-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Subst Further Progress/Employ Goal: Not Met Yet

EXECUTIVE SUMMARY

- MNI BRIEF: Fed On Course to Taper Before Year-End: Minutes

- MNI: Fed Economists Downplay Hopes For Rapid Workforce Rebound

- MNI BRIEF: US Employment Revised Down by 166K on Services

- MNI: BOC May Rejoin Bill Sales With Holdings Lowest Since 1987

- MNI: Cost of Living Woes May Bring Canada Election Stalemate

- CRUDE OIL INVENTORIES FELL 3.23 MLN BARRELS, EIA SAYS, Bbg (-1.45M bbl est)

US TSY SUMMARY: Dovish Minutes? Or Less Hawkish?

Moderately volatile post-July FOMC minutes release, rates and equities both surged off lows, retraced and repeated the see-saw pattern into the close as markets continued to digest the minutes. Differing opinions regarding tapering.

- Minutes squarely stated: "MOST participants judged that the Committee's standard of "substantial further progress" toward the maximum-employment goal had not yet been met."

- Perhaps the the most dovish passage below suggests participants are more worried about Unemp and Inflation. Also helpful for market is reduced uncertainty over Tsy vs MBS pace:

- Several participants also remained concerned about the medium-term outlook for inflation and the possibility of the reemergence of significant downward pressure on inflation, especially in light of the recent decline in longer-term inflation compensation. In addition, several participants emphasized that there was considerable uncertainty about the likely resolution of the labor market shortages and supply bottlenecks and about the influence of pandemic-related developments on longer-run labor market and inflation dynamics.

- Tsys bounced after $27B 20Y Bond auction (912810TA6) stopped through: drawing a high yield of 1.850% (1.890% last month) vs. 1.855% WI. Bid-to-cover 2.44 vs. 2.33 in July.

- The 2-Yr yield is up 0.2bps at 0.2155%, 5-Yr is up 0.7bps at 0.7733%, 10-Yr is up 0.8bps at 1.27%, and 30-Yr is down 0.6bps at 1.9127%.

US

FED: The Federal Reserve is on course to begin winding down its USD120 billion monthly asset purchase program before the year is out despite some officials' concerns the labor market recovery has lagged, according to an account of the FOMC's July meeting published Wednesday.

- "Most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year because they saw the Committee's "substantial further progress" criterion as satisfied with respect to the price-stability goal and as close to being satisfied with respect to the maximum-employment goal," the minutes said.

- Most officials want to reduce buys of Treasuries and agency MBS proportionally to end both at the same time.

FED: Rates and equities moving off lows as markets continue to digest July FOMC minutes. Perhaps the the most dovish passage below suggests participants are more worried about Unemployment and Inflation. Also helpful for market is reduced uncertainty over Tsy vs MBS pace:

- Several participants also remained concerned about the medium-term outlook for inflation and the possibility of the reemergence of significant downward pressure on inflation, especially in light of the recent decline in longer-term inflation compensation. In addition, several participants emphasized that there was considerable uncertainty about the likely resolution of the labor market shortages and supply bottlenecks and about the influence of pandemic-related developments on longer-run labor market and inflation dynamics. Those participants stressed that the Committee should be patient in assessing progress toward its goals and in announcing changes to its plans on asset purchases.

FED: July FOMC on Money Markets, Debt Limit, RRP

July Minutes note "market participants were beginning to focus on the potential effects of changes in the Treasury General Account at the Federal Reserve and Treasury bill issuance over coming months in connection with the debt ceiling.

- The manager noted that, if a number of counterparties reached the per-counterparty limit on their ON RRP investments and downward pressure on overnight rates emerged, it may become appropriate to lift the limit.

FED: A long hoped-for rebound in workforce participation after schools reopen and jobless benefits expire next month may not materialize quickly, Federal Reserve economists told MNI, in comments echoing the case made by Fed officials who believe the economy will need support from near-zero interest rates into 2023.

- The Fed will soon turn its attention to how quickly the U.S. labor force can recover to pre-pandemic levels, as policymakers come close to nailing down a timeline for tapering QE and policy debate shifts toward the timing of eventual interest rate hikes.

- Andreas Hornstein, senior adviser at the Richmond Fed's research department, expects a slow recovery in participation, in line with the experience of past recessions. For more see MNI Policy main wire at 0833ET.

- Downward revisions: https://www.bls.gov/web/empsit/cesprelbmk.htm were concentrated in leisure and hospitality at 597,000 and other services at 216,000, with both declines worth more than 4%. Government payrolls and transportation/warehousing were both were revised up by about 250,000.

- Preliminary revisions won't be incorporated into historical employment data until final revisions are released in February, though the difference between preliminary and final revisions are typically small.

CANADA

BOC: The Bank of Canada's Treasury bill holdings have fallen to the lowest since 1987 after months of skipping the bidding at auctions, and economists told MNI the BOC may resume some buying before it runs out of short-term government debt entirely.

