-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI ASIA OPEN: Stocks Make New Highs

EXECUTIVE SUMMARY

- MNI INTERVIEW: Modest CPI Lift From Biden Relief: Chicago Fed

- MNI BRIEF: Fed's Harker Says No Reason to Withdraw Support Yet

- FEDERAL CHANNELS WILL STOP USING J&J VACCINE IMMEDIATELY: CNN

- J&J VACCINE PAUSE IN U.S. EXPECTED TO BE `MATTER OF DAYS', Bbg

- BIDEN TEAM SEES PFIZER, MODERNA MEETING U.S. SHOT DEMAND BY MAY, Bbg

- BIDEN TO PULL U.S. FORCES FROM AFGHANISTAN BY SEPT. 11: WAPO

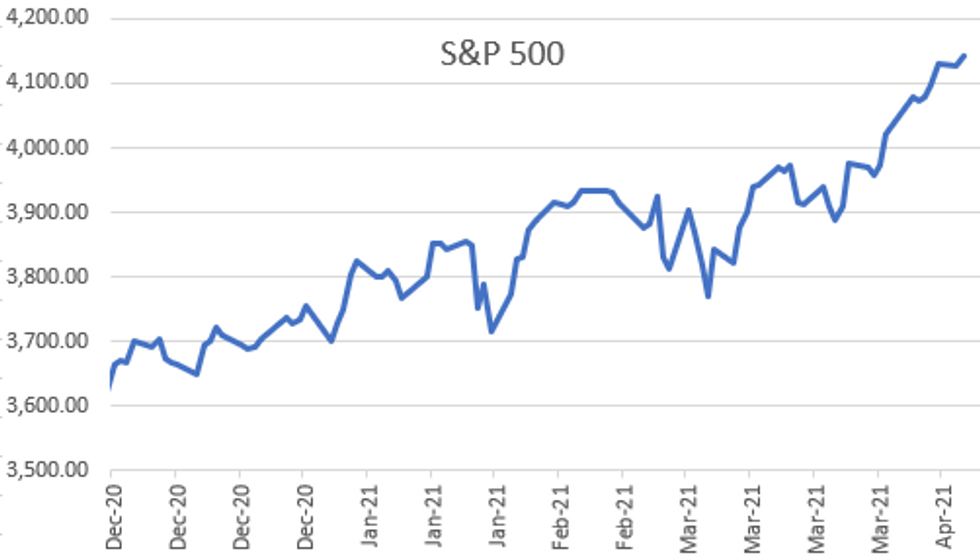

Stocks at New Highs, Shrug Off Vaccine, Geopol Risk Factors

Busy session Tue as early vaccine headlines and geopolitical tensions overshadowed much higher than expected CPI (CPI 0.6%, CORE 0.3%; CPI Y/Y 2.6%, CORE Y/Y 1.6%).- Sharp risk-off move ahead of the NY open: Tsys gap bid, equities reversed course traded lower on J&J headlines that US calling for pause in J&J vaccine due to blood clotting issues. Vaccine headlines dominated the first half while Russia/US geopol angst plays close second amid following:

- Russia warns U.S. warships to steer clear of Crimea 'for their own good', Rtrs

- NATO demands Russia end Ukraine build-up, West examines options, Rtrs

- RUSSIA'S TAKING MEASURES IN RESPONSE TO NATO'S THREATS, Bbg

- Rates and equities gradually recovered by midmorning into the second half when Bonds surged after a strong 30Y auction Re-Open: Yield curves whipped around as short end reversed earlier steeper levels to flatter post auction, 5s and 10s vs. 30s holding steeper. 30Y R/O drew high yld of of 2.320%. Stop through of 1.5bp well above five auction avg of only 0.1bp, topping last Dec's 1.2bp stop. Bid-to-cover 2.47x well above 2.34x five auction avg.

- Equities shrugged off the exogenous risk factors in the second half, S&P eminis making new all-time high of 4139.75.

- The 2-Yr yield is down 0.8bps at 0.1589%, 5-Yr is down 4.2bps at 0.8386%, 10-Yr is down 4.2bps at 1.6233%, and 30-Yr is down 2.6bps at 2.3077%.

