-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Bond Sale Tails, 2s10s Off New 40Y Low

EXECUTIVE SUMMARY

US

FED: U.S unemployment could rise by less than the full percentage point the FOMC expects in the next year, boosting the chances of a soft landing even as rates head to possible levels over 5%, Federal Reserve Bank of Richmond senior adviser Thomas Lubik said in an interview.

- The "exceptionally good" January jobs report, with a stunning 517,000 employees added and the jobless rate sliding to a fresh 50-year low, is just one data point, he told MNI's FedSpeak podcast, "but the upward revisions of employment growth last year contributed to the impression that the labor market is exceptionally strong, and it would take a lot more, I think, to hurt it."

- "It's almost operating in its own universe. It seems almost unaffected by whatever else is going on in the economy, which is actually a very good thing." Moreover, wages growth is cooling, which should help moderate core services inflation over coming months. For more see MNI Policy main wire at 0839ET.

UK

BOE: Evidence to the Treasury Select Committee highlighted the fragmentation on the Bank of England Monetary Policy Committee over policy, with Silvana Tenreyro noting that the central forecast showed inflation falling from its latest double digit reading to well below target. "In my view rates are too high right now," she said, having opposed the 50 basis point hike to 4.0% at the February meeting.

- Governor Andrew Bailey said it was a fair question to ask why the MPC had hiked given its projection of below target inflation ahead but that for him the uncertainties were high and a key upside risk came from weak supply in the UK labour market. "We have had this other shock which is the tightening of the domestic labour market" and particularly the rise in inactivity," Bailey said, although he added that the Bank's agents had found firms reporting the first signs of easing in labour conditions.

- On the hawkish side MPC member Jonathan Haskel stated in his written evidence that he was prepared to act forcefully if need be if inflation pressures prove persistent, thereby restoring previous guidance which had been ditched by the committee.

US TSYS: Late Bond Sell-Off, 2s10s Off 40 Year Lows - For Now

Tsy 30YY hit session high of 3.7459% as selling in futures accelerated in late trade, no obvious headline print or recent block trade to trigger move - though bonds remained soft after $21B 30Y auction tailed 3.1bp (3.686% high yield vs. 3.655% WI) soured interest in long end. Potential factors driving sell-off:- Early selling ahead next week's corporate supply (Tsys see $15B 20Y Bond and $9B 30Y TIPS).

- Technical selling as TYH3 nears support of 112-29 76.4% retracement of the Dec 30 - Jan 19 bull run.

- Curve unwinds following second day of large late 10s/ultra-bond steepeners fading the broader move in curves to multi-decade lows (2s10s currently -82.234 vs. -87.193, a level not seen since 1981.

- Protracted periods of inverted yld curve signaling market expectations of coming recession in the near term. Tsy 2s10s curve spent much of the period between late 1978 through mid 1982 inverted territory, a precursor to recession that ended in late 1982. Yield curve inversion saw wide variance in 1980 after spd fell to -241.65 low in March 1980 and skyrocketed to 130.0 by early July before re-inverting again.

- Meanwhile, short end outperforms mid-late 2023 futures as markets price in continued rate hikes: Fed funds implied hike for Mar'23 at 26.1bp (+0.7), May'23 cumulative 45.4bp (+1.8) to 5.036%, Jun'23 55.2bp (+2.9) to 5.134%, terminal at 5.155% in Jul'23/Aug'23.

OVERNIGHT DATA

- US JOBLESS CLAIMS +13K TO 196K IN FEB 04 WK

- US PREV JOBLESS CLAIMS REVISED TO 183K IN JAN 28 WK

- US CONTINUING CLAIMS +0.038M to 1.688M IN JAN 28 WK

US DATA: Initial Claims Increase But Still Shrug Off Layoffs. Initial jobless claims rise slightly more than expected to 196k (cons 190k) in the week to Feb 4 from 183k.

- It's the first increase in six weeks after a strong run that still sees the 4-week average shift lower to 189k, the lowest since April. For perspective, the 2019 average was 218 and a single week low was 173k.

- The relatively minimal increase on the week is still firmly in contrast to recent surges in Challenger job layoffs.

