-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Fed Vs. Consumer Inflation Dichotomy

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Funds May Need To Reach 7% Or More-Levin

- MNI: US Consumer Inflation Expectations Fall -NY Fed Survey

US

FED: High and persistent inflation will force Federal Reserve policymakers to raise interest rates much more than they are currently projecting, perhaps nearly twice as much, ex-Fed board economist Andrew Levin told MNI.

- Fed Chair Jerome Powell said in his July press conference that the June Summary of Economic Projections, which shows the federal funds rate peaking at 3.8%, was still the best guide available for where official interest rates are headed.

- But that view is too sanguine because it is unclear that inflation has peaked and, even if it has, any decline will likely be choppy and slow, said Levin, a former Fed board economist for two decades until 2012, including two years as a special adviser on monetary policy strategy and communications.

- “The more likely scenario is that core inflation continues running in the neighborhood of 5, 6, 7%, and really to bring inflation down the Fed is going to have to raise the federal funds rate up to 5, 6, 7% or more,” he said in an interview. “The longer this goes on the harder it’s going to get because the more entrenched the expectations are in the wage- and price-setting behavior.” (See MNI: CPI Shortens Odds Of 75-BP Hike In Sept-Ex Fed Staffers). For more see MNI Policy main wire at 1151ET.

US: Consumer expectations for inflation fell sharply in July from the previous month, according to a monthly Federal Reserve Bank of New York survey of consumers.

- Median one-year ahead inflation expectations fell to 6.2% from 6.8%, while the three-year ahead measure dropped to 3.2% and 3.6%, according to the survey. The decreases were largest among lower-income and lower educated respondents.

- Median five-year ahead inflation expectations also declined to 2.3% from 2.8% a month earlier.

- "After being stable at 3.0% during the first three months of the year, the series has been trending down," the New York Fed said.

US TSYS: Modest Position Squaring Ahead Wed's CPI

Rates holding narrow range near midday session highs after the close (30YY taps 2.985% low vs. early overnight high of 3.0836%), light volumes (TYU<840k) on modest rebound after Fri's steep sell-off on stronger than expected jobs gains for July: +528k vs. +250k est, dip in unemployment rate to 3.5% while AHE gained 0.5%, a tenth faster than in June.

- Week opens w/ modest squaring ahead of Wed's key CPI data. A moderate read for the inflation metric will continue to soften 75bp hike expectations while another hot read will see today's bounce reverse, most likely spurring chatter over an inter-meeting hike that saw FFQ2 trade 97.64 briefly, 3 bps above the current 233 EFFR.

- Cross asset update: Stocks off midmorning highs/near steady (SPX eminis at 4144.0 -2.75, DJIA +62.95 at 32872.91); Spot Gold stronger +12.70 at 1788.21; Crude firmer (WTI +1.59 at 90.60).

- Data on tap for Tuesday: Nonfarm Productivity (-4.6% est) and Unit Labor Costs (9.8% est), US Tsy $34B 52W bill and $42B 3Y Note auctions. Primary focus on Wednesday's CPI read for July: 0.2% MoM est vs. 1.3% prior, 8.7% YoY vs. 9.1% prior.

- The 2-Yr yield is down 0.8bps at 3.2177%, 5-Yr is down 4.6bps at 2.9095%, 10-Yr is down 6.8bps at 2.759%, and 30-Yr is down 8.1bps at 2.9855%.

OVERNIGHT DATA

No economic data or Fed speakers Monday. Data on tap for Tuesday: Nonfarm Productivity (-4.6% est) and Unit Labor Costs (9.8% est), US Tsy $34B 52W bill and $42B 3Y Note auctions. Primary focus on Wednesday's CPI read for July: 0.2% MoM est vs. 1.3% prior, 8.7% YoY vs. 9.1% prior.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 17.87 points (0.05%) at 32824.18

