-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Chair Mon/Pol Testimony Wed Ahead Feb Jobs

EXECUTIVE SUMMARY

- MNI SOURCES: Ukraine War To Shelve Calls For ECB Rate Hikes

- MNI INSIGHT: Cenbanks Eye Dollar Funding, Have Tools In Place

- MNI BRIEF: Bostic Says Fed Needs To Hike in March, Favors 25BP

- MNI: Chicago Business Barometer™ Slumps to 56.3 In February

- RUSSIA SAYS EU SANCTIONS WON'T BE LEFT UNANSWERED, Bbg

US

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said Monday that he continues to believe that the U.S. central bank should begin raising its federal funds rate in March and favors a 25 basis point move for now.

- "I think that interest rates need to move," Bostic said, noting that the Fed has been in an "emergency stance" for the better part of two years. "We need to get off that stance and get to interest rates being in a much more normalized level."

- "Today, as we speak, I'm still in favor of a 25 basis point move at the March meeting," he said in a Harvard University event, noting that additional inflation data is to be released before the FOMC's March meeting. "To the extent that we start to see that [month-over-month inflation] trend down, then I'll be comfortable pretty much with a 25 basis point move. If that continues to persist at elevated levels or even move in the other direction, then I'm really going to have to look at a 50 basis point."

GLOBAL CBs: Major central banks are keeping a close eye on an increase in dollar funding costs, though stresses are still far from levels which might prompt actions such as a reintroduction of the 84-day dollar repo operations abandoned in July 2021, MNI understands.

- A more than 20-basis-point rise in the three-month EURUSD basis swap spread on Monday, meaning that it is becoming more expensive to borrow dollars through FX swaps versus doing so domestically, still leaves the spread well below the -200 basis-point levels seen in March 2020, when the Federal Reserve and global peers announced dollar swap facilities.

- But the Fed, together with the Bank of Japan, the Bank of England, the European Central Bank and Swiss National Bank, will be monitoring the situation and could also consider whether to extend any swaps to fresh currencies. In contrast to earlier crises, multiple mechanisms are already in place to come to markets’ aid if necessary. For more see MNI Policy main wire at 1138ET.

EUROPE

ECB/UKRAINE/RUSSIA: Russia’s invasion of Ukraine is set to put an end to any talk of increasing eurozone interest rates this year even from previously hawkish officials, Eurosystem officials told MNI, as European Central Bank policymakers emphasise two-way flexibility to deal with the competing risks of an additional spike in inflation and a potential blow to output.

- This month’s Governing Council meeting will send a message of reassurance, one official said, while pushing ahead with plans to increase the asset purchase programme to EUR40 billion a month in the second quarter.

- “They will retain and stress the flexibility in March -- probably leave the APP at 40 billion for Q2 and say events determine we stick with our course for now, but we are very aware of building two-way risks and that we retain our flexibility and can use and adjust our full range of tools as and when needed,” the source said.

- Until the Russian attack on Ukraine, Governing Council members had become more hawkish on inflation, with even some officials from normally dovish national central banks admitting that monetary policy might have to be tightened sooner. But the situation has now changed, sources from banks on different parts of the hawk-dove spectrum told MNI.

US TSYS: Rates Surge, March 50Bp Liftoff Cools, Geopol, Policy Risk Events Ahead

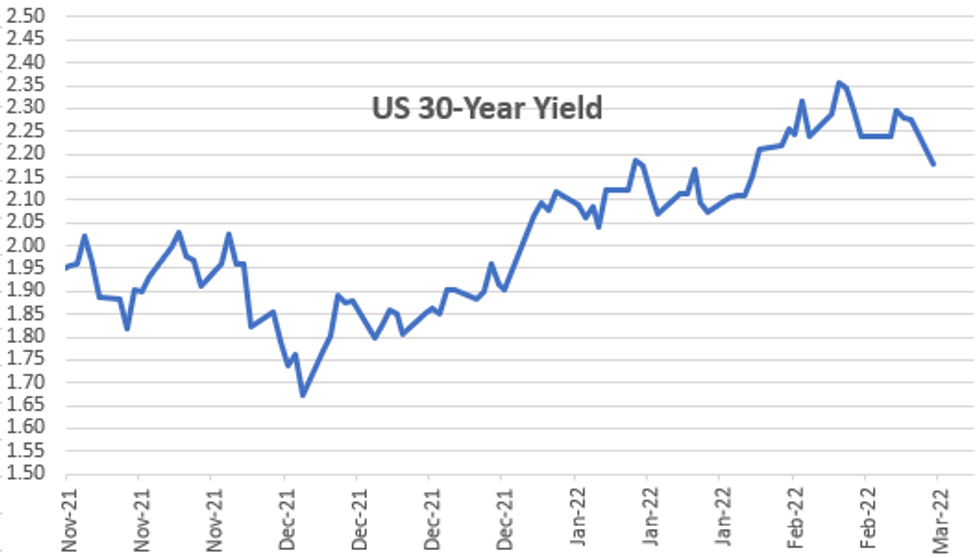

FI Markets very well bid after the bell, 30Y Bonds topping early overnight gap bid late; yield curves bull steepening: 5s30s +4.081 at 44.62. 30YY currently 2.1674% -0.1064 vs. 2.1618% late session low (2.2507% high).

