-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Rate Liftoff Likely After Taper

EXECUTIVE SUMMARY

- MNI: Waller Sees Fed Rate Hike Soon After Taper Ends

- NY Fed Williams: Raising Rates Would Be A Positive Event For Economy, Bbg

- NY Fed Williams: Baseline Outlook For Economy Is Very Good, Bbg

- MNI INTERVIEW: BOC May Benefit From Ending Guidance-Ex Adviser

US

FED: Federal Reserve Governor Christopher Waller said Friday the U.S. labor market is closing in on maximum employment and a hike in the fed funds rate will likely be warranted shortly after the central bank ends its asset purchases in mid-March.- Waller "strongly supported" the FOMC's decision earlier this week to speed up the pace of tapering of asset purchases. "This action gives us increased flexibility to adjust monetary policy as needed in 2022," he said.

- "Given my expectations for inflation and labor market conditions, I believe an increase in the target range for the federal funds rate will be warranted shortly after our asset purchases end," Waller said in his remarks to be given to the Forecasters Club of New York. "By choosing to speed up our reductions in asset purchases, the FOMC is providing flexibility for other adjustments to monetary policy, if needed, as early as spring to accommodate changes in the economic outlook."

FED: NY's Williams Emphasizes Rate Hike "Optionality", Data Dependency. NY Fed's Williams speaking on CNBC in the first post-Dec meeting communication by an FOMC participant - overall the message is very similar to that delivered by Powell and the Statement/Dot Plot on Wednesday.

- Says that the Fed is "very focused on inflation" which is "obviously too high right now".

- Says he doesn't see any benefit to speeding the taper further than currently scheduled, with the first rate hike decision to be dependent upon the incoming data. He emphasizes that this week's decision creates the "optionality" to "likely" raise rates in 2022.

- While timing for the hike will "depend on data", Williams said he feels the "baseline outlook is very good" and that raising rates would be "positive" in terms of reflecting economic strength.

- He said he is focused on real interest rates (adjusted for inflation expectations), and that the higher funds rate path in the dots reflected in part the expected path of inflation. While he sees progress in moving rates back toward "neutral", there remains a question of where "neutral" is.

- Overall not much we didn't hear already on the state of play from Powell (and markets didn't move), though useful to hear from a senior FOMC member who is typically on the dovish end of the spectrum.

CANADA

BOC: The Bank of Canada may benefit from dropping forward guidance at the January rate meeting because the benefits are fading as tightening draws near and policymakers' credibility will take a hit if they make an unscheduled move, former adviser Angelo Melino told MNI.

- “It's a dangerous thing to continue into 2022, I hope that come January they get rid of this extraordinary forward guidance," said Melino, a University of Toronto professor who advised the bank during the global financial crisis.

- Guidance anticipating a rate increase when full output returns and inflation stabilizes around the BOC's 2% target was introduced by Governor Tiff Macklem in July 2020 as the policy rate was cut to a record low 0.25% during the pandemic slowdown. Macklem has already shifted the goalposts from the second half of next year to the middle quarters, and in both cases investors bet he will act sooner. For more see MNI Policy main wire at 1022ET.

