-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN:Inflation Measure Spurs Further Curve Flattening

EXECUTIVE SUMMARY

- MNI: US April CPI Moderates, But Above Expectations

- MNI BRIEF: Dallas Fed Picks Lorie Logan As New President

- MNI BRIEF: U.S. Treasury Posts Record $308B Surplus In April

- BOSTIC: BACKS 50-BPS MOVES UNTIL RATE RAISED TO NEUTRAL LEVEL, Bbg

US

US: CPI inflation across the US rose 0.3% m/m in April and 8.3% y/y, moderating from 8.5% last month but rising at a faster pace than the 8.1% analysts expected. Core CPI jumped 0.6% m/m and 6.2% y/y, a slowing from 6.5% last month.

- Sustained high inflation will likely keep the Federal Reserve on its 50bp rate hike clip for the next few meetings and could see officials debating an even larger 75bp hike later in the year. (See: MNI INTERVIEW: Fed's Barkin Says Hikes Not On Set 50BP Course: https://marketnews.com/mni-fed-s-barkin-says-rates...).

- Owners' equivalent rent rose 0.5%, a significant jump for the slow-to-change shelter category. Energy rose 30.3% y/y and food increased 9.4%, the largest y/y increase since 1981, the BLS said.

- Logan is a native of Kentucky and graduated from Davidson College and Columbia University. She's been a leader on the markets desk at the New York Fed since 2012. She will begin her role as president on August 22, the Dallas Fed said.

- Her predecessor Robert Kaplan resigned last October following a controversy around stock trades during the pandemic.

US TSYS: Core CPI Jumps 0.6%, Underscores Near-Term Rate Hikes

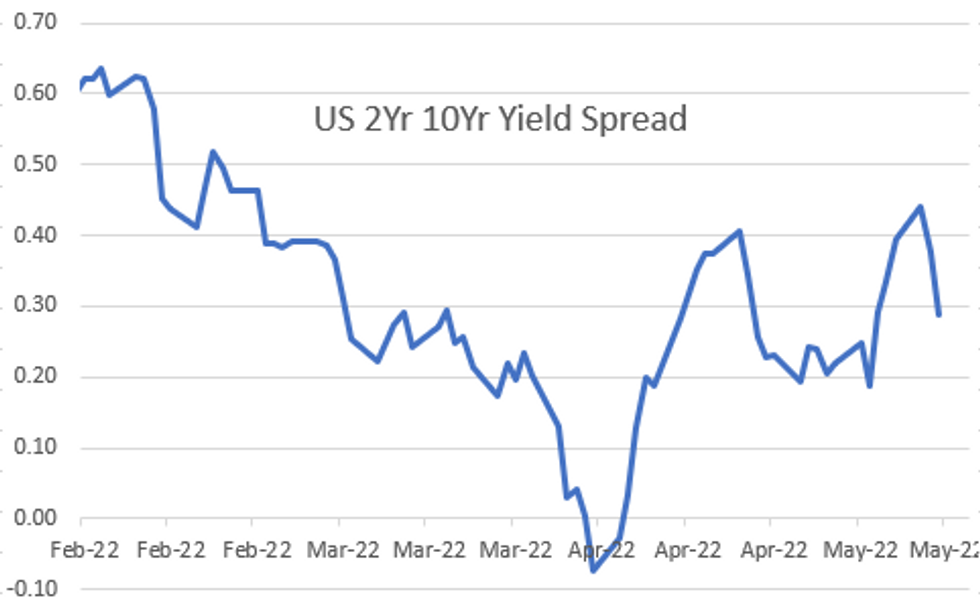

Tsys futures finish mostly higher, well off initial post data lows curves bull flattened (2s10s -9.665 at 27.771) as bonds discounted the April CPI inflation data: up 0.3% m/m in April and 8.3% y/y, Core CPI jumped 0.6% m/m and 6.2% y/y, a slowing from 6.5% last month.

- Short end weaker - anchored as additional three 50bp rate hikes gets baked in (chance of 75bp hike in near term back in realm of possibility. Nevertheless, analysts anticipate inflation softening in the coming months.

