-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Ylds Up Strong Sep Jobs, Soft Landing Possible

EXECUTIVE SUMMARY

US

FED: Rising U.S. interest rates have reduced demand for workers without pushing up layoffs, boding well for the soft landing sought by Federal Reserve officials, San Francisco Fed economist Nicolas Petrosky-Nadeau told MNI Friday.

- The labor market remains tight with employers hiring at a substantially higher pace than before the pandemic and the unemployment rate at a 50-year low. But job openings and quits rates in key sectors have already fallen substantially from their peaks, meaning Fed tightening is doing its job to cool the economy, he told MNI's FedSpeak podcast. The Labor Department reported this week there were 10.1 million job openings in the U.S. at the end of August, a drop of 1.1 million from a month earlier.

- The quits rate, a good predictor of real wage growth because it represents people moving to better opportunities with more pay, has also been slowing in the past six months. Quits rates in the professional and business services and leisure and hospitality sectors are back to where they were pre-pandemic, he noted. For more see MNI Policy main wire Friday at 1637ET.

FED: The Federal Reserve is unlikely to “pivot” on interest-rate increases because of recent financial turbulence like the crisis in the UK gilt market, and doing so would threaten its credibility amid high inflation, New York Fed advisor Sebnem Kalemli-Ozcan told MNI.

- “I wouldn’t expect any intervention from the Federal Reserve on these things, unless there’s a total financial market collapse like there was in 2008,” said Kalemli-Ozcan, a professor at the University of Maryland and a member of the New York Fed’s Economic Advisory Panel. “Without that, I think they are not going to do anything – they’re going to stay in their inflation fighting mood, and hiking rates, because that’s their job.”

- Stubborn inflation could force the Fed to hike beyond the 4.6% projection from the September Summary of Economic Projections, she said, with the federal funds rate potentially peaking at 5% or higher. For more see MNI Policy main wire at 1034ET.

- Average hourly earnings grew 0.3% last month meeting expectations. It's up 5.0% on the year. Federal Reserve officials are looking for wage gains to slow as they raise interest rates. Revisions added 11,000 jobs to August and July, and the number of unemployed fell 261,000. Notable job gains occurred in leisure and hospitality (+83k) and in health care (+60k). The labor force participation rate was 62.3%, down from 62.4% in August, and the employment to population ratio held steady at 60.1%.

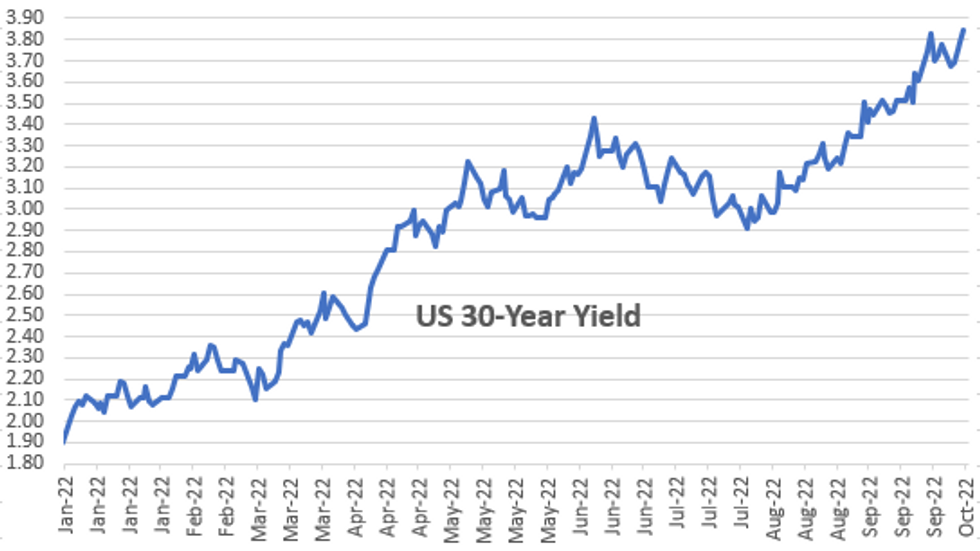

- Bond yields rose across the curve in the wake of the data, with the 10-year T-Note last at 3.895%, higher by 7.5 bps on the day, as markets continue to reverse the midweek Fed 'pivot' hopes.

EUROPE

ECB: Bundesbank President Joachim Nagel tells Seddeutsche that ECB rates must rise significantly, with the ECB needing to send clear signals at the next meeting. ECB-dated OIS shows a 70bp hike priced for the Oct 27 decision with a cumulative 132bps to 1.98% by year-end.