- Continuing claims also modestly higher than expected at 1688k (cons 1660k), but that increase only pushes them back to 2019 averages in a sign of ongoing labor market tightness.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 249.88 points (-0.74%) at 33695.17

- S&P E-Mini Future down 36.5 points (-0.88%) at 4094

- Nasdaq down 111.3 points (-0.9%) at 11798.36

- US 10-Yr yield is up 6.5 bps at 3.675%

- US Mar 10-Yr futures are down 10/32 at 113-3

- EURUSD up 0.0026 (0.24%) at 1.0737

- USDJPY up 0.15 (0.11%) at 131.55

- WTI Crude Oil (front-month) down $0.81 (-1.03%) at $77.66

- Gold is down $13.52 (-0.72%) at $1861.85

- EuroStoxx 50 up 40.99 points (0.97%) at 4250.14

- FTSE 100 up 25.98 points (0.33%) at 7911.15

- German DAX up 111.37 points (0.72%) at 15523.42

- French CAC 40 up 68.53 points (0.96%) at 7188.36

US TSY FUTURES CLOSE

- 3M10Y +3.209, -108.21 (L: -115.157 / H: -106.362)

- 2Y10Y -1.281, -82.804 (L: -87.193 / H: -80.305)

- 2Y30Y -0.909, -76.306 (L: -83.453 / H: -73.684)

- 5Y30Y -1.374, -13.451 (L: -17.775 / H: -10.481)

- Current futures levels:

- Mar 2-Yr futures down 3.25/32 at 102-8 (L: 102-07.25 / H: 102-14)

- Mar 5-Yr futures down 8.75/32 at 108-3.5 (L: 108-01.5 / H: 108-19)

- Mar 10-Yr futures down 10/32 at 113-3 (L: 113-00 / H: 113-26)

- Mar 30-Yr futures down 14/32 at 127-29 (L: 127-25 / H: 129-13)

- Mar Ultra futures down 23/32 at 139-21 (L: 139-16 / H: 142-09)

US 10YR FUTURE TECHS: (H3) Bear Threat Remains Present

- RES 4: 115-22+ High Feb 3

- RES 3: 115-00 Round number resistance

- RES 2: 114-10+ 20-day EMA

- RES 1: 114-02 50-day EMA

- PRICE: 113-03 @ 1510ET Feb 9

- SUP 1: 113-00 Feb 9 Low

- SUP 2: 112-29 76.4% retracement of the Dec 30 - Jan 19 bull run

- SUP 3: 112-18+ Low Jan 5

- SUP 4: 112-13 Trendline support drawn from the Oct 21 low

Treasury futures are trading closer to their recent lows. Recent weakness highlights a bearish cycle and signals scope for an extension lower. The contract has breached 114-05+, the Jan 30 low and a short-term bear trigger. Note that price has also cleared the 50-day EMA. This opens 112-29 next - a Fibonacci retracement. Initial firm resistance to watch is seen at 114-10+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Mar 23 steady at 94.935

- Jun 23 -0.015 at 94.660

- Sep 23 -0.035 at 94.645

- Dec 23 -0.050 at 94.935

- Red Pack (Mar 24-Dec 24) -0.105 to -0.075

- Green Pack (Mar 25-Dec 25) -0.09 to -0.065

- Blue Pack (Mar 26-Dec 26) -0.055 to -0.04

- Gold Pack (Mar 27-Dec 27) -0.035 to -0.02

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00343 to 4.55857% (+0.00586/wk)

- 1M -0.00243 to 4.57257% (+0.00071/wk)

- 3M +0.01328 to 4.88257% (+0.03843/wk)*/**

- 6M -0.03843 to 5.11257% (+0.05514/wk)

- 12M -0.01258 to 5.45571% (+0.20457/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.88257% on 2/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $106B

- Daily Overnight Bank Funding Rate: 4.57% volume: $284B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.184T

- Broad General Collateral Rate (BGCR): 4.52%, $480B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $466B

- (rate, volume levels reflect prior session)

