-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

MNI ASIA OPEN: Risk Appetite Improves Post FOMC

EXECUTIVE SUMMARY

- MNI BRIEF: US Household Wealth Jumps to Record USD142 Trillion

- BOE: Minutes discusses potential Bank Rate hike ahead of the end of QE

- CHINA TELLS EVERGRANDE TO AVOID NEAR-TERM DOLLAR BOND DEFAULT, Bbg

UK

BOE: On the labour market - the Bank is going to look into why there are still so many furloughed workers for the next MPR. They say uncertainty on the labour market is higher than previously.- On inflation " The Committee's central expectation continued to be that current elevated global cost pressures would prove transitory."

- Key paragraph: "All members in this group agreed that any future initial tightening of monetary policy should be implemented by an increase in Bank Rate, even if that tightening became appropriate before the end of the existing UK government bond asset purchase programme."

- For me on first read it seems as though most of the commentary was fairly balanced but then we have this statement about potentially tightening before the APF programme finishes via Bank Rate. That makes you re-read the rest of the MPS in a different light and there are a lot of potentially hawkish statements in here - there's just a lot of tempering of expectations through the number of times uncertainty is mentioned.

BOE: The minutes of the Bank of England September meeting showed that neither of the newcomers, Chief Economist Huw Pill or independent member Catherine Mann, broke ranks, but they underscored the fragmentation within the the Monetary Policy Committee as its focus shifts to tightening policy.

- While only two members of the MPC, Deputy Governor Dave Ramsden and Michael Saunders, voted to end the current round of asset purchases immediately, there was a diversity of views within the majority no change camp. All accepted policy would need to tighten at some stage as the recovery proceeded, but they disagreed over how likely it was that the sharp rise in consumer prices was likely to be temporary or to herald a more sustained period of high inflation.

US

U.S. household wealth jumped USD5.9 trillion to a record USD141.7 trillion through the second quarter, a report from the Federal Reserve showed on Thursday, suggesting continued room for economic growth.

- The increase came on rising equity markets, adding USD3.5 trillion to household assets in the second quarter. Rising real estate values added USD1.2 trillion, according to the U.S. central bank's latest quarterly report on household, business and government financial accounts. Overall U.S. household wealth has risen USD31.1 trillion since March last year and USD10.9 trillion since the end of 2020.

- Household debt rose in the second quarter at an annualized rate of 7.9% compared to a 6.7% rise in the first quarter, as consumer credit and home mortgage borrowing accelerated. Non-financial business borrowing cooled, growing at a 1.4% annualized rate, down from a 4.3% pace in the previous quarter.

OVERNIGHT DATA

- US JOBLESS CLAIMS +16K TO 351K IN SEP 18 WK

- US PREV JOBLESS CLAIMS REVISED TO 335K IN SEP 11 WK

- US CONTINUING CLAIMS +0.131M to 2.845M IN SEP 11 WK

- Flash U.S. Composite Output Index at 54.5 (55.4 in August). 12-month low.

- Flash U.S. Services Business Activity Index at 54.4 (55.1 in August). 14-month low.

- Flash U.S. Manufacturing PMI at 60.5 (61.1 in August). 5-month low.

- Flash U.S. Manufacturing Output Index at 55.2 (56.7 in August). 11-month low.

- CANADA JUL RETAIL SALES -0.6%; SALES EX-AUTOS/PARTS -1.0%

- CANADA JUL RETAIL SALES EX-AUTOS/PARTS-GASOLINE -1.3%

- CANADIAN FLASH AUG RETAIL SALES +2.1%

MARKET SNAPSHOT

Key late session market levels:

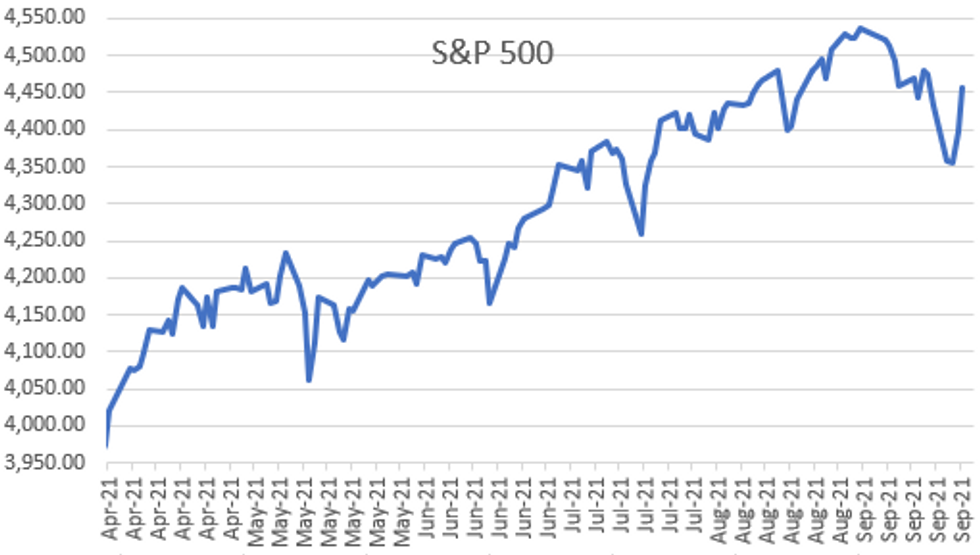

- DJIA up 561.46 points (1.64%) at 34819.53

- S&P E-Mini Future up 63 points (1.44%) at 4447

- Nasdaq up 170.3 points (1.1%) at 15067.22

- US 10-Yr yield is up 10.6 bps at 1.4061%

- US Dec 10Y are down 20/32 at 132-11.5

- EURUSD up 0.0059 (0.5%) at 1.1746

- USDJPY up 0.45 (0.41%) at 110.23

- Gold is down $17.14 (-0.97%) at $1751.00

- EuroStoxx 50 up 44.73 points (1.08%) at 4194.92

- FTSE 100 down 5.02 points (-0.07%) at 7078.35

- German DAX up 137.23 points (0.89%) at 15643.97

- French CAC 40 up 64.98 points (0.98%) at 6701.98

US TSYS: Improved Risk Appetite Holding

Risk appetite improved Thursday, rates holding narrow range near lows since late morning while equities surged -- Dow surged over 600.0 at one point while eminis traded +60.0 at 4444.0 after the FI close, US$ index DXY -.418 at 93.044.

- Brief risk-off move ahead the NY open as China's Evergrande continued to roil markets. Early risk-on tone scaled back slightly after headlines that Chinese officials told "local governments to prepare for downfall" (DJ) of real-estate developer.

- Quickly discounted, risk-on tone gained momentum into midday as participants ruminated over timing and speed of tapering as precursor to lift-off. Main takeaway from Fed Chair Powell's presser: reinforcement that taper very likely annc in Nov barring a poor Sep jobs report (mark your calendar for Fri October 8 ). Re: Sep payrolls report, Powell actually said he's looking for a "reasonably good one" and later a "decent" one, and NOT a "knockout, great, super strong employment report".

- Little react to weekly claims, +16K to 351K; continuing claims +0.131M to 2.845M

- Bonds more than reversed post FOMC gains, yield curves bear steepening -- while 5s30s held below 100bp, front end curves surged: 2s10s +8.5 at 114.7 -- near last Fri's high print -- that married up with strength in financials / banks today.

- Decent overall volumes as yields climbed, two-way deal-tied hedging on $10B corp supply, some option hedging ahead Fri's Oct Tsy expiration.

- The 2-Yr yield is up 2bps at 0.2567%, 5-Yr is up 7.8bps at 0.9286%, 10-Yr is up 10.6bps at 1.4061%, and 30-Yr is up 11.3bps at 1.9207%.

US TSY FUTURES CLOSE

- 3M10Y +10.553, 137.572 (L: 128.633 / H: 137.743)

- 2Y10Y +8.508, 114.74 (L: 106.221 / H: 115.317)

- 2Y30Y +9.374, 166.329 (L: 157.046 / H: 167.694)

- 5Y30Y +3.925, 99.508 (L: 93.752 / H: 100.854)

- Current futures levels:

- Dec 2Y down 1.375/32 at 110-1.875 (L: 110-01.75 / H: 110-03.25)

- Dec 5Y down 9.25/32 at 122-31 (L: 122-29.75 / H: 123-11.25)

- Dec 10Y down 19/32 at 132-12.5 (L: 132-11 / H: 133-06)

- Dec 30Y down 1-18/32 at 162-06 (L: 162-01 / H: 164-15)

- Dec Ultra 30Y down 2-30/32 at 197-05 (L: 196-23 / H: 201-20)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.815

- Mar 22 -0.005 at 99.845

- Jun 22 steady at 99.805

- Sep 22 -0.010 at 99.690

- Red Pack (Dec 22-Sep 23) -0.05 to -0.03

- Green Pack (Dec 23-Sep 24) -0.06 to -0.05

- Blue Pack (Dec 24-Sep 25) -0.08 to -0.06

- Gold Pack (Dec 25-Sep 26) -0.09 to -0.085

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N -0.00062 at 0.07188% (+0.00113/wk)

- 1 Month +0.00275 to 0.08600% (+0.00250/wk)

- 3 Month +0.00300 to 0.13225% (+0.00838/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00050 to 0.15500% (+0.00275/wk)

- 1 Year +0.00375 to 0.22900% (+0.00463/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $265B

- Secured Overnight Financing Rate (SOFR): 0.05%, $879B

- Broad General Collateral Rate (BGCR): 0.05%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $349B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5, $1.401B accepted vs. $4.334B submission

- Next scheduled purchase

- Fri 9/24 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED Reverse Repo Operation, Fifth Consecutive Record High

NY Fed reverse repo usage surged to new record high of 1,352.483B from 77 counter-parties vs. Wednesday's record $1,283.281B.