- The central bank is on track to have no T-bills on its balance sheet by year-end based on the schedule of maturing assets, Dominique Lapointe, former finance department researcher and now senior economist at Laurentian Bank Securities, told MNI. But policy makers are unlikely to break with a long history of having short-term government debt on its books, he said.

- "It never was zero, so I'm assuming that at some point they will go back and buy some," Lapointe said by phone from Montreal. "They do have the option to use their own securities to create liquidity overnight, so maybe they want to leave that option open by owning some." For more see MNI Policy main wire at 1025ET.

- Liberal Prime Minister Justin Trudeau called the election Sunday saying he needs a majority government to push the next phase of the pandemic rebuild, and a rush of pledges to tackle faster inflation and sky-high housing prices hasn't given any side a clear advantage. Problems such as expensive cell phone bills and housing are longstanding and deep issues that are difficult to tackle on the campaign trail, Alboim said. Instead some parties are embracing small solutions to pick up slices of voters, such as Conservative leader Erin O'Toole promising a one-month sales tax holiday. For more see MNI Policy main wire at 1325ET.

OVERNIGHT DATA

- US JUL HOUSING STARTS 1.534M; PERMITS 1.635M

- US JUN STARTS REVISED TO 1.650M; PERMITS 1.594M

- US JUL HOUSING COMPLETIONS 1.391M; JUN 1.317M (REV)

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.06% VS 2.99% PREV

- US MBA: REFIS -5% SA; PURCH INDEX -1% SA THRU AUG 13 WK

- US MBA: UNADJ PURCHASE INDEX -19% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.06% VS 2.99% PREV

- CANADIAN JUL CONSUMER PRICE INDEX INFLATION +3.7% YOY

- CANADA MOM CPI INFLATION WAS +0.6% IN JUL

- BOC AVG 3 CORE CPI RATES 2.5% IN JUL, HIGHEST SINCE MAR 2009

MARKET SNAPSHOT

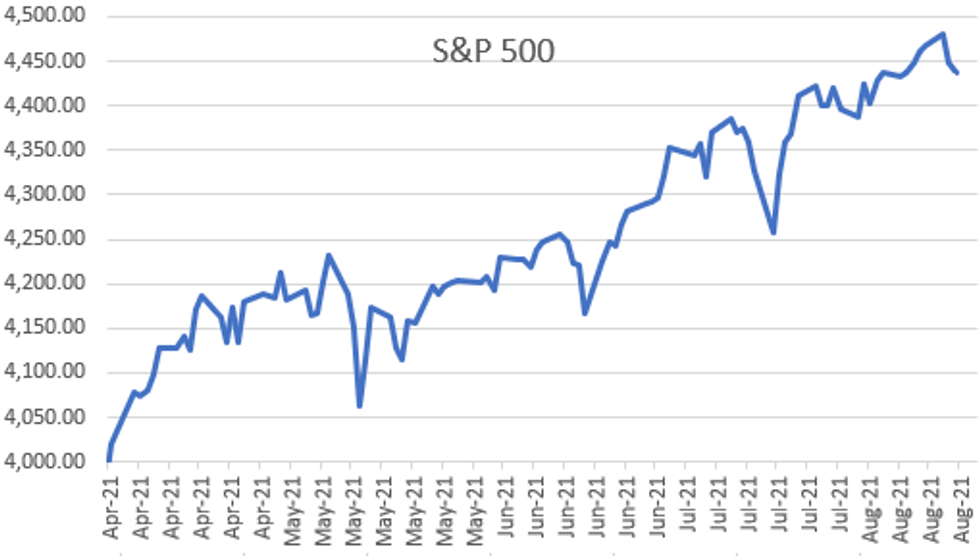

Key late session market levels- DJIA down 141.73 points (-0.4%) at 35304.66

- S&P E-Mini Future down 14 points (-0.32%) at 4437.25

- Nasdaq up 4.2 points (0%) at 14660.29

- US 10-Yr yield is up 1 bps at 1.2717%

- US Sep 10Y are down 3.5/32 at 134-5

- EURUSD up 0.0003 (0.03%) at 1.17

- USDJPY up 0.29 (0.26%) at 110.04

- WTI Crude Oil (front-month) down $1.25 (-1.88%) at $65.53

- Gold is up $0.42 (0.02%) at $1780.85

- EuroStoxx 50 down 6.98 points (-0.17%) at 4189.42

- FTSE 100 down 11.79 points (-0.16%) at 7169.32

- German DAX up 44.02 points (0.28%) at 15965.97

- French CAC 40 down 49.73 points (-0.73%) at 6770.11

US TSY FUTURES CLOSE

- 3M10Y +2.104, 120.92 (L: 117.728 / H: 123.599)

- 2Y10Y +0.622, 105.056 (L: 103.8 / H: 106.93)

- 2Y30Y -1.234, 168.986 (L: 168.308 / H: 172.382)

- 5Y30Y -1.769, 113.347 (L: 112.838 / H: 116.776)

- Current futures levels:

- Sep 2Y steady at at 110-8.375 (L: 110-07.5 / H: 110-08.75)

- Sep 5Y down 1.75/32 at 124-2.5 (L: 123-29.75 / H: 124-05.25)

- Sep 10Y down 3.5/32 at 134-5 (L: 133-29 / H: 134-10)

- Sep 30Y steady at at 165-4 (L: 164-17 / H: 165-09)

- Sep Ultra 30Y up 9/32 at 199-22 (L: 198-19 / H: 200-01)

US EURODOLLAR FUTURES CLOSE

- Sep 21 +0.003 at 99.873

- Dec 21 steady at 99.815

- Mar 22 steady at 99.845

- Jun 22 steady at 99.80

- Red Pack (Sep 22-Jun 23) -0.01 to steady

- Green Pack (Sep 23-Jun 24) -0.015 to -0.01

- Blue Pack (Sep 24-Jun 25) -0.02 to -0.015

- Gold Pack (Sep 25-Jun 26) -0.02 to -0.015

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N +0.00075 at 0.07863% (+0.00100/wk)

- 1 Month +0.00188 to 0.08838% (-0.00438/wk)

- 3 Month +0.00363 to 0.13088% (+0.00663/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00213 to 0.15838% (+0.00175/wk)

- 1 Year -0.00050 to 0.23500% (-0.00375/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08% volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.05%, $905B

- Broad General Collateral Rate (BGCR): 0.05%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $365B

- (rate, volume levels reflect prior session)

- TSY 2.25Y-4.5Y, $8.401B accepted vs. $23.319B submission

- Next scheduled purchases

- Thu 8/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 8/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION, New Record High

NY Fed reverse repo usage climbs to new record high of $1,115.656B from 82 counterparties vs. 1,053.454B on Tuesday. Surpasses prior record of $1,087.342B from Thursday, Aug 12.

PIPELINE: $3.6B To Price Wed; ADB Rolled to Thu

Flurry of corporate issuance around the Tsy 20Y Bond auction/stop.

- Date $MM Issuer (Priced *, Launch #)

- 04/18 $1B #Baidu $300M 5.5Y +83, $700M 10Y +113

- 04/18 $1B #HDFC Bank inaugural 5Y 3.7%

- 04/18 $1B #AON Corp $400M 10Y +80, $600M 30Y +100

- 04/18 $600M #Principal Life $300M 3Y +33, $300M 3ZY FRN/SOFR+38

- Rolled to Thursday:

- 04/19 $Benchmark ADB 5Y FRN/SOFR +18a

EGBs-GILTS CASH CLOSE: Dovish Tone Set By UK CPI Sustained In Afternoon

Bunds and Gilts has a solid session Wednesday. Weaker-than-expected UK July CPI set a bullish tone early for core FI, and with very few headline drivers, morning gains were sustained in the afternoon.

- Periphery spreads mostly compressed, led by Italy; Greece's widened slightly vs Bunds.

- UK CPI was 0.2pp lower than expected in July. Eurozone final CPI was in line with flash.

- Germany held a strong 30-Yr Bund auction (E1bln in supply).

- After hours, the minutes from the July Fed monetary policy meeting will be in focus.

- Thursday's highlights include France selling up to E7bln of MT OATs and E1bln of linkers (Spain's auction has been cancelled), with the Norges Bank decision getting attention as well.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.8bps at -0.744%, 5-Yr is down 0.9bps at -0.738%, 10-Yr is down 1.1bps at -0.482%, and 30-Yr is down 1.3bps at -0.034%.

- UK: The 2-Yr yield is down 0.8bps at 0.141%, 5-Yr is down 0.7bps at 0.292%, 10-Yr is up 0.3bps at 0.565%, and 30-Yr is up 1.8bps at 0.961%.

- Italian BTP spread down 1.1bps at 103.3bps / Spanish unch at 70bps

FOREX: FOMC Minutes Spark Brief Dollar Weakness

- The Greenback had been in favour for the majority of Wednesday with broad dollar indices hugging the highs approaching the July Fed Minutes.

- Initial headlines expressing the broad set of views among Fed participants prompted a sharp dollar sell-off, trading the day's range within minutes and making fresh session lows.

- The move was tempered and partially reversed as further details showed "Most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year".

- EURUSD had previously tested below 1.17 for the first time since late 2020. The sharp greenback turnaround sparked a quick spike in the pair from 1.17 to 1.1742, before paring half the move. The potential false break of 1.1704/06 may be eagerly watched over coming sessions for signs of a reversal indicator.

- NZD remained the laggard following the on-hold decision from the RBNZ, slightly against market consensus. The board cited the most recent national lockdowns but still foresee rate hikes in 2021 in what is being described as a hawkish hold.

- USDCHF and USDJPY held on to 0.25% gains despite equities and the commodity complex remaining in negative territory.

- Overnight, Australia will release their employment data before Thursday's US docket is headlined by Philly Fed Manufacturing Index.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.