-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA MARKETS ANALYSIS - US Front Yields Climb, USD Consolidates Weakness

US TSYS: 2Y Yield Hits Fresh Post-2007 Highs After Fedspeak

- 2Y Tsy yields have pulled back from new cycle highs (and fresh post-2007 highs) of 3.5731% but still sit +6bps at 3.563%.

- ~5bps of that is since Waller and George spoke, with the takeaway being a continued push of higher rates for longer.

- 2s10s flatten 6bps to -24bps despite an unwinding of an earlier rally in the long-end (with 10Y real yields holding just off cycle highs), back to pre-payrolls levels.

- The intraday sell-off for TYZ2 to 115-24 sees it resume its downward trend after the midweek clearance of a bear trigger at 115-23 with a low of 115-13+, forming support, clearance of which would open 114-26 (Jun 16 low).

- Entering the media blackout at midnight Friday, focus is firmly on US CPI on Tuesday. Governor Waller made clear today he wants to see months and months of slowing inflation (rather than just a couple) after being caught out by last year's re-acceleration.

FOREX: Greenback Weakness Consolidates Despite US Front-End Yield Surge

- Despite a partial greenback recovery in early NY trade on Friday, the US Dollar is holding onto broad based sizeable declines to finish the week. The USD weakness is largely stemming from the extended grind higher in major equity indices, significantly boosting the likes of AUD (+1.35%) and NZD (+0.86%).

- The Swiss Franc extended on yesterday’s gains, rising in tandem with the Japanese Yen, which continued to trade in a volatile manner.

- An early move lower for US yields heavily weighed on USDJPY which plummeted to a 1.4151 low from earlier highs of 144.12 during APAC trade. Despite US 2-year yields then rising around 12bps off the lows, USDJPY was only able to partially recover to current rate ~142.65 in early US trade where it consolidated for the majority of the US session.

- FX markets appeared to run out of steam approaching the close and although the USD index printed fresh cycle highs on Wednesday, the index looks set to post a 0.5% decline from last Friday’s close.

- Markets turn their focus to next week’s US CPI data, scheduled to be published on Tuesday.

- Monday’s highlight will be UK GDP data, which the ONS have confirmed will go ahead as planned, despite the BoE deferring its meeting by a week, due to the UK's mourning period. Worth noting Chinese banks will be closed on Monday in observance of the Mid-Autumn Festival.

SWEDEN: Preview Published Ahead Of 11 September Election

MNI's Political Risk team has published a preview ahead of the Swedish general election taking place this Sunday 11 September.

- In this election preview we will provide a short explainer of the electoral system, the main parties contesting the vote, an opinion polling chart-pack, a scenario analysis of potential election outcomes with probabilities, and an expected timeline of the contest.

- Sweden goes to the polls for its general election on 11 September, with the two major political blocs neck-and-neck in opinion polls and the race too close to call. A win for Prime Minister Magdalena Andersson’s Social Democrats and the other parties of the left and centre-left would likely support broad policy continuity. However, a win for the centre-right/right wing grouping of parties could see a prominent role in or around government for the nationalist Sweden Democrats for the first time.

For full article please see the PDF below:

CANADA: Bearish Jobs Print As Unemployment Rate Jumps

- A net bearish jobs print sees USDCAD climb 30pips and notable GoC outperformance to Tsys (2YY -8.5bps vs -2.5bps Tsys)

- A big miss for employment in August (-39.7k vs +15k consensus) and with no revisions to offset a cumulative -74k from the prior two months, was amplified by full-time jobs falling -77k for -90k in two months, almost 0.5% of the workforce.

- There was no support this time from a declining labour force, with the participation rate bouncing a tenth, and as such the u/e rate jumped 0.5pps off record lows to 5.4% (5.0% expected), the highest since February.

- The only caveat from a hawkish BoC perspective was slightly stronger than expected permanent hourly wage growth (from 5.4% to 5.6% Y/Y) with a similar increase in total hourly wage growth.

