-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN:

EXECUTIVE SUMMARY

US

US TSYS

OVERNIGHT DATA

MARKETS SNAPSHOT

US TSY FUTURES CLOSE

US 10Y FUTURES TECH: (U2) Watching Trendline Support

- RES 4: 123-13+ 1.764 proj of the 14 - 23 - 28 price swing

- RES 3: 122-29+ High Mar 31

- RES 2: 122-25 2.0% 10-dma envelope

- RES 1: 120-29/122-02 High Aug 4 / High Aug 02

- PRICE: 119-20+ @ 11:14 BST Aug 08

- SUP 1: 119-05+ 50-day EMA

- SUP 2: 118-03 Trendline support drawn from the Jun 16 low

- SUP 3: 117-14+ Low Jul 21 and key near-term support

- SUP 4: 116-11 Low Jun 28

Treasuries traded lower Friday and in the process cleared a number of support levels. The trend direction remains up though and recent weakness is considered corrective. The contract has remained above support at the 50-day EMA, which intersects at 119-05+. Just below this level is a trendline support at 119-03. A break of this zone would threaten the uptrend. A reversal higher would refocus attention on the bull trigger at 122-02.

US EURODOLLAR FUTURES CLOSE

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00529 to 2.31729% (-0.00957 total last wk)

- 1M +0.01914 to 2.38857% (+0.00714 total last wk)

- 3M +0.04486 to 2.91157% (+0.07842 total last wk) * / **

- 6M +0.14329 to 3.56886% (+0.09571 total last wk)

- 12M +0.13485 to 3.99471% (+0.15257 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 24Y high: 2.91157% on 8/8/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $282B

- Secured Overnight Financing Rate (SOFR): 2.28%, $965B

- Broad General Collateral Rate (BGCR): 2.26%, $391B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $380B

- (rate, volume levels reflect prior session)

FED Reverse Repo Operation

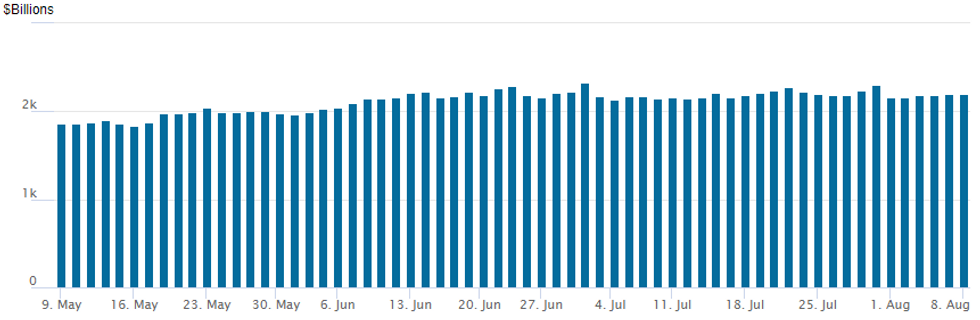

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher to $2,195.692B w/ 102 counterparties vs. $2,194.927B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE

EGBs

FOREX

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/08/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 09/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/08/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 09/08/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.