estate sectors continued to underperform late Friday, chip stocks weighing on the former after seeing strong gains as a whole this week. Intel led laggers as it traded -12.17% after disappointing earning/outlook late Thursday, followed by several downgrades. Elsewhere, KLA Corp -5.72%, Teradyne -4.0%, Applied Materials -3.05%. Real Estate sector weighed by specialized and retail investment trusts: SBA Comm -1.93%, Crown Castle Inc -1.87%, Kimco Realty -1.05%.

- Leading gainers: Health Care and Consumer Discretionary and sectors recovered some ground after Thursday selling. Biotechs and pharmaceuticals buoyed the Health Care sector: BioRad +5.42%, Catalent +4.17%, Danaher +3.77%. Meanwhile, broadline retailers outpaced autos in the second half: Bed&Bath +1.8%, CarMax +1.78%, Home Depot +1%. Auto parts makers buoyed the Discretionary sector earlier: Aptiv +1.8%, Borg-Warner +1.36%. Tesla had recovered slightly earlier after falling over -12% yesterday on dour sales guidance and several downgrades, is now -0.20%.

- Looking ahead: flood of earnings announcements next week: Nucor Corp, Corning, Pfizer, UPS, GM, MSFT, Alphabet, Starbucks, Boeing, Boston Scientific. Mastercard, MetLife and Meta by Wednesday.

E-MINI S&P TECHS: (H4) Bulls Remain In The Driver’s Seat

- RES 4: 5000.00 Psychological round number

- RES 3: 4982.62 1.50 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 4952.45 1.382 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 4934.25 intra-day high

- PRICE: 4921.00 @ 1455 ET Jan 26

- SUP 1: 4813.28/4721.08 20- and 50-day EMA values

- SUP 2: 4702.00 Low Jan 5

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4550.75 Low Nov 16

The uptrend in S&P E-Minis remains intact and this week’s move higher has reinforced current conditions. Resistance at 4841.50, the Dec 28 high has recently been cleared, confirming an extension of the price sequence of higher highs and higher lows. Moving average studies remain in a bull-mode condition, highlighting positive market sentiment. Sights are on 4952.45 next, a Fibonacci projection. Key support lies at 4729.00, the 50-day EMA.

COMMODITIES Crude Futures Surge On Houthi Oil Tanker Attack, Gold Ending A Softer Week

- Crude has surged to be trading higher on the day after reports that the Houthis struck an oil tanker off Yemen. WTI is up more than 6% since the start of the week and heading towards its highest close since Nov. 29.

- A merchant ship has been struck and caught fire around 55m Southeast of Aden in the Red Sea, according to Ambrey analytics. A Houthi spokesperson via X, that it was the Marlin Luanda, which is believed to have been carrying naphtha.

- OPEC+ is not expected to decide on production volumes from April onwards at the next JMMC meeting on 1 February, but the group is likely to announce a decision in the coming weeks.

- WTI is +0.8% at $78.01, extending gains after yesterday’s clearance of the bull trigger at $76.31 (Dec 26 high). It opens new key short-term resistance at $79.56 (Nov 30 high).

- Brent is +1.35% at $83.53 also extending yesterday’s YtD highs and opening a key resistance at $84.22 (Nov 30 high).

- Gold is -0.2% at $2017.02, modestly extending losses for the week that has seen slight USD appreciation. It doesn’t test previously established technical levels, with support at $2001.9 (Jan 17 low) and resistance at $2039.4 (Jan 19 high).

- Weekly moves: WTI +6.3%, Brent +6.4%, Gold -0.6%, US HH nat gas +6.4%, EU TTF nat gas -1.2%

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/01/2024 | 0700/0800 | *** |  | SE | GDP |

| 29/01/2024 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/01/2024 | 1200/1300 |  | EU | ECB's de Guindos on Investment Outlook | |

| 29/01/2024 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 29/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 29/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/01/2024 | 2330/0830 | * |  | JP | labor forcer survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.