-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Atl Fed Bostic More Balanced, Not Dovish

EXECUTIVE SUMMARY

US

FED: The Federal Reserve could need to raise interest rates more than is currently priced in if inflation data remain persistently high and job numbers stronger than expected, Atlanta Fed President Raphael Bostic said Thursday.

- “There is a case that could be made that we need to go higher,” Bostic told reporters during a press conference held via telephone. "Inflation is remaining stubborn at elevated levels, labor markets remain quite tight. The economy’s strength could be a bit more than people think, which means we might need to do more.” (See MNI INTERVIEW-Fed May Need To Hike Rates Above 6%)

- Bostic said the Fed’s aggressive rate tightening of nearly 500 basis points in the last year was just starting to be felt as a drag on the economy, which argues for moving in quarter point increments rather than more aggressive 50 basis point moves.

- “Right now I'm still very firmly in the quarter-point move pacing,” he said. “There’s a plausible case that we’re going to see a more robust slowdown. We’re at a stage where it’s appropriate to be cautious so we don’t do more than we need to but enough.” For more see MNI Policy main wire at 1339ET.

CANADA

BOC: The Bank of Canada is widely expected to leave interest rates unchanged at the highest level since 2007 Wednesday, reaffirming policymakers are done hiking unless inflation becomes stickier, with focus on how the statement frames risks around a hot job market and stalled economic growth.

- The overnight rate on loans between commercial banks will remain at 4.5% according to all 22 economists surveyed by MNI. Experts also see little reason to change the last statement's key phrase -- the Bank probably won't hike again following eight consecutive moves and officials want to see how the economy responds to the strongest tightening cycle in decades.

- While there's uncertainty around when inflation returns to the 2% target, recent data has solidified the view price gains have peaked and will continue fading. The Bank could reiterate its view CPI will slow to 3% in the middle of this year, either in the decision Wednesday or the "report card" speech and press conference Thursday with Senior Deputy Carolyn Rogers. (See: MNI INTERVIEW:BOC Sees Soft Landing In GDP Stall- Ex Govt Econ). For more see MNI Policy main wire at 1041ET

UK

BOE: The Bank of England should follow in the footsteps of independent Monetary Policy Committee member Catherine Mann and come clean about how it thinks its policy changes are impacting the economy, David Aikman, a former Technical Head of Division at the BOE and now director of the Qatar Centre for Global Banking and Finance at King’s College London.

- Aikman welcomed Mann's openness in her Feb 23 speech at the Resolution Foundation although he questioned the validity of her new Financial Conditions Index and questioned any assumption that the policy transmission mechanism has significantly shortened, both of which are building blocks for her case for further, swift policy tightening.

- The MPC has tightened by 390 basis points in over a year and Mann argued that the transmission from policy changes to financial markets has been quick, and likely swifter than the 18-24 months typically assumed for policy to feed through in full to the real economy. Mann has been pushing for faster tightening than the MPC majority, but, while her colleagues may not fully agree with her analysis, the Bank's own views on transmission channels are typically kept in-house. (See MNI BOE WATCH: BOE Hikes By 50, "Watchful" On Inflation). For more see MNI Policy main wire at 1045ET

US TSYS: Bear Curve Steepening, Short End Resists Broader FI Selling

Tsys trading near midday lows after the bell, yield curves bear steepening (2s10s +6.188 at -82.828) with short end resisting broader selling in intermediates to long end.

- Brief risk-on in rates (while stocks continued to rally late) in response to dovish tones (favors 25bp hike in March .. maybe pause late summer) on otherwise balanced comments from Atlanta Fed Bostic (unscheduled conf call w/ reporters: “There is a case that could be made that we need to go higher" while "inflation is remaining stubborn at elevated levels, labor markets remain quite tight.