- Russia invasion of Ukraine main driver for risk-off support in rates. Trading desks report preop, fast- and real$ buying 5s, continued foreign and domestic real$ and bank portfolio buying in 10s-30s.

- Short end funding concerns heat up w/3M FRA/OIS gap wider overnight, tapped 23.80 around Asia/London cross, gradually receding since: currently 18.40 +5.30 vs. late Fri.

- Bostic reiterated need to "move off emergency rate stance", is supportive of 25bps hike at the March 16 FOMC -- unless inflation measures continue to climb -- opens the possibility of 50bp liftoff.

- Wide, near 0.100 range in lead quarterly Mar'22 Eurodollar futures, near highs as 50bps liftoff inches lower. Reds-Gold surge 0.14-0.20 higher by the close. Large Block buys+50k EDH2 99.335, +50K EDU2 98.525, +20k EDM 98.92.

- US Pres Biden State of the Union Address Tue evening 2100ET

- Fed Chair Powell will be giving the semi-annual monetary policy report testimony to the House Financial Services Committee on Weds March 2 and the Senate Banking Committee on Thu March 3 - 1000ET.

- The 2-Yr yield is down 14.1bps at 1.4283%, 5-Yr is down 14.6bps at 1.7194%, 10-Yr is down 12.6bps at 1.8353%, and 30-Yr is down 9.9bps at 2.1745%.

OVERNIGHT DATA

- All five of the main five indicators fell, with New Orders and Supplier Deliveries taking the largest hit. Only Inventories edged up over the month. In February, Production fell for the second consecutive month, dipping 5.2 points to 55.4, the lowest reading since August 2020. Firms were seeing more orders unfilled due to materiel shortages. For more see MNI Policy main wire at 0945ET.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 430.3 points (-1.26%) at 33635.68

- S&P E-Mini Future down 47.75 points (-1.09%) at 4333.25

- Nasdaq down 78.6 points (-0.6%) at 13617.72

- US 10-Yr yield is down 12.6 bps at 1.8353%

- US Mar 10Y are up 39.5/32 at 127-15.5

- EURUSD down 0.0058 (-0.51%) at 1.121

- USDJPY down 0.54 (-0.47%) at 115.01

- WTI Crude Oil (front-month) up $4.05 (4.42%) at $95.65

- Gold is up $16.45 (0.87%) at $1905.86

- EuroStoxx 50 down 46.46 points (-1.17%) at 3924.23

- FTSE 100 down 31.21 points (-0.42%) at 7458.25

- German DAX down 106.21 points (-0.73%) at 14461.02

- French CAC 40 down 93.6 points (-1.39%) at 6658.83

US TSY FUTURES CLOSE

- 3M10Y -11.208, 150.204 (L: 149.868 / H: 160.128)

- 2Y10Y +0.844, 39.642 (L: 39.173 / H: 43.737)

- 2Y30Y +3.559, 73.57 (L: 71.376 / H: 77.079)

- 5Y30Y +4.452, 44.99 (L: 41.616 / H: 46.859)

- Current futures levels:

- Jun 2Y up 11/32 at 107-19.375 (L: 107-13.37 / H: 107-20.62)

- Jun 5Y up 28/32 at 118-10 (L: 117-26.25 / H: 118-11.75)

- Jun 10Y up 1-11.5/32 at 127-17 (L: 126-23.5 / H: 127-19)

- Jun 30Y up 2-31/32 at 156-30 (L: 154-31 / H: 157-00)

- Jun Ultra 30Y up 4-12/32 at 186-17 (L: 183-18 / H: 187-02)

US 10Y FUTURES TECH: (M2) Gains Still Considered Corrective

- RES 4: 128-17 High Jan 24

- RES 3: 128-08+ High Feb 1

- RES 2: 127-29+ 50-day EMA (cont)

- RES 1: 127-12+ High Feb 28

- PRICE: 127-03+ @ 16:30 GMT Feb 28

- SUP 1: 125-29 Low Feb 25

- SUP 2: 125-14+ Low Feb 10 and the bear trigger

- SUP 3: 125-06+ Low May 30 2019 (cont)

- SUP 4: 124-28 2.00 proj of the Jan 13 - 19 - 24 price swing

Treasuries rallied Thursday to a high of 127-11+ and briefly traded above this level earlier Monday. Recent gains still signal scope for an extension of the current corrective cycle and attention is on the 50-day EMA at 127-29+ (cont). Moving average studies still highlight a broader bearish trend condition and the 50-day EMA is seen as an important area of resistance. For bears, support to watch is at 125-14+, Feb 10 low and bear trigger.