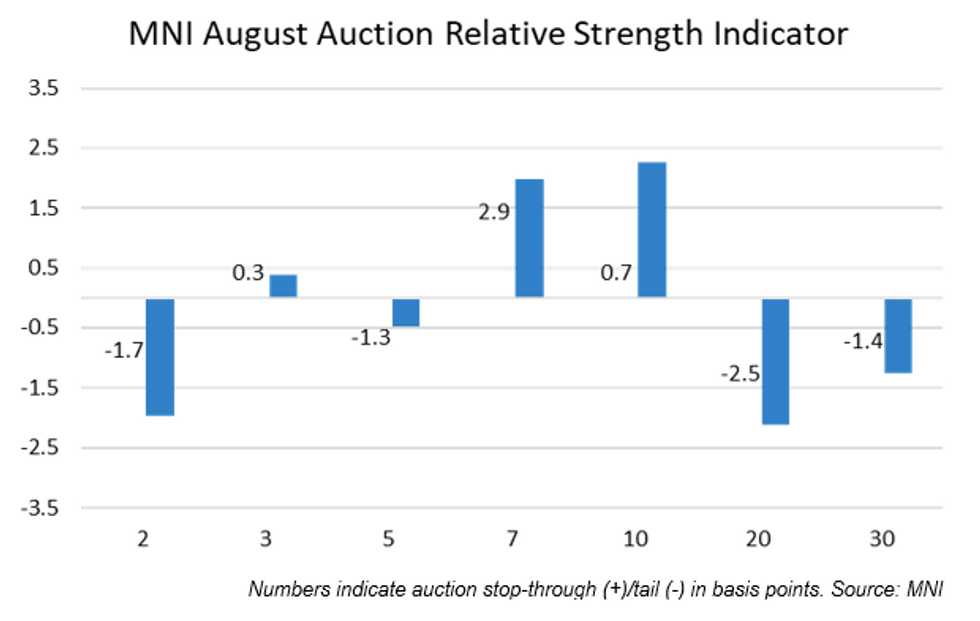

MNI UST Issuance Deep Dive: Sep 2022

Markets

MarketsEXECUTIVE SUMMARY:

- While August's refunding announcement was more or less in line with expectations, the underperformance of the 20Y Note on the curve immediately following the release (poor August’s auction) stood out.

- August’s auction results were mixed-to-weak, as suggested by MNI’s Auction Relative Strength Indicator.

- Of August’s 7 coupon auctions, 3 stopped through, with 4 tailing. By comparison in July, 6 of 7 had traded through (with the 7th tailing).

- Nominal coupon supply restarts next week with $41B of 3Y Note, $32B of 10Y Note (re-open), and $18B of 30Y Bond (re-open) auctions.

Please see PDF for full analysis:

MNI_US_DeepDive_Issuance_Sept2022.pdf

MNI ECB Review - September 2022: ECB Front Loads

Bruce Jeffery

Bruce JefferyMNI ECB Review - September 2022: ECB Front Loads

As expected, the ECB hiked policy rates by 75bp at the September GC meeting, marking another significant turning point for monetary policy. During the press conference President Lagarde repeated numerous times that this marks a frontloading of policy rate tightening and that future interest rate hikes would be delivered in future meetings. She went on to elaborate that the timescale for further hikes would probably be more than two meetings and less than five.

Having gone against its own forward guidance on a 25bp in July by delivering a 50bp hike, subsequently dropping forward guidance altogether, and then seemingly going against Chief Economist Philip Lane’s proposed tightening speed that is “neither too slow nor too fast”, it is clear that the ECB has fallen in line behind the hawks on the GC. Moreover, Lagarde indicated that support for a 75bp hike was unanimous, indicating that the dovish voices previously calling for a gradual approach, must now also be concerned by the scale of the recent inflationary surge.

In our ECB preview we had argued that it could be a risky move if the ECB hiked by less than 75bp as it would beg the question ‘if not now, then when?’ given that inflation is getting closer to double digits and the main policy rate (at the time) was still at zero. Hiking by 50bp, for example, would have risked undermining the ECB’s commitment and determination to restore price stability in a timely manner. As it stands, the more hawkish pivot at the September meeting, including President Lagarde’s particularly hawkish rhetoric, signalled a very clear resolve to rein in inflation. Although Lagarde stated that 75bp hikes should not be considered the new normal, it is now clearly an open option, especially as the ECB president indicated that policy rates were still a long way away from the terminal rate.

For the full publication:

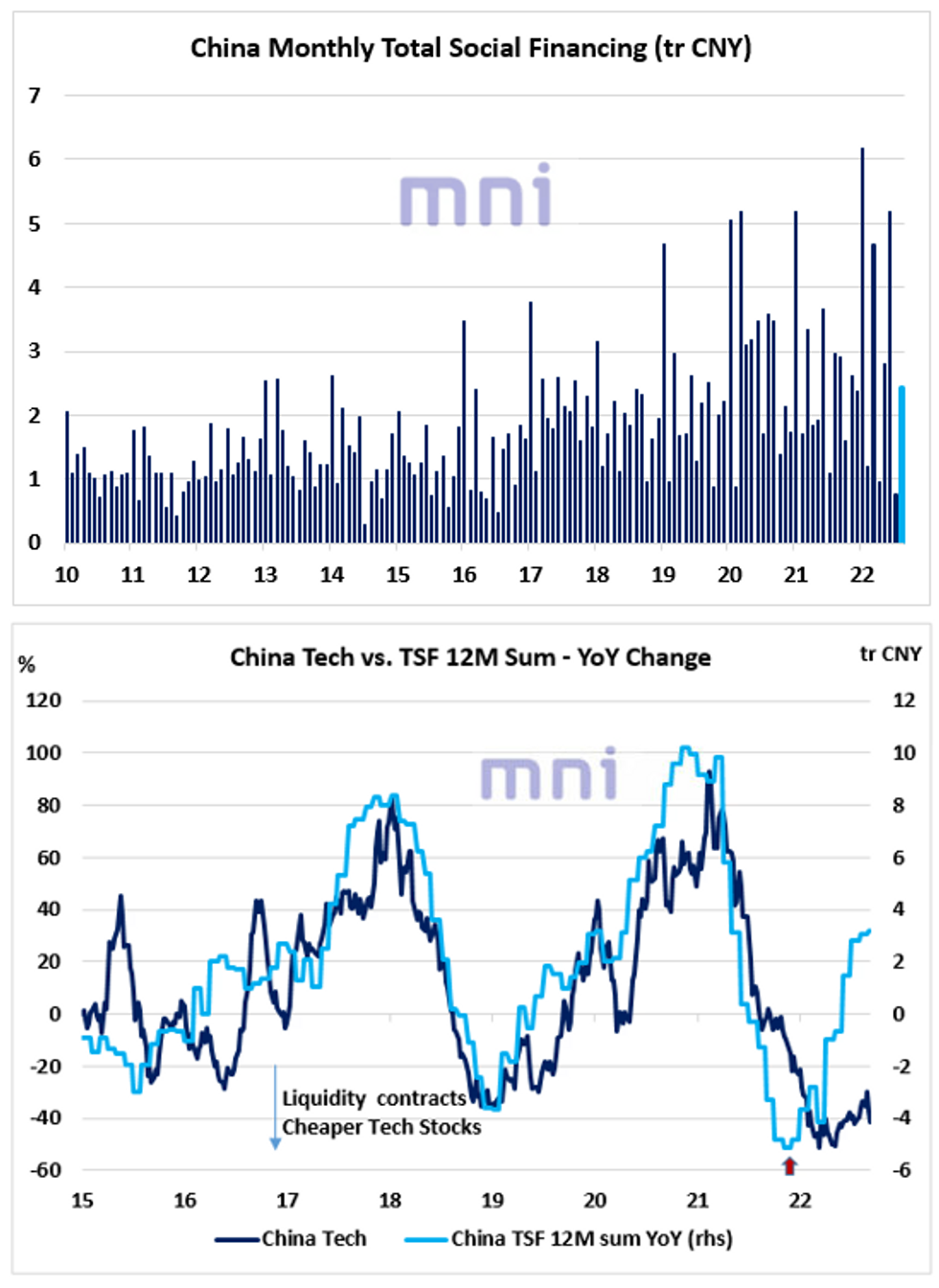

CHINA: Annual Liquidity Continues To Rise, But Not Enough To Levitate Domestic Risky Assets

- The PBoC reported this morning that aggregate financing rose by 2.43tr CNY in August, above expectations of 2.075tr CNY with new yuan loans rising by 1.25tr CNY (1.5tr CNY exp.).

- China ‘liquidity’ metric, computed as the annual change in China Total Social Financing (TSF), continues to rise, now up 3tr USD in the past year.

- Even though a recovery in liquidity has historically had a positive impact on domestic risky assets and some China-sensitive commodities (i.e. copper) or currencies (i.e. AUD), the easing conditions (policy and liquidity) have been barely enough to limit the downside risk on the real economy.

- The bottom chart shows that liquidity-sensitive sectors such as tech equities have remained 'depressed' despite the sharp rebound in liquidity since the start of the year.

- Sell-side firms have been constantly reviewed their 2022 forecasts to the downside, with some analysts expecting GDP growth to average 2.5%-3% this year, diverging significantly from China officials 5.5% growth target.