- S&P E-Mini Future down 8 points (-0.19%) at 4139.25

- Nasdaq down 26.1 points (-0.2%) at 12632.75

- US 10-Yr yield is down 6.4 bps at 2.7627%

- US Sep 10Y are up 15/32 at 119-27

- EURUSD up 0.0009 (0.09%) at 1.0192

- USDJPY down 0.02 (-0.01%) at 134.99

- WTI Crude Oil (front-month) up $1.65 (1.85%) at $90.66

- Gold is up $12.08 (0.68%) at $1787.59

- EuroStoxx 50 up 31.83 points (0.85%) at 3757.22

- FTSE 100 up 42.63 points (0.57%) at 7482.37

- German DAX up 113.76 points (0.84%) at 13687.69

- French CAC 40 up 52.09 points (0.8%) at 6524.44

US TSY FUTURES CLOSE

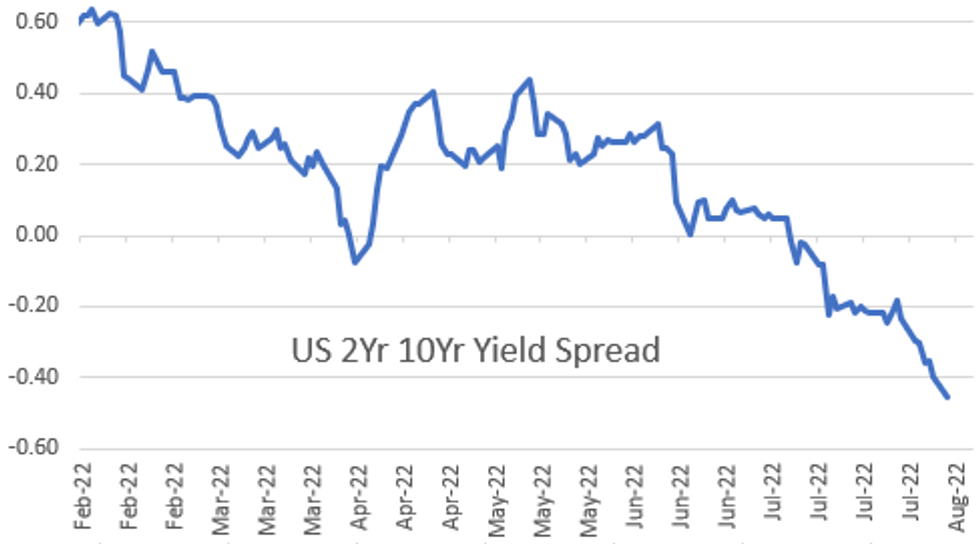

- 3M10Y -8.191, 20.761 (L: 20.213 / H: 31.231)

- 2Y10Y -5.616, -45.915 (L: -46.121 / H: -39.712)

- 2Y30Y -6.388, -22.745 (L: -23.121 / H: -15.268)

- 5Y30Y -2.584, 7.977 (L: 6.774 / H: 11.73)

- Current futures levels:

- Sep 2Y up 2.5/32 at 104-20.875 (L: 104-17.375 / H: 104-21.875)

- Sep 5Y up 8.5/32 at 112-17.75 (L: 112-06.75 / H: 112-20.25)

- Sep 10Y up 15/32 at 119-27 (L: 119-08.5 / H: 119-30.5)

- Sep 30Y up 1-11/32 at 142-18 (L: 141-00 / H: 142-20)

- Sep Ultra 30Y up 2-5/32 at 158-00 (L: 155-07 / H: 158-05)

US 10Y FUTURES TECH: (U2) Trendline Support Still Intact

- RES 4: 123-13+ 1.764 proj of the 14 - 23 - 28 price swing

- RES 3: 122-29+ High Mar 31

- RES 2: 122-25 2.0% 10-dma envelope

- RES 1: 120-29/122-02 High Aug 4 / High Aug 02

- PRICE: 119-26 @ 17:27 BST Aug 08

- SUP 1: 119-05+ 50-day EMA

- SUP 2: 118-03 Trendline support drawn from the Jun 16 low

- SUP 3: 117-14+ Low Jul 21 and key near-term support

- SUP 4: 116-11 Low Jun 28

Treasuries traded lower late last week and in the process cleared a number of support levels. The trend direction remains up and recent weakness is considered corrective. The contract has remained above support at the 50-day EMA, which intersects at 119-05+. Just below this level is a trendline support at 119-03. A break of this zone would threaten the uptrend. A reversal higher would refocus attention on the bull trigger at 122-02.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.010 at 96.545

- Dec 22 +0.020 at 96.050

- Mar 23 +0.010 at 96.105

- Jun 23 +0.010 at 96.280

- Red Pack (Sep 23-Jun 24) +0.030 to +0.080

- Green Pack (Sep 24-Jun 25) +0.090 to +0.095

- Blue Pack (Sep 25-Jun 26) +0.090 to +0.095

- Gold Pack (Sep 26-Jun 27) +0.085 to +0.095

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00529 to 2.31729% (-0.00957 total last wk)

- 1M +0.01914 to 2.38857% (+0.00714 total last wk)

