-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Lot of Fed Speak to Unravel

EXECUTIVE SUMMARY

- MNI: Evans Says Several Years Needed to Reach Employment Goal

- MNI: Evans Challenges Inflation Hawks to Define Credible Danger

- MNI: Fed Rosengren On Guard Against Inflation Structural Shift

- MNI: Bowman Sees Small Risk of Persistently Higher Inflation

- MNI: US to Cut T-Bills on Debt Limit, Coupons Steady

US

FED: It will take several years to move towards policy makers' full employment goal and monetary policy will likely need to remain accommodative over that time, Chicago Fed President Charles Evans said Wednesday.

- "We still have quite a way to go before we return to pre-pandemic levels of employment, but given the growth prospects for the economy, I am confident that we will be making good progress toward our inclusive employment objective over the next couple of years," Evans said.

- There is also no sign inflation will get out of control, or even of a needed rise in expectations reflecting the Fed's quest to generate price gains averaging 2%, he said in the text of a speech. Inflation expectations remained below 2% even before the pandemic drove the unemployment rate down to 3.5% and investors are still buying 10-year Treasuries at a 1.6% yield, he noted. For more see MNI Policy main wire at 0930ET.

- "I wish people would fill in the dots" when they make this argument, he told reporters after a speech. Some critics appear to be talking about scenarios from decades long past when there were fears price gains could surge beyond 10%, he said.

- "I just don't see that progression" of runaway inflation, Evans said. "I don't see in place the building blocks" for inflation sustained even at a rate of 2.5% or 3%, he said. For more see MNI Policy main wire at 1200ET.

- "Despite the improved public health outlook and the expansion in economic activity, it is very important to note that significant slack remains in the economy," said Rosengren in prepared remarks at Boston College. Although fiscal policy has been "unusually stimulative," monetary policy will remain highly accommodative waiting for realized, rather than expected, outcomes, he said.

- "Although I expect these upward price pressures to ease after the temporary supply bottlenecks are resolved, the exact timing of that dynamic is uncertain. If the supply bottlenecks prove to be more long-lasting than currently expected, I will adjust my views on the inflation outlook accordingly," she said. Inflation will be above 2% for the next few months, she added. For more see MNI Policy main wire at 0930ET.

- The department will issue a record USD126 billion of securities at next week's quarterly refunding, the same as last quarter, and raising USD47.7 billion in new cash.

- Officials say they plan to sell USD58 billion in 3-year notes on May 11, USD41 billion in 10-year notes on May 12, and USD27 billion in 30-year bonds on May 13. For more see MNI Policy main wire at 0830ET.

OVERNIGHT DATA

US APR ADP PRIVATE SECTOR EMPLOYMENT +742K (+850K EXP., +565K REV. PRIOR). NOTE MARCH WAS REVISED FROM +517K TO +565K

US DATA: ISM Services PMI Eased in March

- US ISM SERVICES PMI 62.7 APR VS 63.7 MAR

- US ISM SERVICES BUSINESS INDEX 62.7 APR VS 69.4 MAR

- US ISM SERVICES EMPLOYMENT INDEX 58.8 APR VS 57.2 MAR

- US ISM SERVICES NEW ORDERS 63.2 APR VS 67.2 MAR

- US ISM SERVICES SUPPLIER DELIVERIES 66.1 APR VS 61.0 MAR (NSA)

- US FINAL APR SERVICES PMI 64.7; FLASH 63.1; MAR 60.4

- US FINAL APR SERVICES PMI 64.7; FLASH 63.1; MAR 60.4

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 144.16 points (0.42%) at 34279.62

- S&P E-Mini Future up 9.25 points (0.22%) at 4167

- Nasdaq down 16.9 points (-0.1%) at 13616.62

- US 10-Yr yield is down 1.2 bps at 1.5801%

- US Jun 10Y are up 4.5/32 at 132-18

- EURUSD down 0.0016 (-0.13%) at 1.1998

- USDJPY down 0.07 (-0.06%) at 109.26

- WTI Crude Oil (front-month) down $0.23 (-0.35%) at $65.47

- Gold is up $5.16 (0.29%) at $1784.30

European bourses closing levels:

