-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: EU Targets Retaliation Tariffs On US Red States

MNI BRIEF: EU Working On New Trade Retaliation Steps Vs US

MNI ASIA OPEN: Chair Powell Pushes Back On March Cut

- MNI FOMC: Fed Needs More Confidence In Inflation Drop Before Cuts

- MNI BRIEF: Fed's Powell Suggests March Cut Not Likely

- MNI INTERVIEW: Swift Inflation Decline To Prompt Early Fed Cut

- MNI Coupon Size Increases And Bill Trajectory As Expected

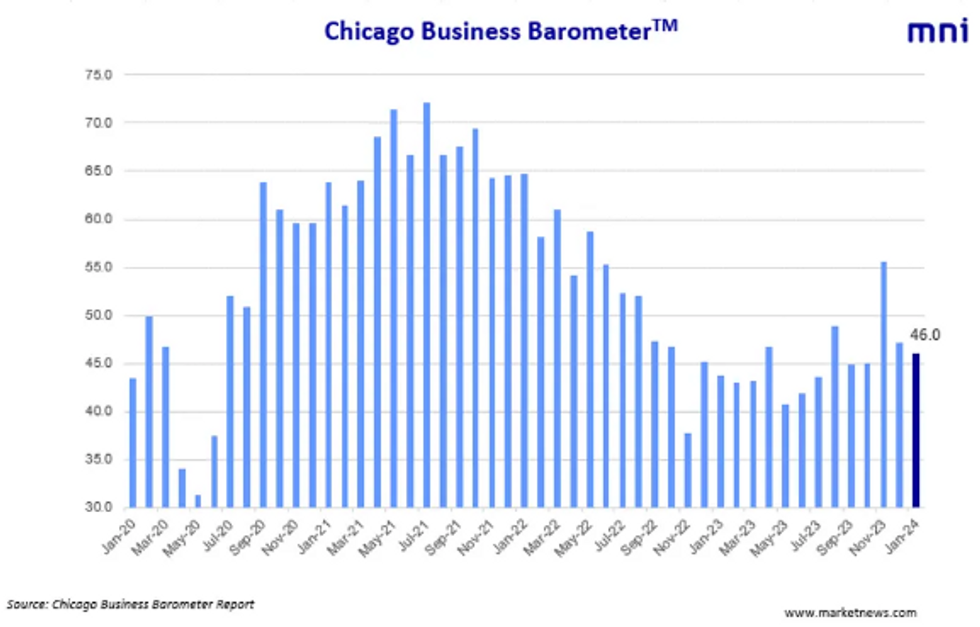

- MNI Chicago Business Barometer™ - Tempered to 46.0 in January

US

US FED (MNI): FOMC Statement Comparison: January vs December

US FED (MNI): Rough Transcript of Fed's Powell's Jan 31 Press Conference

FOMC (MNI): Fed Needs More Confidence In Inflation Drop Before Cuts

The Federal Reserve left interest rates on hold for a fourth meeting Wednesday and pushed back against market expectations for an imminent cut in interest rates, saying it does not expect to reduce borrowing costs until officials are more certain inflation is heading comfortably back to 2%.

"The committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%," the Fed said in its post-meeting statement.

That was a shift from previous guidance stating the FOMC was mulling "the extent of any additional policy firming that may be appropriate."

INTERVIEW (MNI): Swift Inflation Decline To Prompt Early Fed Cut

Fast-falling inflation raises the concern the U.S. is switching back to a pre-pandemic low-inflation regime, a downside risk that will prompt the Federal Reserve to begin lowering interest rates rapidly starting March, former New York Fed and IMF economist Dominique Dwor-Frecaut told MNI.

NEWS

FOMC BRIEF (MNI): Powell-Need Continuing Evidence Of Lower Inflation

Falling inflation rates over the latter part of last year are welcome but the Federal Reserve still needs to see additional progress before it can begin lowering interest rates, Fed Chair Jerome Powell said during his press conference Wednesday.

FED BRIEF (MNI): Fed's Powell Suggests March Cut Not Likely

Federal Reserve Chair Jerome Powell Wednesday downplayed the prospect of a March rate cut that many in financial markets have been expecting, saying it's unlikely there will be enough progress on inflation by then to justify such a move.