- 3M +0.04486 to 2.91157% (+0.07842 total last wk) * / **

- 6M +0.14329 to 3.56886% (+0.09571 total last wk)

- 12M +0.13485 to 3.99471% (+0.15257 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 24Y high: 2.91157% on 8/8/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $282B

- Secured Overnight Financing Rate (SOFR): 2.28%, $965B

- Broad General Collateral Rate (BGCR): 2.26%, $391B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $380B

- (rate, volume levels reflect prior session)

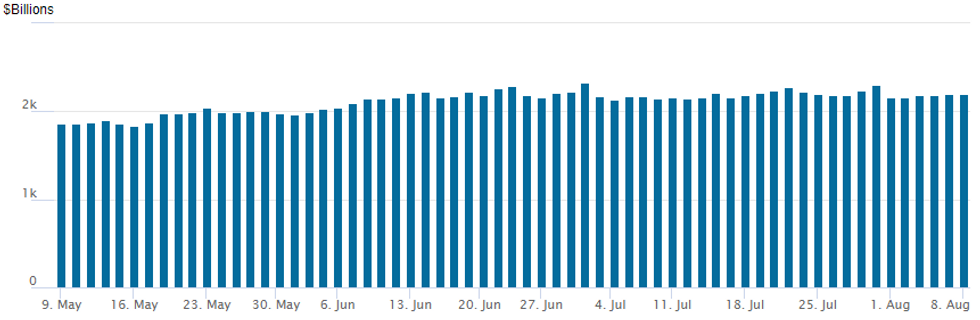

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher to $2,195.692B w/ 102 counterparties vs. $2,194.927B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $3.2B Duke Energy 3Pt Launched

Still waiting on Credit Suisse to launch

- Date $MM Issuer (Priced *, Launch #)

- 08/08 $3.2B #Duke Energy $900M +5Y +142, $1.15M 10Y +177, $1.15M 30Y +202

- 08/08 $2.5B #Global Payments $500M 5Y +205, $500M 7Y +245, $750M 10Y +265, $750M 30Y +295

- 08/08 $2B #Wells Fargo 4NC3 +140

- 08/08 $2B #BNP Paribas PerpNC7 7.75%

- 08/08 $1.8B #Mexico 2033 +235

- 08/08 $1.5B #Caterpillar $800M 3Y +55, $700M 5Y +70

- 08/08 $1.2B #Prudential 30NC10 6.0%

- 08/08 $1B #MPLX 10Y +225

- 08/08 $1B #Sherwin-Williams $600M 2Y +85, $400M 3Y +110

- 08/08 $600M #Ford Motor 40NC5 par prfd 6.5%

- 08/08 $600M *Wisconsin Power & Light WNG 10Y +160a

- 08/08 $500M *Becton Dickenson WNG 10Y +153

- 08/08 $Benchmark Credit Suisse 4NC3 +325a, 6NC5 +355a, 11NC10 +380a

- 08/08 $Benchmark AIIB 5Y SOFR+63a - may price Tuesday

FOREX: Greenback Unwinds Post-NFP Advance, AUD Leads Charge

- The greenback edged lower on Monday as the USD index slowly erased the NFP-inspired gains from Friday with markets potentially squaring positions ahead of a crucial set of US inflation data on Wednesday. While the broad USD index maintained a steady downward trajectory, performance across G10 was mixed.

- Firmer Chinese exports data and an initial rally across major equity benchmarks bolstered a firm 1% rally in antipodean FX and despite the late turnaround for stocks, AUD and NZD have maintained the majority of their advances for the session. In similar vein, CHF and CAD were notable beneficiaries of the Dollar weakness with more tempered gains of around +0.6%.

- EURUSD was happy to trade blows either side of 1.0200 and this marks the 15th consecutive session that the pair holds between 1.01/03. This consolidatory price action placed pressure on EUR crosses with EURAUD trading back below the 1.4600 mark and narrowing the gap with the July lows at 1.4511.

- USDJPY was less volatile than seen in recent memory, however, the pair still registered a 120-pip range on Monday. Despite an initial attempt above Friday’s highs at 135.50 during the APAC session, momentum immediately waned and the pair slowly reversed course throughout Monday in line with the general theme across currency markets. Lows were made at 134.36, however the pair now trades just below its opening level approaching the APAC crossover at 134.80.

- An extremely quiet data calendar for Tuesday may prompt currency markets to trade tentatively ahead of Wednesday’s US CPI, barring any major developments on the geopolitical front that could impact overall risk sentiment.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/08/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 09/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/08/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 09/08/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.