- Tsy futures holding near session highs but scaling back support slightly after $36B 10Y note auction (91282CEP2) tails: 2.943% high yield vs. 2.925% WI; 2.49x bid-to-cover off last month's 2.43x.

- Indirect take-up climbs to 70.30% vs. last month's 64.33% high; direct bidder take-up at 18.21 from 17.02%, while primary dealer take-up falls to 11.49% vs. 18.66%.

- Meanwhile, the U.S. Treasury said it posted a record budget surplus of USD308 billion in April, fueled by record tax receipts and lower outlays, versus a budget deficit of USD226 billion in the same month one year earlier.

- The fiscal year-to-date budget deficit was USD360 billion, following a record USD1.9 trillion deficit in the same period a year earlier, the Treasury said.

- Thursday focus on PPI Final Demand MoM (1.4% prior, 0.5% est); YoY (11.2%, 10.7%), weekly claims (192k) and $22B 30Y Bond auction (912810TG3)

OVERNIGHT DATA

- US APR CPI 0.3%, CORE 0.6%; CPI Y/Y 8.3%, CORE Y/Y 6.2%

- US APR ENERGY PRICES -2.7%

- US APR OWNERS' EQUIVALENT RENT PRICES 0.5%

- US DATA: Unrounded Figures Show Core CPI A Little Softer Than Headline Suggests

- A little softer on core unrounded:

- Unrounded % M/M figures: Headline 0.332%; Core: 0.569%

- Unrounded % Y/Y figures: Headline 8.259%; Core: 6.161%

- US DATA: Core Services Prices Accelerate. Biggest standout of the above-consensus core CPI print is that core services on fire, +0.72% M/M, a fresh post-1990 high.

- Airfares +18.6% M/M, and rent of primary residences bounce back from unusually low March print (0.56% from 0.43% prior).

- Core goods remain relatively subdued at +0.18% (following March's 0.42% contraction).

- US MBA: REFIS -2% SA; PURCH INDEX +5% SA THRU MAY 6 WK

- US MBA: UNADJ PURCHASE INDEX -8% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 5.53% VS 5.36% PREV

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 163.38 points (-0.51%) at 31990.92

- S&P E-Mini Future down 44.25 points (-1.11%) at 3951.25

- Nasdaq down 324.2 points (-2.8%) at 11411.36

- US 10-Yr yield is down 7.2 bps at 2.9187%

- US Jun 10Y are up 14/32 at 119-7

- EURUSD down 0.0005 (-0.05%) at 1.0524

- USDJPY down 0.54 (-0.41%) at 129.91

- WTI Crude Oil (front-month) up $5.66 (5.67%) at $105.41

- Gold is up $15.61 (0.85%) at $1853.82

- EuroStoxx 50 up 93.07 points (2.62%) at 3647.87

- FTSE 100 up 104.44 points (1.44%) at 7347.66

- German DAX up 293.9 points (2.17%) at 13828.64

- French CAC 40 up 152.82 points (2.5%) at 6269.73

US TSY FUTURES CLOSE

- 3M10Y -6.502, 199.591 (L: 197.778 / H: 212.167)

- 2Y10Y -9.286, 28.15 (L: 26.517 / H: 37.052)

- 2Y30Y -10.912, 39.75 (L: 38.809 / H: 50.412)

- 5Y30Y -5.405, 15.255 (L: 12.576 / H: 23.162)

- Current futures levels:

- Jun 2Y down 1.25/32 at 105-18.625 (L: 105-12.375 / H: 105-22.875)

- Jun 5Y up 4.25/32 at 112-30 (L: 112-09.75 / H: 113-05)

- Jun 10Y up 14/32 at 119-7 (L: 118-03.5 / H: 119-13)

- Jun 30Y up 32/32 at 139-19 (L: 137-07 / H: 139-25)

- Jun Ultra 30Y up 83/32 at 157-3 (L: 152-00 / H: 157-08)

