-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Short Base Unwinds Accelerate Ahead Fri's NFP

EXECUTIVE SUMMARY

- MNI: Fed Willing To Risk Bubbles To Achieve Jobs, Price Goals

- MNI BRIEF: Fed is Far From Goals Needed to End QE, Daly Says

- US: Yellen: "May Be That Interest Rates Will Have To Rise Somewhat"

- YELLEN SAYS RATES MAY HAVE TO RISE TO STOP ECONOMY OVERHEATING, Bbg

US TSY SUMMARY: It's Not Headline Driven This Time

Game plan for Wednesday: Unless ADP comes out well off mean est (currently +860k): Set your clock for 0800ET for tomorrow's Tsy gap bid that runs to 1030ET, followed by a 50% retraces over next hour. This is how Bonds have reacted last two days. This wk's moves are not headline (China incursion into Taiwan airspace) driven or immediate risk-off in nature.

- Bond futures gap-bid at appr 0800ET the last two sessions, weaker stocks adding impetus to new duration highs in Tsys (ESM1 -47.0 at 4139.0 late), yield curves bull flattening, while the CBOE vol index VIX climbing +3.55 to21.85 high.

- Support Impetus speculation: not risk-off but accts unwinding net shorts as mean est' for Fri's NFP nears 1M, some desks say prop, fast$ and dealers that have been scaling back net short positions in Tsy and MBS inventories since February have accelerated. Blocks and stops exacerbating the current moves with cross asset hedging weighing on equities.

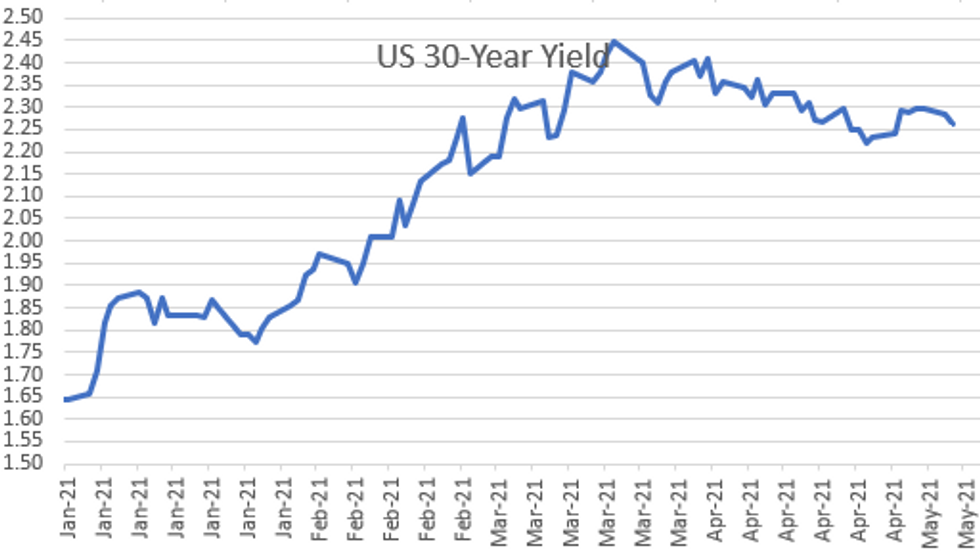

- 10Y futures Block buy (8.4k at 132-14, through a -13.5 offer) a more visible factor for support as 30YY slips to 2.2334% low, 10YY 1.5552%. Eurodollar and Tsy option trades consistently favored buying low delta puts outright or funded via upside calls.

- The 2-Yr yield is up 0.2bps at 0.1605%, 5-Yr is down 0.3bps at 0.8205%, 10-Yr is down 0.5bps at 1.5924%, and 30-Yr is down 1.7bps at 2.2668%.

US

FED: Federal Reserve officials recognize their policies may be helping to inflate asset bubbles, but view this as a risk worth taking for the sake of the broader economy and hope strong growth prospects will prevent a serious market crash, current Fed advisers and former officials told MNI.

- The Fed's patient stance, with the central bank determined to keep policy easy until it achieves concrete economic outcomes, may soon face a stern test as it struggles with market trepidation ahead of potentially elevated inflation readings in coming months, they said.

- "Their preference would be slow slow slow, to ideally pull this off without rattling markets -- but it's not up to them," former Fed governor Jeremy Stein said in an interview. For more, see MNI Policy main wire at 1147ET.

- "We are a long way from digging out of the hole that Covid caused," Daly said during a webinar with Minneapolis Fed President Neel Kashkari. Fears of rapid inflation are a bit overblown, she said, noting that tolerating a phase of inflation around 2.5% wouldn't be that different than when the Fed was coping with price gains around 1.5%.