US TSYS: Fed Gov Waller Supports Hawkish Fed Pivot

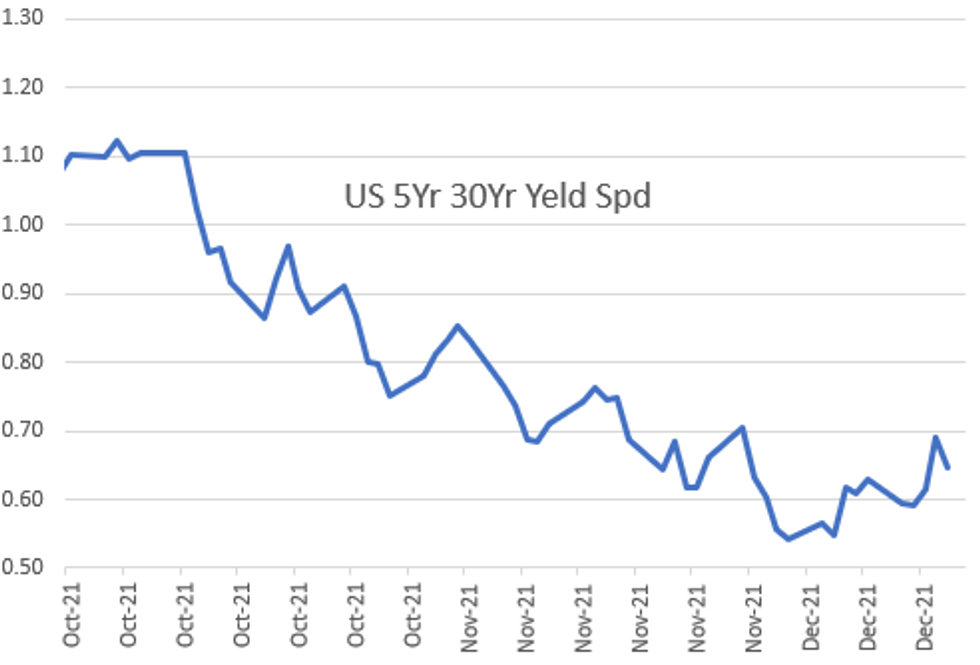

Tsys finished mixed Friday, just off week highs tapped by midmorning. Yield curves unwound a fair portion of Thu's steepening (5s30s -4.5 to appr 64.0) as rate support quickly evaporated on Fed Gov Waller comments in the second half. US$ index finished strong (DXY +.559, 96.601), stocks weaker (ESH2 -33.0 at 4626.0); crude weaker (WTI -1.71 at 70.67 after dip below 70.0).- No data, but NY Fed Pres Williams CNBC interview held market interest early, followed by Fed Gov Waller economic outlook speech to Forecasters Club in NY and SF Fed Pres Daly on live WSJ event, both at 1300ET. SF Fed Daly (non-voter 2022) a non-event, but comments from Gov Waller weighed as he aggressively supported the 2x taper pace/asset buying ending in March calling March a live event for a hike.

- Rates were back to opening levels after Gov Waller posited balance-sheet run-off by summer of 2022 "WOULD ALSO HELP REMOVE ACCOMMODATION, REDUCING THE NEED FOR ADDITIONAL RATE HIKES" Rtrs.

- Short end rates traded lower in turn, TYH2 mildly higher, well off first half levels (10YY 1.3699% low). Two-way trade, positioning from prop and fast$ accts ahead weekend and next week's Christmas holiday.

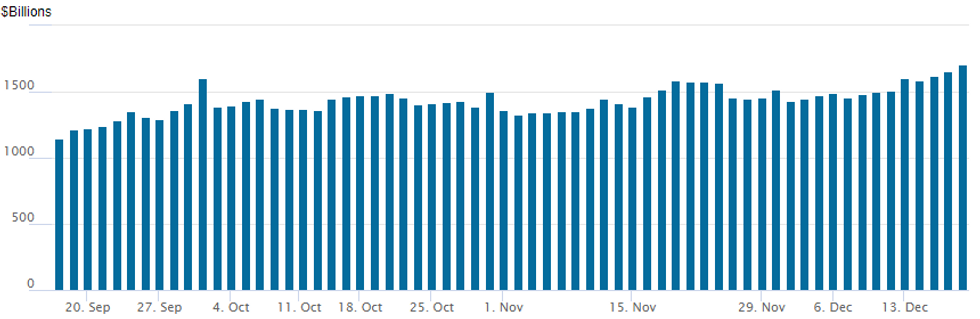

- NY Fed reverse repo usage climbs to third consecutive all-time high of $1,704.586B from 77 counterparties vs. Wednesday's $1,657.626B.

