-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN

EXECUTIVE SUMMARY

- MNI BRIEF: Fed's Mester Prefers To Taper QE in 2022

- MNI BRIEF: Polls Open For Pivotal Georgia Senate Runoffs

- MNI INTERVIEW: ISM's Fiore Sees More Fiscal Relief in February

- MNI POLICY: ECB Should Explore Yield Curve Control - BoS Chief

- GERMANY TO EXTEND LOCKDOWN RESTRICTIONS UNTIL JAN. 31, Bbg

- SAUDIS TO CUT 1M B/D OIL UNILATERALLY IN FEB, MARCH, Bbg

US

FED: Federal Reserve Bank of Cleveland President Loretta Mester said Tuesday she expects to begin winding down asset purchases starting next year, but a stronger-than-expected recovery could pull that timeline forward.

- "I'd like us to start to taper asset purchases next year but it's going to depend on the economy," she told reporters on a call. For more see MNI Policy Mainwire at 1005ET.

US: The U.S. will need to pass another fiscal relief package shortly after Joe Biden and a new Congress are sworn in because faltering demand outweighs concern that more benefits deter people from working, Institute for Supply Management manufacturing chair Tim Fiore told MNI Tuesday. For more see MNI Policy Mainwire at 1300ET.

US: The latest polling headed into Tuesday's crucial George runoff elections suggests the candidates remain neck and neck as residents head to voting stations. A faceoff between Republicans David Perdue and Kelly Loeffler and Democrats Jon Ossoff and Raphael Warnock will determine which party gains control of the Senate.

EUROPE

ECB: The European Central Bank should assess the practicality of adopting a form of yield curve control as part of its strategic monetary policy review, the governor of the Central Bank of Spain said in an interview Monday, also stating his support for a symmetrical 2% inflation target and hinting at the possibility banks' eligibility for Targeted-Longer Term Refinancing Operations could be increased. for more see MNI Policy Mainwire at 0540ET.

OVERNIGHT DATA

ISM Dec Manufacturing PMI Higher At 60.7 vs Nov 57.5

- US ISM NEW ORDERS INDEX 67.9 DEC VS 65.1 NOV

- US ISM EMPLOYMENT INDEX 51.5 DEC VS 48.4 NOV

- US ISM PRODUCTION INDEX 64.8 DEC VS 60.8 NOV

- US ISM SUPPLIER DELIVERY INDEX 67.6 DEC VS 61.7 NOV

- US ISM INVENTORIES INDEX 51.6 DEC VS 51.2 NOV

- The ISM Mfg PMI rose 3.2pt to 60.7 in Dec, beating expectations of a decline to 56.6. The Dec reading marks the highest level since Aug 2018 and the increase was broad-based.

- Among the main five categories, Supplier Deliveries showed the largest uptick, gaining 5.9pt to the highest since May. Production gained 4.0pt, while New Orders increased by 2.8pt.

- Employment shifted back to expansion territory, rising by 3.1pt in Dec. Inventories ticked up slightly by 0.4pt following Nov's drop.

- Among the other categories, Prices saw the largest gain, surging 12.2pt to 77.6, its highest level since May 2018. Order Backlogs rose 2.2pt to 59.1, while the Customer's Inventory index edged up 1.6pt to 37.9. Meanwhile, imports dropped 0.5pt to 54.6 and exports declined 0.3pt to 57.5.

