-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Ylds March Higher Aftermath of FOMC, BoE

EXECUTIVE SUMMARY

- MNI INTERVIEW: Scant Signs Inflation Pressures Abating - Altig

- MNI INTERVIEW: FOMC Opens Door To 5% Rates and Beyond In 2023

- MNI UK: Fiscal Event Marks Major Shift In Conservative Gov'ts Policy Stance

US

FED: The Federal Reserve's aggressive monetary tightening campaign has made scant difference in easing or narrowing U.S. inflation pressures so far, Atlanta Fed research director David Altig told MNI Friday.

- Inflation is "very high and it seems to be stuck with few signs of mitigating yet," he told MNI's FedSpeak podcast. "The key development over the course of the next year is whether we're going to see moderation proceed at a pace that gets us pretty quickly to something near the the FOMC's goal, and that seems highly uncertain."

- Ahead of the September FOMC meeting, Altig said Atlanta Fed staff were surprised to learn that supply pressures are not relaxing for firms in the Fed region, adding that business contacts described the rolling nature of problems and disruptions as a game of Whack-A-Mole. For more see MNI Policy main wire at 1431ET.

FED: This week’s FOMC decision represents a reset of Fed policy to decisively communicate to markets that economic weakness -- even a recession -- will not dissuade the Fed from hiking interest rates to control inflation, former Dallas Fed adviser Danielle DiMartino Booth told MNI.

- The Fed not only jacked up borrowing costs by 75 basis points for a third meeting in a row but also signaled a much higher peak for rates – up to a 4.6% median from 3.8% in June -- with a third of officials estimating an even higher peak rate of 4.9%.

- “By pushing out the terminal rate and by repeatedly saying we’re not just going to get to 5%, we’re going to get to 5% and stay there, they completely shifted the dialogue,” she told MNI’s FedSpeak podcast. “This was something bigger than Jackson Hole because it was portrayed as being an institutionally wide, accepted new regime." For more see MNI Policy main wire at 1049ET.

UK

UK: Politically the fiscal event just concluded by Chancellor Kwasi Kwarteng in the House of Commons marks the largest shift in the policy stance of the Conservative party in a generation.

- An economic agenda built around tax cuts, with many of them focused on higher earners, would not have been thinkable under former PM David Cameron and his Chancellor George Osborne's 'austerity' policies, nor Boris Johnson's 'leveling-up' agenda. The former of which focused on lowering gov't spending, while the latter was centered on boosting investment and infrastructure projects in the north of England.

- Bloomberg reports that the cost of the package will be GBP161bn over five years.

- The overt shift to a low-tax stance from the Conservatives could be seen as a risk to the party's seats in the north, where many voters were viewed to have been swayed to vote Conservative for the first time ever by former PM Johnson's lavish spending promises.

- Opinion polling continues to show the Conservatives trailing the main opposition centre-left Labour Party by around 8-10% nationwide. On these figures, a Labour majority gov't or Labour-led coalition would be the most likely outcome of a general election.

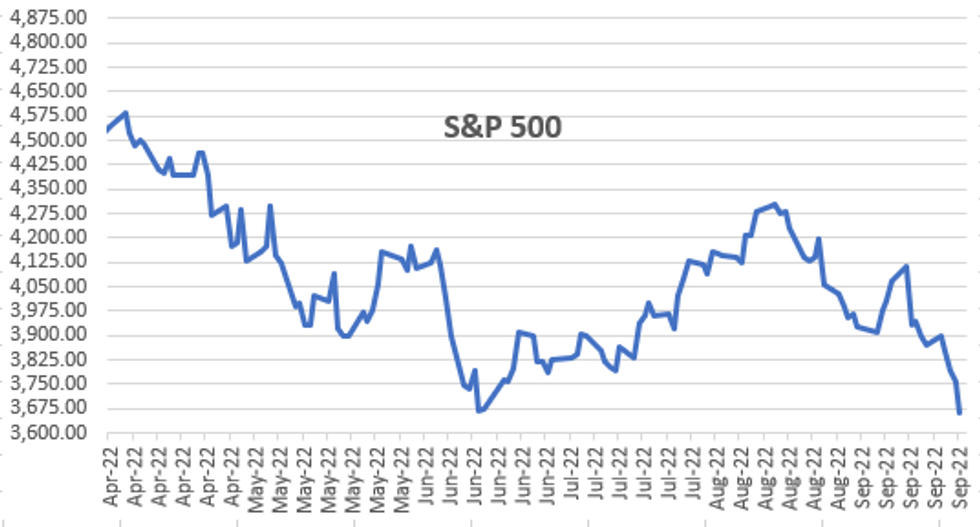

US TSYS: Tsy Ylds Off New Lows, Stocks Bouncing Late, US$ Index Surge To 113.228

Well off late overnight lows when 2YY made new 15Y high of 4.2657%, FI markets finishing mixed, curves unwinding a large portion of Thu's steepening with bonds trading higher through the second half, 2s10s currently -10.559 at -51.613.