Source: Bloomberg/MNI

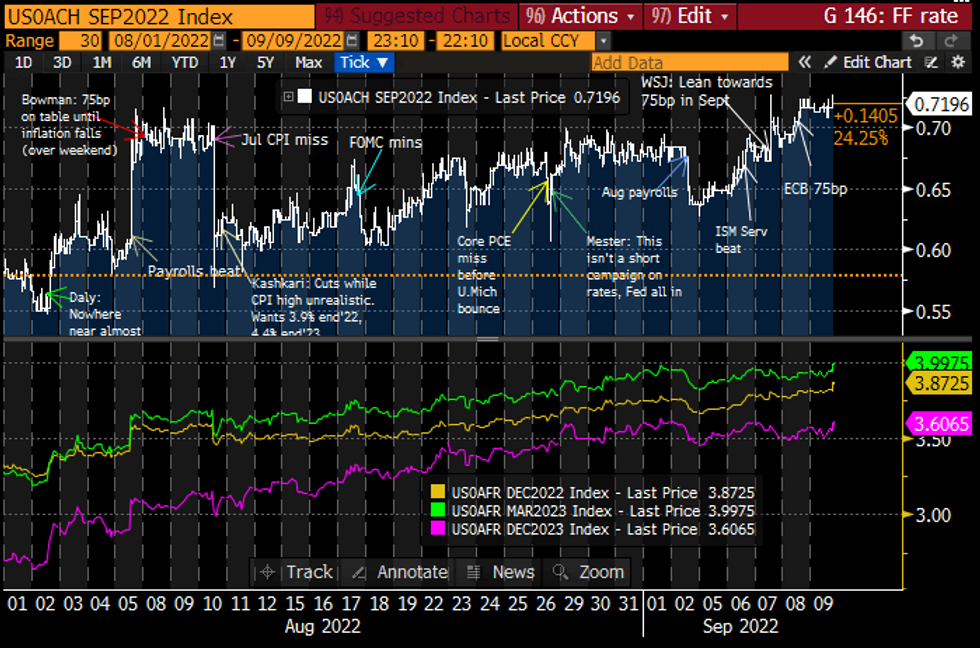

STIR FUTURES: New Highs For Hiking Cycle Into Fed Blackout

- Fed Funds implied hikes hovering at 72bp for Sep, maintaining the earlier rise after what is interpreted as endorsement for a 75bp hike from Waller, joining Bullard explicitly earlier as part of his push back against market under-pricing higher for longer.

- New highs for Dec’22 (3.87%, +6bp on day) and the Mar’23 terminal (4.00%, +6bp) whilst the 3.59% for Dec’23 is just under prior highs.

- Waller stressed data dependence but struck a hawkish tone including the months and months of lower inflation he wants to see although George was more cautious, wanting steadiness and purposefulness over speed “given the likely lags in pass through of tighter monetary conditions”.

FOMC-dated Fed Funds implied Sep hike (white) and implied rates at specific meetings (bottom panel)Source: Bloomberg

FOMC-dated Fed Funds implied Sep hike (white) and implied rates at specific meetings (bottom panel)Source: Bloomberg

FED: RRP Usage Unchanged

- Fed RRP usage unchanged at $2.210T after its small climb over the past week (counterparties -1 to 103), staying below the latest month-end boost of $2.251B from Aug 31.

- Waller earlier: QT run-rate hitting full stride is priced in and not clear how much more pressure it will have on rates. We’ll start to see it if we see “a lot” of drainage out of our RRP facility, that reserves are getting pretty scarce, then we might see some other issues.

- The Fed anticipates take-up to decline over time as money market interest rates rise relative to the Fed's rate, the NY Fed's market chief pro tem Zobel said yesterday.

EGBs-GILTS CASH CLOSE: Mixed Curve Movements As Hike Pricing Firms

The German curve twist steepened with the UK's bull flattening Friday.

- Short end Eurozone rate hike expectations firmed, with ECB speakers in the morning mostly on the hawkish side (Knot, Kazimir).

- Oct ECB hike pricing closed at about 62bp; Dec 2022 implied rate rose 2.8bp to 1.81% on the day; terminal remained around 2.3%.

- An FT sources piece pointing to the ECB discussing QT starting in October with a potential start by year-end to put renewed pressure on BTPs.

- The BoE decision was postponed from next week to Sept 22nd due to the mourning period for the Queen, leading to some volatility in front rate futures, though settled a little higher on the day (67bp priced).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 0.7bps at 1.327%, 5-Yr is down 1.7bps at 1.538%, 10-Yr is down 1.9bps at 1.698%, and 30-Yr is up 2.9bps at 1.808%.

- UK: The 2-Yr yield is down 1.4bps at 3.054%, 5-Yr is down 2bps at 2.987%, 10-Yr is down 5.2bps at 3.095%, and 30-Yr is down 2.2bps at 3.476%.

- Italian BTP spread up 6.3bps at 232bps / Greek up 7bps at 258.2bps

FX OPTIONS: Expiries for Sep12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000-15(E1.3bln), $1.0050-65(E784mln), $1.0075-80(E532mln), $1.0100(E563mln)

- USD/JPY: Y141.50($515mln), Y142.50-52($761mln). Y143.00($760mln)

- GBP/USD: $1.1875(Gbp955mln)

- EUR/GBP: Gbp0.8600(Gbp1.6bln)

- USD/CNY: Cny7.00($1.2bln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.