-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Asia Open: Moderate De-Risking Tone Ahead Weekend

EXECUTIVE SUMMARY:

- Extra Fed Guidance May Be Delayed Till Year-End; Fed May Wait Until End-2020 Before Detailing Guidance; Uncertain Outlook Might Force Delay, Former Officials Tell MNI

- MNI POLICY: China Aiming For Win-Win Relations With US: Wang

US

- FED: Federal Reserve officials may need to wait until the end of this year to deliver greater clarity on just how long they expect to keep easing monetary policy, as the ruling Republicans struggle to reach a deal over the next U.S. fiscal aid package and the coronavirus case count eclipses 4 million, former Fed officials told MNI. Such a delay, driven by a renewed deterioration in the economy that has upended early forecasts for a fairly rapid rebound from the Covid-19-led recession, might disappoint market expectations for additional forward guidance to be announced at the Fed's September meeting. For more, see 07/24 main wire at 0752ET.

- FED: Many have pondered why long-end yields have not risen despite the surge in both issuance and risk asset prices in the last few months. TD points to the "significant removal of duration by the Fed via QE", having removed $1.21trn of 10Y equivalent vs $1.07trn of Tsy issuance btwn March-July, leaving the market with a net duration shortfall. This is set to change, with the Fed's current pace implying purchases of only $250bn of 10y equiv for the rest of the year, vs $1.21trn in Tsy issuance. As such, TD sees the Fed extending purchase durations as it shifts from 'market functioning' QE to 'compressing term premium' QE. The Fed's adoption of inflation-based fwd guidance in Sep will give scope to extend its purchase maturity in similar way to QE3, with 20-30Yrs benefiting (as Fed ownership of 10-20Yr sector is already very high, and limits apply). Currently, $80bln/month in buys = around $50bln 10-Yr equiv duration; but if the QE3 duration profile is applied, that rises to $125bln/month equiv. TD thus expects 10-Yr yields to remain <1% through end-2021, with 10y real rates falling to a new low of -150bps and long-end swap spreads widening.

ASIA

- CHINA: China still hopes to reach a non-confrontational outcome with the U.S., leading to a win-win relationship, China's foreign minister Wang Yi said Friday. During an online conference call with German foreign minister Heiko Maas, Wang said, "China still hopes to achieve non-conflict, non-confrontation, mutual respect, and win-win cooperation with the U.S.", according to a statement published on the website of Ministry of Foreign Affairs of China. For more, see 07/24 main wire at 0907ET.

OVERNIGHT DATA

- IHS Markit Jul Flash Manufacturing PMI 51.3 (52.0 exp, 49.8 prior)

- IHS Markit Jul Flash Services PMI 49.6 (51.0 exp, 47.9 prior)

- IHS Markit Jul Flash Jul Composite PMI 50.0 (47.9 prior)

US DATA REACT: A miss vs expectations for both Manufacturing and Services July flash PMIs (the Svcs miss is perhaps more glaring, with a sub-50 reading).

- Despite a stabilization of private sector activity at the start of Q3, "growth was impeded by an increased rate of decline of new orders, linked in part to renewed [COVID-19] containment measures", per the IHS Markit release.

- Unsurprisingly, the 2nd round of COVID lockdowns weighing on services more than manufacturing: "Service sector firms registered a faster decline in new orders in July. In contrast, manufacturing firms signaled the strongest expansion in new orders since January."

- The report also cites an increase in hiring after 4 straight months of job-shedding, and intensifying inflationary pressures (including both output and output charges which rose at the sharpest rate since Oct 2018).

U.S. JUNE NEW-HOME SALES AT 776,000 ANNUAL RATE; EST. 700,000

MARKETS SNAPSHOT

- Key market levels in late NY trade:

- DJIA down 141.47 points (-0.53%) at 26652.33

- S&P E-Mini Future down 16.5 points (-0.51%) at 3216.25

- Nasdaq down 75.7 points (-0.7%) at 10461.42

- US 10-Yr yield is up 0.7 bps at 0.5839%

- US Sep 10-Yr futures are down 1/32 at 139-19

- EURUSD up 0.0044 (0.38%) at 1.1583

- USDJPY down 0.88 (-0.82%) at 106.37

- WTI Crude Oil (front-month) up $0.2 (0.49%) at $41.38

- Gold is up $13.89 (0.74%) at $1890.17

- European bourses closing levels:

- EuroStoxx 50 down 60.85 points (-1.8%) at 3322.33

- FTSE 100 down 87.62 points (-1.41%) at 6149.07

- German DAX down 265.33 points (-2.02%) at 12911.75

- French CAC 40 down 77.33 points (-1.54%) at 4968.11

US TSY SUMMARY: Relative quiet end to the week, moderate risk-off tone with equities paring gains (Sep eminis near steady for the week) rates firmer but well off overnight highs on light volumes (TYU<650k). Bonds inched off lows on choppy two-way trade post IHS PMI data (missed exp but improved from prior month: Jul Flash Manuf PMI 51.3 (52.0 exp, 49.8 prior), Services PMI 49.6 (51.0 exp, 47.9 prior), Composite PMI 50.0 (47.9 prior). No deal-tied flow, high-grade issuance should remain muted next week as earning's cycle kicks into high gear w/ some 200 companies issuing. Monday and Tuesday see flood of Tsy bill and note issuance ahead Wednesday's FOMC policy annc at 1400ET (no rate change exp), Fed Chairman Powell with press conf half hour later. August Treasury options expire today, generating some two-way hedging in 10s and 30s as they neared strike (139-16 and 181-00 respectively). The 2-Yr yield is down 0.4bps at 0.1473%, 5-Yr is up 0bps at 0.2708%, 10-Yr is up 0.7bps at 0.5839%, and 30-Yr is down 0.1bps at 1.2305%.

TSY FUTURES CLOSE: Mixed after the bell, marginally weaker 5s and 10s lagging the wings, yld curves steeper for the most part. Update:

- 3M10Y +1.919, 47.49 (L: 42.769 / H: 48.385)

- 2Y10Y +1.248, 43.455 (L: 40.713 / H: 44.807)

- 2Y30Y +0.533, 108.114 (L: 105.387 / H: 111.589)

- 5Y30Y -0.067, 95.815 (L: 94.385 / H: 99.086); Current futures levels:

- Sep 2-Yr futures steady at at 110-13.25 (L: 110-13 / H: 110-13.75)

- Sep 5-Yr futures down 0.5/32 at 125-25.75 (L: 125-24.75 / H: 125-27.75)

- Sep 10-Yr futures down 1/32 at 139-19 (L: 139-17 / H: 139-25)

- Sep 30-Yr futures up 3/32 at 181-6 (L: 180-23 / H: 181-30)

- Sep Ultra futures up 20/32 at 226-0 (L: 224-20 / H: 227-13)

US TSYS/SUPPLY: Next week's schedule gets crowded ahead the FOMC policy annc on Wednesday. US Tsy bill/note auction schedule:

DATE TIME AMOUNT SECURITY (CUSIP)

- 27 Jul 1130ET $51B 26W Bill (912796UC1)

- 27 Jul 1130ET $48B 2Y Note (91782CAC5)

- 27 Jul 1300ET $54B 13W Bill (9127962T5)

- 27 Jul 1300ET $49B 5Y Note (91282CAB7)

- 28 Jul 1130ET $30B 42D Bill CMB (912796TJ8)

- 28 Jul 1130ET $30B 120D Bill CMB (9127963B3)

- 28 Jul 1300ET $24B 2Y Note FRN (91282CAA9)

- 28 Jul 1300ET $44B 7Y Note (91282CAD3)

- 30 Jul 1130ET TBA 4W Bill 28 Jul Annc

- 30 Jul 1130ET TBA 8W Bill 28 Jul Annc

US EURODLR FUTURES CLOSE: Steady to marginally weaker across the strip after the bell, lead quarterly (EDU0) steady after latest 3M LIBOR set' +0.0022 to 0.2467% (-0.0246/wk) this morning. Current White pack (Sep'20-Jun'21):

- Sep 20 steady at 99.760

- Dec 20 -0.005 at 99.710

- Mar 21 -0.005 at 99.80

- Jun 21 -0.005 at 99.820

- Red Pack (Sep 21-Jun 22) -0.005

- Green Pack (Sep 22-Jun 23) -0.005 to steady

- Blue Pack (Sep 23-Jun 24) -0.005 to steady

- Gold Pack (Sep 24-Jun 25) -0.005 to steady

US DOLLAR LIBOR: Latest settles:

- O/N -0.0007 at 0.0849% (-0.0006/wk)

- 1 Month +0.0010 to 0.1726% (-0.0073/wk)

- 3 Month +0.0022 to 0.2467% (-0.0246/wk)

- 6 Month -0.0066 to 0.3185% (-0.0151/wk)

- 1 Year -0.0026 to 0.4595% (-0.0104/wk)