- Tsy dipped briefly after better than exp S&P US Sep Flash Mfg PMI: 51.8 vs. 51.0 est, much better than expected services (49.2 vs. 45.5 est) and comp (49.3 vs. 46.1) still contractionary (below 50).

- Otherwise, Tsys and EGBs tracked Gilts amid heavy selling in short end to intermediates after fiscal event concluded by Chancellor Kwasi Kwarteng in the House of Commons earlier. Event marked largest shift in the policy stance of the Conservative party in a generation. Bloomberg reports that the cost of the package will be GBP161bn over five years.

- In the aftermath of Wed's 75bp Fed and Thu's 50bp BoE hikes, debate over how much hawkish forward guidance to price in continues. Many US and London banks adjusting rate hike expectations to 75bp again in respective November policy meetings.

- Meanwhile, persistent rally in USD Index has extended through the London close, with the greenback hitting new cycle highs of 112.866. Move exacerbated by protracted weakness in GBP (making up around 12% of the USD Index) following the UK mini budget earlier today.

- Cross asset roundup: stocks making a move off late session lows, Energy sector underperforming (SPX -77 at 3695.0) crude sharply lower (WTI -4.67 at 78.82), as is Gold -28.64 at 1642.58.

OVERNIGHT DATA

- US S&P GLOBAL SEPT. COMPOSITE PMI AT 49.3 VS 44.6 PRIOR

- US S&P GLOBAL SEPT. SERVICES PMI AT 49.2 VS 43.7 LAST MONTH

- US S&P GLOBAL SEPT. MANUFACTURING PMI AT 51.8 VS 51.5 PRIOR

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 744.25 points (-2.47%) at 29324.03

- S&P E-Mini Future down 101 points (-2.68%) at 3670.75

- Nasdaq down 304.6 points (-2.8%) at 10760.45

- US 10-Yr yield is down 2.7 bps at 3.6866%

- US Dec 10Y are down 1.5/32 at 112-22.5

- EURUSD down 0.0157 (-1.6%) at 0.9679

- USDJPY up 0.97 (0.68%) at 143.36

- Gold is down $29.65 (-1.77%) at $1641.63

- EuroStoxx 50 down 78.54 points (-2.29%) at 3348.6

- FTSE 100 down 140.92 points (-1.97%) at 7018.6

- German DAX down 247.44 points (-1.97%) at 12284.19

- French CAC 40 down 135.09 points (-2.28%) at 5783.41

US TSY FUTURES CLOSE

- 3M10Y +2.372, 49.27 (L: 40.062 / H: 57.828)

- 2Y10Y -11.221, -52.275 (L: -52.507 / H: -42.52)

- 2Y30Y -12.469, -60.687 (L: -61.115 / H: -50.194)

- 5Y30Y -7.721, -37.495 (L: -38.241 / H: -29.799)

- Current futures levels:

- Dec 2Y down 4.875/32 at 102-20.375 (L: 102-17 / H: 102-27)

- Dec 5Y down 8/32 at 107-20 (L: 107-05.25 / H: 107-31.25)

- Dec 10Y down 1/32 at 112-23 (L: 111-25 / H: 112-30.5)

- Dec 30Y up 23/32 at 128-30 (L: 126-29 / H: 129-12)

- Dec Ultra 30Y up 28/32 at 141-1 (L: 138-08 / H: 141-28)

US 10YR FUTURE TECHS: (Z2) Southbound

- RES 4: 116-31 50 day EMA values

- RES 3: 115-15/116-26 20-day EMA / High Sep 2

- RES 2: 114.17/115-01 High Sep 20 / 15

- RES 1: 114-00 High Sep 22

- PRICE: 112-17+ @ 1100ET Sep 23

- SUP 1: 111-25 Low Sep 23

- SUP 2: 111-22 3.0% Lower Bollinger Band

- SUP 3: 111-04+ 3.0% 10-dma envelope

- SUP 4: 111-00 Psychological Support

Treasuries remain soft and the contract extended losses Friday. A bearish price sequence of lower lows and lower highs, bearish moving average studies and a lack of any meaningful correction, clearly highlights the markets current bearish sentiment. Prices have shown below the 112-00 handle, thereby opening 111-22, a lower Bollinger band value. Initial resistance is the Thursday high of 114-00.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.055 at 95.250

