-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Stay Strong, Powell On

EXECUTIVE SUMMARY

- MNI BRIEF: Fed's Powell Says Economy Going Into Higher Gear

- MNI BRIEF: Maximum Employment Alone Won't Move Fed-Clarida

- MNI REALITY CHECK: Bounce On The Cards For US Retail Sales

- FED KAPLAN REPEATS HE SEES FED RATE LIFTOFF SOONER THAN MEDIAN, Bbg

- FED KAPLAN: DON'T WANT FED TO GET IN WAY OF YIELDS DRIFTING HIGHER. Bbg

US TSY SUMMARY: Powell, Second Verse Same as the First

Rates trade weaker after the bell, well off lows to near middle of the session range, perhaps ironically as equities trimmed gains under heavier late session selling. Futures held mildly weaker levels in shorts to intermediates post-Import/export index data.

- Data was not expected to be a market mover, however, focus on headline risk over Fed-speak: vaccine-centric with safety of other jab-makers evaluated after J&J blood clot news Tue; geopolitical on Russia/US tensions related to former's troop buildup on Ukraine border.

- Several Fed speakers on day included Chairman Powell: No market reaction to Fed Chair's comments during Washington Economic Club virtual event, Tsys holding near recent lows, yld curves steeper. Economy at a bit of inflection point, going into period of faster growth and higher job creation; risk to improvement -- spike in virus mutations. Too much focus on dot plot and not enough outcome based. Three outcomes / goals need to be met: labor market recovery, inflation stable at 2% (not temporary), moving above 2%. Late Fed VC Clarida: "policy will not tighten solely because the unemployment rate has fallen below any particular econometric estimate of its long-run natural level."

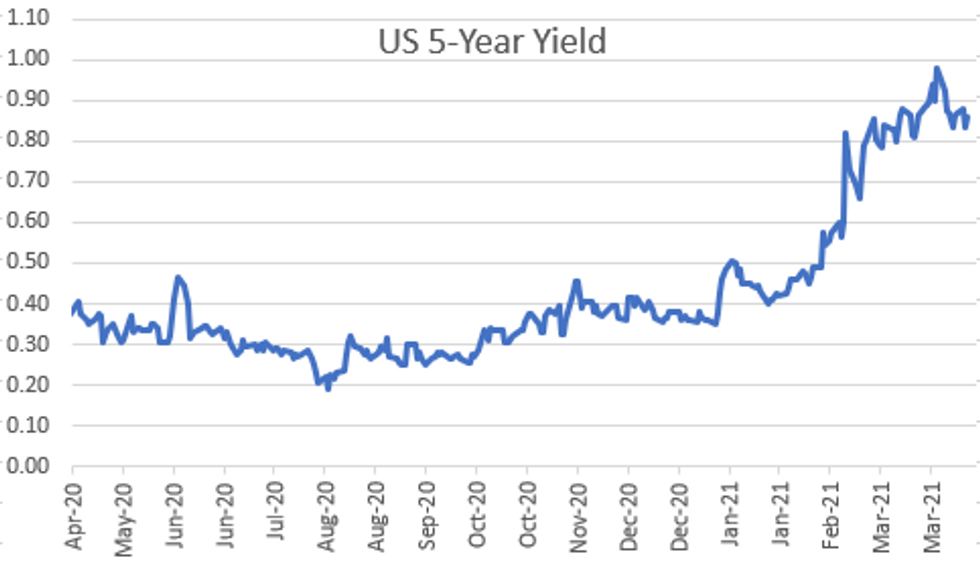

- The 2-Yr yield is up 0.2bps at 0.161%, 5-Yr is up 2.1bps at 0.8564%, 10-Yr is up 2bps at 1.6341%, and 30-Yr is up 2.9bps at 2.3232%.

US

FED: Federal Reserve Chairman Jerome Powell said Wednesday the economy is entering a "period of faster growth and higher job creation" as vaccinations take hold despite lingering risks from the gradually fading Covid pandemic.

- MNI reported this week that current and former Fed officials are increasingly focused on the lack of a clear exit path of QE as the economy improves more rapidly than previously thought. Powell's comments came in a webinar for the Economic Club of Washington.

- "Policy will not tighten solely because the unemployment rate has fallen below any particular econometric estimate of its long-run natural level," he said. "In our new framework, when in a business cycle expansion labor market indicators return to a range that in the Committee's judgment is broadly consistent with its maximum-employment mandate, it will be data on inflation itself that policy will react to."

US: U.S. March retail sales should get a boost from fresh stimulus and job growth through the month, industry experts told MNI, although some of that improvement came from pent up demand after winter storm disruptions depressed sales in February and isn't necessarily indicative of the coming months' sales pace.

- March saw a "perfect alignment" of positive factors like fresh stimulus, strong employment growth, and increased household mobility as vaccines became more widely available and state economies continued to reopen, said Jack Kleinhenz, chief economist at the National Retail Federation.

- Put together, those factors will translate into a "very, very strong March" for retail spending, he said.

