-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead

MNI POLITICAL RISK - Trump Rounds Out Cabinet Nominations

MNI ASIA OPEN - Focus Shifts To US Jobless Claims & Philly Fed

MNI ASIA OPEN - Focus Shifts To US Jobless Claims & Philly Fed

EXECUTIVE SUMMARY:

- Fed's Williams Urges More Resilient Treasury Market

- US Treasury Says Central Clearing Appears Promising

- No Stagflation, But Upside Price Risk-ECB's Schnabel

NORTH AMERICA

US (MNI): US Treasury Says Central Clearing Appears Promising

Treasury Department undersecretary for domestic finance Nellie Liang Wednesday said reforms in the Treasury market to expand central clearing appear promising in terms of potential improvements in efficiencies from netting across all counterparties, but cautioned it could concentrate risk.

FED (MNI): Fed's Williams Urges More Resilient Treasury Market

New York Fed President John Williams Wednesday urged regulators and members of the private sector to come together to build a more resilient Treasury market. In keynote remarks at a Treasury market conference among U.S. regulators, Williams cited the the so-called flash rally of October 2014, repo market distress in September 2019, and the market dislocations from the pandemic in March of 2020 in exposing weaknesses in the Treasury market.

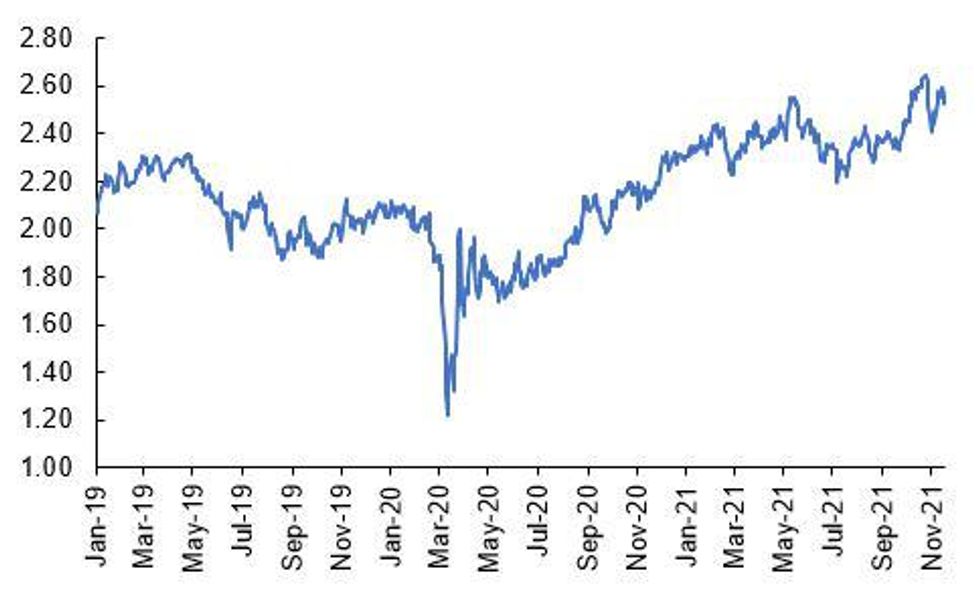

US (MNI): US Trimmed Mean Inflation Headed To 2.5% In '22

The Dallas Fed's trimmed mean PCE inflation rate, a favorite gauge of underlying inflation for Fed officials, is likely to rise to 2.5% next year as price pressures spread, Dallas Fed economist Jim Dolmas told MNI. Supply shocks that initially showed up in a small subset of categories are finding their way to a broader set of goods while rent and owners' equivalent rent inflation will keep accelerating based on house price gains, as firms continue to pass on some or all of their rising wage costs to consumers, boosting core PCE inflation, Dolmas said.

EUROPE

UK (MNI): BOE's Mann-Shift To Services Easing Price Pressures

Bank of England Monetary Policy Committee member Catherine Mann said that so far the tight labour market is only feeding through to wage growth acceleration in some segments of the jobs market. While "there is a very robust labour market", wage growth has been most marked at the bottom end of the scale, said Mann, who voted against a rate hike in November, speaking at a JP Morgan event Mann.

ECB (MNI): No Stagflation, But Upside Price Risk-ECB's Schnabel

The global and European economies are undergoing a process of reflation, not stagflation, ECB Executive Board member Isabel Schnabel said Wednesday, adding that concerns over an abrupt slowdown in the economic recovery under the impact of higher energy prices and supply chain disruptions are largely unwarranted. Economies are better placed today to prevent a recurrence of the negative effects of the oil price shocks of the 1970s and 1980s, Schnabel said, but inflation will remain higher for longer than previously anticipated.

DATA

Canada Oct Inflation Rises to 4.7%, Most Since 2003

- Canada's inflation rate was the fastest since 2003 in October at 4.7% on gains in every major category led by gasoline and automobiles, the federal statistics office reported Wednesday.

