-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Countervailing Fed Speak

- MNI US FED: Bowman Doesn’t See Rate Cuts Being Warranted This Year

- MNI FED BRIEF: Goolsbee Sees No `Last Mile' Inflation Problem

- MNI SOURCES: Fed, Geopolitics, Feed ECB Caution Over Cuts

- MNI US DATA: University of Michigan Consumer Sentiment Slides As Inflation Expectations Climb:

US

US FED (MNI): Bowman Doesn’t See Rate Cuts Being Warranted This Year: Gov. Bowman (voter) told Bloomberg News in an interview that she doesn’t see rate cuts being warranted this year.

- “I, at this point, have not written in any cuts” for 2024, Bowman said in the interview, referring to the economic projections officials submit each quarter. “I’ve sort of had an even expectation of staying where we are for longer. And that continues to be my base case.”

- She wants to see a “number of months” of better inflation data and expects it will probably be “a number of meetings” before she’s ready to cut.

FED BRIEF (MNI): Goolsbee Sees No `Last Mile' Inflation Problem: Chicago Federal Reserve President Austan Goolsbee on Friday rejected the idea inflation has a so-called 'last mile' problem and was hopeful recent setbacks reflect a "bump" on the way back to price stability.

- “There isn’t at this time much evidence in my view that inflation is stalling out at 3%,” Goolsbee said. Investors also don't see inflation taking back off again, he said.

- While the last three months of inflation data merit something of a shift to a more wait-and-see mode, the Fed's policy rate remains high in real terms, Goolsbee said. “You have to think about how long you want to be in that position” of restrictive policy because at some point it will influence the job side of the dual mandate, he said. Batting away questions about what specific action the Fed may take, he expressed optimism labor supply growth will have some cooling effect on the economy again this year.

SOURCES (MNI): Fed, Geopolitics, Feed ECB Caution Over Cuts: The diminishing prospects for Federal Reserve easing this year are adding to broader concerns about geopolitical risks to prices to feed European Central Bank caution about the path of monetary policy, with some Eurosystem officials telling MNI that the scope for rate cuts past June may already have been somewhat reduced.

- One official who recently anticipated 75-100 basis points in deposit rate cuts this year has shifted to a range of 50-75bp. All sources agreed with consensus expectations for the cycle’s clearly-signalled first rate reduction, by 25bp to 3.75%, at the ECB’s next meeting on June 6.

- “If the Fed does not cut, we have to cut less,” said the source, though he cautioned that uncertainty over U.S. rates was high. “The Fed not moving or moving later means that we can see more imported inflation based on our inflation differential.”

NEWS

UK (MNI): Breeden says she is more focused on service inflation than wage growth: Breeden says this morning's growth figures "were great in confirming the short and shallow recession is behind us". She says in the May MPR forecasts show inflation falling with "little new, particularly with respect to the shocks of the past". She says "no news is good news."

ISRAEL (MNI): US' Blinken To Report On Gaza Conduct As GOP Criticizes Withholding Arms: Overnight, Axios reported that US Secretary of State Antony Blinken could, as soon as today, submit a report to Congress on Israel's conduct in Gaza. While the report is set to prove critical of the IDF's operations and tactics, it is seen as unlikely to conclude that Israel has broken the terms of agreement for its use of US weapons in its offensive.

POLAND (MNI): PM Tusk Confirms New Ministers In Cabinet Reshuffle: Polish Prime Minister Donald Tusk has announced a cabinet reshuffle, with the most prominent shift coming in line with earlier expectations.

UKRAINE (MNI): Significant Escalation In Russian Attacks Along Kharkiv Frontier: Following a major artillery barrage in the Kharkiv region, reports are emerging that Russian forces have attempted to break through the Ukrainian frontlines in the northern border region.

US (RTRS): US CFTC seeks to ban derivatives bets on elections, calamities: The U.S. Commodity Futures Trading Commission (CFTC) on Friday was poised to propose a ban on listed derivatives used to bet on U.S. elections and other major real world events, its chair said.

US/CHINA (RTRS): Exclusive-Biden to put tariffs on China medical supplies: The Biden administration is expected to issue new tariffs on Chinese-made medical devices like syringes and personal protective equipment when it unveils its new trade strategy next week, according to two sources familiar with the decision.

US TSYS: Dour UofM Sentiment Tempers Post-Claims Rally, Rate Cut Pricing Cools

- Treasuries have traded sideways - near lows since midday by the bell, completely reversing Thursday's post-claims rally following this morning's after higher than expected UofM inflation exp.

- UofM consumer sentiment was much weaker than expected in the preliminary May report at 67.4 (cons 76.2) after an unrevised 77.2. The press release notes the 10pt decline is “statistically significant” and leaves sentiment at the lowest in about six months.