US (MNI): House Vote On Bipartisan Tax Package Expected Today

House Speaker Mike Johnson (R-LA) appears set to bring the roughly USD$80 billion bipartisan and bicameral tax deal up for a vote today after overcoming a rebellion from moderate ‘blue-state’ Republicans.

US TSYS Extending Highs After Fed Keeps Rates Steady, March Cut Unlikely

- Treasury futures are extending highs into the close (TYH4 112-18.5 +30.5, 10Y yield 3.9199% low) after paring post-FOMC gains following Chairman Powell said chances of a rate cut at the next FOMC on March 20 was unlikely.

- Chairman Powell was more balanced on net, however, while providing his own executive summary: Growth is solid to strong over the course of last year; 3.7% unemployment indicates that the labor market is strong. We have had just about two years now of unemployment under 4% -- that hasn't happened in 50 years, so it is a good labor market. And we have seen inflation come down. So, we have six months of good inflation data and expectation there is more to come. Let's be honest, this is a good economy. But what is the Outlook? We expect growth to moderate."

- Rates gained after this morning's lower than expected ADP Employment Change: 107k vs. 135k est (prior down-revised to 158k from 164k). Further supported after Tsy Quarterly Refunding announcement and Employment Cost Index at 0.9% vs. 1.0% est.

- Focus turns to Weekly Claims, Flash PMIs, ISMs tomorrow followed by headline employment data for January on Friday.

OVERNIGHT DATA

US TSYS (MNI): Coupon Size Increases And Bill Trajectory As Expected. Some initial takeaways from today's Quarterly Refunding Announcement (Treasury link here):

- Treasury's coupon upsizing for the upcoming quarter was exactly as MNI (and consensus) had anticipated, as was the unchanged guidance (does not anticipate needing to make any further increases...for at least the next several quarters).

US DATA (MNI) Chicago Business Barometer™ - Tempered to 46.0 in January

The Chicago Business Barometer™, produced with MNI tempered by -1.2 points to 46.0 from December’s revised figure of 47.2. This is the second consecutive monthly fall, keeping the Chicago ReportTM in contractionary territory, although still +0.6 points above the 2023 average and above the levels seen in both September 2023 and October 2023.

US DATA (MNI): ECI Cools More Than Expected In Q4 To Softest Pace Since 2Q21

- The 3.5% annualized pace for the overall Employment Cost Index is the softest since 2Q21. Details below.

- Tomorrow’s labor productivity data (estimated at 2.5% ar after a booming 5.2% in Q3) will help guide implications for inflationary pressures.

- Focusing on the private wages & salaries component, the moderation to 3.7% annualized tallies with the 3.7% seen in the AHE data for Q4, and is softer than the 4.2% in the non-supervisory data (at least at this stage prior to revisions). Details below.

- ECI for all workers: 0.87% Q/Q (cons 1.0) or 3.5% ar in Q4, from 1.07% Q/Q (4.3% ar) in Q3.

- ECI for private sector: 0.87% Q/Q or 3.5% ar in Q4 from 4.1% ar in Q3.

- Wages & salaries for all workers: 0.93% Q/Q or 3.8% ar in Q4, from 4.9% ar in Q3.

- Wages & salaries for private sector: 0.92% Q/Q or 3.7% ar in Q4, from 4.3% ar in Q3.

US DATA (MNI): MBA composite mortgage applications fell a seasonally adjusted -7.2% in the week to Jan 26, with another large split between purchases and refis.

- Purchase applications fell -11.4% on the week, the largest decline since Dec’22 but following a string of strong increases that still leaves them 10% higher than they ended 2023.

- Refi applications meanwhile increased 1.6% on the week after falling -7%. An even stronger profile prior to that sees them 24% higher than end-2023.

