-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Curves Extend Inversion; Debt Talks Stalled

- MNI INTERVIEW: Fed Must Hike Rates To 6%, Maybe 7%-Ex-Staffer

- May FOMC Minutes Preview: June Pause Potential In Focus

- MNI: MN Fed Kashkari Keeps To Data Dependence

- MNI US: White House Negotiators Depart Capitol After Two-Hour Debt Limit Talks

- MNI: Stronger US Service PMI Details Help Mitigate Debt Talk Back And Forth

- MNI: Richmond Fed Index Tilts Balance To Further Mfg Deterioration In May

- MNI: New Home Sales Beat With Downward Revision Taking Some Gloss Off

US

FED: Federal Reserve officials must hike interest rates to 6% and perhaps even to 7% to tame inflation even if they pause in June to assess the speed of recent tightening, ex-Philadelphia Fed economist Dean Cruoshore told MNI.

- Cruoshore disagreed with Jerome Powell’s description of monetary policy as “tight” in his May press conference, especially in light of inflation that has been subsiding but remains far above the 2% target. The Fed chair hinted at a pause on Friday when he said turmoil in U.S. regional banks likely meant interest rates wouldn't rise as much.

- “Policy is not really tight and we see that in the stubbornness of core inflation. I’m thinking they need to get the fed funds rate to at least 6% before they are done, and possibly as high as 7%,” said Cruoshore. He spent 14 years at the Philadelphia Fed and his research was cited in a recent speech by Fed Governor and Vice Chair nominee Philip Jefferson.

- “Core inflation is likely to remain high and that they will need to tighten more in subsequent meetings," Cruoshore said. Inflation has been coming down since a summer 2022 peak but core CPI remained stubbornly hot at 5.5% as of April. For more see MNI Policy main wire at 1457ET.

FED: The minutes to the May FOMC meeting arrive Wednesday at 1400ET/1900UK. As usual there is a staleness factor to the release, given that we've heard from Powell and most of the FOMC since the meeting and have up to date views on monetary policy from most of them (see our latest FedSpeak update).

- Our May meeting review is here.

- An initial area of focus will be on how widely the May 25bp hike was supported - apart from the fact that it passed by unanimous vote, Powell suggested in the press conference that there may have been some hesitation: "support for the 25 basis point rate increase was very strong across the board. I would say there are a number of people—and, you know, you’ll see this in the minutes. I don’t want to try to do the head count in real time....but people did talk about pausing, but not so much at this meeting".

- The latter raises the key question of how many participants expected- at that time - a rate pause at the June meeting. Powell: "a decision on a pause was not made today...we will be driven by incoming data meeting by meeting and we will approach that question at the June meeting."

- Along with discussion of the degree to which FOMC participants saw policy as now being "sufficiently restrictive" (the statement change, and Powell's comments, suggest much of the Committee sees themselves as already there), any indication of the degree to which banking sector stress is equivalent to rate hikes would be interesting.

- Additionally, any color on recession risks (Powell was asked about this in the press conference) and the scenario of inflation persisting even through a labor market downturn would be of note.

- The potential economic impact of the debt ceiling crisis could be discussed, though while Powell said it “came up” in the meeting, “I wouldn’t say it was a factor in today’s decision”.

FED: Minneapolis Fed’s Kashkari (’23 voter) offers CNN some data dependency soundbites:

Need to get more data about economy; If inflation stays high, may need to keep rates higher; Possible mild recession would bring inflation down - bbg

- It follows more comprehensive commentary yesterday and also Sunday for which the main takeaway was that recently one of the most hawkish FOMC members sees the June decision as a close call and that he’s open to skipping a hike then but clearly wouldn’t describe it as a pause whilst continuing to assess conditions.

- After two already sizeable increases in Fed rate expectations over the past two days, the continued data dependency (taking a leaf out of Daly’s book yesterday re the need for “extreme” data dependency) limits any further reaction. FOMC-dated OIS currently prices a 6.5bp hike for June with a terminal at 5.20% in July (+11.5bp).

US: Max Cohen at Punchbowl News tweets: "[White House] negotiators just left Capitol after roughly over two hours of debt limit talks. [White House Negotiator] Steve Ricchetti wouldn't share more than to just say they're continuing to work when I asked him how talks were going."

- Talks likely to continue this evening with considerable activity continuing on Capitol Hill. Today, House Freedom Caucus members signaled skepticism over Treasury Secretary Janet Yellen's June 1 x-date projection.

- House Financial Services Committee Chairman Patrick McHenry (R-NC), one of House Speaker Kevin McCarthy's negotiators, appeared to agree with HFC saying: "I want to trust the Treasury's math, but they're going to have to show their work. And if the White House team doesn't have a sense of urgency, if the President doesn't have a sense of urgency here, then that raises more questions - valid questions - about how they justify the date."