- Additionally, 1Y inflation expectations increased to 3.5% (cons 3.2) after 3.2%, its highest since November, while 5-10Y expectations increased a tenth to 3.1% (cons 3.0) after 3.0%, also its highest since November but still within the 2.9-3.1% typically seen since Aug 21.

- The projected rate cut pricing cooled vs. late Thursday: June 2024 at -5% w/ cumulative rate cut -1.2bp (-2.5bp late Thu) at 5.307%, July'24 at -22% w/ cumulative at -6.7bp (-9bp late Thu) at 5.253%, Sep'24 cumulative -19.2bp vs. -22.4bp, Nov'24 cumulative -27.7bp -31.1bp, Dec'24 -40.9bp vs. -45bp.

- After a slow start to next week, focus is on PPI and CPI on Tue/Wed.

OVERNIGHT DATA

US DATA (MNI): U.Mich Consumer Sentiment Slides As Inflation Expectations Climb: U.Mich consumer sentiment was much weaker than expected in the preliminary May report at 67.4 (cons 76.2) after an unrevised 77.2.

- The press release notes the 10pt decline is “statistically significant” and leaves sentiment at the lowest in about six months.

- “This month’s trend in sentiment is characterized by a broad consensus across consumers, with decreases across age, income, and education groups.”

- Consumers “expressed worries that inflation, unemployment and interest rates may all be moving in an unfavorable direction in the year ahead.”

- 1Y expectations increased to 3.5% (cons 3.2) after 3.2%, its highest since November.

- 5-10Y expectations increased a tenth to 3.1% (cons 3.0) after 3.0%, also its highest since November but still within the 2.9-3.1% typically seen since Aug 21.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 156.9 points (0.4%) at 39536.1

- S&P E-Mini Future up 11.25 points (0.21%) at 5249.25

- Nasdaq down 0.3 points (0%) at 16344.23

- US 10-Yr yield is up 4.7 bps at 4.5003%

- US Jun 10-Yr futures are down 12.5/32 at 108-22.5

- EURUSD down 0.0009 (-0.08%) at 1.0773

- USDJPY up 0.3 (0.19%) at 155.78

- WTI Crude Oil (front-month) down $0.88 (-1.11%) at $78.37

- Gold is up $17.65 (0.75%) at $2364.00

- European bourses closing levels:

- EuroStoxx 50 up 30.67 points (0.61%) at 5085.08

- FTSE 100 up 52.41 points (0.63%) at 8433.76

- German DAX up 86.25 points (0.46%) at 18772.85

- French CAC 40 up 31.49 points (0.38%) at 8219.14

US TREASURY FUTURES CLOSE

- 3M10Y +5.478, -90.58 (L: -101.229 / H: -89.862)

- 2Y10Y -0.296, -36.735 (L: -37.433 / H: -34.361)

- 2Y30Y -1.225, -22.226 (L: -22.424 / H: -19.631)

- 5Y30Y -0.775, 12.9 (L: 12.424 / H: 14.129)

- Current futures levels:

- Jun 2-Yr futures down 3.75/32 at 101-20.375 (L: 101-20.25 / H: 101-23.75)

- Jun 5-Yr futures down 7.75/32 at 105-19 (L: 105-18.25 / H: 105-26.75)

- Jun 10-Yr futures down 12/32 at 108-23 (L: 108-21.5 / H: 109-03.5)

- Jun 30-Yr futures down 22/32 at 116-2 (L: 115-30 / H: 116-29)

- Jun Ultra futures down 29/32 at 122-13 (L: 122-08 / H: 123-16)

US 10Y FUTURE TECHS: (M4) Channel Resistance Remains Exposed

- RES 4: 110-06 High Apr 4

- RES 3: 109-22+ 38.2% retracement of the Feb 1 - Apr 25 bear leg

- RES 2: 109-09+ High May 3

- RES 1: 109-06+/08+ Channel top from Feb 1 high / 50-day EMA

- PRICE: 108-24 @ 16:28 BST May 10

- SUP 1: 108-15+ 20-day EMA

- SUP 2: 107-04 Low Apr 25

- SUP 3: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 106-09 Base of a bear channel drawn from the Feb 1 low

Treasuries faded into the Friday close, however maintain a firmer tone overall and are holding on to the bulk of their recent gains. The contract has recently breached the 20-day EMA and has tested resistance at 109-08+, the 50-day EMA. Price is also approaching a channel top drawn from the Feb 1 high, at 109-06+ too. Clearance of these two resistance points would strengthen a bullish condition. Initial support lies at 108-15+, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 -0.010 at 94.70

- Sep 24 -0.030 at 94.880

- Dec 24 -0.055 at 95.095

- Mar 25 -0.065 at 95.330

- Red Pack (Jun 25-Mar 26) -0.085 to -0.08

- Green Pack (Jun 26-Mar 27) -0.075 to -0.055

- Blue Pack (Jun 27-Mar 28) -0.055 to -0.045

- Gold Pack (Jun 28-Mar 29) -0.05 to -0.045

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00098 to 5.31987 (-0.00354/wk)

