-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk-Off Gains Late Momentum

EXECUTIVE SUMMARY

- MNI BRIEF: SLR Did Not Constrain Dealer Intermediation: NY Fed

- MNI BRIEF: Williams Says Fed to Sustain Robust Support

- MNI BRIEF: Atlanta Fed Model Revises US Q1 GDP Outlook Lower

US

FED: NY Fed Pres John Williams said Wednesday the U.S. central bank will "provide strong monetary policy support for a robust and full recovery over the next couple of years."

- The Fed will keep stimulating the economy despite Williams' own forecasts for strengthening growth this year. "I expect the pace of recovery later this year to be really quite rapid in terms of jobs, in terms of economic growth," he said.

- Most dealers not subject to SLR, which requires the largest banks to hold a minimum ratio of 3% of tier 1 capital to total on- and off-balance sheet exposures, did not expand their long and short positions and, in many cases, reduced them, the researchers found.

- The Fed last week said it would allow SLR relief to expire at the end of the month and seek comment on longer run adjustments to SLR.

- The downward revision was mostly driven by disappointing economic data this week from the National Association of Realtors which saw existing home sales down 6.6%, and by the Census Bureau, which reported orders of U.S. durable goods fell 1.1% in February, the first m/m decline since April.

- The nowcast of Q1 real gross private investment growth fell to 8.8% from 10.6% forecast last week. The GDPNow model is not an official forecast of the Atlanta Fed and is best viewed as a real-time estimate of real GDP growth based on available economic data.

OVERNIGHT DATA

- US FEB DURABLE NEW ORDERS -1.1%; EX-TRANSPORTATION -0.9%

- US JAN DURABLE GDS NEW ORDERS REV TO +3.5%

- US FEB NONDEF CAP GDS ORDERS EX-AIR -0.8% V JAN +0.6%

- US FLASH MAR MFG PMI 59.0 (SURV. 59.5); FEB 58.6

- US FLASH MAR SERVICES PMI 60.0 (SURV. 60.1); FEB 59.8

- US FLASH MAR COMPOSITE PMI 59.1; FEB 59.5

- US MBA: MARKET COMPOSITE -2.5% SA THRU MAR 19 WK

- US MBA: REFIS -5% SA; PURCH INDEX +3% SA THRU MAR 19 WK

- US MBA: UNADJ PURCHASE INDEX +26% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.36% VS 3.28% PREV

- CANADA FLASH FEB FACTORY SALES -1.0%

MARKETS SNAPSHOT

Key late session market levels- DJIA up 169.26 points (0.52%) at 32566.74

- S&P E-Mini Future up 3.75 points (0.1%) at 3900.75

- Nasdaq down 166.2 points (-1.3%) at 13056.42

- US 10-Yr yield is down 1.4 bps at 1.6067%

- US Jun 10Y are up 6.5/32 at 132-4

- EURUSD down 0.0028 (-0.24%) at 1.1822

- USDJPY up 0.13 (0.12%) at 108.69

- Gold is up $7.54 (0.44%) at $1734.76

European bourses closing levels:

- EuroStoxx 50 up 5.53 points (0.14%) at 3832.55

- FTSE 100 up 13.7 points (0.2%) at 6712.89

- German DAX down 51.63 points (-0.35%) at 14610.39

- French CAC 40 up 1.99 points (0.03%) at 5947.29

US TYS SUMMARY: Risk-Off Gains Momentum

Generally a nascent risk-off tone to midweek session: stocks pared gains/traded weaker while Tsys trade strong after the closing bell, just off late session highs (but off early overnight levels) yield curves mildly flatter, decent over all volumes (TYM >1.5M).

