-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: Ambiguous Fed Speak, Strong Data

- MNI FED: Fed's Harker Sees Inflation Heading Steadily To 2%

- MNI: Fed’s Bostic - Soft Inflation Could Bring Cuts Before Q3

- MNI INTERVIEW: Oil Oversupplied Amid Sagging Demand-Dallas Fed

- MNI SOURCES: "Biggest Minority" Favours ECB June Cut

- MNI Chicago Business Barometer December Adjusted Higher

- MNI Trump Maintains Lead Over Haley In New Hampshire

- MNI Initial Jobless Claims See Second Lowest Print On Record

US

Philadelphia Fed President Patrick Harker said Thursday he expects inflation to fall steadily toward 2% and labor market tightness to continue to ease, suggesting heightened chances of a soft landing.

- "Now, as the curtain rises on 2024, inflation is roughly half of what it was at this time last year, and my expectation remains that inflation will continue to ebb as we head — slowly yet surely — toward our 2% annual target," he said in a blog. "Along with this, labor market tightness continues to ease, GDP growth continues to exceed expectations, and the possibility of a recession seems less likely."

Fed’s Bostic - Soft Inflation Could Bring Cuts Before Q3

Atlanta Federal Reserve President Raphael Bostic Thursday repeated he expects policymakers to begin cutting interest rates in the third quarter, but added if there is a further accumulation of soft inflation data then cuts could begin sooner.

- "Because I’m data dependent, I have incorporated the unexpected progress on inflation and economic activity into my outlook, and thus moved up my projected time to begin normalizing the federal funds rate to the third quarter of this year from the fourth quarter," said Bostic in prepared remarks. "The rub is that if we keep policy too restrictive for too long, we risk doing unnecessary damage to the labor market and the macroeconomy."

NEWS

INTERVIEW (MNI): Oil Oversupplied Amid Sagging Demand-Dallas Fed

Oil prices are likely to move down over the year as the market increasingly looks oversupplied in the face of stuttering demand growth and high U.S. output, Dallas Fed senior business economist Garrett Golding told MNI.

US (MNI): House Expected To Vote On Government Funding Continuing Resolution Today

Hill reporters have confirmed that, due to inclement weather forecast for Washington DC tomorrow, the House of Representatives will vote on the Continuing Resolution to extend government funding into March today.

US (MNI) Trump Maintains Lead Over Haley In New Hampshire

A new survey from Suffolk University/NBC10 Boston/Boston Globe has found that former President Donald Trump is holding onto his sizeable lead over Nikki Haley in New Hampshire… but Haley continues to close the gap.” NBC Boston writes: “Trump holding steady at 50%, while Haley jumped two percentage points to 36%.”

SOURCES (MNI): "Biggest Minority" Favours ECB June Cut

An early consensus within the European Central Bank is forming for a first interest rate cut of the cycle to take place in June, Eurosystem officials told MNI, but they added that signs of a significant further easing in the inflation outlook could still prompt the Governing Council to move in April.

INTERVIEW (MNI): German Pay Rises To Add To Inflation- Wise Man

Previous German pay rises are likely to continue to put upward pressure on prices this year even as new nominal wage demands become more closely aligned with falling levels of inflation, a leading German labour market specialist and government “Wise Man” adviser told MNI.

US/ISRAEL(MNI): Netanyahu Informs US That He Opposes Postwar Palestinian State

Amichai Stein at Kann reporting on X that, "Israeli Prime Minister Netanyahu says he has informed the US that he opposes the establishment of a Palestinian state as part of any postwar scenario." White House National Security Council Spokesperson John Kirby, speaking aboard Air Force One, says in response: "Nothings changed about President Biden's desire that a two-state is in the best interests o... the region as a whole."

US TSYS Data Continues to Temper Rate Cut Expectations

- Treasury futures mostly weaker, near midday lows after the bell, curves bear steepening with the short end holding steady (TUH4 102-21.88). Off Wednesday's four month highs, the 2s10s is still +4.236 after the bell at -21.865.

- Large curve Block underscored the move: +24,980 TUH4 102-22.25, buy through 102-21.88 post time offer, DV01 $954,600 vs. -15,135 TYH4, 111-06.5, post time bid, DV01 $985,600.

