-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Chicago PMI Rebound

EXECUTIVE SUMMARY

US

US: The Chicago Business BarometerTM, produced with MNI, increased by 7.7 points to 44.9 in December. This month’s recovery broke a three-month streak of falls, yet the index remained contractive for a fourth consecutive month.

- The majority of sub-indexes improved over the month, led by Order Backlogs and New Orders whilst upticks in Production and Supplier Deliveries were more muted. Inventories, Employment and Prices Paid all weakened and only Order Backlogs, Supplier Deliveries and Prices Paid were above 50.

- New Orders jumped by 13.4 points to 44.1, the highest since August. A number of last-minute and year-end blanket orders has provided a solid December boost.

- Production rose by 3.3 points to 39.2 in December, improving from November’s 29-month low. Material and staff shortages were cited as hampering production, which remained below the 50-breakeven mark since September.

- Order Backlogs saw the largest December increase, rising by 17.6 points to 53.7, giving back more than the November fall. Order Backlog levels are now again in line with the 12-month average of 54.4, due to the unanticipated boost in December orders coupled with continued shortages. For more see MNI Policy main wire at 0946ET.

EGBs

EGB Issuance: Germany and France are both due to hold auctions next week with estimated gross nominal issuance of E17.0bln at auction.

- There is also a high chance that we will see syndications with Italy, Ireland (probably 10-year) and Slovenia the most likely candidates, we pencil in E12.25bln for these deals.

- We also look for syndications from Belgium (10-year), the EFSF, Portugal and Spain (10-year) in the first half of January, potentially also as early as next week. For more see MNI Policy main wire at 0722ET.

US TSYS: Heading Into Year End: Adieu 2022

Tsy futures hold weaker across the board, near midmorning lows in the last hour of trade for 2022. Yield curves running steeper as long end looks to extend lows following better than expected Chicago PMI data: 44.9 vs. 40.0 est (37.2 prior) spurred better selling in long end earlier. 30YY tapped 3.9854% high, 2s10s curve climbed to -52.612 high compared to -42.072 on Wednesday.

- This month’s recovery broke a three-month streak of falls, yet the index remained contractive for a fourth consecutive month.

- The majority of sub-indexes improved over the month, led by Order Backlogs and New Orders whilst upticks in Production and Supplier Deliveries were more muted. Inventories, Employment and Prices Paid all weakened and only Order Backlogs, Supplier Deliveries and Prices Paid were above 50.

- Light holiday volumes (USH3<160k; TYH<600k) ahead the early close: FI/FX trading floor closes at 1300ET, cash Tsys close 1 hour later at 1400ET, while GLOBEX closes at 1700ET. Markets closed Monday. LINK

- Aside from month/year end portfolio rebalancing, focus on next week's data: FOMC meeting minutes for December to be release Wednesday at 1400ET.