Indifferent data react, Tsy futures pared overnight gains, 2s-30s held just above steady on two-way flow post-data: Durables new orders -1.1%/ex-trans -0.9%. Two-way flow with slightly better buying in 10s-30s.- Small auction tail: Tsys slipped briefly after US Tsy $61B 5Y Note auction (91282CBT7) drew high yld of 0.850% (0.621% last month) vs. 0.847% WI; 2.36 bid/cover vs. 2.24 prior. Indirects drew 58.08% vs. 57.05% prior, directs 16.62% vs. 14.38% prior, dealers 25.31% vs. 28.57% prior.

- Rates gradually rebounded, inched higher in latter/second half of session as equities traded back to early overnight lows. Focus on Thursday's weekly claims and flurry of more Fed speakers.

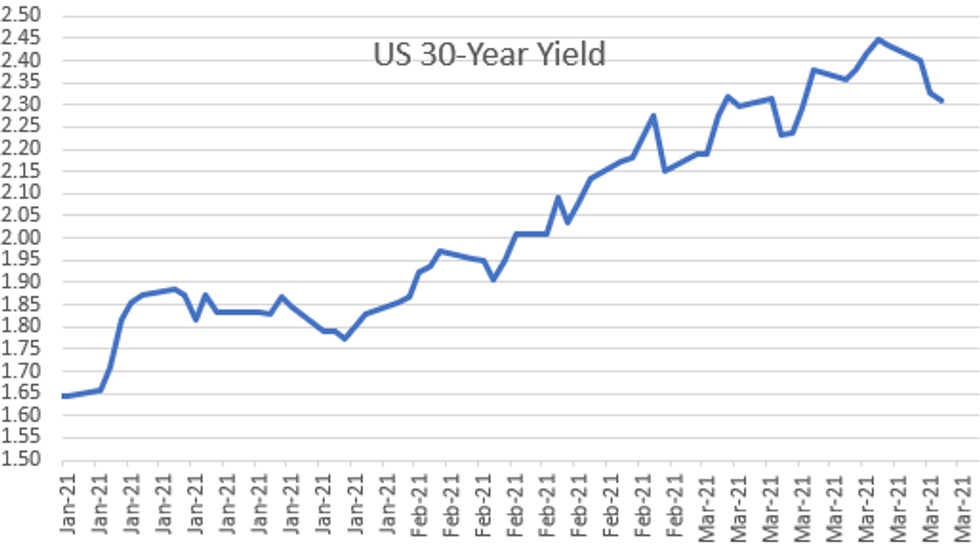

- The 2-Yr yield is down 0.1bps at 0.1446%, 5-Yr is down 0.8bps at 0.8076%, 10-Yr is down 1.4bps at 1.6067%, and 30-Yr is down 1.9bps at 2.3079%.

MONTH-END EXTENSIONS: Preliminary Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS 0.07Y; Govt inflation-linked, 0.02. Notice the bounce in US Tsy, Agency and MBS estimates, and drop in Credit extension est vs. last year.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.07 | 0.09 | -0.03 |

| Agencies | 0.03 | 0.05 | -0.03 |

| Credit | 0.09 | 0.09 | 0.16 |

| Govt/Credit | 0.08 | 0.09 | 0.06 |

| MBS | 0.12 | 0.06 | 0.03 |

| Aggregate | 0.09 | 0.08 | 0.04 |

| Long Gov/Cr | 0.1 | 0.09 | 0 |

| Iterm Credit | 0.09 | 0.08 | 0.09 |

| Interm Gov | 0 | 0.08 | 0.01 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.05 |

| High Yield | 0.12 | 0.1 | 0.12 |

US TSY FUTURES CLOSE:

- 3M10Y -1.999, 158.54 (L: 156.696 / H: 162.941)

- 2Y10Y -1.673, 145.662 (L: 144.267 / H: 150.063)

- 2Y30Y -2.242, 215.754 (L: 214.486 / H: 220.482)

- 5Y30Y -1.111, 149.81 (L: 149.419 / H: 152.103)

- Jun 2Y up 0.625/32 at 110-12.875 (L: 110-12.375 / H: 110-13)

- Jun 5Y up 4/32 at 123-30.5 (L: 123-25.75 / H: 124-00)