- The 2-Yr yield is up 2.7bps at 0.6396%, 5-Yr is up 1.1bps at 1.1749%, 10-Yr is down 0.9bps at 1.4021%, and 30-Yr is down 3.7bps at 1.8159%.

OVERNIGHT DATA

No economic data released Friday, but Federal Reserve Governor Christopher Waller and NY Fed President Williams each gave their respective economic outlooks.

- Waller "strongly supported" the FOMC's decision earlier this week to speed up the pace of tapering of asset purchases. "This action gives us increased flexibility to adjust monetary policy as needed in 2022," he said.

- Williams said he doesn't see any benefit to speeding the taper further than currently scheduled, with the first rate hike decision to be dependent upon the incoming data. He emphasizes that this week's decision creates the "optionality" to "likely" raise rates in 2022.

MNI: FED TERMINATES PRIMARY, SECONDARY CORPORATE CREDIT FACILITIES

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 359.06 points (-1%) at 35537.09

- S&P E-Mini Future down 23.5 points (-0.5%) at 4635.75

- Nasdaq up 62.6 points (0.4%) at 15243.42

- US 10-Yr yield is down 0.9 bps at 1.4021%

- US Mar 10Y are up 2.5/32 at 131-5.5

- EURUSD down 0.0079 (-0.7%) at 1.1251

- USDJPY up 0.02 (0.02%) at 113.69

- WTI Crude Oil (front-month) down $1.53 (-2.11%) at $70.85

- Gold is up $1.65 (0.09%) at $1800.91

- EuroStoxx 50 down 40.52 points (-0.96%) at 4161.35

- FTSE 100 up 9.31 points (0.13%) at 7269.92

- German DAX down 104.71 points (-0.67%) at 15531.69

- French CAC 40 down 78.44 points (-1.12%) at 6926.63

US TSY FUTURES CLOSE

- 3M10Y +0, 135.732 (L: 131.918 / H: 137.438)

- 2Y10Y -2.989, 76.179 (L: 74.896 / H: 80.148)

- 2Y30Y -5.803, 117.554 (L: 116.742 / H: 123.445)

- 5Y30Y -4.446, 64.103 (L: 63.408 / H: 68.272)

- Current futures levels:

- Mar 2Y down 1.375/32 at 109-5.125 (L: 109-03.875 / H: 109-08)

- Mar 5Y down 1.25/32 at 121-7.25 (L: 121-04.75 / H: 121-13.5)

- Mar 10Y up 1.5/32 at 131-4.5 (L: 130-30.5 / H: 131-14)

- Mar 30Y up 12/32 at 162-16 (L: 161-29 / H: 162-31)

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.020 at 99.640

- Jun 22 -0.035 at 99.405

- Sep 22 -0.035 at 99.215

- Dec 22 -0.025 at 98.985

- Red Pack (Mar 23-Dec 23) -0.015 to -0.01

- Green Pack (Mar 24-Dec 24) -0.015 to steady

- Blue Pack (Mar 25-Dec 25) +0.005 to +0.020

- Gold Pack (Mar 26-Dec 26) +0.025 to +0.035

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00213 at 0.07425% (+0.00200/wk)

- 1 Month -0.00138 to 0.10250% (-0.00612/wk)

- 3 Month -0.00100 to 0.21263% (+0.01438/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00125 to 0.31275% (+0.02450/wk)

- 1 Year +0.00500 to 0.52963% (+0.02025/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.05%, $914B

- Broad General Collateral Rate (BGCR): 0.05%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, appr $1.799B accepted vs. $3.096B submission