- EuroStoxx 50 up 77.99 points (1.99%) at 4002.79

- TSE 100 up 116.13 points (1.68%) at 7039.3

- German DAX up 314.3 points (2.12%) at 15170.78

- French CAC 40 up 87.72 points (1.4%) at 6339.47

US TSY SUMMARY: Grinding Higher After ADP Miss, Tsy Refunding In-Line

Rates trading firmer after the bell, off late session highs amid moderate two-way positioning tending toward better buying after early post-ADP Chop. Tsy futures blipped off lows after ADP private employ came out lower than expected: +742k vs. +850k mean est.

- Rates reflexively sold off a few minutes later despite a largely in-line quarterly refunding annc from the US Tsy -- unchanged from the first quarter' record amount, $126B in 3s, 10s and 30s to auction next week. Tsy anticipates cutting T-bill auctions by USD150 billion in the months ahead and leaving longer-dated issuances steady, relying on its cash pile to fund the Biden administration's fiscal policies, as officials contend with uncertain debt limit deadlines to come at the end of July.

- Weakness was short lived as rates see-sawed higher by midday, finishing near session highs while equities pared gains, ESM1 near steady ahead the close. No obvious trigger or headline in play, amid decent overall volumes, TYM1 over 1.14M, that included sporadic buying in 5s and 10s from prop and fast$.

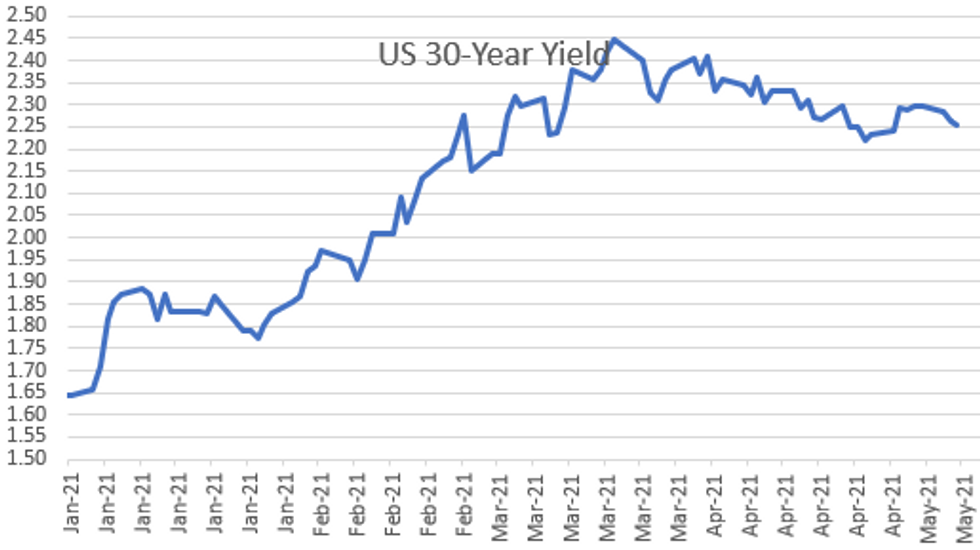

- The 2-Yr yield is down 0.4bps at 0.1546%, 5-Yr is down 1.8bps at 0.7997%, 10-Yr is down 1.2bps at 1.5801%, and 30-Yr is down 0.8bps at 2.2539%.