US 10Y FUTURES TECH: (M2) Corrective Bounce

- RES 4: 122-12+ High Apr 4

- RES 3: 121-16 50-day EMA

- RES 2: 121-09 High Apr 14

- RES 1: 119-11/120-18+ 20-day EMA / High Apr 27

- PRICE: 119-08 @ 1525ET May 11

- SUP 1: 117-08+ Low May 9 and the bear trigger

- SUP 2: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 116-15 2.0% 10-dma envelope

- SUP 4: 116.00 Round number support

The primary downtrend in Treasuries remains intact and the recovery from Monday’s low is considered corrective. Recent fresh cycle lows confirmed a resumption of the downtrend and an extension of the price sequence of lower lows and lower highs. Furthermore, recent corrections have tended to be shallow and this highlights bearish sentiment. Sights are on 116-28 next, a Fibonacci projection. Key resistance is 120-18+, Apr 27 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.015 at 98.160

- Sep 22 -0.045 at 97.370

- Dec 22 -0.050 at 96.890

- Mar 23 -0.025 at 96.710

- Red Pack (Jun 23-Mar 24) +0.005 to +0.025

- Green Pack (Jun 24-Mar 25) +0.035 to +0.055

- Blue Pack (Jun 25-Mar 26) +0.060 to +0.085

- Gold Pack (Jun 26-Mar 27) +0.085 to +0.10

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00229 to 0.82600% (+0.00743/wk)

- 1M +0.01100 to 0.85414% (+0.01200/wk)

- 3M +0.02200 to 1.42186% (+0.02000/wk) * / **

- 6M +0.03071 to 1.96271% (-0.00186/wk)

- 12M +0.02842 to 2.61671% (-0.07800/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.42186% on 5/11/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $72B

- Daily Overnight Bank Funding Rate: 0.82% volume: $253B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $914B

- Broad General Collateral Rate (BGCR): 0.80%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $338B

- (rate, volume levels reflect prior session)

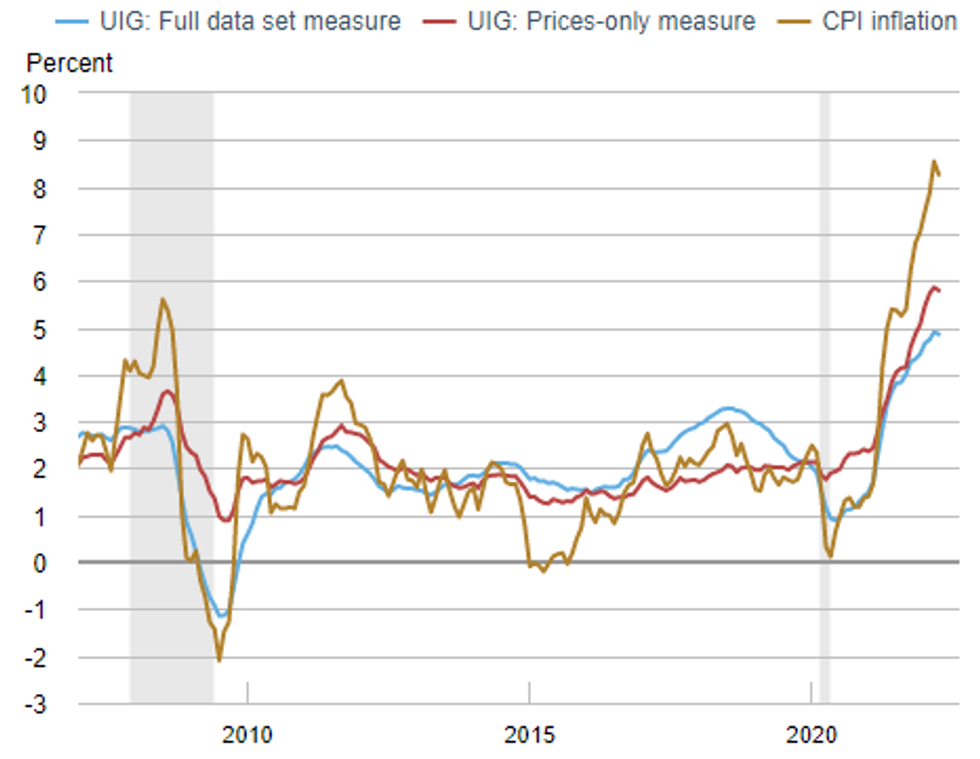

NY Fed Underlying Inflation Gauge

NY Federal Reserve

- The UIG "full data set" measure for April is currently estimated at 4.9%, similar to the previous month.