- US REDBOOK: DEC STORE SALES +0.5% V NOV THROUGH JAN 02 WK

- US REDBOOK: DEC STORE SALES +5.1% V YR AGO MO

- US REDBOOK: STORE SALES +5.5% WK ENDED JAN 02 V YR AGO WK

- US ISM-NY CURRENT CONDITIONS INDEX 61.3 DEC

- US ISM-NY 6-MONTH OUTLOOK INDEX 70.7 DEC

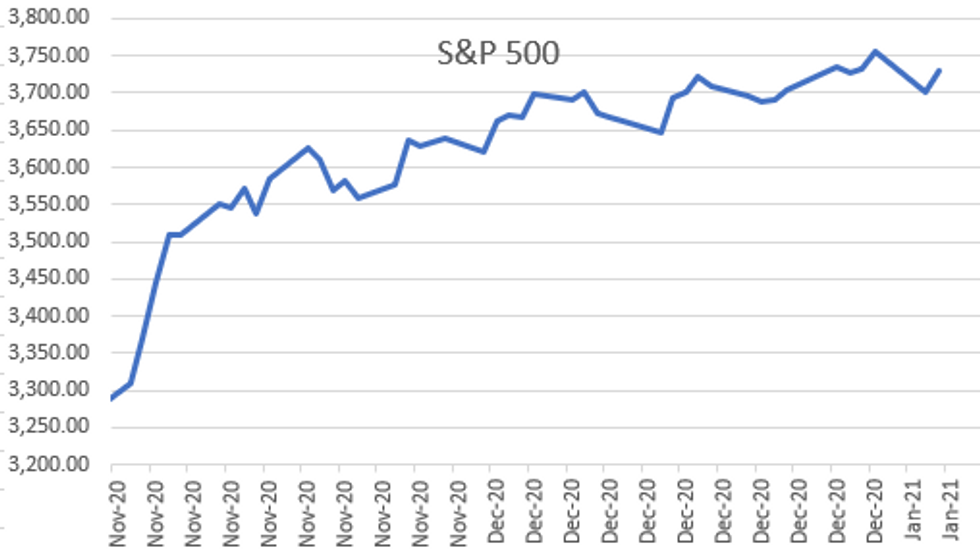

MARKETS SNAPSHOT

- DJIA up 184.37 points (0.61%) at 30408.19

- S&P E-Mini Future up 25 points (0.68%) at 3717.25

- Nasdaq up 102.2 points (0.8%) at 12800.56

- US 10-Yr yield is up 3.3 bps at 0.9465%

- US Mar 10Y are down 8/32 at 137-28

- EURUSD up 0.0051 (0.42%) at 1.2298

- USDJPY down 0.48 (-0.47%) at 102.65

- WTI Crude Oil (front-month) up $2.26 (4.75%) at $49.89

- Gold is up $7.07 (0.36%) at $1950.03

- EuroStoxx 50 down 16.54 points (-0.46%) at 3547.85

- FTSE 100 up 40.37 points (0.61%) at 6612.25

- German DAX down 75.52 points (-0.55%) at 13651.22

- French CAC 40 down 24.36 points (-0.44%) at 5564.6

US TSY SUMMARY

General risk-on as rates traded weaker vs. stronger equities Tuesday -- despite upcoming risk-events surrounding the Georgia state run-off (polls close 1900ET, election officials est winners likely annc'd early Wed), and Wednesday's electoral vote count in DC. Though the count may take some time due to expected objections from select Republicans, it's more the potentially violent protests in/around DC that have people on edge.

- Better than expected data weighed on rates: Mfg PMI rose 3.2pt to 60.7 in Dec, beating expectations of a decline to 56.6. The Dec reading marks the highest level since Aug '18 and the increase was broad-based.

- Second consecutive session decent if not heavy corporate debt issuance, near $25B (over $52B since Mon) generated additional hedging pressure in rates.

- Yield curves bear steepened to multi-year highs, 5Y30Y topped 134.5 on the day, level not seen since late 2016.

- The 2-Yr yield is up 0.8bps at 0.1211%, 5-Yr is up 2.2bps at 0.3718%, 10-Yr is up 3.3bps at 0.9465%, and 30-Yr is up 4.2bps at 1.6979%.

US TSY FUTURES CLOSE: Off Lows After Bell

General risk-on tone despite the political event risk ahead GA run-off and electoral vote count Wed. Tsys weaker but off late session lows while equities hold near highs. Yield curves bear steepened to multi-year highs (5Y30Y).

- 3M10Y +3.082, 86.541 (L: 82.271 / H: 88.385)

- 2Y10Y +2.942, 82.548 (L: 79.378 / H: 84.082)

- 2Y30Y +3.841, 157.687 (L: 153.786 / H: 160.123)

- 5Y30Y +2.02, 132.451 (L: 130.56 / H: 134.712)

- Current futures levels:

- Mar 2Y down 0.37/32 at 110-15.375 (L: 110-15.12 / H: 110-16)

- Mar 5Y down 3.5/32 at 126-3 (L: 126-02 / H: 126-07)

- Mar 10Y down 8/32 at 137-28 (L: 137-25 / H: 138-05)

- Mar 30Y down 28/32 at 172-5 (L: 171-23 / H: 173-01)

- Mar Ultra 30Y down 1-27/32 at 211-11 (L: 210-12 / H: 213-01)

US EURODOLLAR FUTURES CLOSE

Futures trading steady to weaker after the bell, Blues-Golds underperforming. Lead quarterly EDH1 holding steady since 3M LIBOR benchmark set -0.00037 to 0.23688% (-0.00150/wk).