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.015 at 99.343

- Jun 22 +0.110 at 98.915

- Sep 22 +0.195 at 98.60

- Dec 22 +0.215 at 98.275

- Red Pack (Mar 23-Dec 23) +0.195 to +0.220

- Green Pack (Mar 24-Dec 24) +0.175 to +0.195

- Blue Pack (Mar 25-Dec 25) +0.160 to +0.165

- Gold Pack (Mar 26-Dec 26) +0.150 to +0.160

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00000 at 0.07714% (+0.00157 total last wk)

- 1 Month +0.01086 to 0.24143% (+0.05986 total last wk)

- 3 Month -0.01871 to 0.50429% (+0.04343 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.02400 to 0.80471% (+0.04742 total last wk)

- 1 Year -0.04271 to 1.28800% (+0.04485 total last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $249B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $962B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $347B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Next scheduled purchases

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

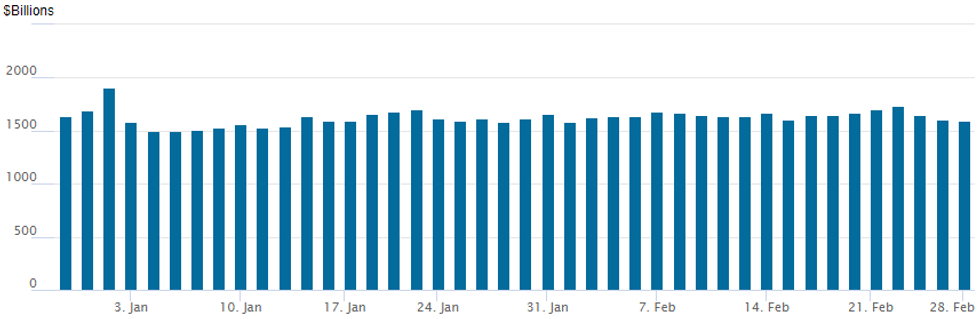

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,596.052B w/ 82 counterparties vs. $1,603.349B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $3B EIB 7Y SOFR On Tap Tuesday

Date $MM Issuer (Priced *, Launch #)

- 02/28 $Benchmark -- issuers still holding sidelines since last Thursday.

- EIB SOFR expected Tue:

- 03/01 $3B European Investment Bank 7Y SOFR +34a

- 02/24-02/25 No new Issuance Thursday/Friday, $16.4B total for week

FOREX: Initial USD Strength Unwinds, Swiss Franc Outperforms

- The US Dollar Index gapped higher at the Sunday night open amid severe pressure on equities as geopolitical developments weight on global risk sentiment over the weekend.

- Throughout the course of Monday trading, amid the recovery in global equity benchmarks, the greenback gradually edged lower, erasing almost the entirety of the gap to Friday’s close.

- The Swiss Franc had the most notable move on Monday with EURCHF currently within a few pips of Thursday’s lows at 1.0279, a breach of which would see the pair at the lowest levels since 2015.

- Commodity gains, and in particular the four percent gains in crude futures, prompted strong recoveries from the likes of AUD, NZD and CAD, all bridging the gaps at the open and extending their resilient performances throughout US trading hours.

- Despite a firm bounce for the euro, the single currency remains around 0.5% lower against the dollar. EUR underperformance largely down to the struggling crosses such as EURJPY (-1.05%) and EURCHF (-1.42%).

- FX hedging activity via options surged on Monday, with markets rushing to hedge EUR exposure vs. both USD and AUD aswell as USD/CNY across Asia-Pac hours.

- Options volumes are running higher alongside implied volatility metrics, with front-month implieds for EUR/USD nearing 8.50 points for the first time since H2 2020.

- Risk reversals contracts tell us that markets are favouring EUR/USD downside protection, with markets now pricing a 29.3% implied probability for the pair to trade below 1.11 in one month's time (a horizon that captures both the next Fed and ECB rate decisions). This implied probability was just 16.6% this time last week.

- While the USD/RUB rate did gain as much as 35%, the CBR's snap decision to more than double domestic interest as well as the rebound in broader sentiment did support the Ruble off it’s worst levels as Monday progressed.

- Overnight Chinese manufacturing PMI data will kick off the Asia-Pac session before the March RBA meeting/decision, where little adjustment to the RBA’s tone is expected.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/03/2022 | 0030/1130 |  | AU | Balance of Payments: Current Account | |

| 01/03/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 01/03/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/03/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/03/2022 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 01/03/2022 | 0730/0730 |  | UK | DMO Gilt Operations Announcement W/C 4/11 April | |

| 01/03/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 01/03/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/03/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/03/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/03/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/03/2022 | 1000/1100 | *** |  | DE | Saxony CPI |

| 01/03/2022 | - |  | EU | ECB Panetta at G7 Finance Ministers/CB Governors Meeting | |

| 01/03/2022 | - | *** |  | US | domestic made vehicle sales |

| 01/03/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 01/03/2022 | 1300/1400 |  | EU | ECB Lagarde visits Chancellor Scholz | |

| 01/03/2022 | 1330/0830 | * |  | US | construction spending |

| 01/03/2022 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 01/03/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/03/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2022 | 1830/1830 |  | UK | BOE Saunders speech at East Anglia University | |

| 01/03/2022 | 1900/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/03/2022 | 1900/1900 |  | UK | BOE Mann panels Cleveland Fed discussion | |

| 01/03/2022 | 1900/1400 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.