- Nagel sees inflation threatening growth more than rates hikes, with the German growth outlook looking weak: the German economy probably shrank slightly in Q3, worsened in Q4 and with economic contraction probably also at start of 2023 and could also slightly contract in 2023 as a whole but it probably.

US TSYS: Focus Turns to Next Wk's CPI, Sep FOMC Minutes

Tsy futures remain weaker after the bell, off lows after September employment data came out slightly better than expected w/ jobs gain of +263k vs. +255k est, August up-revision by +11k.

- Yield curves bear steepened (2s10s climbed to -40.616) as focus turned to drop in participation rate and unemployment as traders anticipate more rate hikes into 2023. Stocks not taking the data positively either, SPX eminis falling to late session low of 3643.75.

- Tsys held the lower range as desks turn focus on next week Thursday's CPI (0.2% MoM est, 8.1% YoY est) for next inflation metric. Sep FOMC minutes release on Wednesday at 1400ET.

- Earlier Fed speak underscored the hawkish tempo, NY Fed Williams said need to raise rate to around 4.5% "over time" citing strong jobs market. Williams added he does expect to see inflation "down significantly next year."

OVERNIGHT DATA

- US SEP NONFARM PAYROLLS +263K; PRIVATE +288K, GOVT -25K

- US PRIOR MONTHS PAYROLLS REVISED: AUG +315K; JUL +537K

- NET REVISIONS FOR AUGUST, JULY PAYROLLS +11K

- US AUG CONSUMER CREDIT +$32.2B

- US AUG REVOLVING CREDIT +$17.2B

- US AUG NONREVOLVING CREDIT +$15.1B

- CANADA SEPT JOBS +21.1K VS FORECAST +22.5K, AUG -39.7K

- CANADA SEPT JOBLESS RATE 5.2% VS FORECAST 5.4%, AUG 5.4%

- CANADA HOURLY WAGES +5.2% YOY; PERMANENT WORKERS +5.2%

- CANADA SEPT JOB GAIN LED BY TEACHERS AFTER AUG DECLINE

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 662.72 points (-2.21%) at 29265.52

- S&P E-Mini Future down 105.25 points (-2.8%) at 3651.25

- Nasdaq down 402.4 points (-3.6%) at 10671.23

- US 10-Yr yield is up 6.6 bps at 3.8895%

- US Dec 10Y are down 16.5/32 at 111-13.5

- EURUSD down 0.0054 (-0.55%) at 0.9737

- USDJPY up 0.21 (0.14%) at 145.35

- WTI Crude Oil (front-month) up $4.65 (5.26%) at $93.06

- Gold is down $17.38 (-1.01%) at $1695.17

- EuroStoxx 50 down 57.99 points (-1.69%) at 3375.46

- FTSE 100 down 6.18 points (-0.09%) at 6991.09

- German DAX down 197.78 points (-1.59%) at 12273

- French CAC 40 down 69.48 points (-1.17%) at 5866.94

US TSY FUTURES CLOSE

- 3M10Y +7.495, 51.198 (L: 39.342 / H: 52.313)

- 2Y10Y +1.597, -42.455 (L: -47.715 / H: -40.616)

- 2Y30Y +0.985, -47.044 (L: -53.43 / H: -43.934)

- 5Y30Y -1.359, -30.039 (L: -35.112 / H: -26.31)

- Current futures levels:

- Dec 2Y down 4/32 at 102-16 (L: 102-14 / H: 102-20)

- Dec 5Y down 12/32 at 107-0.5 (L: 106-27 / H: 107-12)

- Dec 10Y down 16.5/32 at 111-13.5 (L: 111-06 / H: 111-31)

- Dec 30Y down 28/32 at 125-13 (L: 125-02 / H: 126-13)

- Dec Ultra 30Y down 1-14/32 at 134-31 (L: 134-13 / H: 136-25)

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.10 at 95.185

- Mar 23 -0.115 at 95.110

- Jun 23 -0.110 at 95.135

- Sep 23 -0.110 at 95.220

- Red Pack (Dec 23-Sep 24) -0.11 to -0.095

- Green Pack (Dec 24-Sep 25) -0.09 to -0.075

- Blue Pack (Dec 25-Sep 26) -0.07 to -0.07

- Gold Pack (Dec 26-Sep 27) -0.07 to -0.055

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00758 to 3.06629% (+0.00115/wk)

- 1M +0.01328 to 3.31357% (+0.17086/wk)