US TSY FUTURES CLOSE:

- 3M10Y -1.227, 156.238 (L: 155.53 / H: 160.674)

- 2Y10Y -0.443, 142.553 (L: 141.845 / H: 145.805)

- 2Y30Y -0.051, 209.853 (L: 209.016 / H: 212.804)

- 5Y30Y +1.003, 145.262 (L: 143.898 / H: 146.297)

- Current futures levels:

- Jun 2Y up 0.5/32 at 110-12.75 (L: 110-12 / H: 110-12.875)

- Jun 5Y up 3.25/32 at 124-6.75 (L: 124-00 / H: 124-07.75)

- Jun 10Y up 4.5/32 at 132-18 (L: 132-05.5 / H: 132-20)

- Jun 30Y up 6/32 at 158-6 (L: 157-08 / H: 158-12)

- Jun Ultra 30Y up 12/32 at 187-24 (L: 186-08 / H: 188-02)

US EURODOLLAR FUTURES CLOSE

- Jun 21 +0.010 at 99.825

- Sep 21 steady at 99.810

- Dec 21 steady at 99.755

- Mar 22 +0.005 at 99.785

- Red Pack (Jun 22-Mar 23) steady to +0.005

- Green Pack (Jun 23-Mar 24) +0.005 to +0.015

- Blue Pack (Jun 24-Mar 25) +0.020

- Gold Pack (Jun 25-Mar 26) +0.025

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N +0.00338 at 0.06788% (-0.00338/wk)

- 1 Month -0.00275 to 0.10563% (-0.00162/wk)

- 3 Month -0.00550 to 0.16988% (-0.00650/wk) ** (NEW Record Low vs. prior: 0.17288% on 4/22/21)

- 6 Month -0.00600 to 0.20063% (-0.00425/wk)

- 1 Year -0.00388 to 0.27900% (-0.00213/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $73B

- Daily Overnight Bank Funding Rate: 0.05% volume: $257B

- Secured Overnight Financing Rate (SOFR): 0.01%, $895B

- Broad General Collateral Rate (BGCR): 0.01%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $344B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $18.282B submission