- The "prices-only" measure for April is currently estimated at 5.8%, a 0.1 percentage point decrease from the current estimate for the previous month.

- The twelve-month change in the April CPI was +8.3%, a 0.2 percentage point decrease from the previous month.

PIPELINE: Issuance Slowdown

- Date $MM Issuer (Priced *, Launch #)

- 05/11 $550M *ENN Energy 5Y +180

- 05/11 $500M *Korea Expressway 3Y +85

- On tap for Thursday:

- 05/12 $Benchmark Province of Ontario 5Y SOFR+50a

EGBs-GILTS CASH CLOSE: Post-US CPI Reversal

European bond yields fully reversed a sharp rise after stronger-than-expected US inflation data over the course of Wednesday afternoon. Short end yields reversed lower as Fed hawkishness post-CPI was second-guessed. This allowed the UK and German curves to re-steepen after modest flattening earlier in the session.

- Periphery spreads fell sharply, mirroring risk-on moves in equities.

- Little impact from ECB headlines, as markets had already priced the news in: a BBG sources piece reporting ECB officials are increasingly seeing rates rising above zero this year, Pres Lagarde's comment that hikes could come "a few weeks" after net asset purchases in Q3 conclude left the door open for a July rate hike

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 2.2bps at 0.139%, 5-Yr is down 3.1bps at 0.659%, 10-Yr is down 1.5bps at 0.985%, and 30-Yr is down 0.2bps at 1.138%.

- UK: The 2-Yr yield is down 4.2bps at 1.286%, 5-Yr is down 3.3bps at 1.45%, 10-Yr is down 2.4bps at 1.824%, and 30-Yr is up 0.9bps at 2.064%.

- Italian BTP spread down 9.2bps at 190.9bps / Spanish down 6bps at 104.2bps

FOREX: Greenback Sustains Losses Despite Higher CPI

- The greenback headed into the April CPI release as the worst performing currency in G10, as markets positioned for a soft reading. This quickly reversed course following the release, with the greenback rallying in tandem with US yields while equities fell. Core CPI was 0.2ppts ahead of expectations, driven by services inflation. This helped drive rate expectations higher and prompted a wave of risk off.

- EUR/USD traded through overnight lows of 1.0526 to narrow in on the 1.0500 handle, before the price action partially reversed into the close - with markets adopting the view that the bar to larger hikes from the Fed remains high. For EUR/USD, however, the trend remains lower. Weakness through 1.0500 would open the YTD and cycle lows of 1.0472 next.

- Elsewhere, EUR/GBP traded well, with the cross topping 0.8550 as the European Union warned that they would suspend the post-Brexit trade deal should the UK move to unilaterally revoke the Northern Ireland protocol. The renewed concern surrounding the Brexit Withdrawal Agreement pushed GBP to be the poorest performer in G10 Wednesday.

- UK preliminary GDP data crosses Thursday, with markets expecting 1.0% growth on the quarter and 8.9% on the year. US PPI data is also due, in which markets will be watching for any follow through of inflationary pressure after Wednesday's above-forecast CPI. ECB's de Cos and Makhlouf are also due to speak.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/05/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 12/05/2022 | 0001/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 12/05/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 12/05/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/05/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 12/05/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 12/05/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/05/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/05/2022 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 12/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 12/05/2022 | 1230/0830 | *** |  | US | PPI |

| 12/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 12/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 12/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 12/05/2022 | 1535/1135 |  | CA | BOC Deputy Gravelle speech on commodity shocks. | |

| 12/05/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/05/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/05/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.