STIR: Federal Reserve Bank of New York EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $50B

- Daily Overnight Bank Funding Rate: 0.09%, volume: $152B

US TSYS: REPO REFERENCE RATES:

- Secured Overnight Financing Rate (SOFR): 0.10%, $942B

- Broad General Collateral Rate (BGCR): 0.08%, $392B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $378B

- (rate, volume levels reflect prior session)

FED: NY Fed operational purchase

- Tsy 2.25Y-4.5Y, $8.801B accepted of $23.862B submitted

- Next week:

- Mon 07/27 1010-1030ET: Tsy 20Y-30Y, appr $1.175B

- Mon 07/27 1500ET: updated purchase schedule release

PIPELINE: While the pace of issuance has slowed due to latest earnings cycle, running total for June still decent at $71B.

- Date $MM Issuer/Rating/Desc/Maturity/Yld; Priced *; Launch #

- 07/24 Nothing in the works Friday

- $3.2B Priced Thursday; $18.3B total for week

- 07/23 $2B *Ukraine +12Y around 7.25%

- 07/23 $600M *Mirae Asset $300M 3Y +205, $300M 5Y +245

- 07/23 $600M *Swedish Export Credit Corp 4Y +17

EGB: Bund and Gilt yields rose for most of the day, with no clear catalyst. Data was largely ignored, and supply limited - and besides, equities fell sharply. BTP spreads rounded out a very strong week, narrowing 2bps to 10-Yr Bunds to tightest levels since late February. Yet it was Greece that outperformed, tightening 3.8bps (Spain and Portugal down a touch).

- Closing levels:

- Germany: The 2-Yr yield is up 2bps at -0.651%, 5-Yr is up 3.4bps at -0.636%, 10-Yr is up 3.3bps at -0.448%, and 30-Yr is up 3bps at -0.028%.

- UK: The 2-Yr yield is up 0.8bps at -0.088%, 5-Yr is up 1.2bps at -0.099%, 10-Yr is up 2bps at 0.144%, and 30-Yr is up 1.7bps at 0.656%.

- 10-Yr Periphery EGB Spreads:

- Italian BTP spread down 2bps at 144.5bps

- Spanish bond spread down 0.4bps at 80bps

- Portuguese PGB spread down 0.3bps at 80.4bps

- Greek bond spread down 3.8bps at 151.6bps

FOREX: USD/JPY tipped to multi-month low

- The USD index looks to finish the week at the lowest levels since 2018 having recorded six consecutive sessions in the red. The continued decline of US real yields has weighed further on the greenback, proving supportive of precious metals - with spot gold coming within about $15 of the all-time high printed in 2011.

- Markets traded risk-off for the bulk of the session, with US markets shedding just under 1% apiece. This helped drive haven currencies higher, with USD/JPY breaking through support layered at the Y106 handle. Growth and commodity proxies took a knock, with AUD, CAD and NZD among the poorest performers Friday.

- The latest round of GDP numbers from Germany, France, Italy, Canada and the US cross next week, as well as Australian inflation and MNI Chicago Business Barometer. The coming week is the busiest of the quarter for US earnings, with nearly 200 S&P500 firms due to report, most notably Apple, Amazon and Alphabet. The Fed rate decision is also due, with focus turning to any potential revision to the bank's forward guidance.

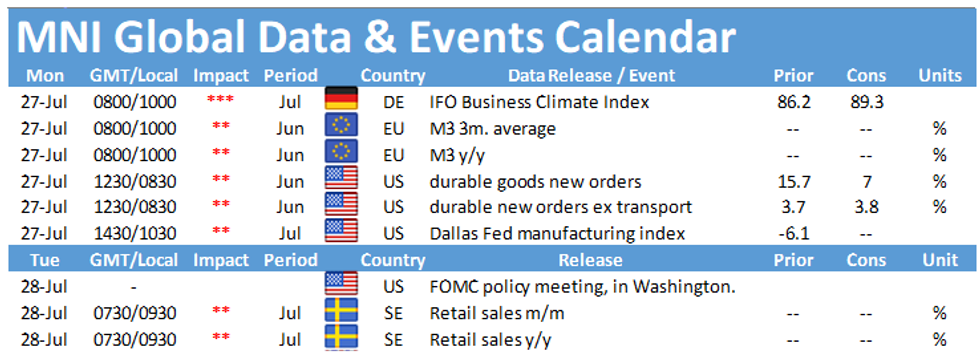

UP TODAY:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.