- Mortgages rates were unchanged: the 30Y conforming rate held at 6.78%, still 16bps lower than the jumbo with the -16bp spread within recent ranges.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 293.08 points (-0.76%) at 38176.56

- S&P E-Mini Future down 76 points (-1.54%) at 4875.75

- Nasdaq down 322.4 points (-2.1%) at 15190.23

- US 10-Yr yield is down 5.9 bps at 3.9728%

- US Mar 10-Yr futures are up 19.5/32 at 112-7.5

- EURUSD down 0.0041 (-0.38%) at 1.0804

- USDJPY down 0.33 (-0.22%) at 147.28

- WTI Crude Oil (front-month) down $2.02 (-2.6%) at $75.77

- Gold is down $1.95 (-0.1%) at $2035.31

- European bourses closing levels:

- EuroStoxx 50 down 14.3 points (-0.31%) at 4648.4

- FTSE 100 down 35.74 points (-0.47%) at 7630.57

- German DAX down 68.58 points (-0.4%) at 16903.76

- French CAC 40 down 20.72 points (-0.27%) at 7656.75

US TREASURY FUTURES CLOSE

- 3M10Y -6.939, -140.584 (L: -142.568 / H: -133.909)

- 2Y10Y +2.947, -27.52 (L: -31.57 / H: -24.56)

- 2Y30Y +5.826, -2.79 (L: -9.39 / H: 0.791)

- 5Y30Y +5.181, 33.173 (L: 27.908 / H: 35.322)

- Current futures levels:

- Mar 2-Yr futures up 6.125/32 at 102-24.875 (L: 102-19.875 / H: 102-29.5)

- Mar 5-Yr futures up 14/32 at 108-10.25 (L: 107-30.75 / H: 108-17)

- Mar 10-Yr futures up 18.5/32 at 112-6.5 (L: 111-23.5 / H: 112-15.5)

- Mar 30-Yr futures up 31/32 at 122-7 (L: 121-13 / H: 122-24)

- Mar Ultra futures up 35/32 at 128-31 (L: 128-02 / H: 129-25)

US 10Y FUTURE TECHS: (H4) Corrective Cycle Remains In Play

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 112-15+/112-26+ Intraday high / High Jan 12

- PRICE: 112-05 @ 1545 Jan 31

- SUP 1: 110-26 Low Jan 19

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11 and a key short-term support

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

A bearish trend condition in Treasuries remains intact for now. Recent gains appear to be a correction, however, the recovery does suggest scope for an extension near-term. Initial resistance is at 112-02, today’s intraday high. A break of this level would expose the firm resistance at 112-26+, the Jan 12 high. Clearance of this level would be a bullish development. For bears, key support and the bear trigger lies at 110-26, the Jan 19 low.

SOFR FUTURES CLOSE

- Mar 24 +0.015 at 94.870

- Jun 24 +0.090 at 95.345

- Sep 24 +0.125 at 95.775

- Dec 24 +0.135 at 96.135

- Red Pack (Mar 25-Dec 25) +0.140 to +0.150

- Green Pack (Mar 26-Dec 26) +0.105 to +0.130

- Blue Pack (Mar 27-Dec 27) +0.090 to +0.10

- Gold Pack (Mar 28-Dec 28) +0.080 to +0.085

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00161 to 5.32995 (-0.00652/wk)

- 3M +0.00890 to 5.31533 (-0.00210/wk)

- 6M +0.01888 to 5.16501 (+0.00761/wk)

- 12M +0.03663 to 4.82603 (+0.02705/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.642T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $675B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $655B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $92B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $265B

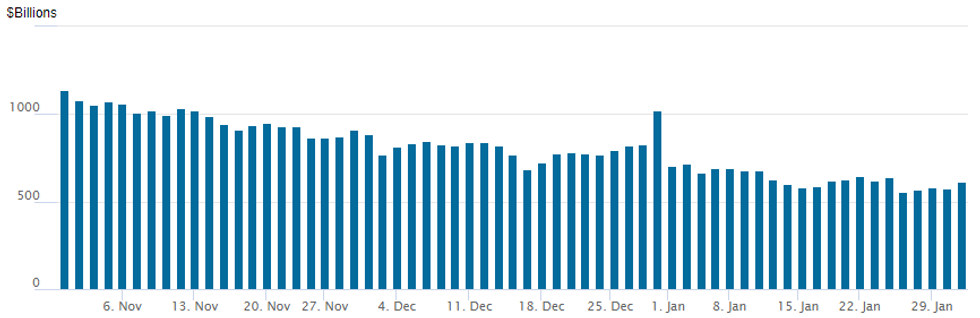

US FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

- RRP usage rebounds to $615.379B vs. $577.755B yesterday. Compares to cycle low of $557.687B on Thursday, January 25 -- the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties climbs to 82 from 78 Tuesday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE: Jan'24 Corporate & Supra Sovereign Issuance Highest Since Apr 2020