- Next scheduled purchase

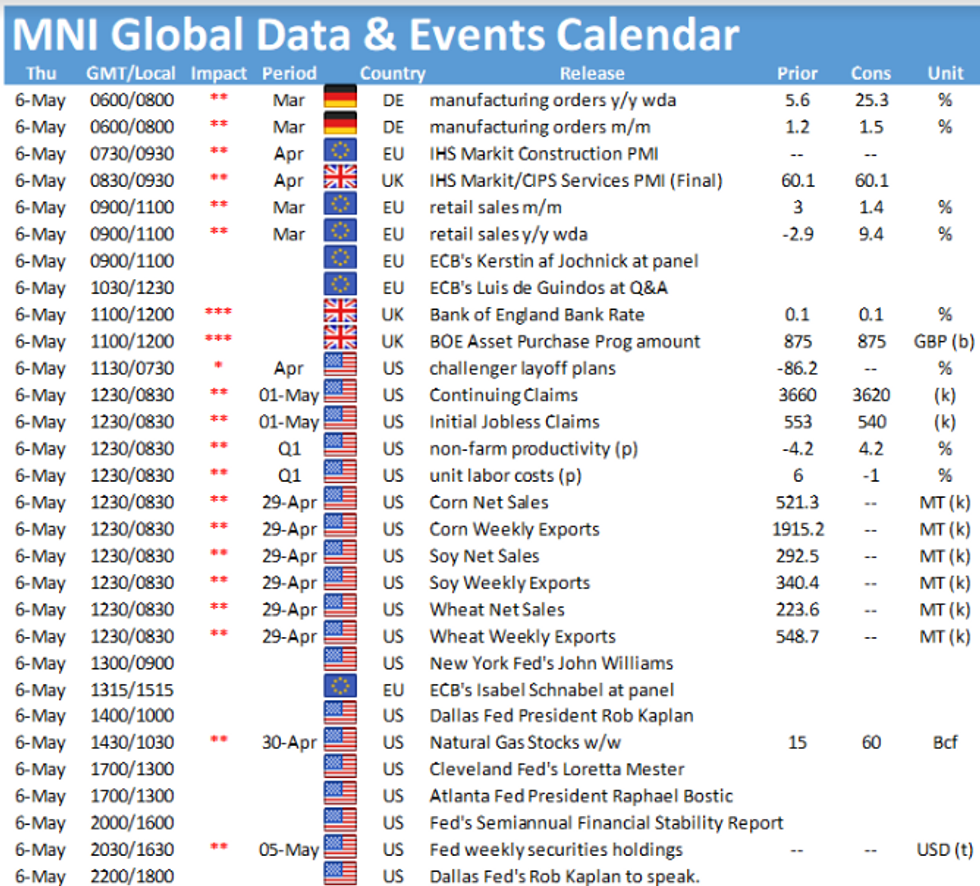

- Thu 5/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

PIPELINE: $2B JP Morgan 5Y Launched

$5.7B to Price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 05/05 $2B #JP Morgan 5Y 3.65%

- 05/05 $1B #Florida Power & Light 2NC.5 FRN SOFR+25

- 05/05 $800M #Highmark $400M 5Y +68, 00M $10Y +98

- 05/05 $650M #Agree Realty $350M 7Y +90, $300M 12Y +115

- 05/05 $1.25B Vistra Operations Co 8NC3 investor call

- On tap:

- 05/06 $1B EIB 10Y +12a

- 05/06 $500M NIB 5Y FRN SOFR+20a

FOREX: NZD Remains Top Of The Pile, CAD hits 3-year highs

- Broad dollar indices are roughly unchanged from yesterday as ADP Employment Change and ISM Services Index numbers were unable to ignite markets on Wednesday with G10 currencies holding tight ranges.

- USDCAD reached three-year lows, matching the lowest level reached in January 2018 at 1.2251/2. The break of 1.2365, Mar 18 low confirmed a resumption of the downtrend that has been in place since March 2020. Moving average studies are also in bear mode, reinforcing current trend conditions. Focus is now on the 1.2251 low as well as 1.2239, a Fibonacci projection, with Canadian jobs data on Friday's docket.

- NZDUSD consolidated overnight gains, above the 50-day MA at 0.7141, following solid employment figures and remains 0.87% higher on the session at 0.7207.

- This dragged Aussie higher with additional impetus stemming from initially higher oil prices and a firm commodity complex.

- EURUSD spent the majority of the session either side of 1.20, however maintains a slightly offered tone and resides down 0.15% on the day at 1.1995.

- Focus now turns to the Bank of England Rate Decision and US Weekly jobless claims on Thursday before Friday's Non-farms Payrolls report.

EGBs-GILTS CASH CLOSE: Gilts Underperform With BoE Ahead

Gilts and Bunds weakened Wednesday with some bear steepening.

- Periphery spreads widened, with the exception of Greece - which sold E3bln of new 5-Yr EUR benchmark via syndication; GGBs outperformed on the session as guidance tightened.

- Gilts underperformed, ahead of the BoE decision Thursday.

- Supply weighed on Gilts somewhat. In auctions, Germany allotted E3.3bn of Bobl and the UK sold combined GBP4.75bln of Jul-31 and Jan-46 Gilt.

- Data held some sway over price action, with Spanish services PMI beat and Italian miss alternatively weighing on / boosting EGBs, and later, US ISM Services missing estimates boosted core bonds.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.2bps at -0.695%, 5-Yr is up 0.4bps at -0.603%, 10-Yr is up 1bps at -0.228%, and 30-Yr is up 1.6bps at 0.331%.

- UK: The 2-Yr yield is up 0.7bps at 0.054%, 5-Yr is up 1bps at 0.359%, 10-Yr is up 2.4bps at 0.819%, and 30-Yr is up 3.6bps at 1.326%.

- Italian BTP spread up 2.7bps at 112.6bps/ Greek spread down 3.6bps at 120.6bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.