- Speaker McCarthy criticized President Biden for including drug price provisions in a deal: "That seems like a place to try and disrupt the whole negotiations. Like trying to throw taxes in, now trying to start talking about Medicare?"

US TSYS: Debt Ceiling Talks Remain Deadlocked; Curves Extend Inversion

Rates extended modest session highs in a late risk-off move as White House debt ceiling negotiators departed the capitol. Stocks extended session lows (SPX Eminis tap 4154.50) in turn as no resolution to avoid default somewhere on or after June 1 yet reached.

- Treasury Jun'23 10Y futures marked a session high of 113-22 (+7), while yield slipped to 3.6861% low, scaling back to 113-18 amid reports that negotiators will resume talks this evening.

- Short end continued to underperform, Jun'23 2Y futures -2 at 102-15.12; 2s10s curve -3.574 at -64.273 - amid higher market expectation of a near-term default.

- Separately, Fed Chairman Powell has left the New Democrat Coalition lunch recently, lack of notable headlines from the closed door meeting other than to note debt-ceiling was not part of the discussion.

- Despite the bounce, Treasury futures bear cycle extends. The break of 113-30+ last week, the Apr 19 low and a key support, has strengthened a bearish theme. Today’s move lower opens 112-30 next, a Fibonacci retracement.

- On the upside, initial resistance is seen at 113-30+ ahead of the 50-day EMA, at 114-25. A break of the average is required to signal a potential reversal.

OVERNIGHT DATA

- US MAY FLASH S&P MANUF PMI 48.5 (FCST 50.0); APR 50.2

- US MAY FLASH S&P SERVICES PMI 55.1 (FCST 52.5); APR 53.6

- US MAY FLASH S&P COMPOSITE PMI 54.5 (FCST 53.0); APR 53.4

US: Continued debt limit headlines still muddy the waters (latest McCarthy follows Graves in saying a deal is not close yet), but stronger service PMI details including “resilient strong increases in service sector charges” help support earlier increases in rate expectations.

- With the Fed so keenly watching non-housing services inflation and companies often stating that “greater wage bill drove inflation, as firms sought to pass-through higher cost burdens to clients”, June FOMC OIS pricing is only slightly off session highs at +8bps (Friday’s pre-debt talk impasse levels of +8-9bps).

- Subsequent meetings have seen larger moves off earlier highs but still hold decent increases on the day. Cumulative change from 5.08% effective: +8bp Jun (+2.5bp), +12.5bp Jul (+3bp), +3.5bp Sep (+3bp), -14bp Nov (+5bp), -34bp Dec (+4.5bp) and -59bp Jan (+7bp).

- US APR NEW HOME SALES +4.1% TO 0.683M SAAR

- US MAR NEW HOME SALES REVISED TO 0.656M SAAR

US: New home sales were stronger than expected in April at +4.1% (cons -2.1) but only after March’s surge was revised down to 4.0% (prior 9.6).

- In level terms it left a smaller overall beat, at 683k vs cons 665k. It sees new sales continue to push higher off apparent cycle lows than is the case for the much larger existing segment.

- The particularly volatile median price data registered their first Y/Y decline since Aug’20 with -8.2% Y/Y, despite the 7.6 months of supply registering its lowest since Mar’22.

- RICHMOND FED COMPOSITE MANUFACTURING INDEX -15 IN MAY VS -10 IN APRIL

US: The Richmond Fed mfg index was softer than expected in May at -15 (cons -8) after -10, which aside from the -16 of Feb is the lowest this cycle and outside of Apr/May’20 is the lowest since early 2009.

- The survey adds support to misses from last week’s Empire (-31.8 vs cons -3.9) and today’s mfg PMI (48.5 vs cons 50.0), with the Philly Fed beat (-10.4 vs cons -20.0) looking like the odd one out for now.

- Service indicators coming in stronger than expected and price pressures still elevated, as shown by today’s service PMI, keep the pressure on the Fed but recent manufacturing surveys are a timely reminder of the continued strains facing the sector.