OVERNIGHT DATA

- US MAR IMPORT PRICES +1.2%

- US MAR EXPORT PRICES +2.1%; NON-AG +2.0%; AGRICULTURE +2.4%

- FED: U.S. ECONOMIC ACVIVITY ACCELERATED TO A MODERATE PACE

- FED: MOST DISTRICTS NOTED MODERATE INCREASE IN HEADCOUNTS

- FED: U.S. PRICES ACCELERATED SLIGHTLY SINCE LAST BEIGE BOOK

- FED: DISTRICT OUTLOOKS WERE MORE OPTIMISTIC MAINLY ON VACCINES

- US MBA: MARKET COMPOSITE -3.7% SA THRU APR 09 WK

- US MBA: REFIS -5% SA; PURCH INDEX -1% SA THRU APR 9 WK

- US MBA: UNADJ PURCHASE INDEX +51% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.27% VS 3.36% PREV

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 78.65 points (0.23%) at 33755.26

- S&P E-Mini Future down 14.25 points (-0.34%) at 4118.5

- Nasdaq down 135 points (-1%) at 13861.63

- US 10-Yr yield is up 2 bps at 1.6341%

- US Jun 10Y are down 5/32 at 131-29.5

- EURUSD up 0.0024 (0.2%) at 1.1972

- USDJPY down 0.12 (-0.11%) at 108.94

- WTI Crude Oil (front-month) up $2.75 (4.57%) at $62.92

- Gold is down $8.54 (-0.49%) at $1736.96

- EuroStoxx 50 up 9.29 points (0.23%) at 3976.28

- FTSE 100 up 49.09 points (0.71%) at 6939.58

- German DAX down 25.21 points (-0.17%) at 15209.15

- French CAC 40 up 24.48 points (0.4%) at 6208.58

US TSY FUTURES CLOSE

- 3M10Y +1.959, 161.382 (L: 157.879 / H: 163.053)

- 2Y10Y +1.755, 147.114 (L: 145.029 / H: 148.331)

- 2Y30Y +2.732, 216.026 (L: 213.109 / H: 216.68)

- 5Y30Y +0.992, 146.519 (L: 144.395 / H: 146.603)

- Current futures levels:

- Jun 2Y down 0.375/32 at 110-11.5 (L: 110-11.25 / H: 110-11.875)

- Jun 5Y down 3.25/32 at 123-24.75 (L: 123-22 / H: 123-28.75)

- Jun 10Y down 4.5/32 at 131-30 (L: 131-25 / H: 132-06)

- Jun 30Y down 8/32 at 156-29 (L: 156-21 / H: 157-14)

- Jun Ultra 30Y down 18/32 at 185-7 (L: 184-28 / H: 186-09)

US EURODOLLAR FUTURES CLOSE

- Jun 21 steady at 99.820

- Sep 21 +0.005 at 99.815

- Dec 21 steady at 99.735

- Mar 22 +0.005 at 99.775

- Red Pack (Jun 22-Mar 23) -0.02 to -0.005

- Green Pack (Jun 23-Mar 24) -0.015 to -0.01

- Blue Pack (Jun 24-Mar 25) +/-0.005

- Gold Pack (Jun 25-Mar 26) +0.010 to +0.015

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00112 at 0.07363% (-0.00112/wk)

- 1 Month +0.00100 to 0.11563% (+0.00438/wk)

- 3 Month -0.00012 to 0.18363% (-0.00388/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00012 to 0.21938% (+0.00900/wk)

- 1 Year -0.00100 to 0.28675% (+0.00100/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $67B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $242B

- Secured Overnight Financing Rate (SOFR): 0.01%, $894B

- Broad General Collateral Rate (BGCR): 0.01%, $379B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $354B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, appr $12.801B accepted vs. $46.828B submission

- Next scheduled purchases:

- Thu 4/15 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/16 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Mon 4/19 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 4/20 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 4/21 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

PIPELINE: Still Waiting for UAL Launch

- Date $MM Issuer (Priced *, Launch #)

- 04/14 $1B #Quebec 10Y +29

- 04/14 $2B #Public Storage (3Y fix dropped) $700M 3NC1 FRN SOFR+47, $650M 7Y +55, $650M 10Y +70

- 04/14 $4B United Airlines $25B 5Y 4.375%, $2B 8Y 4.625% ($1.5B moved to term loan after initial total topped $5.5B)

- 04/14 $1.9B #Bank of Nova Scotia $1.25B 3Y +38, $650M 3Y FRN SOFR+44.5

- 04/14 $1.2B #Viterra Finance $600M 5Y +120, $600M 10Y +160

- 04/14 $500M *Kommunalbanken (KBN) WNG 3.5Y +2

- 04/14 $500M #Shinhan Bank 5.5Y +65

FOREX: Commodity-Tied Currencies On Top as Oil Markets Break Out

- Powell's end-of-session speech did little to turnaround the weaker greenback Wednesday as surging equity markets and still-low Treasury yields helped pressure the USD Index to new April lows. The 50-dma undercuts as support for the index, today crossing at 91.602.