- Mar 21 steady at 99.830

- Jun 21 steady at 99.840

- Sep 21 steady at 99.835

- Dec 21 -0.005 at 99.795

- Red Pack (Mar 22-Dec 22) -0.005 to steady

- Green Pack (Mar 23-Dec 23) -0.02 to -0.005

- Blue Pack (Mar 24-Dec 24) -0.03 to -0.025

- Gold Pack (Mar 25-Dec 25) -0.03

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00175 at 0.08638% (+0.00875/wk)

- 1 Month -0.00887 to 0.13088 (-0.01300/wk)

- 3 Month -0.00037 to 0.23688% (-0.00150/wk)

- 6 Month -0.00200 to 0.25388% (-0.00375/wk)

- 1 Year -0.01088 to 0.32975% (-0.01213/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.09%, volume: $131B

- Secured Overnight Financing Rate (SOFR): 0.10%, $1.046T

- Broad General Collateral Rate (BGCR): 0.06%, $367B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $335B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 20Y-30Y, $1.733B accepted vs. $3.345B submission

- Next scheduled purchase:

- Wed 1/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 1/07 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/08 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: Another Day Heavy Issuance

At least $23.4B to price Tuesday, waiting on Berkshire Hathaway, IADB, Indonesia to launch.

- Date $MM Issuer (Priced *, Launch #)

- 01/05 $5B *European Inv Bank (EIB) 5Y +5

- 01/05 $3B *Sinopec $1.15B 5Y +110, $1.2B 10Y +140, $650M 30Y +138

- 01/05 $2.7B #Hyundai $1.25B 3Y +67, $850M 5Y +95, $650M 7Y +115

- 01/05 $2.5B #General Motors $1.5B 5Y +92, $1B 10Y +140

- 01/05 $1.5B #Credit Agricole 20Y +110

- 01/05 $1.5B #Cooperative Rabobank $750M 3Y +23, $750M 3Y FRN SOFR+30

- 01/05 $1.25B #National Australia Bank 20Y +95

- 01/05 $1.25B #Macquarie Grp 6NC5 fix/FRN +97

- 01/05 $1.25B #Standard Chartered perp NC10 4.75%

- 01/05 $900M #So-Cal Edison $150M 2030 tap +85, $750M 30Y +127

- 01/05 $750M #Protective Life Global Funding $500M 3Y +30, $250M 10Y +80

- 01/05 $750M Berkshire Hathaway WNG 30Y +90a

- 01/05 $550M #Principle Life Global Funding 5Y +55

- 01/05 $500M *Kroger Co 10Y +77

- 01/05 $Benchmark IADB 10Y +16a

- 01/05 $Benchmark Indonesia +10Y 2.35%a, +30Y 3.55%a, +50Y 3.85%a

- On tap for Wednesday:

- 01/06 $Benchmark Kommunalbanken 5Y +11a

FOREX: USD Lower As Risk Grinds Higher, Oil Spike

Risk is trading back on the front foot today with Equities reversing from yesterday's lows, spurring fresh Dollar selling and a reversal of yesterday's safe haven rally.

- The Dollar Index was steadily lower throughout the session and has picked up some momentum to trade just above most recent lows at 89.43

- AUD (+1.3%), NZD (1.1%) and CAD (+0.87%) have been the main beneficiaries of the improved sentiment in the G10 space.

- Less pronounced moves were witnessed in EUR and JPY which were both boosted around 0.4% in a slow grind throughout the session. EURUSD is currently trading just below 1.2310 which has been notable resistance over the past week and remains the bull trigger for another leg higher.

- Cable was off the lows in line with a weaker USD, however, seems to be struggling for momentum as the UK logged another record daily Covid Case count of over 60,000.