- Next scheduled purchases

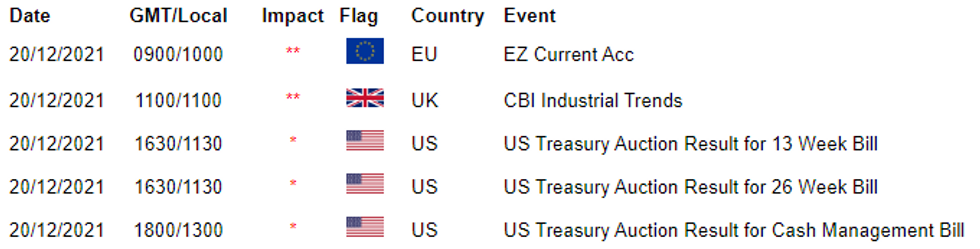

- Mon 12/20 1010-1030ET: Tsy 4.5Y-7Y, appr $4.525B vs. $5.275B prior

- Tue 12/21 1010-1030ET: TIPS 7.5Y-30Y, appr $0.925B vs. $1.075B prior

- Wed 12/22 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B

- NY Fed buy-operations pause for holidays, resume Jan 3

FED Reverse Repo Operation -- Third Consecutive New High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to third consecutive all-time high of $1,704.586B from 77 counterparties vs. Wednesday's $1,657.626B.

EGBs-GILTS CASH CLOSE: Gilts Underperform Again

Bunds outperformed Gilts for a second consecutive session, settling into a risk-off tone going into the weekend, amid continued concern over the Omicron variant, and ahead of a less liquid holiday period.

- Gilts were basically flat on the session as the market continued to digest Thursday's semi-surprise rate increase.

- BoE's Pill noted uncertainty of the impact of rate hikes, as well as "genuine two-sided uncertainty" over the economic impact of Omicron.

- We published our BOE and ECB meeting reviews today, see our website / emails for full analysis.

- Among periphery EGBs, BTP spreads reversed Thursday's widening, with Greece giving back some post-ECB gains.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3bps at -0.72%, 5-Yr is down 2.4bps at -0.607%, 10-Yr is down 3bps at -0.378%, and 30-Yr is down 3.2bps at -0.037%.

- UK: The 2-Yr yield is up 0.1bps at 0.509%, 5-Yr is up 0.4bps at 0.614%, 10-Yr is up 0.2bps at 0.759%, and 30-Yr is up 1.4bps at 0.932%.

- Italian BTP spread down 4.9bps at 127.3bps / Greek up 2.1bps at 158.4bps

FOREX: US Dollar Back In Favour, Retraces Thursday Sell-Off

- After consolidating just above Thursday’s lows for much of the European session on Friday, the dollar index began a grinding retracement higher throughout the US session, rising a little over half a percent.

- The DXY retraced the entirety of the prior day’s sell-off and remains closely pinned to pre-FOMC levels around 96.60.

- Waning risk sentiment prompted a flight to quality, weighing on the Euro, Aussie, Kiwi and CAD which all fell between 0.65%-0.85%.

- EURUSD once again failed to test key resistance at 1.1383, Nov 30 high. German IFO survey suggesting GDP growth has stalled, which also weighed on the single currency. The trigger for a resumption of the downtrend is 1.1186/85, a break would open 1.1128, a Fibonacci projection.

- USDJPY, despite being unchanged, had a volatile session. Initial dollar and a softer tone for risk prompted more bailing of longs and fresh recent lows at 113.14. The sell-off was cut short as strong broad dollar demand supported the pair back to around unchanged at 113.70. Sub 112.53 levels would reverse the overall bullish trend conditions.

- In emerging markets, another turbulent day for the struggling Turkish Lira. At its worst point, USDTRY was up around 9.5% on the day to fresh all-time highs of 17.1452. CBRT intervention managed to halt the pair’s ascent, however TRY is still 5% lower on the session, with likely headwinds still lingering.

- With all major central bank meetings out of the way, next week’s event risk declines dramatically in the lead up to the holiday period. RBA minutes will be published Tuesday before markets see US Core PCE Price Index on Thursday December 23.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.