- Building on a strong start, AUD and NZD rose further into the US close as commodity markets surged to outperform all others, with AUD/USD cracking near-term resistance to trade at the best levels since mid-March. Bulls need to build a base above the 50-dma to extend the recovery, with the key bull trigger now seen at March's 0.7849.

- A stellar session for WTI and Brent crude futures helped these currencies, alongside CAD, outperform, as a considerably larger draw on inventories than expected in the weekly DoE inventories helped fuel gains.

- USD and CHF were the weakest Wednesday, with AUD, NZD well ahead of the rest of G10.

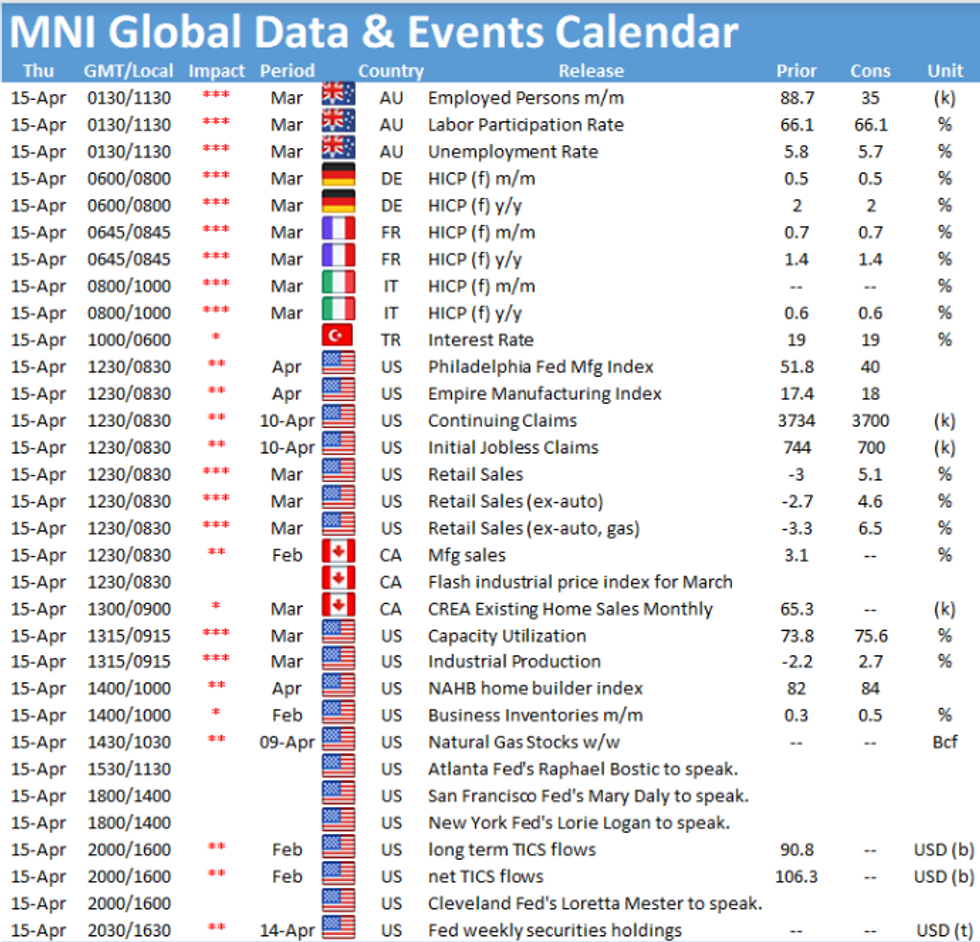

- Focus Thursday remains on US earnings season, with the Australian jobs report, weekly US jobless claims, industrial production and retail sales data as well as rate decisions from the the Turkish and South Korean central banks.

EGBs-GILTS CASH CLOSE: Bear Steepening

A strong start gave way to sizeable weakness for Bunds and Gilts, with yields testing their highest levels since March in a bear steepening move Weds afternoon.

- No overt catalyst though, with most of the week's (large) supply already having seemed to have been absorbed, and only some facets of a risk-on move (equities mixed, USD weaker). Periphery spreads mixed but basically steady.

- The E.U. confirmed details on issuance for the E800bn NextGenEU programme, with auctions and syndications due to start in the summer. Afternoon comments by ECB Lagarde had little impact.

- Slovakia held a 15-Yr syndication, raising E1.5bn; Germany held 30-Yr Bund sale and UK a 30-Yr linker auction. Ireland announced a 20-Yr Mandate.

- Thursday sees some final March CPI data, but no scheduled speakers or bond auctions.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1.4bps at -0.688%, 5-Yr is up 2.8bps at -0.603%, 10-Yr is up 3.4bps at -0.258%, and 30-Yr is up 3.1bps at 0.295%.

- UK: The 2-Yr yield is up 1.2bps at 0.061%, 5-Yr is up 1.1bps at 0.367%, 10-Yr is up 2.5bps at 0.804%, and 30-Yr is up 3.8bps at 1.345%.

- Italian BTP spread up 1bps at 105.1bps / Spanish down 0.5bps at 67.4bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.