PIPELINE: $8B Debt Issuance to Price, $3B Egypt 3Pt Leads

- Date $MM Issuer (Priced *, Launch #)

- 09/23 $3B #Arab Rep of Egypt $1.125B 6Y 5.8%, $1.125B 12Y 7.3%, $750M 30Y 8.75%

- 09/23 $1.8B #American Tower $600M 5Y +63, $700M 10Y +95, $500M 30Y +115

- 09/23 $1.5B #Nordea Bank 5Y +60

- 09/23 $1B #Bank of Ireland 6NC5 +110

- 09/23 $700M *CCB HK 5Y +65a

- 09/23 $/E Benchmark Altice France investor calls

- 09/23 $Benchmark Credit Bank of Moscow NC5.5 AT1 investor calls

FOREX: Risk On Provides Boost To Cross/JPY, Greenback Under Pressure

- Buoyant market sentiment provided a tailwind for risk-tied currencies on Thursday, with the Japanese Yen seeing steady selling pressure throughout the session.

- This led to significant moves in yen crosses, with particular strength seen in AUDJPY, CADJPY and NZDJPY, all rising just shy of 1.5%.

- Despite the higher US yields, the recovery in equities worked against the US dollar, with broad dollar indices retreating around 0.5%.

- Some hawkish repricing in UK money markets following the Bank of England also supported GBPUSD, rising 1% from the early lows hovering 20 pips below the week's highs and the 20-day EMA circa 1.3760.

- Today's gains leave a key support at 1.3602 unchallenged, Aug 20 low. Furthermore, it also means triangle support at 1.3633 remains intact despite being probed yesterday and today.

- In similar fashion, the Norwegian krone rallied over 1% against the greenback with an upbeat central bank meeting as well as oil prices providing a beneficial backdrop for NOK.

- In the EM space, a surprise rate cut worked against the Turkish Lira. USDTRY (+1.3%) matched record levels just above 8.80, last seen in June earlier this year.

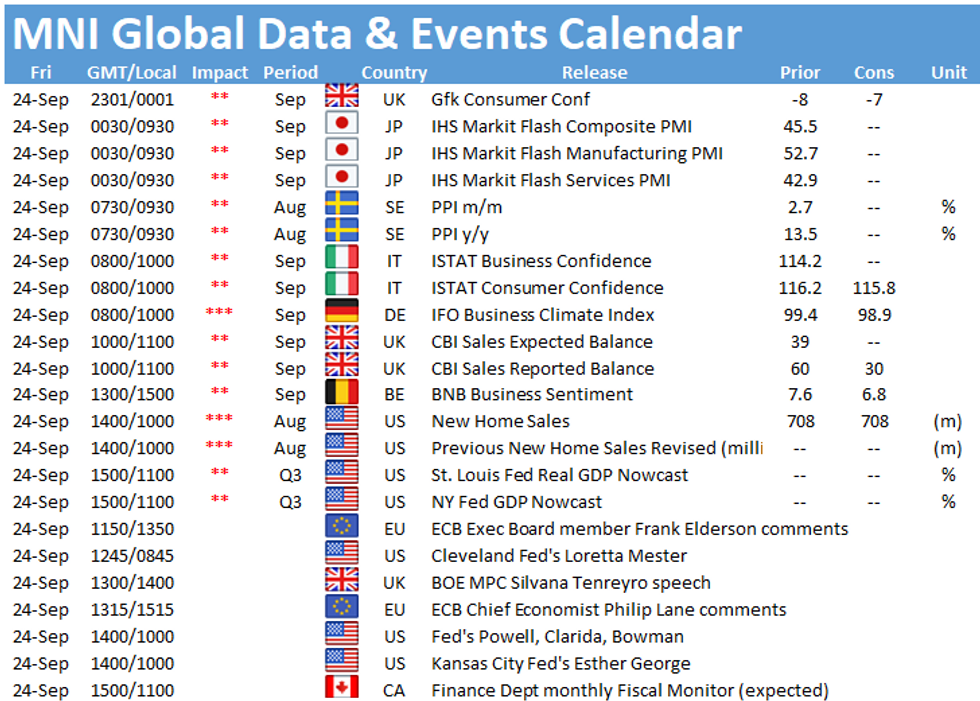

- German IFO data headlines the EU session on Friday before Fed Chair Powell, Gov Bowman and VC Clarida are due to deliver remarks at an online event.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.