-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Cautious Optimism on Russia/Ukraine Tension

EXECUTIVE SUMMARY

- MNI BRIEF: Republicans Block Committee Vote on Fed Nominees

- US Pres Biden on Russia: As long as there is hope for diplomatic resolution, we will pursue it.

- NATO head Stoltenberg on Russia said there's "no concrete sign of de-escalation", yet remains "cautiously optimistic", Bbg.

US

FED: Republicans on the Senate Banking Committee boycotted a Tuesday vote on the White House's five nominees for the Federal Reserve, including Jerome Powell, slowing the confirmation process and thwarting the candidacy of President Biden's pick for Fed vice chair for supervision.

- "We will update you all when we have rescheduled," said Senator Sherrod Brown, a Democrat of Ohio and leader of the Senate Banking Committee, specifically citing the FOMC's March meeting. "At this pivotal moment in our economy, everybody understands we need a full [Federal] Reserve Board. This will be the first time in almost a decade we will have all seven members of the Federal Reserve Board, as they step up for the importance of the meeting that is going to happen in March."

- All 12 Democrats signaled support for the Fed nominees, but none of the 12 Republicans showed for the scheduled votes. The nominees need to pass the Senate Banking Committee and then go up for a vote before the full Senate. The Fed announced earlier this month Jerome Powell was named by his board colleagues chair pro tempore: https://marketnews.com/mni-powell-re-designated-fe... while he awaits Senate confirmation.

WHITE HOUSE: Biden Speaks On Ukraine Crisis; US is ready to respond decisively to Russian attack on Ukraine which is still a possibility.

- Biden: 'I spoke with Putin yesterday to make clear we are ready to continue high level diplomacy and address legitimate security concerns.' Yesterday Russia agreed to continue diplomacy and Biden agreed.

- 'The US has put forward concrete proposals to improve security concerns. These will apply to all parties. Russia and NATO alike. New arms control measures. New transparency measures. New strategic stability measures.'

- 'We will not sacrifice basic principles though. Nations have a right to sovereignty and territorial integrity. Countries can chose their own course but this still leaves room for diplomacy and de-escalation.'

- As long as there is hope for diplomatic resolution, we will pursue it. Russian defence ministry reported some units are leaving but US has not verified this yet. Analysts believes they are still in a very threatening position.

- Invasion remains distinctly possible and Americans should leave Ukraine now. If Russia attacks Ukraine it will be a war of choice not of necessity. US and partners will respond decisively in the event of war and inflict considerable pain on Russia. Long term sanctions are ready to go and affect Russia economically in a significant way. Nordstream 2 will be stopped.