- US MAY PHILADELPHIA FED NONMFG INDEX -16 vs -22.8 prior

- US REDBOOK: MAY STORE SALES +1.5% V YR AGO MO

- US REDBOOK: STORE SALES +1.5% WK ENDED MAY 20 V YR AGO WK

- CANADA APRIL INDUSTRIAL PRODUCT PRICE FALLS 0.2% M/M, est +0.1%

- CANADA APRIL RAW MATERIALS PRICE RISES 2.9% M/M; EST. +0.7%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 166.74 points (-0.5%) at 33123.07

- S&P E-Mini Future down 39 points (-0.93%) at 4166.25

- Nasdaq down 136.8 points (-1.1%) at 12584.89

- US 10-Yr yield is down 1 bps at 3.7053%

- US Jun 10-Yr futures are up 1.5/32 at 113-16.5

- EURUSD down 0.0042 (-0.39%) at 1.077

- USDJPY down 0.02 (-0.01%) at 138.59

- Gold is up $2.69 (0.14%) at $1974.48

- EuroStoxx 50 down 43.25 points (-0.99%) at 4342.38

- FTSE 100 down 8.04 points (-0.1%) at 7762.95

- German DAX down 71.13 points (-0.44%) at 16152.86

- French CAC 40 down 99.45 points (-1.33%) at 7378.71

US TREASURY FUTURES CLOSE

- 3M10Y -4.792, -159.888 (L: -174.868 / H: -156.757)

- 2Y10Y -4.001, -64.7 (L: -66.054 / H: -60.272)

- 2Y30Y -4.446, -40.007 (L: -42.34 / H: -34.961)

- 5Y30Y -1.586, 18.67 (L: 15.391 / H: 20.762)

- Current futures levels:

- Jun 2-Yr futures down 2.25/32 at 102-14.875 (L: 102-11.25 / H: 102-17.75)

- Jun 5-Yr futures steady at at 108-19.5 (L: 108-09.75 / H: 108-23.25)

- Jun 10-Yr futures up 2/32 at 113-17 (L: 113-04 / H: 113-22)

- Jun 30-Yr futures up 2/32 at 126-27 (L: 126-06 / H: 127-03)

- Jun Ultra futures up 7/32 at 134-14 (L: 133-13 / H: 134-23)

US 10YR FUTURE TECHS: (M3) Bearish Extension

- RES 4: 117-00 High May 4

- RES 3: 115-18+/116-16 High May 16 / 11

- RES 2: 114-05/114-25 High MAy 19 / 50-day EMA

- RES 1: 113-30+ Low Apr 19 and a recent breakout level

- PRICE: 113-05 @ 11:17 BST May 23

- SUP 1: 112-30 61.8% retracement of the Mar 2 - 24 rally

- SUP 2: 112-21 Low Mar 13

- SUP 3: 111-31 76.4% retracement of the Mar 2 - 24 rally

- SUP 4: 111-20+ Low Mar 10

Treasury futures remain soft and the contract is trading lower today as the bear cycle extends. The break of 113-30+ last week, the Apr 19 low and a key support, has strengthened a bearish theme. Today’s move lower opens 112-30 next, a Fibonacci retracement. On the upside, initial resistance is seen at 113-30+ ahead of the 50-day EMA, at 114-25. A break of the average is required to signal a potential reversal.

SOFR FUTURES CLOSE

- Jun 23 -0.025 at 94.778

- Sep 23 -0.035 at 94.950

- Dec 23 -0.045 at 95.30

- Mar 24 -0.040 at 95.770

- Red Pack (Jun 24-Mar 25) -0.035 to +0.015

- Green Pack (Jun 25-Mar 26) +0.005 to +0.015

- Blue Pack (Jun 26-Mar 27) +0.005 to +0.020

- Gold Pack (Jun 27-Mar 28) +0.030 to +0.040

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00205 to 5.09996 (+.00623/wk)

- 3M +0.01532 to 5.16617 (+.00270/wk)

- 6M +0.02418 to 5.16336 (+.01683/wk)

- 12M +0.02638 to 4.91373 (+.03607/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00400 to 5.06614%

- 1M +0.01114 to 5.13800%

- 3M +0.02115 to 5.39586% */**

- 6M +0.04943 to 5.50429%

- 12M +0.09114 to 5.52214%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.39586% on 5/23/23

- Daily Effective Fed Funds Rate: 5.08% volume: $124B

- Daily Overnight Bank Funding Rate: 5.06% volume: $290B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.434T

- Broad General Collateral Rate (BGCR): 5.02%, $580B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $572B

- (rate, volume levels reflect prior session)