- OPEC - reports emerged that OPEC+ members have agreed to broadly maintain production levels around their current amounts for both February and March. Most recently *Saudis to cut 1m b/d oil unilaterally in Feb, March has seen WTI Crude back above $50 a barrel for the first time since February.

- Both EURSEK and EURNOK (benefitting from the rebound in oil) are trading at the lows of their daily ranges, down 0.5%.

EGBs-GILTS CASH CLOSE: Big Supply Weighs

Heavy supply weighed on European bonds all session, with Italy, Germany, Ireland and Slovenia combining to sell EUR22.3bln via syndications and auction today.

- The German curve bear steepened, but solid demand for Italy 15-Yr sale helped periphery spreads tighten. In the UK, Chancellor Sunak's announcement of a GBP4.6bn lockdown support package for businesses helped keep a lid on Gilts, which also bear steepened.

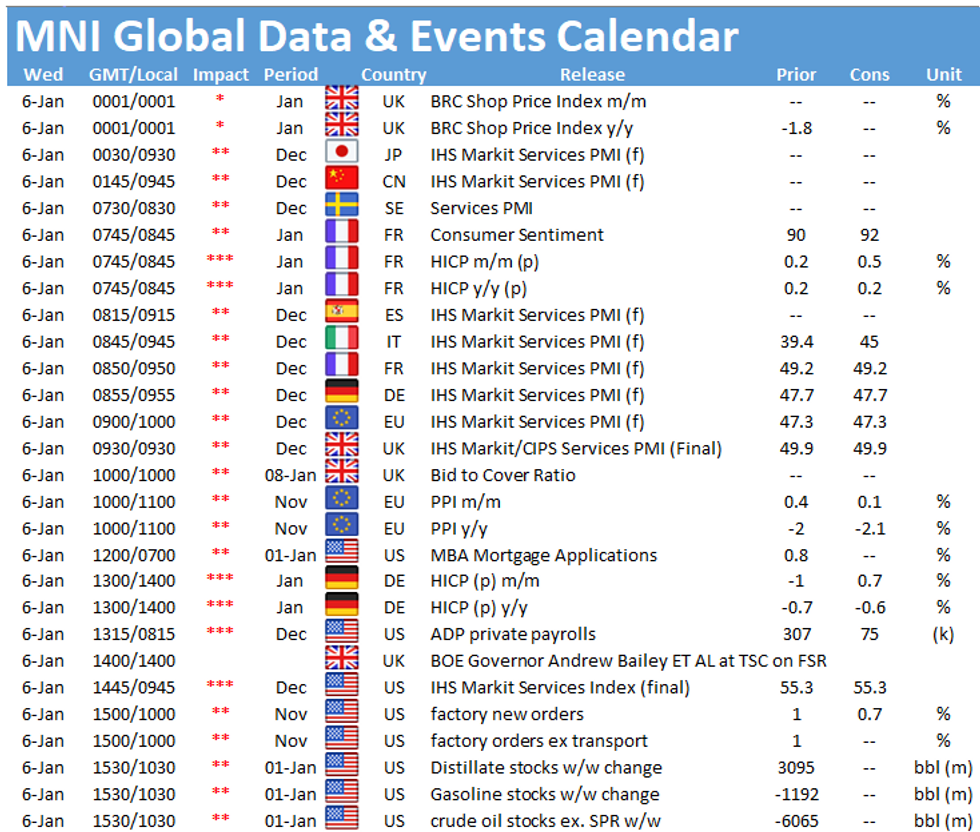

- Supply slows a bit Weds but we still get 10-Yr auctions from the UK (GBP3bn) and Germany (E5bn of new Bund). Also, Services PMI and Inflation data tomorrow. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.6bps at -0.716%, 5-Yr is up 1.5bps at -0.747%, 10-Yr is up 2.7bps at -0.577%, and 30-Yr is up 3bps at -0.166%.

- UK: The 2-Yr yield is up 1bps at -0.143%, 5-Yr is up 1.1bps at -0.092%, 10-Yr is up 3.6bps at 0.209%, and 30-Yr is up 4.9bps at 0.779%.

- Italian BTP spread down 0.9bps at 114.3bps / Spanish spread down 1.5bps at 61.2bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.