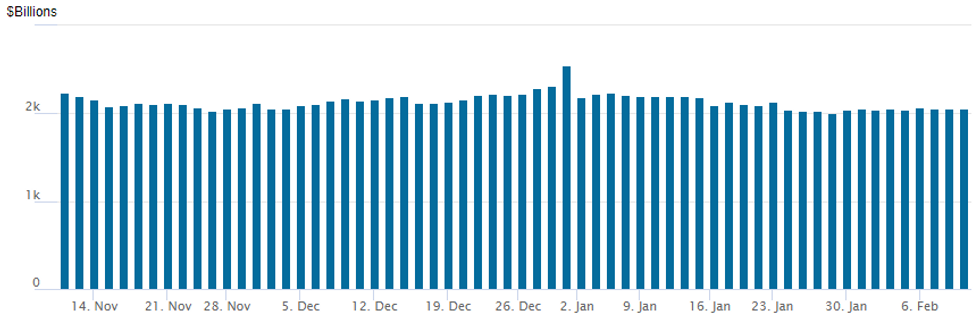

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,058.942B w/ 101 counterparties vs. prior session's $2,059.604B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $2.25B BP Capital 10Y Launched

- Date $MM Issuer (Priced *, Launch #)

- 02/09 $2.25B #BP Capital 10Y +112

- 02/09 $1.75B *AFD (French Development Agency) 3Y SOFR+44

- 02/09 $750M #Westpac NZ +105

EGBs-GILTS CASH CLOSE: UK Underperforms Amid Broader Flattening Move

Longer-duration instruments outperformed in Europe Thursday as part of a global flattening move, with periphery EGB spreads tightening.

- The UK short-end and belly weakened after an uncovered BoE APF sales operation. BoE Treasury committee testimony didn't really move rate expectations.

- The German curve bull flattened. The data highlight was German inflation which was on the soft side of consensus but consistent with an upward 0.2pp revision to Eurozone inflation in the final Jan reading.

- BTPs outperformed despite little change in implied ECB hike pricing, reflecting a broader risk-on move (Eurostoxx futures hit the highest levels since January 2022).

- Appearances by the ECB's de Cos and de Guindos come after the cash close; attention early Friday is on UK GDP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.5bps at 2.692%, 5-Yr is down 3.8bps at 2.33%, 10-Yr is down 6bps at 2.303%, and 30-Yr is down 6.2bps at 2.272%.

- UK: The 2-Yr yield is up 3.2bps at 3.5%, 5-Yr is up 3bps at 3.215%, 10-Yr is down 2.2bps at 3.291%, and 30-Yr is down 3.3bps at 3.736%.

- Italian BTP spread down 5.1bps at 181.6bps / Spanish down 0.8bps at 93.3bps

FOREX: USD Index Moderately Softer, Banxico Hawkish Surprise Boosts MXN

- Weakness across major equity benchmarks throughout Thursday’s US session has underpinned a greenback recovery, however, the USD index is has been unable to reverse the entirety of this morning’s move lower and sits 0.2% lower on the day.

- Outperformance in G10 is clearly being led by Scandinavian FX following the Riksbank rate decision, which not only saw a 50bps rate hike, but projected further tightening in the Spring and committed to unwinding their balance sheet from April onwards. EURSEK is down over 2% on the day, breaching multiple technical points, including the medium-term support at 11.1411, the 50-dma.

- Across the major currencies in G10, daily adjustments have been more moderate, however intra-day ranges in the case of the antipodeans and the JPY have been substantial.

- In the case of AUDUSD, the pair initially was clocking an advance of around 1.25% before the turn in global sentiment sent the pair steadily lower, narrowing the gap with the overnight lows at 0.6921.

- Price recently tested support at 0.6880, the 50-day EMA. A clear break and close below this average would signal scope for a deeper retracement.

- In emerging markets, an above consensus Banxico rate hike of 50bps and a hawkish accompanying statement saw the Mexican peso firm around 1%. USDMXN has consolidated around 18.75 ahead of the APAC crossover and will eye key support and the bear trigger at 18.5080, the Feb 02 low.

- Chinese CPI & PPI data is due overnight before UK growth data for December highlights the European docket. Canadian jobs data and US UMich sentiment data will be in focus to round off the week.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2023 | 0130/0930 | *** |  | CN | CPI |

| 10/02/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 10/02/2023 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 10/02/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 10/02/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 10/02/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 10/02/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 10/02/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 10/02/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/02/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 10/02/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/02/2023 | 1400/1400 |  | UK | BOE Pill Panellist at BIS SUERF Workshop | |

| 10/02/2023 | 1400/1500 |  | EU | ECB Schnabel Twitter Q&A | |

| 10/02/2023 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/02/2023 | 1730/1230 |  | US | Fed Governor Christopher Waller | |

| 10/02/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2023 | 2100/1600 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.