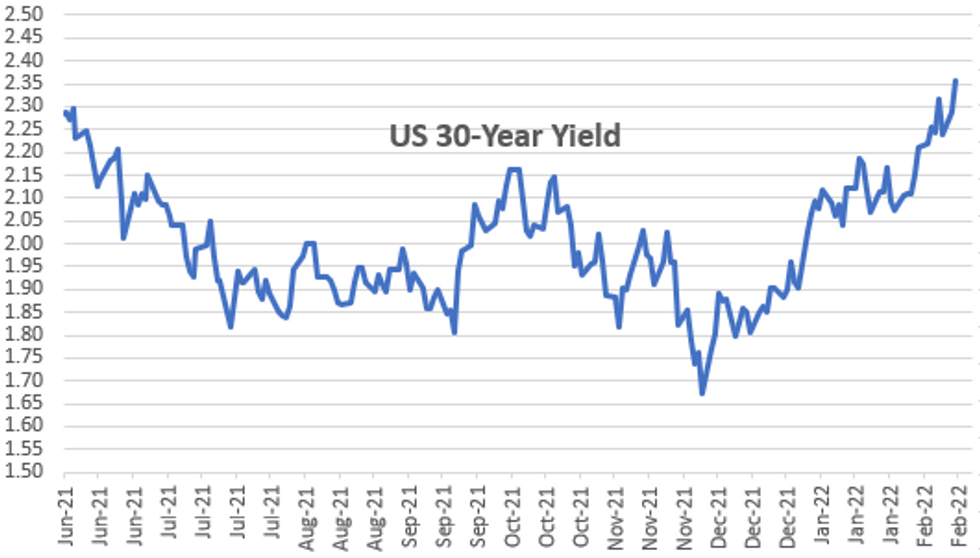

US TSYS: There's Always Time For Diplomacy

Risk-on early London hours: Russia/Ukraine tensions cool after reports that Russia withdrawing some troops from Ukraine border. NATO head Stoltenberg said there's "no concrete sign of de-escalation", yet remains "cautiously optimistic", Bbg.- Tsys extended lows after the bell (30YY tapped 2.3669% high) as US President Biden commented on Ukraine situation: "As long as there is hope for diplomatic resolution, we will pursue it. Russian defense ministry reported some units are leaving but US has not verified this yet. Analysts believes they are still in a very threatening position." However, Biden added "invasion remains distinctly possible and Americans should leave Ukraine now. If Russia attacks Ukraine it will be a war of choice not of necessity."

- Higher than forecasted PPI for Jan (+1.0% vs. 0.05% est) weighed on FI and pre-open stocks.

- Contributing to bear steepening (5s30s +5.5 at 42.69 late), trading desks report real$ buying short end and separately selling 30s, deal-tied rate lock selling keeping pressure on as markets hedged $6B Bristol Myers 4pt jumbo (10s, 20s, 30s and 40s).

- Eurodollar/Treasury option flow was mixed, two-way call interest in the former: Scale buyer 38,000 short Sep 99.00 calls, 2.0 ref: 97.615-.62, after a Block sale of -20,000 Sep 98.50/98.75 call spds, 0.5 over Sep 97.37 puts vs. 98.33/0.30%.

- After the close 2-Yr yield is down 0.5bps at 1.5692%, 5-Yr is up 2.4bps at 1.9351%, 10-Yr is up 5.8bps at 2.0451%, and 30-Yr is up 7.5bps at 2.3609%.

OVERNIGHT DATA

- US JAN PPI: FOOD +1.6%; ENERGY +2.5%

- US JAN PPI: GOODS +1.3%; SERVICES +0.7%; TRADE SERVICES +0.6%

- US JAN FINAL DEMAND PPI +1.0%, EX FOOD, ENERGY +0.8%

- US JAN FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.9%

- US JAN FINAL DEMAND PPI Y/Y +9.7%, EX FOOD, ENERGY Y/Y +8.3%

- US NY FED EMPIRE STATE MFG INDEX 3.1 FEB

- US NY FED EMPIRE MFG NEW ORDERS 1.4 FEB

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 23.1 FEB

- US NY FED EMPIRE MFG PRICES PAID INDEX 76.6 FEB

- US REDBOOK: FEB STORE SALES +14.3% V YR AGO MO

- US REDBOOK: STORE SALES +15.4% WK ENDED FEB 12 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 388.4 points (1.12%) at 34954.34

- S&P E-Mini Future up 65.75 points (1.5%) at 4460.75

- Nasdaq up 322 points (2.3%) at 14114.84

- US 10-Yr yield is up 5.8 bps at 2.0451%

- US Mar 10Y are down 9/32 at 125-22.5

- EURUSD up 0.0056 (0.5%) at 1.1362

- USDJPY up 0.08 (0.07%) at 115.62

- WTI Crude Oil (front-month) down $3.58 (-3.75%) at $91.88

- Gold is down $15.08 (-0.81%) at $1856.07

- EuroStoxx 50 up 79.26 points (1.95%) at 4143.71

- FTSE 100 up 77.33 points (1.03%) at 7608.92

- German DAX up 298.74 points (1.98%) at 15412.71

- French CAC 40 up 127.77 points (1.86%) at 6979.97

US TSY FUTURES CLOSE

- 3M10Y +2.714, 162.646 (L: 152.348 / H: 162.997)

- 2Y10Y +6.692, 47.391 (L: 40.003 / H: 48.098)