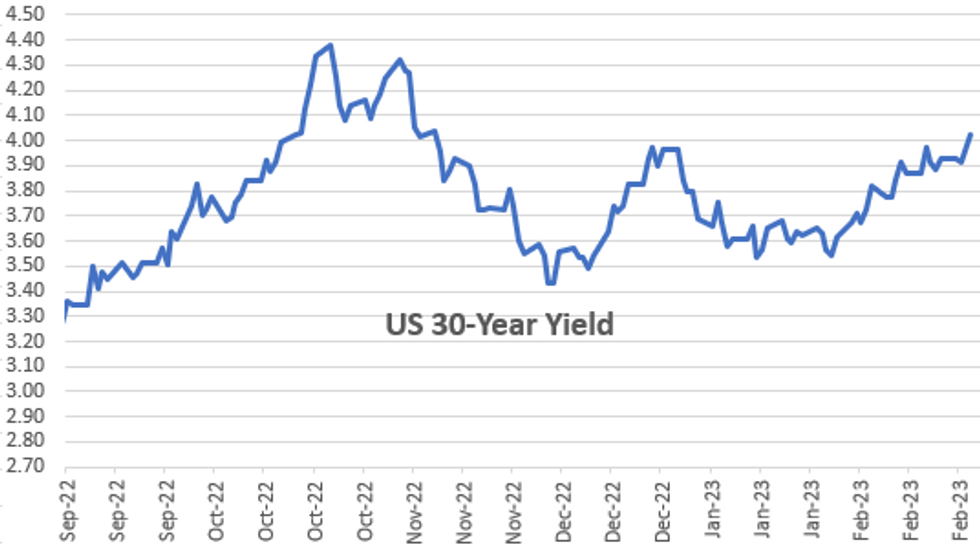

- Early technical buying after 2YY tapped 4.9414%, highest level since mid-2007, while intermediates to long end yields still below Nov'22 levels. 10YY tapped 4.0893% high, 30YY tapped 4.0446% - highest since Nov 10.

- Fed funds implied hike for Mar'23 at 30.5bp, May'23 cumulative 57.6bp to 5.154%, Jun'23 75.3bp to 5.331%, terminal slips to 5.430% in Oct'23 vs. 5.51% morning high.

- Fed speaker scheduled later: Fed Gov Waller eco-outlook, text, moderated virtual event at 1600ET

- MN Fed Kashkari on race, justice and economy w/ MN Supreme Court Justice Alan Page at 1830ET, Livestreamed

OVERNIGHT DATA

- US WEEKLY JOBLESS CLAIMS AT 190,000 LAST WEEK; EST. 195,000

- Unit Labor Costs (QoQ) for Q4 3.2% Vs 1.6% est.; 2.0% prior

- Nonfarm Productivity for Q4 3.2% vs 1.6% est

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 312.85 points (0.96%) at 32969.62

- S&P E-Mini Future up 23 points (0.58%) at 3978.75

- Nasdaq up 63.5 points (0.6%) at 11440.47

- US 10-Yr yield is up 8.1 bps at 4.0734%

- US Jun 10-Yr futures are down 16/32 at 110-16

- EURUSD down 0.0077 (-0.72%) at 1.0591

- USDJPY up 0.6 (0.44%) at 136.78

- WTI Crude Oil (front-month) up $0.35 (0.45%) at $78.04

- Gold is down $0.79 (-0.04%) at $1835.96

- EuroStoxx 50 up 24.84 points (0.59%) at 4240.59

- FTSE 100 up 29.11 points (0.37%) at 7944.04

- German DAX up 22.62 points (0.15%) at 15327.64

- French CAC 40 up 49.97 points (0.69%) at 7284.22

US TREASURY FUTURES CLOSE

- 3M10Y +8.158, -78.485 (L: -88.657 / H: -77.419)

- 2Y10Y +5.77, -83.246 (L: -90.819 / H: -83.037)

- 2Y30Y +4.347, -88.596 (L: -95.875 / H: -87.515)

- 5Y30Y -0.331, -30.678 (L: -33.469 / H: -28.362)

- Current futures levels:

- Jun 2-Yr futures down 1.25/32 at 101-19.875 (L: 101-17.5 / H: 101-22.375)

- Jun 5-Yr futures down 8.5/32 at 106-12 (L: 106-08.75 / H: 106-22.5)

- Jun 10-Yr futures down 16/32 at 110-16 (L: 110-12.5 / H: 111-02)

- Jun 30-Yr futures down 1-04/32 at 123-00 (L: 122-22 / H: 124-06)

- Jun Ultra futures down 1-16/32 at 132-29 (L: 132-11 / H: 134-19)

US 10YR FUTURE TECHS: (M3) Bear Cycle Extends

- RES 4: 113-16+ 50-day EMA

- RES 3: 113-03 High Feb 15

- RES 2: 112-22 20-day EMA

- RES 1: 111-23+/112-03 High Feb 28 / 24

- PRICE: 110-15+ @ 16:30 GMT Mar 2

- SUP 1: 110-13 Low Mar 02

- SUP 2: 110-06 3.00 proj of the Jan 19 - Jan 30 - Feb 2 price swing

- SUP 3: 110-03+ Lower 2.0% Bollinger Band

- SUP 4: 108-26+ Low Oct 21 (cont)

Treasury futures traded lower still Thursday, reinforcing and extending the current bear cycle. The move lower maintains the bearish price sequence of lower lows and lower highs and note that moving average studies are in a bear-mode position. This reflects market sentiment. The focus is on 110-06, a Fibonacci projection. On the upside, resistance is seen at 112-03, the Feb 24 high.