- Mar 23 -0.055 at 95.050

- Jun 23 -0.070 at 95.060

- Sep 23 -0.090 at 95.190

- Red Pack (Dec 23-Sep 24) -0.11 to -0.10

- Green Pack (Dec 24-Sep 25) -0.085 to -0.04

- Blue Pack (Dec 25-Sep 26) -0.035 to +0.005

- Gold Pack (Dec 26-Sep 27) +0.020 to +0.050

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00228 to 3.06943% (+0.75386/wk)

- 1M -0.00371 to 3.08029% (+0.06643/wk)

- 3M -0.01300 to 3.62843% (+0.06314/wk) * / **

- 6M +0.01858 to 4.20129% (+0.07800/wk)

- 12M +0.03529 to 4.83486% (+0.16272/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.64143% on 9/22/22

- Daily Effective Fed Funds Rate: 3.08% volume: $99B

- Daily Overnight Bank Funding Rate: 3.07% volume: $308B

- Secured Overnight Financing Rate (SOFR): 2.99%, $1.023T

- Broad General Collateral Rate (BGCR): 2.99%, $387B

- Tri-Party General Collateral Rate (TGCR): 2.99%, $369B

- (rate, volume levels reflect prior session)

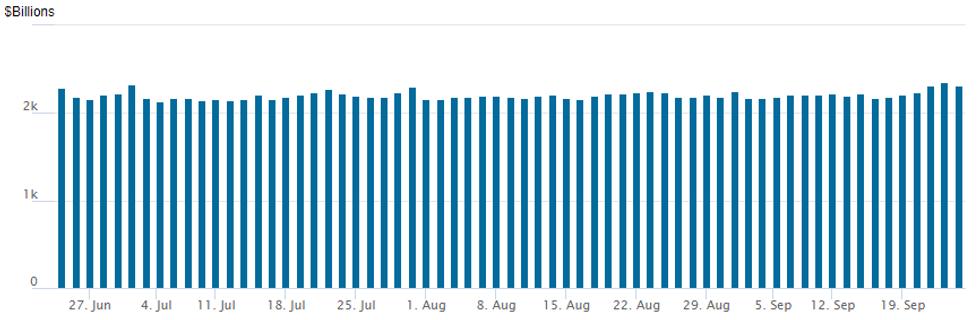

FED Reverse Repo Operation: Off Thu's Record High

NY Federal Reserve/MNI

NY Fed reverse repo usages recedes to $2,319.361B w/ 102 counterparties after climbing to new record high of $2,359.227B in the prior prior session (first new high since Thursday June 30: $2,329.743B).

PIPELINE: $13.9B Total High-Grade Issuance on Week

- Date $MM Issuer (Priced *, Launch #)

- 09/23 No new issuance Friday, $13.9B total for week

- $3.65B Priced Thursday

- 09/22 $2.75B *Citigroup 4NC3 +148

- 09/22 $900M *WEC Energy $500M 3Y +90, $400M 5Y +128

- 09/22 $Benchmark JBIC 5Y Green bond investor call

FOREX: Trends Extend, With GBP, EUR, CNH And Others Touching New Cycle Lows

- The persistent rally in the USD Index is extending through the London close, with the greenback hitting new cycle highs of 112.866.

- The move has been exacerbated by the protracted weakness in GBP (making up around 12% of the USD Index) following the UK mini budget earlier today. A number of sell-side analysts have revised lower their near-term forecasts for currency, with Citi now expected GBP/USD to trade in a range of $1.05-1.10, raising the risk of a "confidence crisis" in the currency. Similarly, JP Morgan write that the UK rate market's reaction today is a sign of a "broader loss of confidence in the government's approach".

- Support for GBP/USD has proved ineffective on today's sell-off, with markets reaching new multi-decade lows of 1.0897. This narrows the gap with levels last seen in 1985 - with 1.0520 printed in February of that year.

- Friday's fiscal statement - marking the most significant wave of tax cuts in a generation - will cause considerable uncertainty for BoE rates policy, with SONIA futures falling sharply throughout the day and prompting BoE rate pricing to spike to an implied rate of near 5.50% for the August 2023 meeting.

- GBP/JPY also a notable mover given Thursday's BoJ intervention. The cross approaches support at 155.60 ahead of 155.17 - the 76.4% retracement for the March - June upleg.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/09/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 26/09/2022 | 0700/0900 |  | EU | ECB de Guindos Speaks with AED in Madrid | |

| 26/09/2022 | 0730/0930 |  | EU | ECB Panetta Speaks at Bundesbank | |

| 26/09/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 26/09/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 26/09/2022 | 1300/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 26/09/2022 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 26/09/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/09/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 26/09/2022 | 1600/1700 |  | UK | BOE Tenreyro Speaks on Climate Change | |

| 26/09/2022 | 1630/1230 |  | US | Dallas Fed's Lorie Logan | |

| 26/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/09/2022 | 2000/1600 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.