US

US TSY FUTURES: Gap Bid in Rates, Stock Sell-Off On J&J Headlines Quick risk-off move: Tsys gap bid, equities reverse course trade lower on J&J headlines at top of the hour, US calling for pause in J&J vaccine due to blood clotting issues. Decent volumes, TYM1 >415k at moment.

CROSS ASSET: J&J Vaccine Pause in the US Prompts Risk Unwind New York Times reports that the US are to call for a pause in the rollout of the Johnson & Johnson vaccine on clotting cases, prompting some risk unwind trade over the past few minutes.

- The e-mini S&P inches back into negative territory and touches 4,114.50. Tsy yields move in tandem, with 10y slipping through 1.67% on the way lower.

- USD/JPY falls further, with the pair narrowing the gap with Y109.00 handle and falling through 109.25 support.

- J&J: TO PROACTIVELY DELAY ROLLOUT OF VACCINE IN EUROPE, Bbg

- J&J: REVIEWING BLOOD CLOT CASES WITH EUROPE HEALTH AUTHORITIES, Bbg

- J&J: AWARE OF EXTREMELY RARE DISORDER OF PEOPLE WITH BLOOD CLOTS, Bbg

- "Modest and transitory is how I would describe the main message," he said in an interview discussing a paper he co-authored with Duke University associate professor Francesco Bianchi and Chicago Fed senior economist Leonardo Melosi.

- "While the economic situation is improving, recovery is still in its early stages, and there's no reason to withdraw support yet," said Harker in a speech before the Delaware State Chamber of Commerce. Harker isn't a voting member of the rate-setting FOMC this year.

- His remarks on the need to keep the federal funds rate very low and continue making USD120 billion in monthly Treasury bond and mortgage-backed securities purchases comes after former Fed staffers told MNI an eventual move to pare back hefty bond-buying program could disrupt financial markets.

OVERNIGHT DATA

- US MAR CPI 0.6%, CORE 0.3%; CPI Y/Y 2.6%, CORE Y/Y 1.6%

- US MAR ENERGY PRICES 5.0%

- US MAR OWNERS' EQUIVALENT RENT PRICES 0.2%

DATA REACT: Core Services Highlights Above-Consensus CPI Print At 0.3385% unrounded, the core M/M US core CPI reading in March was a solid upside surprise vs 0.2% M/M expected.

- At first glance, the most notable dynamic underlying this is a continued divergence between goods and services inflation over the past couple of months, which has handily seen services prices rise more quickly.

- March saw another weak number for core goods (+0.080% M/M) but core services was very strong at +0.419%, led by Transportation services (+1.8% M/M). In fact that core services print was the 2nd highest going back to 2005. (July 2020 saw an 0.49% print).

- The Transportation price surge is probably related to US consumers travelling much more now that lockdowns are easing and vaccines are becoming more prevalent - something several analysts flagged prior to the report.

- US REDBOOK: APR STORE SALES +13.2% V YR AGO MO

- US REDBOOK: STORE SALES +13.2% WK ENDED APR 10 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 46.61 points (-0.14%) at 33698.57

- S&P E-Mini Future up 15 points (0.36%) at 4135.25

- Nasdaq up 136.5 points (1%) at 13986.28

- US 10-Yr yield is down 4.2 bps at 1.6233%

- US Jun 10Y are up 14.5/32 at 132-2.5

- EURUSD up 0.0035 (0.29%) at 1.1946

- USDJPY down 0.3 (-0.27%) at 109.08

- WTI Crude Oil (front-month) up $0.67 (1.12%) at $60.37

- Gold is up $12.9 (0.74%) at $1745.68

- EuroStoxx 50 up 5.09 points (0.13%) at 3966.99

- FTSE 100 up 1.37 points (0.02%) at 6890.49

- German DAX up 19.36 points (0.13%) at 15234.36

- French CAC 40 up 22.42 points (0.36%) at 6184.1

US TSY FUTURES CLOSE

- 3M10Y -4.492, 160.307 (L: 159.953 / H: 167.865)

