-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed to Stay the Course

EXECUTIVE SUMMARY

MNI: Brainard Says Fed Must Avoid Easing Off Too Soon

MNI: Barkin Says Fed Will Persist Until Inflation Comes Down

MNI: Fed May Adjust SLR Rules To Help Treasury Market- Bowman

MNI INTERVIEW: Models Of Inflation Expectations Need Refining

US

FED: Federal Reserve Vice Chair Lael Brainard joined a growing consensus on the FOMC that a long period of restrictive interest rates is needed to bring inflation back to target, and warned against the dangers of easing off too soon.

- "We are committed to avoiding pulling back prematurely," she said in the text of a speech. "We also recognize that risks may become more two sided at some point," she said, a reference to the views of some economists that going too far on rate hikes will needlessly trigger a damaging recession.

- Most of the speech focused on global financial conditions and potential spillovers from the Fed's actions, including through a stronger U.S. dollar, though it didn't directly reference recent volatility in U.K. markets. Brainard noted many central banks are tightening like the Fed as they too see the dangers of entrenched inflation. For more see MNI Policy main wire at 0905ET.

- "One of the key lessons from the ‘70s was not to declare victory prematurely. Perhaps we will get help from supply chain and energy market normalization," he said, without giving a view of what kind of rate hike he'd prefer at the next meeting. "But we have the tools to bring inflation down, even if those disruptions continue."

- "Our rate and balance sheet moves take time to bring inflation down. But the Fed will persist until they do," he said, also suggesting he doesn't see a recession on the horizon. "While there is a lot of talk about a recession, the strength of the labor market suggests that is still premature." For more see MNI Policy main wire at 1221ET.

- The leverage ratio can discourage banks from intermediation in the Treasury market or holding ultra-safe assets, Bowman said. The SLR requires large banks to hold capital equal to 3% of their assets and 5% for systematically important banks.

- Leverage ratios could become less binding as QT drains reserves from the system, she said in remarks prepared for the The Institute of International Finance in Washington. As the Fed recalibrates capital requirements to implement Basel III, Bowman said it should examine SLR, the countercyclical capital buffer and the stress capital buffer, "particularly where specific actions may have unintended consequences."

UK

BOE: Central banks should incorporate a more sophisticated model of inflation expectations into their projections, a former head of modelling at the Bank of England told MNI, noting how the distribution of expectations shifted to the upside well before the current surge in headline inflation, even as average expectations remained relatively subdued.

- While some economists, including the Federal Reserve Board’s Jeremy Rudd, have questioned the usefulness of inflation expectations, whose failure to rise sharply after the Covid pandemic reinforced arguments against more rapid tightening of monetary policy, research by Francesca Monti, now a professor at Universite Catholique de Louvain, together with the IMF’s Roland Meeks has produced empirical evidence that variations in expectations feed through to headline inflation.

- “After Covid, for example, the distribution of inflation expectations started moving upwards earlier than the consensus measure. The point of our paper is policymakers should pay attention to the whole distribution of inflation expectations. It does really matter,” Monti said in an interview. For more see MNI Policy main wire at 0936ET.

US TSYS: FI Support Evaporates Amid Late Month End Selling

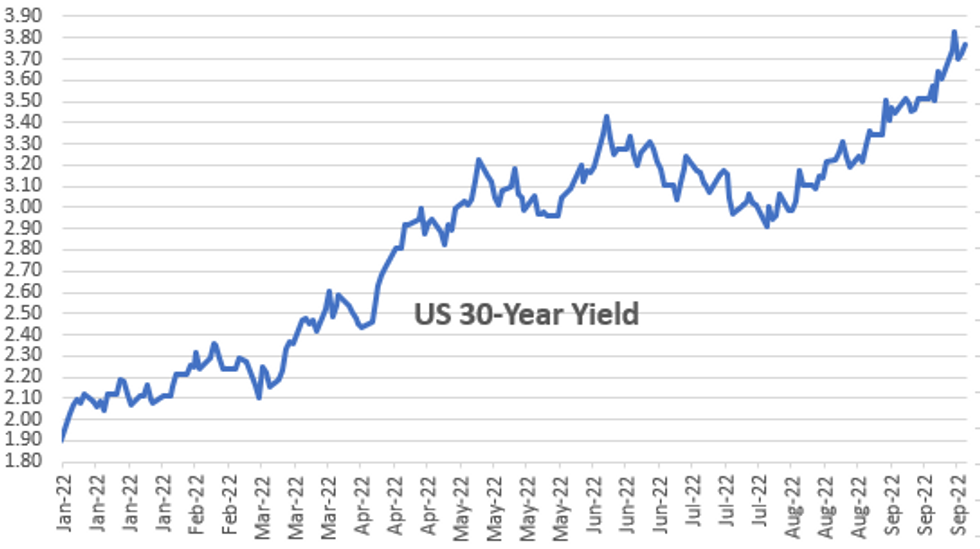

Trading higher for much of the session, Tsys extended session lows into the close, bids scarce in month end trade, yield curves bear steepening off deeper inverted lows in early trade (2s10 +1.044 at -40.259 vs. -49.174 low).