Issuers sidelined ahead the FOMC policy annc. This week's $26.25B total high grade corporate debt issuance pushed total January 2024 issuance (includes supra sovereigns) to $295.35B - the highest monthly total since April 2020 and compares to $231.425B on January 2023. Link to US$ Corporate Supply Pipeline

EGBs-GILTS CASH CLOSE: Strongest Core FI Rally Of 2024 Led By Belly

European core FI rallied strongly Wednesday in a session beset with heavy data flow and event risk.

- Early focus was on French inflation data which came in on the soft side of expectations, with German state level readings later in the morning pointing to a largely in-line national print.

- While the initial Bund gains faded by late morning, European safe havens enjoyed their best rally of 2024 so far as Treasuries soared.

- Multiple factors were involved: weakness in banking equities, an as-expected US Treasury quarterly auction size announcement removing some uncertainty, and soft US labour market indicators and January MNI Chicago PMI raising potential for near-term rate cuts.

- The rally in both the German and UK curves was led by the belly, with 5Y yields down 11bp.

- Periphery EGB spreads widened amid a broader risk-off move; GGBs underperformed.

- The Federal Reserve decision takes focus after the European cash close, with attention set to swiftly turn to Italian/Eurozone inflation data Thursday morning (consensus remains relatively unchanged since the start of the week), followed by the Bank of England.

- MNI's BoE preview is here: the vote split, guidance and forecasts will be in focus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 10bps at 2.428%, 5-Yr is down 11.3bps at 2.051%, 10-Yr is down 10.2bps at 2.166%, and 30-Yr is down 9.1bps at 2.405%.

- UK: The 2-Yr yield is down 8.1bps at 4.258%, 5-Yr is down 11.2bps at 3.745%, 10-Yr is down 10.7bps at 3.794%, and 30-Yr is down 7.4bps at 4.456%.

- Italian BTP spread up 3.3bps at 156.2bps / Greek up 3.9bps at 104.9bps

FOREX Greenback Rips Higher As Powell Plays Down March Cut Likelihood

- An initial hawkish reaction to the January FOMC statement was followed by the greenback resuming a downward trend on Wednesday as Powell began his January press conference. However, with the Fed Chair expecting the committee to not be in a position to cut in March, the US Dollar has spiked higher, prompting the DXY to quickly erase all prior declines and tilt into positive territory as the APAC crossover approaches.

- Given the sensitivity to front end US rates, USDJPY has predictably been among the most volatile G10 pairs. The original dip to session lows of 146.01 has been overshadowed by the impressive near 1% bounce since. Spot deals around 147.35, still a way off the much earlier overnight highs of 147.90.

- The USD index stands 0.3% higher on the session and with equities hard hit by the news, the likes of AUD (-0.67%) and NZD (-0.46%) are among the poorest performing currencies on Wednesday. The Euro and GBP losses are more reflective of the advance seen for the broad USD index as Powell’s late remarks have trumped the plethora of weak US data points that crossed in early US hours.

- Focus quickly turns to Eurozone inflation data on Thursday, which will be followed by the Bank of England decision. In the US, ISM manufacturing PMI headlines the docket before Friday’s release of non-farm payrolls.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2024 | 0030/1130 | * |  | AU | Building Approvals |

| 01/02/2024 | 0030/1130 | ** |  | AU | Trade price indexes |

| 01/02/2024 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/02/2024 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/02/2024 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 01/02/2024 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/02/2024 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/02/2024 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/02/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 01/02/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/02/2024 | 1130/1230 |  | EU | ECB's Lane remarks at EIEF | |

| 01/02/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 01/02/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 01/02/2024 | 1230/1230 |  | UK | BoE Press Conference | |

| 01/02/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 01/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/02/2024 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 01/02/2024 | 1400/1400 |  | UK | DMP Data | |

| 01/02/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2024 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 01/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 01/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/02/2024 | 1630/1130 |  | CA | BOC Governor Macklem testifies at House finance committee. |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.