- 2Y10Y -3.248, 146.243 (L: 145.69 / H: 152.658)

- Y30Y -1.407, 214.835 (L: 214.095 / H: 218.926)

- 5Y30Y +1.959, 146.906 (L: 143.999 / H: 147.345)

- Current futures levels:

- Jun 2Y up 0.75/32 at 110-11.75 (L: 110-10.625 / H: 110-12)

- Jun 5Y up 8.25/32 at 123-27.75 (L: 123-16.25 / H: 123-28)

- Jun 10Y up 14/32 at 132-2 (L: 131-12 / H: 132-03)

- Jun 30Y up 27/32 at 157-4 (L: 155-25 / H: 157-07)

- Jun Ultra 30Y up 1-8/32 at 185-21 (L: 183-25 / H: 185-30)

US EURODOLLAR FUTURES CLOSE

- Jun 21 steady at 99.820

- Sep 21 steady at 99.810

- Dec 21 -0.005 at 99.735

- Mar 22 steady at 99.770

- Red Pack (Jun 22-Mar 23) +0.015 to +0.055

- Green Pack (Jun 23-Mar 24) +0.065 to +0.085

- Blue Pack (Jun 24-Mar 25) +0.085 to +0.095

- Gold Pack (Jun 25-Mar 26) +0.090 to +0.095

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00125 at 0.07475% (+0.00000/wk)

- 1 Month +0.00238 to 0.11463% (+0.00338/wk)

- 3 Month -0.00200 to 0.18375% (-0.00375/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00487 to 0.21950% (+0.00912/wk)

- 1 Year +0.00337 to 0.28775% (+0.00200/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $68B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $252B

- Secured Overnight Financing Rate (SOFR): 0.01%, $863B

- Broad General Collateral Rate (BGCR): 0.01%, $377B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $350B

- (rate, volume levels reflect prior session)

- Wed 4/14 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Thu 4/15 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/16 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Mon 4/19 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 4/20 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 4/21 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

PIPELINE: $8B World Bank Dual-Tranche Lion's Share $15B Total Debt Issuance

- Date $MM Issuer (Priced *, Launch #)

- $15B to price Tuesday

- 04/13 $8B #World Bank (IBRD) $3B 2Y -5, $5B 7Y +7

- 04/13 $4.25B *IADB 5Y +0.0

- 04/13 $1.5B *Ontario Teachers Finance Trust 10Y +40

- 04/13 $1.25B *JFM 5Y +18

- 04/13 $Benchmark Tencent investor calls

- Expected this week:

- 04/14 $500M Kommunalbanken WNG 3.5Y +2a

- 04/14 $Benchmark Quebec 10Y +29a

- 04/15 $5.5B United Airlines $2.75B 5Y, $2.75B 8Y

- 04/?? $Benchmark/Euro Altice France 8NC3

FOREX: CPI Headfake Sees Greenback Slip to April Lows

- The USD initially found some support after a higher-than-expected CPI print for March, but price action swiftly reversed and the USD slipped against most others in G10 ahead of the close.

- Much attention was paid to the decision that the US would pause the rollout of the J&J vaccine on blood-clotting concerns, prompting some equity selling and JPY strength in early US hours. JPY remained strong into the US close, narrowing the gap with the April lows at Y109.00.

- GBP found another headwind following news that Bank of England Chief Economist and MPC member Haldane is due to step down from his role after the June MPC meeting.

- Haldane had been one of the more hawkish members of the BoE rate-setting committee, raising the risk that the Bank could adopt a more active approach later this year. EUR/GBP broke to new April highs in response, with the 50-dma undercutting as firm support going forward.