- Mixed early data reacts has rates holding inside session' range. Fast two-way trade saw Tsys and equities extended lows as inflation metric remains hot: Core PCE 0.6% MoM vs. 0.5% est, 4.9% YoY, unrounded +0.562%.

- Knee jerk bid in 10s before support evaporated after midmorning Chicago PMI came out lower than expected - contractionary w/ sub-50 business barometer read of 45.7 vs. 52.2 in August. The 6.5pt slide to 45.7 in the Chicago PMI, which has closely tracked recent ISM movements, adds support for a sub-50 ISM reading, contrary to consensus for a decline from 52.8 to 52.4 for Monday's report.

- Technical view for TYZ2 at 112-18 (+3.5): Treasuries remain vulnerable and short-term gains are considered corrective. Recent weakness has reinforced current bearish trend conditions w/ price sequence of lower lows and lower highs and bearish moving average studies clearly highlight the market's sentiment. The focus is on 109-20, a lower moving average band value. Initial resistance is 112-30+, the Sep 23 high.

- Late cross-asset snapshot: stocks near late session lows on same month-end positioning, SPX eminis -37.25 at 3617.00, Gold firmer +0.61 at 1661.15, Crude paring midweek gains w/ WTI -1.40 at 79.83, US$ index -.030 at 112.224 (while GBP sits at 1.1155 after tapping 1.1234 high).

OVERNIGHT DATA

- US AUG PERSONAL INCOME +0.3%; NOM PCE +0.4%

- US AUG PCE PRICE INDEX +0.3%; +6.2% Y/Y

- US AUG CORE PCE PRICE INDEX +0.6%; +4.9% Y/Y

- US AUG UNROUNDED PCE PRICE INDEX +0.285%; CORE +0.562%

- MNI CHICAGO: SEP BUSINESS BAROMETER 45.7 vs. 52.2 AUG

- MNI CHICAGO: SEP PRICES PAID EDGES 74.1 VS 81.8 AUG

- MNI CHICAGO: SEP EMPLOYMENT 40.2 VS 54.6 AUG

- MNI CHICAGO: SEP PRODUCTION 44.5 VS 54.9 AUG

- MNI CHICAGO SURVEY PERIOD SEP 1 TO 20

- MICHIGAN FINAL SEPT. CONSUMER SENTIMENT AT 58.6; EST. 59.5

- MICHIGAN SEPT. 1-YR EXPECTED INFLATION AT 4.7% FROM 4.8%

- MICHIGAN SEPT. 5-YR EXPECTED INFLATION AT 2.7% FROM 2.9%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 272.7 points (-0.93%) at 28959.61

- S&P E-Mini Future down 24.5 points (-0.67%) at 3630.25

- Nasdaq down 46.5 points (-0.4%) at 10692.49

- US 10-Yr yield is up 1.3 bps at 3.7984%

- US Dec 10Y are down 10.5/32 at 112-4

- EURUSD down 0.0012 (-0.12%) at 0.9805

- USDJPY up 0.33 (0.23%) at 144.78

- WTI Crude Oil (front-month) down $1.6 (-1.97%) at $79.59

- Gold is up $2.02 (0.12%) at $1662.55

- EuroStoxx 50 up 39.16 points (1.19%) at 3318.2

- FTSE 100 up 12.22 points (0.18%) at 6893.81

- German DAX up 138.81 points (1.16%) at 12114.36

- French CAC 40 up 85.47 points (1.51%) at 5762.34

US TSY FUTURES CLOSE

- 3M10Y +3.946, 50.289 (L: 32.971 / H: 51.151)

- 2Y10Y +0.495, -40.808 (L: -49.174 / H: -39.634)

- 2Y30Y +2.875, -44.602 (L: -53.878 / H: -41.285)

- 5Y30Y +1.946, -27.557 (L: -32.907 / H: -23.777)

- Current futures levels:

- Dec 2Y down 2/32 at 102-22.625 (L: 102-21.25 / H: 102-26.875)

- Dec 5Y down 8/32 at 107-16.75 (L: 107-15.25 / H: 108-00.5)

- Dec 10Y down 11/32 at 112-3.5 (L: 112-01 / H: 112-28.5)

- Dec 30Y down 21/32 at 126-13 (L: 126-11 / H: 128-01)

- Dec Ultra 30Y down 1-18/32 at 137-02 (L: 136-29 / H: 140-04)

US 10YR FUTURE TECHS: (Z2) Corrective Bounce Still In Play

- RES 4: 115-06+ High Sep 14

- RES 3: 114-17 High Sep 20

- RES 2: 114-04 20-day EMA

- RES 1: 112-30+/114-00 High Sep 23 / 22

- PRICE: 112-26 @ 11:40 BST Sep 30

- SUP 1: 110-19 Low Sep 28

- SUP 2: 110-00 Psychological Support

- SUP 3: 109 20 3.0% 10-dma envelope

- SUP 4: 109-23+ Low Nov 30 20074 (cont)

Treasuries remain vulnerable and short-term gains are considered corrective. Recent weakness has reinforced current bearish trend conditions. A price sequence of lower lows and lower highs and bearish moving average studies clearly highlight the market's sentiment. The focus is on 109-20, a lower moving average band value. Initial resistance is 112-30+, the Sep 23 high.