- 3M -0.00155 to 5.32198 (-0.00557/wk)

- 6M -0.00548 to 5.28431 (-0.02262/wk)

- 12M -0.01066 to 5.13893 (+0.04939/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.871T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $717B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $706B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $79B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $271B

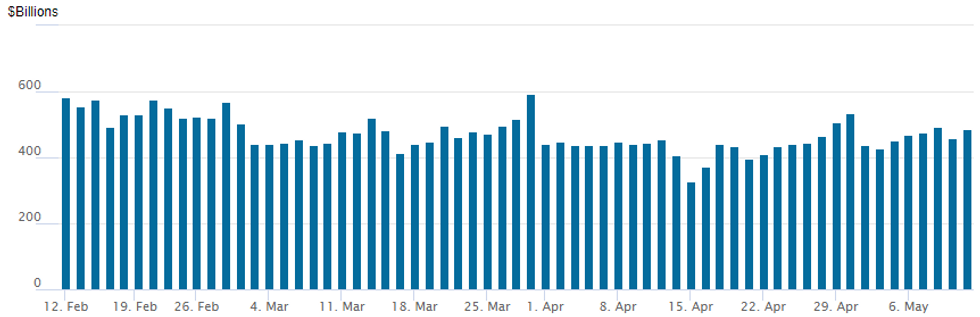

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbed to $486.434B vs. $458.550B Wednesday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021. Meanwhile, the latest number of counterparties slipped from 75 to 72.

PIPELINE

No new US$ corporate issuance Friday after May supply surged to $55.5 on the week

EGBs-GILTS CASH CLOSE: Gilts Outperform Bunds On The Week

Core European yields edged higher to close out the week.

- Gilts failed to be dented by a stronger-than-expected UK GDP report to kick off the session, with limited data and supply (Italy) keeping trade constructive if relatively subdued in the morning.

- Afternoon data from North America saw global core FI retreat for the rest of the European cash session, with strong Canadian jobs data and elevated US consumer inflation expectations casting doubt on dovish developments earlier in the week.

- The UK and German curves bear flattened on the day, with Gilts slightly underperforming Bunds.

- The late session weakness ensured that 10Y Bund yields closed the week higher (by 2bp). UK counterparts finished 7bp off their weekly lows but still fell over 5bp on the week, helped by a dovishly-perceived BoE decision on Thursday.

- Periphery EGB spreads were mixed, after coming off early session tights along with the broader FI sell-off.

- UK labour market data is the highlight of the docket early next week.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 2.9bps at 2.967%, 5-Yr is up 2.9bps at 2.55%, 10-Yr is up 2.2bps at 2.517%, and 30-Yr is up 2bps at 2.651%.

- UK: The 2-Yr yield is up 4bps at 4.319%, 5-Yr is up 3.6bps at 4.038%, 10-Yr is up 2.4bps at 4.166%, and 30-Yr is up 2.1bps at 4.645%.

- Italian BTP spread down 0.2bps at 134bps / Spanish up 0.2bps at 79.4bps

FOREX: Mixed UMich Messaging Underpins Mild USD Recovery

- Having started the session poorly, the greenback headed through the London close toward the top-end of the daily range on the back of the mixed messaging in the University of Michigan sentiment release. While headline sentiment missed expectations and pointed to a deteriorating consumer, inflation expectations firmed - the one-year inflation expectation metric rose to 3.5% from 3.2%, the highest since late 2023.

- While gas pump prices were the likely driver, a fresh run higher in US yields helped underpin USD buying - although the week's ranges were largely respected.

- Canadian jobs data came in notably firmer than forecast, with over 90k jobs added across the month vs. Exp. 20k. This kept a lid on the unemployment rate of 6.1%, which was expected to tick higher to 6.2%. As a result, USD/CAD heads through Friday close toward the weekly lows, with the 50-dma support undercutting at 1.3621.

- Despite a brief reprieve mid-week, JPY weakened further Friday, with markets finding little argument for tighter Japanese monetary policy from the much poorer-than-expected real cash earnings release for March. As such, the trade-weighted JPY remains uncomfortably close to pre-intervention levels, and raising the risk of a pushback from the Japanese authorities should US CPI top expectations next week.

- Focus for the upcoming week turns to US inflation data, with both CPI and PPI data for April due for release. Markets expect CPI to have slowed by 0.1ppts to 3.4%, and for core to slow to 3.6%.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/05/2024 | 0700/0900 |  | EU | ECB's Cipollone in Eurogroup meeting | |

| 13/05/2024 | 1230/0830 | * |  | CA | Building Permits |

| 13/05/2024 | 1300/0900 |  | US | Cleveland Fed's Loretta Mester | |

| 13/05/2024 | 1300/0900 |  | US | Fed Vice Chair Philip Jefferson | |

| 13/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.