OVERNIGHT DATA

- MNI DEC CHICAGO BUSINESS BAROMETER 44.9 VS 37.2 NOV

- MNI CHICAGO: DEC PRICES PAID 64.1 VS 66.2 NOV

- MNI CHICAGO: DEC EMPLOYMENT 40.8 VS 47.1 NOV

- MNI CHICAGO: DEC PRODUCTION 39.2 VS 35.9 NOV

- MNI CHICAGO SURVEY PERIOD DEC 1 TO 19

Chicago Business Barometer Finds Weak H1 2023 Growth Expectations

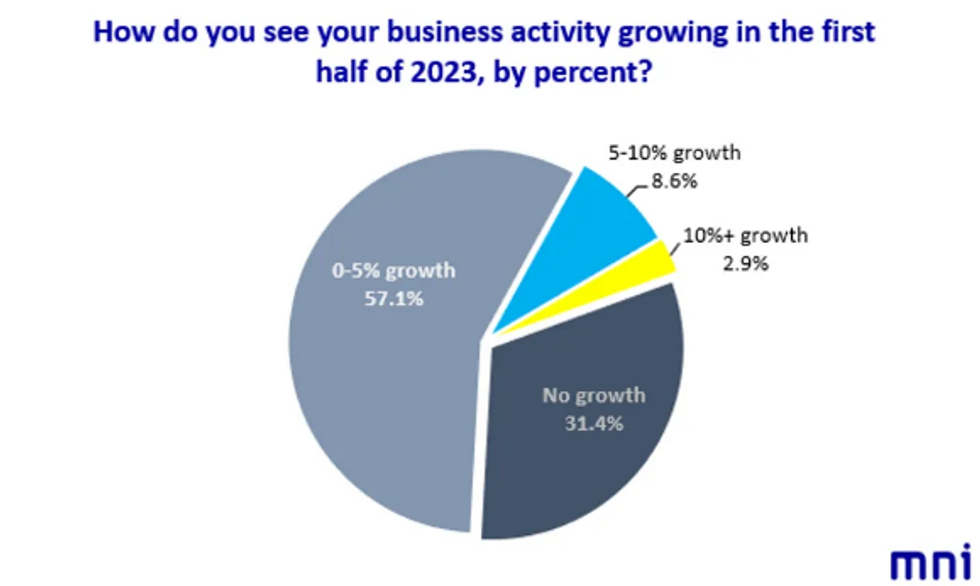

In December, the Chicago Business BarometerTM, produced with MNI, asked firms "How do you see your business activity growing in the first half of 2023, by percent?"

- Firms’ growth outlooks for 2023 varied.

- The majority (around 57%) expected 0-5% growth in business activity in H1 2023, whilst a substantially smaller approx. 9% are anticipating a 5-10% expansion. Just 3% expect stronger growth of 10%+.

- Close to one-third (31%) of respondents forecast no H1 2023 business-activity growth.

- This is in line with weaker national growth outlooks. The Federal Reserve's median GDP forecast for 2023 was downgraded to +0.5% growth in the December projections (from +1.2% in the previous September forecasts).

MARKETS SNAPSHOT

Key late session market levels:

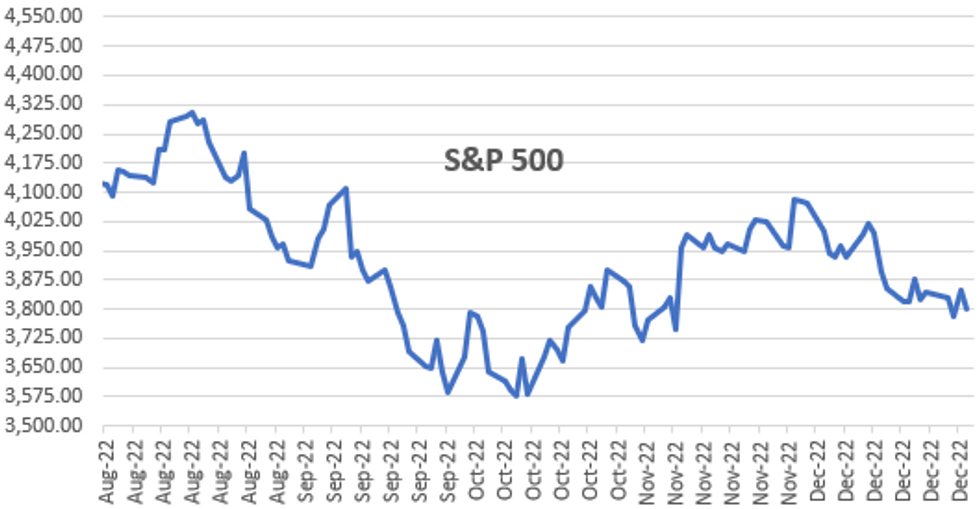

- DJIA down 327.25 points (-0.99%) at 32894.18

- S&P E-Mini Future down 44.5 points (-1.15%) at 3827.5

- Nasdaq down 130 points (-1.2%) at 10348.58

- US 10-Yr yield is up 4.9 bps at 3.8634%

- US Mar 10-Yr futures are down 7.5/32 at 112-6.5

- EURUSD up 0.004 (0.38%) at 1.0701

- USDJPY down 2.05 (-1.54%) at 130.98

- WTI Crude Oil (front-month) up $0.8 (1.02%) at $79.21

- Gold is up $6.29 (0.35%) at $1821.19

- EuroStoxx 50 down 56.45 points (-1.47%) at 3793.62

- FTSE 100 down 60.98 points (-0.81%) at 7451.74

- German DAX down 148.13 points (-1.05%) at 13923.59

- French CAC 40 down 99.71 points (-1.52%) at 6473.76

US TSY FUTURES CLOSE

- 3M10Y +4.393, -54.605 (L: -65.356 / H: -51.065)