- 3M +0.08300 to 3.90871% (+0.15400/wk) * / **

- 6M +0.07714 to 4.38471% (+0.15271/wk)

- 12M +0.11158 to 4.99629% (+0.21572/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.90871% on 10/07/22

- Daily Effective Fed Funds Rate: 3.08% volume: $109B

- Daily Overnight Bank Funding Rate: 3.07% volume: $282B

- Secured Overnight Financing Rate (SOFR): 3.05%, $985B

- Broad General Collateral Rate (BGCR): 3.00%, $399B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $375B

- (rate, volume levels reflect prior session)

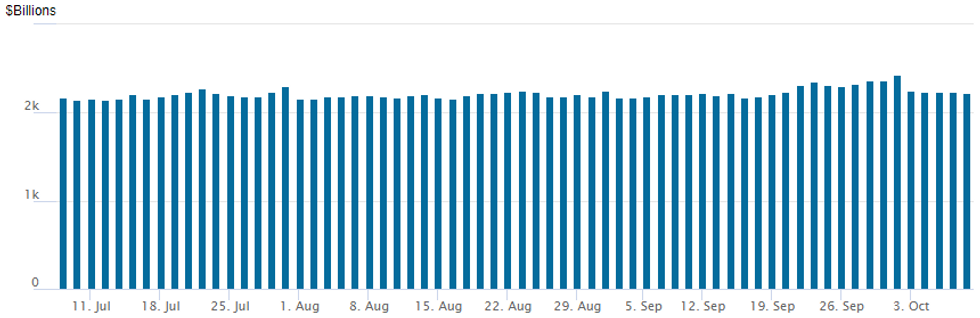

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,226.950B w/ 101 counterparties vs. $2,232.801B in the prior session. Recent record high stands at $2,425.910B on Friday, September 30.

FOREX: USD Edges Higher For Third Consecutive Session Following NFP

- Despite the sharp moves seen in equity indices and oil prices, currencies traded in a less volatile manner on Friday after the greenback was given a firm boost following the release of September jobs data for the US.

- The USD Index (+0.28%) looks set to post a positive week after rising for a third successive session amid surging US yields on the back of the employment report.

- With risk sentiment under significant pressure, GBP (-0.62%) and NZD (0.80%) were the weakest performers, however, losses/ranges were more contained compared to prior sessions this week.

- EURUSD has faded further off the bear channel top throughout Friday trade, erasing the entirety of the mid-week rally and briefly trading below the Sep 30 low of 0.9735.

- A significant 4% extension of the rally in crude futures underpinned CAD and NOK outperformance as general bullish sentiment after the OPEC+ cut this week was reinforced.

- Worth noting that Japanese markets will be closed on Monday owing to observance of the Health Sports Day national holiday. Additionally, US Columbus Day and Canada Thanksgiving Holiday may see a relatively quiet start to next week.

- Wednesday will see the release of the FOMC minutes before Thursday’s important release of US CPI for September.

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/10/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/10/2022 | 0830/1030 | * |  | EU | Sentix Economic Index |

| 10/10/2022 | 1200/0800 |  | US | Chicago Fed's Charles Evans | |

| 10/10/2022 | - |  | EU | ECB Lagarde at IMF/World Bank Annual Meetings | |

| 10/10/2022 | 1300/1500 |  | EU | ECB Lane Opens ECB Monetary Policy Conference | |

| 10/10/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 10/10/2022 | 1735/1335 |  | US | Fed Vice Chair Lael Brainard | |

| 11/10/2022 | 2145/1045 | ** |  | NZ | Electronic card transactions m/m |

| 11/10/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 11/10/2022 | 2330/1030 |  | AU | Westpac-MI Consumer Sentiment | |

| 11/10/2022 | 0030/1130 |  | AU | NAB Business Survey | |

| 11/10/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 11/10/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 11/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 11/10/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/10/2022 | - |  | EU | ECB Panetta IMF/World Bank Annual Meetings | |

| 11/10/2022 | 1245/1445 |  | EU | ECB Lane Keynote Speech | |

| 11/10/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/10/2022 | 1530/1130 |  | US | Philadelphia Fed's Patrick Harker | |

| 11/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/10/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 11/10/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/10/2022 | 1800/1900 |  | UK | BOE Cunliffe Panels IIF Annual Meeting | |

| 11/10/2022 | 1800/2000 |  | EU | ECB Lane NY Fed Fireside Chat | |

| 11/10/2022 | 1835/1935 |  | UK | BOE Bailey in Conversation w. Tim Adams at IIF Meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.