US EURODOLLAR FUTURES CLOSE

- Dec 22 steady at 95.315

- Mar 23 +0.005 at 95.305

- Jun 23 +0.005 at 95.345

- Sep 23 -0.020 at 95.425

- Red Pack (Dec 23-Sep 24) -0.065 to -0.03

- Green Pack (Dec 24-Sep 25) -0.08 to -0.075

- Blue Pack (Dec 25-Sep 26) -0.085 to -0.085

- Gold Pack (Dec 26-Sep 27) -0.085 to -0.07

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00414 to 3.06514% (-0.00429/wk)

- 1M +0.01485 to 3.14271% (+0.05242/wk)

- 3M +0.01185 to 3.75471% (+0.12628/wk) * / **

- 6M +0.02271 to 4.23200% (+0.03071/wk)

- 12M -0.00672 to 4.78057% (-0.05429/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.75471% on 9/30/22

- Daily Effective Fed Funds Rate: 3.08% volume: $103B

- Daily Overnight Bank Funding Rate: 3.07% volume: $260B

- Secured Overnight Financing Rate (SOFR): 2.96%, $906B

- Broad General Collateral Rate (BGCR): 2.97%, $350B

- Tri-Party General Collateral Rate (TGCR): 2.97%, $332B

- (rate, volume levels reflect prior session)

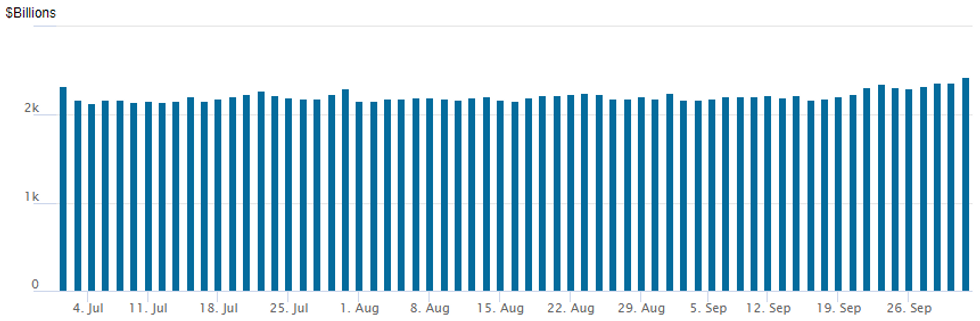

FED Reverse Repo Operation, Third Consecutive New High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of $2,425.910B w/ 108 counterparties vs. $2,371.763B record in the prior session. Surpasses last week's record high of $2,359.227B marked Thursday, September 22.

EGBs-GILTS CASH CLOSE: Solid End To Volatile Week/Month/Quarter

European yields fell to end the week/month/quarter, with German instruments outperforming UK counterparts, but 2Y and 30Y Gilts seeing the sharpest yield drops.

- Yields rose sharply in the late afternoon, with little discernable trigger (quarter and month-end possibly a factor), and in fact defied US data flow (including a very weak MNI Chicago PMI).

- French inflation surprised to the downside, but Italy's was in line and Eurozone was higher than expected.

- While the Gilt market has calmed considerably since mid-week, there was some modest disappointment that the OBR wouldn't publish a full forecast of the new budget earlier than 23 Nov.

- BoE Nov hike pricing ended the week close to 140bp, vs well above 160bp mid-week.

- BoI's Visco warned of big rate hikes risking a recession; no reaction in front-end rate pricing though.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 4.3bps at 1.761%, 5-Yr is down 6.9bps at 1.963%, 10-Yr is down 7.3bps at 2.108%, and 30-Yr is down 6.5bps at 2.09%.

- UK: The 2-Yr yield is down 16.5bps at 4.231%, 5-Yr is down 4bps at 4.394%, 10-Yr is down 5bps at 4.093%, and 30-Yr is down 14bps at 3.825%.

- Italian BTP spread down 6.3bps at 240.9bps / Spanish down 1.1bps at 118bps

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/10/2022 | 2350/0850 | *** |  | JP | Tankan |

| 03/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 03/10/2022 | 0630/0830 | *** |  | CH | CPI |

| 03/10/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/10/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/10/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/10/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 03/10/2022 | 1305/0905 |  | US | Atlanta Fed's Raphael Bostic | |

| 03/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/10/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/10/2022 | 1400/1000 | * |  | US | Construction Spending |

| 03/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/10/2022 | 1800/1900 |  | UK | BOE Mann Panellist at CD Howe Institute |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.