- 2Y30Y +8.334, 78.824 (L: 69.608 / H: 79.537)

- 5Y30Y +5.296, 42.438 (L: 36.44 / H: 42.666)

- Current futures levels:

- Mar 2Y up 1/32 at 107-18 (L: 107-15.75 / H: 107-19.12)

- Mar 5Y down 1.75/32 at 117-16 (L: 117-11.75 / H: 117-22.5)

- Mar 10Y down 8/32 at 125-23.5 (L: 125-18. / H: 126-06.5)

- Mar 30Y down 1-10/32 at 150-24 (L: 150-21 / H: 152-07)

- Mar Ultra 30Y down 1-31/32 at 179-14 (L: 179-11 / H: 182-15)

US 10Y FUTURES TECH: (H2) Path Of Least Resistance Remains Down

- RES 4: 128-14 50-day EMA

- RES 3: 127-24 High Feb 4

- RES 2: 127-05+ 20-day EMA

- RES 1: 127-01 High Feb 7

- PRICE: 125-25+ @ 16:28 GMT Feb 15

- SUP 1: 125-17+ Low Feb 10 and the bear trigger

- SUP 2: 125-06+ Low May 30 2019 (cont)

- SUP 3: 125-04+ 2.00 proj of the Jan 13 - 19 - 24 price swing

- SUP 4: 124-11 2.0% 10-dma envelope

Treasuries stalled at Monday’s high and are trading lower today. Price is approaching its recent low of 125-17+ where a break would confirm a resumption of the current downtrend. A bearish sequence of lower lows and lower highs, together with a bear mode set-up in moving averages suggests the path of least resistance remains down. Scope is seen for a move to 125-06+ next, 30 May 2019 low (cont). Firm resistance is seen at 127-01.

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.025 at 99.308

- Jun 22 +0.045 at 98.745

- Sep 22 +0.045 at 98.345

- Dec 22 +0.030 at 98.040

- Red Pack (Mar 23-Dec 23) -0.01 to +0.015

- Green Pack (Mar 24-Dec 24) -0.015 to -0.005

- Blue Pack (Mar 25-Dec 25) -0.055 to -0.025

- Gold Pack (Mar 26-Dec 26) -0.08 to -0.065

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00257 at 0.07414% (-0.00429/wk)

- 1 Month -0.00600 to 0.11971% (-0.07143/wk)

- 3 Month +0.01014 to 0.46871% (-0.03772/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00115 to 0.79271% (-0.04772/wk)

- 1 Year +0.02057 to 1.34271% (-0.04958/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $63B

- Daily Overnight Bank Funding Rate: 0.07% volume: $249B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $895B

- Broad General Collateral Rate (BGCR): 0.05%, $329B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $325B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Tsy 4.5Y-7Y, $3.201B accepted vs. $16.425 submission

- Next scheduled purchases:

- Thu 02/17 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/22 1010-1030ET: TIPS 1Y-7.5Y, appr $1.025B vs. $2.025B prior

- Thu 02/24 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B steady

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

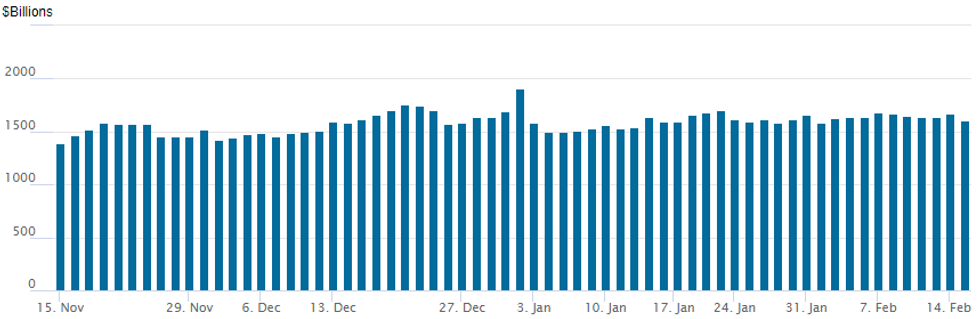

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage fall to $1,608.494B w/ 81 counterparties vs. $1,666.232B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $6B Bristol-Myers 4Pt Jumbo Launched