- Treasury futures reversed early gains/gapped lower after lower than expected Initial Jobless Claims (187k vs 205k est), Continuing Claims (1.806M vs. 1.843M est) -- not to mention higher than expected Building Permits (1.495M vs 1.476M est) and Housing Starts (1.460M vs 1.425M est, prior down-revised to 1.525M from 1.560M).

- Chicago Business BarometerTM, produced with MNI, was revised up to 47.2 in December from 46.9, as result of the annual seasonal adjustment recalculation.

- Mar'24 10Y futures hit 111-04.5 low (-9) on the day, briefly through initial technical support of 111-06+ (Low Jan 05) before rebounding to 111-07. 10Y yield firmly above 4% to 4.1516% high on the day.

- Fed speak: Philly Fed Harker said he expects inflation to fall steadily toward 2% and labor market tightness to continue to ease, suggesting heightened chances of a soft landing. Atlanta Federal Reserve President Raphael Bostic Thursday repeated he expects policymakers to begin cutting interest rates in the third quarter, but added if there is a further accumulation of soft inflation data then cuts could begin sooner.

- Projected rate cuts held steady to mixed: January 2024 cumulative -0.6bp at 5.323%, March 2024 chance of rate cut -52.4% vs. -58.2% early Thursday w/ cumulative of -13.7bp at 5.192%, May near steady at -88.4% w/ cumulative -35.8bp at 4.970%. June still pricing in the first 25bp cut with cumulative -61.9bp at 4.710%. Fed terminal at 5.32% in Feb'24.

OVERNIGHT DATA

- The single week print is below the 2019 low of 197k for a pre-pandemic comparison, and there was only one lower in 2022 with a 182k.

- The four-week average dropped 5k to 203k for fresh lows since Feb’23.

- Continuing claims meanwhile also surprised lower, falling to a seasonally adjusted 1806k (cons 1840k) after a marginally downward revised 1832k (initial 1834k).

- Recall that last week’s non-seasonally adjusted figure received attention as it spiked to 2105k at year-end. This week’s 2122k is notably above the 2023 equivalent but more in keeping/lower than prior years – see chart.

US DEC HOUSING STARTS 1.460M; PERMITS 1.495M

US NOV STARTS REVISED TO 1.525M; PERMITS 1.467M

US DEC HOUSING COMPLETIONS 1.574M; NOV 1.448M (REV)

US JAN PHILADELPHIA FED MFG INDEX -10.6

MNI US DATA: Chicago Business BarometerTM, produced with MNI, was revised up to 47.2 in December from 46.9, as result of the annual seasonal adjustment recalculation. Growth in the first half of the year was slightly softer than previously estimated while the second half of the year – Q3 in particular – was stronger than previously estimated.

- April saw the largest downward revision, with the Barometer revised lower -1.8 points to 46.8 from its initial estimate of 48.6, while October recorded the biggest upward revision of +1.0 point to 45.0.

- Although the Barometer remained below 50 most of the year, Q3 showed a softer pace of contraction that extended to Q4, with the Barometer revised up to 45.8 in Q3 (+0.6 points) and to 49.3 in Q4 (+0.4 points).

- Order backlogs saw the largest upwards revision (+2.5 points) followed by Employment that was revised higher by +1.1 points in December to 46.2.

- New Orders were little changed, while Production also saw a small revision to 58.6 (-0.2 points).

- Supplier Deliveries was revised lower by -0.8 points.

- Prices remained high but expanded at a lower rate by the end of the year, with the Prices Paid Indicator revised lower by -2.0 points to 68.0.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 131.06 points (0.35%) at 37400.6

- S&P E-Mini Future up 31.25 points (0.66%) at 4802

- Nasdaq up 182.8 points (1.2%) at 15038.96

- US 10-Yr yield is up 3.4 bps at 4.1363%

- US Mar 10-Yr futures are down 6/32 at 111-7.5

- EURUSD down 0.0019 (-0.17%) at 1.0864

- USDJPY up 0.02 (0.01%) at 148.18

- WTI Crude Oil (front-month) up $1.44 (1.98%) at $74.01

- Gold is up $13.81 (0.69%) at $2019.93

- European bourses closing levels:

- EuroStoxx 50 up 49.97 points (1.13%) at 4453.05

- FTSE 100 up 12.8 points (0.17%) at 7459.09

- German DAX up 135.66 points (0.83%) at 16567.35

- French CAC 40 up 82.66 points (1.13%) at 7401.35

US TREASURY FUTURES CLOSE

- 3M10Y +4.301, -124.091 (L: -141.336 / H: -122.816)

- 2Y10Y +4.275, -21.826 (L: -26.373 / H: -19.655)

- 2Y30Y +6.296, 1.171 (L: -4.513 / H: 3.643)

- 5Y30Y +4.032, 32.304 (L: 28.456 / H: 33.838)

- Current futures levels:

- Mar 2-Yr futures up 0.125/32 at 102-22 (L: 102-20.125 / H: 102-24.5)

- Mar 5-Yr futures down 2.5/32 at 107-26.25 (L: 107-24.5 / H: 108-02.25)

- Mar 10-Yr futures down 6/32 at 111-7.5 (L: 111-04.5 / H: 111-21)

- Mar 30-Yr futures down 25/32 at 120-0 (L: 119-22 / H: 121-03)

- Mar Ultra futures down 1-06/32 at 125-25 (L: 125-12 / H: 127-14)

US 10Y FUTURE TECHS: (H4) Watching Support

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 112-26+ High Jan 12

- PRICE: 111-18 @ 11:12 GMT Jan 18

- SUP 1: 111-06+ Low Jan 05

- SUP 2: 111-02+ 50-day EMA

- SUP 3: 110-16 Low Dec 13

- SUP 4: 109-31+ Low Dec 11 and a key short-term support

Treasuries traded lower again yesterday. Initial resistance has been defined at 112-26+, the Jan 12 high. The trend outlook remains bullish and a breach of 112-26+ would reinforce this condition and signal scope for a test of the key resistance and bull trigger at 113-12, the Dec 27 high. Clearance of this level would resume the uptrend and open 114-00. On the downside, a breach of 111-06+ support, the Jan 5 low, would be bearish.

SOFR FUTURES CLOSE

- Mar 24 +0.005 at 94.895

- Jun 24 +0.015 at 95.345

- Sep 24 +0.015 at 95.755

- Dec 24 +0.010 at 96.10

- Red Pack (Mar 25-Dec 25) -0.02 to steadysteady0

- Green Pack (Mar 26-Dec 26) -0.04 to -0.025

- Blue Pack (Mar 27-Dec 27) -0.05 to -0.045

- Gold Pack (Mar 28-Dec 28) -0.05 to -0.05

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00188 to 5.33666 (-0.00132/wk)

- 3M +0.00824 to 5.31781 (+0.00128/wk)

- 6M +0.04752 to 5.16363 (+0.01016/wk)

- 12M +0.11378 to 4.80270 (+0.01292/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.764T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $671B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $661B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.01), volume: $262B

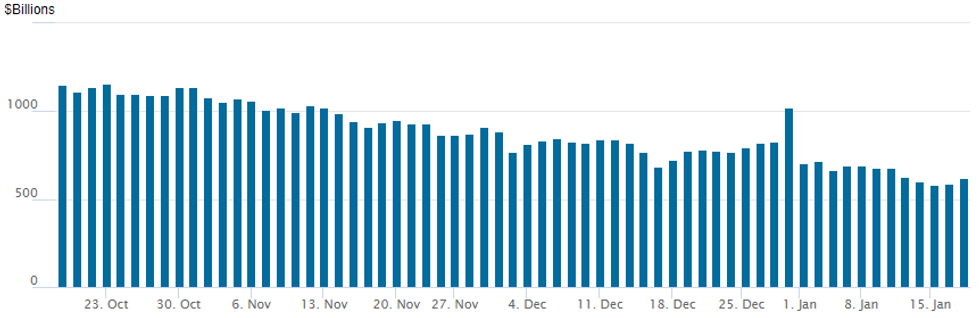

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $618.234B vs. $590.191B Wednesday. Compares to $583.103B on Tuesday - the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties climbs 81 vs. 65 Tuesday, the lowest since July 7, 2021.