- Jun 10Y up 7/32 at 132-4.5 (L: 131-26 / H: 132-09)

- Jun 30Y up 23/32 at 156-28 (L: 155-29 / H: 157-04)

- Jun Ultra 30Y up 52/32 at 185-14 (L: 183-21 / H: 185-26)

US EURODOLLAR FUTURES CLOSE:

- Jun 21 steady00 at 99.830

- Sep 21 -0.005 at 99.810

- Dec 21 steady00 at 99.745

- Mar 22 +0.005 at 99.785

- Red Pack (Jun 22-Mar 23) +0.005 to +0.015

- Green Pack (Jun 23-Mar 24) +0.020 to +0.035

- Blue Pack (Jun 24-Mar 25) +0.025 to +0.025

- Gold Pack (Jun 25-Mar 26) +0.020 to +0.030

Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00050 at 0.07638% (-0.00050/wk)

- 1 Month +0.00162 to 0.11025% (+0.00187/wk)

- 3 Month -0.00550 to 0.19513% (-0.00175/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00412 to 0.20950% (+0.00712/wk)

- 1 Year +0.00062 to 0.28000% (+0.00375/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $247B

- Secured Overnight Financing Rate (SOFR): 0.01%, $896B

- Broad General Collateral Rate (BGCR): 0.01%, $383B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $349B

- (rate, volume levels reflect prior session)

- Tsys 2.25Y-4.5Y, $8.801B accepted vs. $24.564B submission

- Next scheduled purchases:

- Thu 3/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/26 No buy operation

PIPELINE: Late Issuers, London Stock Exchange Jumbo/Multi FX Chatter

- Date $MM Issuer (Priced *, Launch #)

- 03/24 $2.25B #ING $1.1B 6NC +92, $400M 6NC5 FRN SOFR+101, $750M 11NC10 +112

- 03/24 $1.85B #So-California Edison $350M 2Y +60, $400M 2Y FRN SOFR+64, $700M 3NC2 +80, 00M $3NC2 FRN SOFR+83

- 03/24 $1.4B #American Tower $700M each: 5Y +80, 10Y +110

- 03/24 $1.35B #Steris $675M each: 10Y +110, 30Y +145

- 03/24 $1.1B #Dominion Energy $500M Y +65, $500M 20Y +110

- 03/24 $650M #Mizrahi Tefahot Bank 10NC5 +225

- 03/24 $Benchmark ISDB (Islamic Development Bank) 5Y Sukuk +32

- 03/24 $Benchmark Ghana bond investor call

- On tap for Thursday:

- 03/24 $Benchmark MGM China 5.8NC2.8

- 03/25 $2B Imola Merger Corp 8NC3 investor calls

- 03/?? $Benchmark (w/EUR & GBP) London Stock Exchange multi-tranche

FOREX: GBP Skids to March Low as Inflation Disappoints

- Sterling held the session's losses throughout European and US hours after lower than expected inflation numbers out of the UK for February. CPI rose by just 0.1% m/m vs. Exp. 0.5%, with soft clothing prices largely responsible. GBP/USD took out support at the $1.37 handle, hitting new March lows in the process and narrowing the gap with key support at the 1.3619 100-dma.

- At the other end of the table, NOK traded particularly well on the oil price recovery, with WTI and Brent crude futures adding well over 5% apiece to enjoy the best session in months. The move allowed USD/NOK to undo some recent outperformance, pressuring the rate back below the 100-dma at 8.6440.