- It was the seventh month above the central bank's 1%-3% target band and accelerated from September's 4.4% pace. The consumer price index climbed 0.7% on the month. The monthly and 12-month gains matched economist forecasts. Inflation hasn't topped 4.7% since 1991 when the Bank of Canada became the first G7 nation to adopt inflation targets, following only New Zealand.

US OCT HOUSING COMPLETIONS 1.242M; SEP 1.242M (REV)

US SEP STARTS REVISED TO 1.530M; PERMITS 1.586M

FIXED INCOME: Grinding Higher

US TSYS have firmed during the day with the belly of the curve marginally outperforming.

- Cash yields are 2-4bp lower on the day with the curve slightly bull flattening.

- TYZ1 is holding near the highs of the day and last traded at 130-14+ (L: 130-01+ / H: 130-16+)

- Today's 20Y auction had a a high yield of 2.065% and bid-to-cover ratio of 2.34x

- The White House earlier indicated that President Biden will likely make a decision on the Fed Chair before Thanksgiving.

- The data slate was light today with mortgage applications and housing starts not giving much for the market digest.

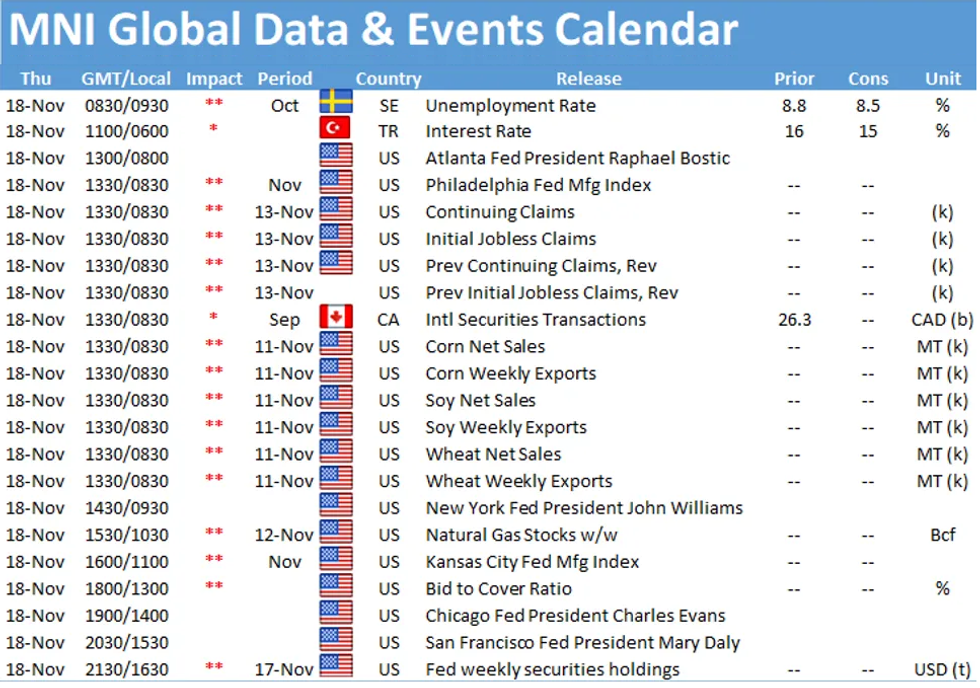

- Focus tomorrow will shift to jobless claims, and the Philly Fed index.

FOREX: USDJPY Strongly Rejects 115, GBP Buoyed By CPI Data

- USDJPY experienced strong volatility on Wednesday as failed momentum above the crucial 114.70 inflection point sparked a strong reversal throughout the US trading session.

- Falling just 3 pips shy of the 115.00 mark overnight, the pair edged back below the breakout throughout European trade. With the path of least resistance defined as lower, USDJPY weakening gathered pace with the pair trading back below 114.00 amid a degree of pressure in global equity indices.

- AUD remained the weakest currency in the G10 space, extending the November downtrend below the 0.73 handle in AUDUSD with AUDJPY retreating well over 1%. The price action was largely in response to wage index data overnight, which showed pay growth well shy of the RBA's cited 3% requirement for rate hikes.

- GBP traded on a surer footing, boosted by the above estimate CPI readings released early on Wednesday. Sterling gains were broad based with cable rising close to 1.35 and the cross slipping to the lowest levels since February 2020, back below 0.8400. This has opened 0.8356 next, the Feb 26, 2020 low. Initial resistance is seen at 0.8463.

- In emerging markets, continued weakness in the Turkish lira remains the standout talking point ahead of tomorrow's central bank decision. USDTRY reached +3% gains for the second day in a row, briefly printing a high of 10.6848 before consolidating around 10.60 heading into the close.

- New Zealand inflation expectations data scheduled overnight as well as potential comments from RBA Assist. Governor Ellis speaking at an online event. US jobless claims and Philly Fed Manufacturing Index headline the US docket before potential commentary from Fed members Williams, Evans and Daly.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.