PIPELINE $3.5B US Bancorp 2Pt Launched

- Date $MM Issuer (Priced *, Launch #

- 1/18 $5B #Bank of America 11NC10 +133

- 1/18 $3.5B #US Bancorp $1.5B 6NC5 +133, $2B 11NC10 +153

- 1/18 $2.5B #BNG Bank 5Y SOFR+49

- 1/18 $2.5B #European Bank for Reconstruction/Development 5Y SOFR+39

- 1/18 $2B *African Development Bank 3YSOFR+31

- 1/18 $1.35B #Central AM Bank for Economic Integration (CABEI) 3Y +115

- 1/18 $1.25B #Citizens Financial 6NC5 +180

- 1/18 $700M #Banque Saudi Fransi 5Y Sukuk +105

- 1/18 $500M #Principal Life Global Funding 5Y +110

- 1/18 $500M #Blackstone Private Credit 7Y +245

- 1/18 $Benchmark Prologis 10Y +92, 30Y +98

EGBs-GILTS CASH CLOSE: Gilts Partially Recover Prior Session Losses

Gilts easily outperformed Bunds Thursday, with the short end strengthening slightly in both the UK and Germany in a steepening move.

- Earlier in the session, supply from Spain, France and Austria had weighed on EGBs.

- With headlines and data comparatively light in Europe (the ECB December meeting accounts somewhat hawkishly noted the "substantial" loosening of financial conditions), US releases had the most impact, including a stronger-than-expected jobless claims figure that presented the latest challenge to the 2024 rate-cut narrative.

- The German curve twist steepened on the day, with the UK's bull steepening.

- Gilt strength is more attributable to a rebound from Wednesday's sharp sell-off after above-expected UK CPI data. However, Gilts could only partially retrace those losses today.

- Periphery EGB spreads finished modestly tighter amid a constructive session for risk assets, with BTPs and GGBs leading.

- Retail sales rounds off a busy week for UK data first thing Friday morning, with German PPI released alongside.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.2bps at 2.686%, 5-Yr is up 1.2bps at 2.254%, 10-Yr is up 3.3bps at 2.349%, and 30-Yr is up 4.9bps at 2.518%.

- UK: The 2-Yr yield is down 8.1bps at 4.297%, 5-Yr is down 7.6bps at 3.831%, 10-Yr is down 5.5bps at 3.93%, and 30-Yr is down 4.7bps at 4.593%.

- Italian BTP spread down 2.3bps at 157.8bps / Greek down 2.8bps at 106.3bps

FOREX G10 Currencies Hold Narrower Ranges, CHF Underperforms

- A more stable risk backdrop prompted a more contained session for currency markets on Thursday, which saw the USD index consolidate towards the week's highs, keeping hold of the 1% gains from last Friday's close. Very moderate adjustments in US yields have likely stalled the greenback’s momentum, amid a light data docket and the impending Fed speaker blackout period.

- The Swiss Franc is underperforming as USDCHF continues to grind higher across 2024, extending a winning streak to six consecutive session. This follows the sharp depreciation late last year which prompted EURCHF to trade at the lowest level since January 2015. EURCHF has extended back above the 0.9400 mark, a previous break level that had stoked downside momentum in late December.

- The slightly firmer equity markets sees AUD marginally outperform, although Australian jobs data may be restraining the recovery. December data showed a surprise decline in full time employment over the month, but the pullback to key support at 0.6526 in AUD/USD proved short-lived, with the pair recovering back to around 0.6560 where it remained for the majority of Thursday trade.

- Japan will report national core CPI data overnight before both UK and Canada retail sales figures for December are published. In the US, UMich consumer sentiment and inflation expectations may garner some interest, as well as existing home sales data.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2024 | 0700/0800 | ** |  | DE | PPI |

| 19/01/2024 | 0700/0700 | *** |  | UK | Retail Sales |

| 19/01/2024 | 1000/1100 |  | EU | GDP Q3 2023 revisions | |

| 19/01/2024 | 1000/1100 |  | EU | ECB's Lagarde participates in Stakeholder Dialogue at WEF | |

| 19/01/2024 | 1330/0830 | ** |  | CA | Retail Trade |

| 19/01/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 19/01/2024 | 1500/1000 | *** |  | US | NAR existing home sales |

| 19/01/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 19/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 19/01/2024 | 1800/1300 |  | US | Fed Vice Chair Michael Barr | |

| 19/01/2024 | 2100/1600 | ** |  | US | TICS |

| 19/01/2024 | 2115/1615 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.