- 2Y10Y -0.278, -55.806 (L: -57.968 / H: -52.612)

- 2Y30Y +0.865, -46.282 (L: -48.715 / H: -44.467)

- 5Y30Y +1.305, -3.138 (L: -7.258 / H: -2.483)

- Current futures levels:

- Mar 2-Yr futures down 2.75/32 at 102-17 (L: 102-14.875 / H: 102-19.875)

- Mar 5-Yr futures down 4.5/32 at 107-28 (L: 107-21 / H: 108-02)

- Mar 10-Yr futures down 7.5/32 at 112-6.5 (L: 111-28 / H: 112-16.5)

- Mar 30-Yr futures down 13/32 at 125-3 (L: 124-11 / H: 125-21)

- Mar Ultra futures down 26/32 at 134-0 (L: 133-05 / H: 135-04)

US 10YR FUTURE TECHS: (H3) Bear Threat Remains Present

- RES 4: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 3: 115-14 50% Aug - Oct Downleg

- RES 2: 114-23/115-11+ High Dec 19 / 13 and the bull trigger

- RES 1: 113-13 20-day EMA

- PRICE: 112-09 @ 1315ET Dec 30

- SUP 1: 112-04 Low Dec 28

- SUP 2: 111-27+ 61.8% retracement of the Nov 3 - Dec 13 rally

- SUP 3: 111-01 76.4% retracement of the Nov 3 - Dec 13 rally

- SUP 4: 110-22 Low Nov 10

Treasury futures remain soft and the contract traded lower this week, extending the pullback from 115-11+, the Dec 13 high and key resistance. The move lower has resulted in a print below support at 112-11+, the Nov 21 low. A clear break of this level would open 111-27+, a Fibonacci retracement. On the upside, the 20-day EMA, at 113-16, marks a firm resistance. A break is required to ease the current bearish pressure.

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.030 at 94.920

- Jun 23 -0.045 at 94.830

- Sep 23 -0.045 at 94.925

- Dec 23 -0.060 at 95.195

- Red Pack (Mar 24-Dec 24) -0.055 to steady

- Green Pack (Mar 25-Dec 25) +0.010 to +0.010

- Blue Pack (Mar 26-Dec 26) -0.005 to +0.040

- Gold Pack (Mar 27-Dec 27) -0.015 to -0.01

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00614 to 4.31800% (+0.00129/wk)

- 1M +0.02286 to 4.39157% (+0.00471/wk)

- 3M +0.01343 to 4.76729% (+0.04176/wk)*/**

- 6M +0.00129 to 5.13886% (-0.01428/wk)

- 12M +0.03957 to 5.48214% (+0.03828/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $94B

- Daily Overnight Bank Funding Rate: 4.32% volume: $249B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.037T

- Broad General Collateral Rate (BGCR): 4.26%, $380B

- Tri-Party General Collateral Rate (TGCR): 4.26%, $366B

- (rate, volume levels reflect prior session)

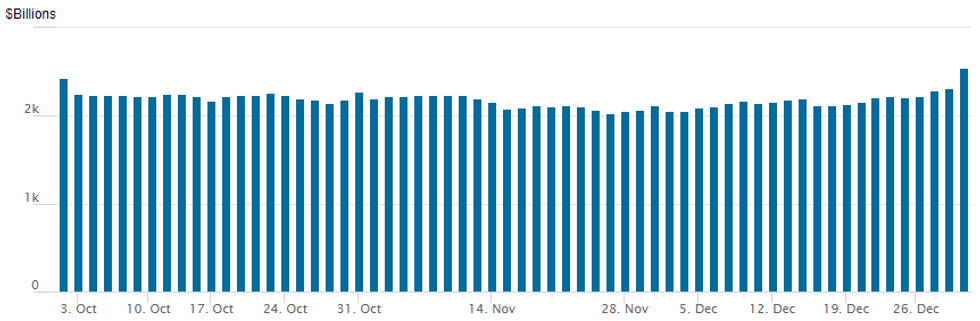

FED Reverse Repo Operation: New All-Time High

NY Federal Reserve/MNI

NY Fed reverse repo usage surges to new all-time high of $2,553.716B w/ 113 counterparties vs. $2,308.319B in the prior session. Prior record high was $2,425.910B on Friday, September 30.

Look Ahead

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/12/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/12/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 02/01/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/01/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.