Bristol Myers 4pt jumbo the lion's share of $11B total high grade debt issued Tue:

- Date $MM Issuer (Priced *, Launch #)

- 02/15 $6B #Bristol-Myers $1.75B 10Y +95, $1.25B 20Y +115, $2B 30Y +135, $1B 40Y +155

- 02/15 $1.5B #Enbridge $400M 2Y +63, $600M 2Y FRN/SOFR+63, $500M 3Y +73

- 02/15 $1B #Norfolk Southern $600M 10Y +95, $400M 31Y +135

- 02/15 $1B FactSet WNG $500M 5Y +100, $500M 10Y +145

- 02/15 $600M #Kimco 10Y +125

- 02/15 $500M #Israel Electric Corp WNG 10Y +175

- 02/15 $400M #Kemper 10Y +180

EGBs-GILTS CASH CLOSE: Safe Haven Bid Continues To Unwind

Geopolitical risk once again drove European FI Tuesday, with yields continuing to rise from Monday's lows on signs of de-escalation between Russia and Ukraine.

- Periphery spreads narrowed in a broad risk-on move, with equities in the green. Though 10Y BTP yields rose to just shy of 2% (post-May 2020 high).

- German 10Y Bund yields hit the highest since Nov 2018 (0.3254% intraday) as safe haven bids unwound further and the curve bear steepened.

- With attention on Wednesday's UK CPI data, 2 Year UK yields continued their ascent (reversing an early drop), in a flattening move on the curve.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.6bps at -0.347%, 5-Yr is up 1.1bps at 0.055%, 10-Yr is up 2.5bps at 0.308%, and 30-Yr is up 5.6bps at 0.551%.

- UK: The 2-Yr yield is up 2.7bps at 1.537%, 5-Yr is up 2.2bps at 1.526%, 10-Yr is down 0.7bps at 1.582%, and 30-Yr is down 3.7bps at 1.609%.

- Italian BTP spread down 3.9bps at 164.9bps / Spanish down 1.6bps at 99.8bps

FOREX: US Dollar Retraces Monday’s Gains As Equities Recover

- The greenback lost favour on Tuesday as Equity indices recovered on reports of de-escalation at the Ukraine border, reviving risk appetite across global equity markets.

- The dollar index find itself 0.4% lower approaching the end of the US session, giving up the entirety of yesterday’s advance.

- EURUSD found good support below 1.1300 and has bounced. The pair now sits between key short-term resistance at 1.1495 and strong support of 1.1267, the Feb 2 low. A breach of this support would signal scope for a deeper retracement of recent gains.

- Risk-tied Antipodean FX had a good showing with both AUD and NZD rising 0.35%, however, GBP and CAD remained broadly unchanged ahead of their respective inflation prints, scheduled for tomorrow.

- With the Euro strength and the easing geopolitical tensions, CEE FX saw strong support, with RUB, PLN, HUF and CZK all rising over 1%. SEK was a notable outperformer (USDSEK -1.07%), continuing to unwind the post Riksbank Krona losses.

- Overnight, markets will receive CPI/PPI data from China before later in the day, both the UK and Canada also release consumer price data. The early US session will be headlined by January retail sales before markets try and extrapolate any clues from the slightly dated FOMC minutes of the January meeting.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/02/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 16/02/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 16/02/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 16/02/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 16/02/2022 | 1000/1100 | ** |  | EU | industrial production |

| 16/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/02/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 16/02/2022 | 1330/0830 | ** |  | US | import/export price index |

| 16/02/2022 | 1330/0830 | *** |  | CA | CPI |

| 16/02/2022 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/02/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 16/02/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 16/02/2022 | 1500/1000 | * |  | US | business inventories |

| 16/02/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 16/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/02/2022 | 1830/1330 |  | CA | BOC Deputy Lane speech |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.