- "It does involve a reallocation of resources...It may be that interest rates will have to rise somewhat to make sure that our economy doesn't overheat, even though the additional spending is relatively small relative to the size of the economy. So it could cause some very modest increases in interest rates to get that reallocation."

OVERNIGHT DATA

- US MAR TRADE GAP -$74.4B VS FEB -$70.5B

- US REDBOOK: APR STORE SALES +13.7% V YR AGO MO

- US REDBOOK: STORE SALES +14.2% WK ENDED MAY 01 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

- CANADIAN MAR BUILDING PERMITS +5.7% MOM

- CANADA RESIDENTIAL BUILDING PERMITS +15.9%; NON-RESIDENTIAL -15.6%

- CANADIAN MAR TRADE BALANCE -1.1 BILLION CAD

- CANADA MAR EXPORTS 50.6 BLN CAD, IMPORTS 51.8 BLN CAD

- CANADA REVISED FEB MERCHANDISE TRADE BALANCE +1.4 BLN CAD

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 92.94 points (-0.27%) at 34019

- S&P E-Mini Future down 45 points (-1.08%) at 4140.25

- Nasdaq down 324.2 points (-2.3%) at 13570.51

- US 10-Yr yield is down 0.5 bps at 1.5924%

- US Jun 10Y are up 2.5/32 at 132-13

- EURUSD down 0.0052 (-0.43%) at 1.2011

- USDJPY up 0.26 (0.24%) at 109.33

- WTI Crude Oil (front-month) up $1.19 (1.85%) at $65.68

- Gold is down $16.26 (-0.91%) at $1776.58

European bourses closing levels:

- EuroStoxx 50 down 75.45 points (-1.89%) at 3924.8

- FTSE 100 down 46.64 points (-0.67%) at 6923.17

- German DAX down 379.99 points (-2.49%) at 14856.48

- French CAC 40 down 56.15 points (-0.89%) at 6251.75

US TSY FUTURES CLOSE:

- 3M10Y -0.773, 157.465 (L: 154.004 / H: 160.559)

- 2Y10Y -0.328, 142.996 (L: 139.654 / H: 145.442)

- 2Y30Y -1.796, 210.134 (L: 207.44 / H: 213.226)

- 5Y30Y -1.51, 144.328 (L: 142.888 / H: 146.168)

- Current futures levels:

- Jun 2Y down 0.125/32 at 110-12.25 (L: 110-11.875 / H: 110-12.625)

- Jun 5Y up 0.5/32 at 124-3.25 (L: 123-31.5 / H: 124-08.5)

- Jun 10Y up 2.5/32 at 132-13 (L: 132-05 / H: 132-23.5)

- Jun 30Y up 11/32 at 157-31 (L: 157-11 / H: 158-23)

- Jun Ultra 30Y up 28/32 at 187-12 (L: 186-01 / H: 188-15)

US EURODOLLAR FUTURES CLOSE

- Jun 21 -0.005 at 99.810

- Sep 21 steady at 99.805

- Dec 21 steady at 99.745

- Mar 22 steady at 99.775

- Red Pack (Jun 22-Mar 23) -0.005 to steady

- Green Pack (Jun 23-Mar 24) +0.005 to +0.015

- Blue Pack (Jun 24-Mar 25) +0.020

- Gold Pack (Jun 25-Mar 26) +0.025 to +0.030

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00675 at 0.06450% (-0.00212 total last wk)

- 1 Month +0.00113 to 0.10838% (-0.00375total last wk)

- 3 Month -0.00100 to 0.17538% (-0.00500 total last wk) ** (Record Low 0.17288% on 4/22/21)

- 6 Month +0.00175 to 0.20663% (+0.00075 total last wk)

- 1 Year +0.00175 to 0.28288% (+0.00025 total last wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $74B

- Daily Overnight Bank Funding Rate: 0.05% from Mon's 0.03% all-time low, volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.01%, $930B

- Broad General Collateral Rate (BGCR): 0.01%, $376B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $349B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $5.551B submission

- Next scheduled purchases:

- Wed 5/05 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 5/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

PIPELINE: $2B NXP Semiconductors 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 05/04 $2B #NXP Semiconductors $1B 10Y +95, $1B 20Y +115

- 05/04 $Benchmark Rep of Chile tap 10Y +100a, 20Y +145a

FOREX: USD Moves From Strength to Strength

- In a relatively eventful session, the greenback surged, bouncing well off the Monday lows, as renewed equity weakness helped boost haven currencies and undermine growth-proxy and commodity-tied FX. Notable weakness in the global chipmakers helped shake sentiment, with the S&P 500 knocked to new multi-week lows to open a near 70 point gap with the all time highs posted in late April.