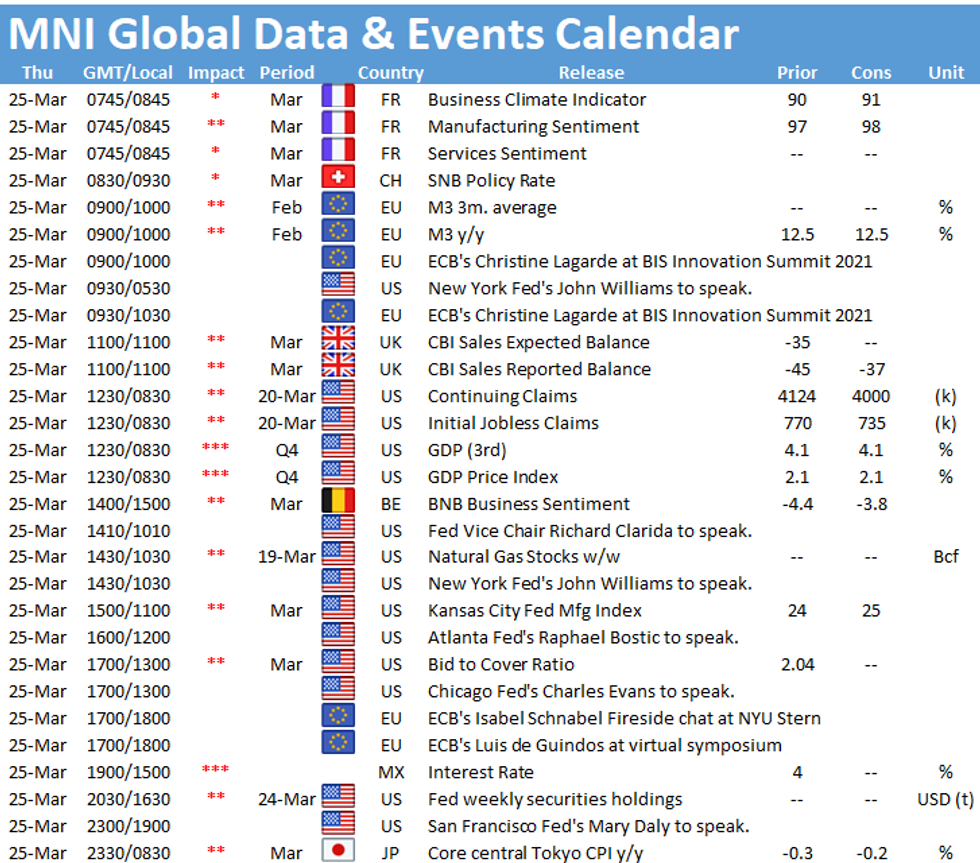

- Central banks are again a focus Thursday, with rate decisions due from the South African, Mexican and Swiss central banks.

- Data crossing Thursday includes weekly US jobless claims and tertiary Q4 GDP - neither of which will likely prove significant market movers.

EGBs-GILTS CASH CLOSE: Data Takes Top Billing

The Bund and Gilt curves flattened modestly Wednesday, but an early fall in yields fully reversed following stronger-than-expected PMI data for Germany, France, and the UK.

- Some mixed interpretations of the PMI data (ie survey taken before renewed lockdowns in the Eurozone) dampened the impact, however, with yields well off highs by session's end. Earlier, UK Feb inflation came in much weaker than expected, helping boost Gilts at the open.

- Periphery EGBs continued their recent impressive performance, tightening vs Bunds.

- EU-UK vaccine tensions simmered, though a WSJ reporter suggested a mutual statement on cooperation could be issued this evening. Looking ahead, Thursday's highlights include the European Council summit which will include discussion of the COVID vaccine situation.

- We also get Italian BTP linker + 2022 nominal auction Thursday, and appearances by BOE's Bailey and ECB's Lagarde among many others.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.3bps at -0.712%, 5-Yr is down 1.2bps at -0.682%, 10-Yr is down 1.2bps at -0.353%, and 30-Yr is down 2.1bps at 0.21%.

- UK: The 2-Yr yield is up 1.5bps at 0.061%, 5-Yr is up 0.4bps at 0.334%, 10-Yr is down 0.5bps at 0.758%, and 30-Yr is down 0.6bps at 1.282%.

- Italian BTP spread up 0.1bps at 94.4bps /Spanish spread down 0.6bps at 62.8bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.