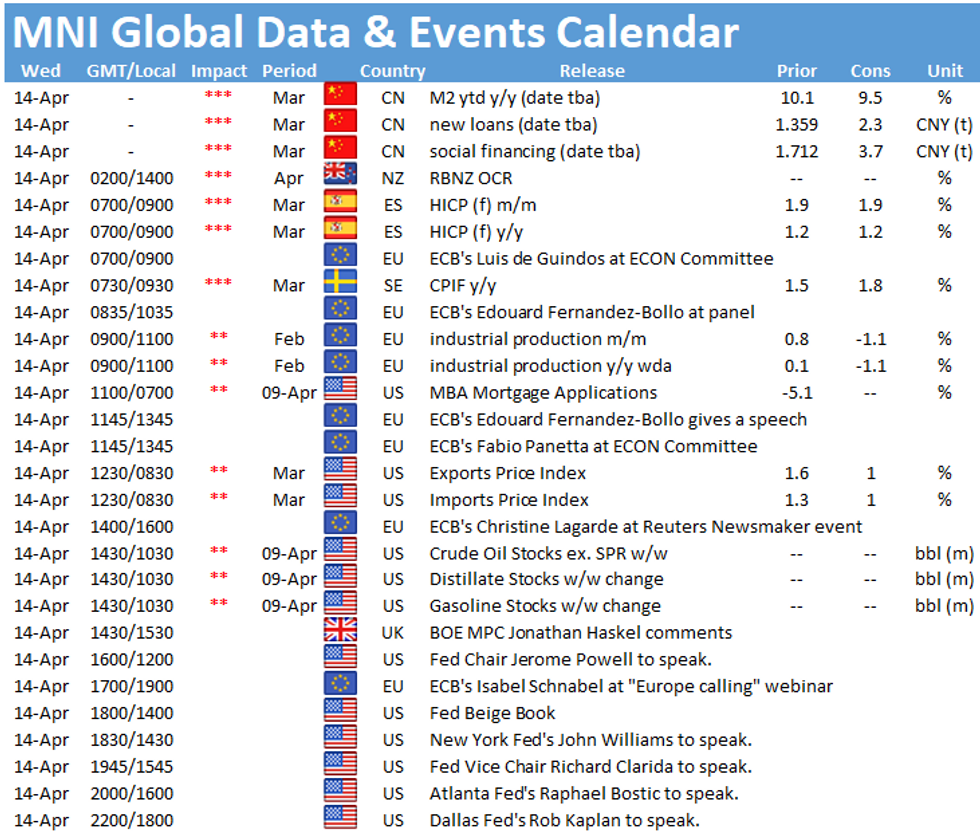

- Focus Wednesday turns to US import/export price indices and Australia's Westpac consumer confidence data. Central bank speak picks up further, with ECB's de Guindos, Panetta and Lagarde due to speak as well as Fed's Powell & Clarida and BoE's Haskel.

EGBs-GILTS CASH CLOSE: Heavy Supply Ends Up Well-Absorbed

The theme of Tuesday was issuance, unsurprising given the heavy auction/syndication schedule going into the day. This weighed on the space in the morning, though news that J&J's COVID vaccine rollout would be paused in the US and Europe boosted Gilts and Bunds midday London time.

- In the end, Bunds and Gilts were little changed, with periphery spreads mixed.

- Supply this morning came from the UK (Gilt , GBP1bn), Germany (Linker, E0.387bn allotted), Italy (BTPs, E7.75bn) Syndications today include: Spain 15-year bond (E6bn) Austria (dual tranche 4-/50-year issues for combined E5.75bn, and the Netherlands (0% Jan-38 DSL, E5.9bn).

- German ZEW and UK Feb GDP disappointed, but little reaction. ECB's Villeroy said that he didn't favor the bank adopting yield curve control.

- Note Slovakia today announced a 15-Yr syndication mandate. Auctions Weds include 30-Yr Gilt linker and Germany Aug-48 Bund.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.1bps at -0.702%, 5-Yr is unchanged at -0.631%, 10-Yr is up 0.1bps at -0.292%, and 30-Yr is up 0.2bps at 0.264%.

- UK: The 2-Yr yield is down 0.5bps at 0.049%, 5-Yr is down 0.5bps at 0.356%, 10-Yr is down 1bps at 0.779%, and 30-Yr is down 0.3bps at 1.307%.

- Italian BTP spread up 1.3bps at 104.1bps / Spanish spread down 0.3bps at 67.9bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.