- The strong dollar sentiment was also reinforced by commentary from US Treasury Secretary (and former Fed chair) Yellen, who stated that rates may need to move higher to temper an economy that may 'overheat'.

- The bouncing greenback prompted the USD Index to narrow the gap with next key resistance at the 91.718 50-dma. A clean break and close above here opens initially 91.980 ahead of 92.286.

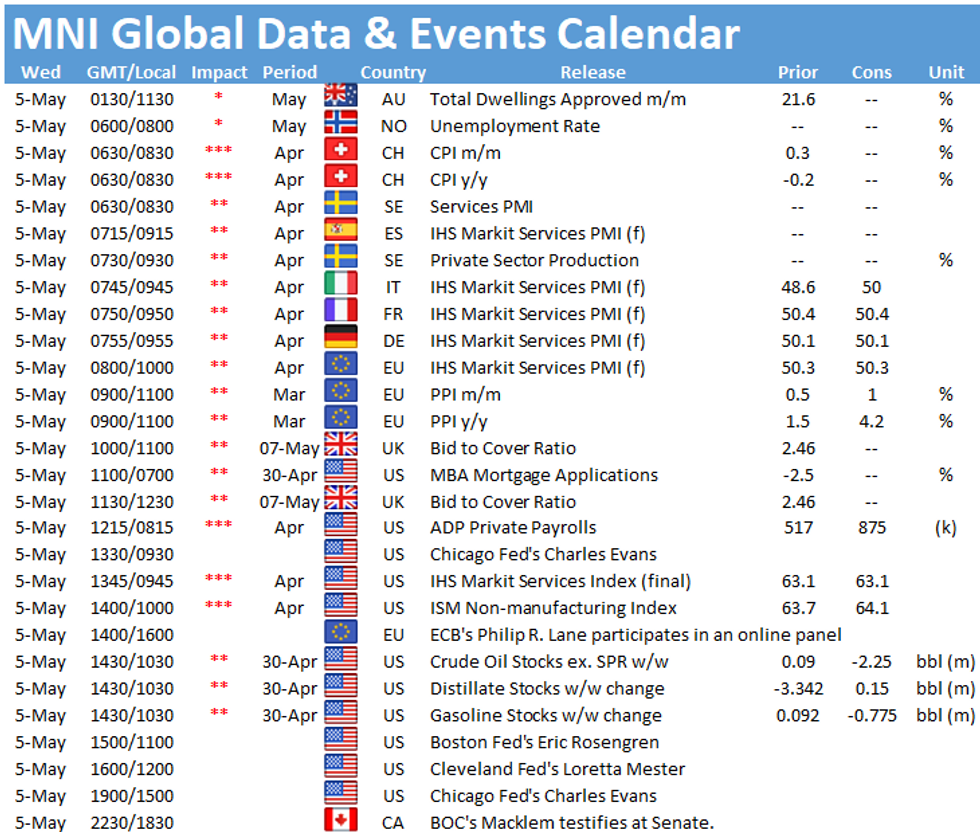

- Focus Wednesday turns to final April PMI data from across the Eurozone and US, European PPI number s for March and the April US ISM Services data. The ADP employment change report will also be watched for any read through to Friday's NFP release. Central bank speakers include Fed's Evans, Rosengren and Mester as well as ECB's Lane.

EGBs-GILTS CASH CLOSE: Reversal Of Fortune

Bunds and Gilts traded with a weak tone in the morning, until a sudden rout in US equities after midday London time triggered a significant risk-off move benefiting safe havens.

- No particular trigger to the risk-off move, though it was led by tech stocks, and could be some squaring ahead of Friday's US payrolls figured. Curves flattened as long-end yields fell sharply, with periphery spreads widening a couple of bps vs Bunds.

- That said, EGBs/Gilts ignored comments by US Treas Sec Yellen on the potential need for rising rates to stop the economy overheating on gov't spending (Tsys sold off sharply).

- Greece underperformed 5-Yr EUR benchmark syndication was announced.

- Weds sees Germany sell Bobl, UK sells 2031/ 2046 Gilts, final EZ/UK and IT/ES Apr PMI data.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 1.1bps at -0.697%, 5-Yr is down 2.4bps at -0.607%, 10-Yr is down 3.4bps at -0.238%, and 30-Yr is down 4.4bps at 0.315%.

- UK: The 2-Yr yield is down 3.3bps at 0.047%, 5-Yr is down 4bps at 0.349%, 10-Yr is down 4.7bps at 0.795%, and 30-Yr is down 5.2bps at 1.29%.

- Italian BTP spread up 2.1bps at 109.9bps / Greek spread up 4.5bps at 124.2bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.