EURODOLLAR FUTURES CLOSE

- Mar 23 +0.008 at 94.920

- Jun 23 +0.030 at 94.450

- Sep 23 +0.015 at 94.290

- Dec 23 +0.015 at 94.425

- Red Pack (Mar 24-Dec 24) -0.09 to -0.005

- Green Pack (Mar 25-Dec 25) -0.09 to -0.085

- Blue Pack (Mar 26-Dec 26) -0.105 to -0.095

- Gold Pack (Mar 27-Dec 27) -0.115 to -0.105

SHORT TERM RATES

NY Federal Reserve/MNI

- O/N +0.00215 to 4.55929% (-0.00242/wk)

- 1M +0.02843 to 4.70143% (+0.06657/wk)

- 3M +0.00457 to 4.98571% (+0.03228/wk)*/**

- 6M +0.02272 to 5.31086% (+0.07572/wk)

- 12M +0.02786 to 5.71400% (+0.07529/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.96243% on 2/27/23

- Daily Effective Fed Funds Rate: 4.58% volume: $107B

- Daily Overnight Bank Funding Rate: 4.57% volume: $304B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.172T

- Broad General Collateral Rate (BGCR): 4.52%, $462B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $446B

- (rate, volume levels reflect prior session)

FED Reverse Repo Operation

NY Federal Reserve/MNI

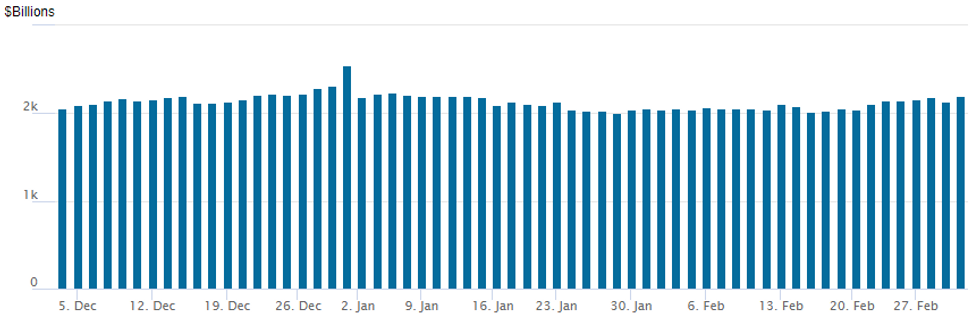

NY Fed reverse repo usage climbs to $2,192.355B w/ 99 counterparties vs. prior session's $2,133.950B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: Surprise $7B HSBC 3Pt Launched

HSBC 3pt issuance larger than anticipated- Date $MM Issuer (Priced *, Launch #)

- 03/02 $7B HSBC $2B 6NC5 +185, $2.25B 11NC10 +220, $2.75B 21NC20 +210

- 03/02 $2B #EBRD 5Y SOFR+31

- 03/02 $2B #LBank 3Y SOFR+26

- 03/02 $2B *FHLB 2Y Global +15

- 03/02 $500M #Norinchukin Bank 5Y +110

- 03/02 $Benchmark Verisk 10Y +200a

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/03/2023 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 03/03/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/03/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/03/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 03/03/2023 | 0700/0800 | * |  | NO | Norway Unemployment Rate |

| 03/03/2023 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/03/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/03/2023 | 0815/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 03/03/2023 | 0830/0930 |  | EU | ECB de Guindos Q&A at CUNEF University | |

| 03/03/2023 | 0845/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 03/03/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/03/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/03/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/03/2023 | 0900/1000 | *** |  | IT | GDP (f) |

| 03/03/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/03/2023 | 1000/1100 | ** |  | EU | PPI |

| 03/03/2023 | 1330/0830 | * |  | CA | Building Permits |

| 03/03/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/03/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/03/2023 | 1600/1100 |  | US | Dallas Fed's Lorie Logan | |

| 03/03/2023 | 1700/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 03/03/2023 | 2000/1500 |  | US | Fed Governor Michelle Bowman | |

| 03/03/2023 | 2115/1615 |  | US | Richmond Fed Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.