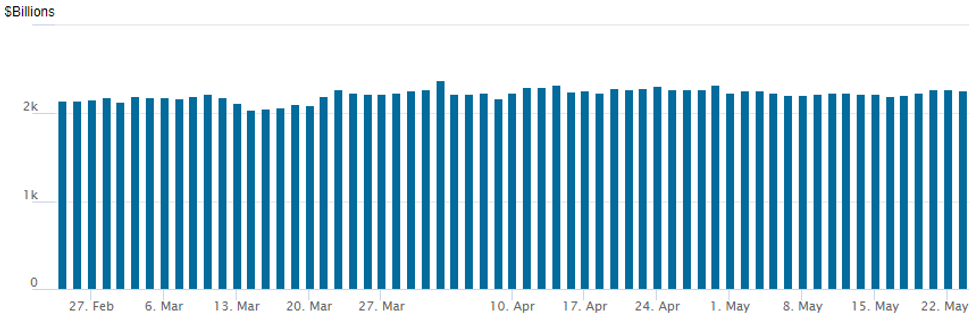

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,256.689B w/ 102 counterparties, compares to prior $2,275.311B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $4B High-Grade Corporate Debt Issued Tuesday

$4B Priced Tuesday. No word on timeline of $36B John Deere medium-term note issuance.

- Date $MM Issuer (Priced *, Launch #)

- 05/23 $2B *Lockheed Martin $500M 5Y +75, $850M +10Y +110, $650M +30Y +130

- 05/23 $1B *NWB (Netherlands Bank) WNG 5Y SOFR+45

- 05/23 $500M *Tokyo Metro Gov 3Y SOFR+84

- 05/23 $500M *Ameren Illinois WNG 10Y +127

- 05/23 $Benchmark John Deere filed prospectus to issue $36B in medium-term notes, details over timing and individual size TBA. If JD does issue $36B at one offering, would be new fourth largest on record, $5B larger than last week's 8-tranche jumbo issued by Pfizer.

- Rolled to Wednesday's order of business:

- 05/24 $Benchmark KFW 5Y SOFR+36a

- 05/23 $1B Seagate HDD Cayman 6.5NC3, 8NC3

EGBs-GILTS CASH CLOSE: Gilts Lead Rout

Gilts led a global core FI rout Tuesday, with UK yields rising 8-9bp across the curve.

- The Gilt sell-off was not due to a single factor: partly in anticipation of Wednesday's CPI release, and partly on prelim May services PMI which slipped to a 2-month low but held hawkish details.

- Terminal BoE pricing rose as much as 13bp to 5.13%, before fading.

- Weakness in the German curve was relatively tame, with yields up 0-1bp. Like the UK's PMI report, Eurozone manufacturing came in weak, but services were probably too strong for the ECB's comfort.

- Eurozone central bank speakers had little impact: BoE's Bailey had little new to say, while the largest mover was Monday's hawkish-leaning after hours comments by ECB's de Cos who said there was still a way to go on rate hikes.

- Following Monday's strong rally led by Greece, periphery spreads were mixed/unchanged.

- UK inflation leads Wednesday's docket, but we also get German IFO, Bund and Gilt supply, and appearances by Bailey and ECB's Lagarde.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.3bps at 2.822%, 5-Yr is up 0.3bps at 2.451%, 10-Yr is up 1bps at 2.469%, and 30-Yr is up 0.8bps at 2.642%.

- UK: The 2-Yr yield is up 8.2bps at 4.135%, 5-Yr is up 8.8bps at 3.991%, 10-Yr is up 9.4bps at 4.158%, and 30-Yr is up 8.1bps at 4.533%.

- Italian BTP spread down 0.3bps at 185.2bps / Greek down 0.4bps at 141.4bps

FOREX: Greenback Firms Amid Weakness In Equities, NZD Falls 0.6% Ahead of RBNZ

- Despite the US dollar whipsawing throughout US hours, the DXY sits 0.3% firmer as we approach the APAC crossover. The moderate greenback strength is in line with weaker major equity benchmarks as e-mini S&P futures extend their decline to 1%.

- Antipodean FX sits bottom of the G10 pile, with both Aussie and Kiwi seen down around 0.6%. The move for NZDUSD comes ahead of Wednesday’s RBNZ decision where MNI believe that the RBNZ can afford to step down to a 25bp hike as inflation and inflation expectations are moving in the right direction and policy is now restrictive. However, with inflation elevated and demand robust, the RBNZ is still likely to tighten further and keep its tightening bias.

- EURUSD (-0.30%) has also moved south on Tuesday, although last Friday’s low at 1.0760 has acted as solid support up to this point. Overall, following the break of the 50-day EMA, at 1.0879, EURUSD has strengthened bearish conditions, signalling scope for a continuation lower towards 1.0737 next, a Fibonacci retracement. Clearance of this level would place the focus on 1.0713, the Mar 24 low. A firm resistance is now seen at 1.0899, the 20-day EMA.

- USDJPY sits close to unchanged on the session, although the pair has registered a new multi-month high at 138.91, placing the pair briefly at the best levels since November 2022.

- Looking ahead, UK April CPI will precede German IFO data, both due to cross the wires on Wednesday. The focus for the US docket will be on the FOMC minutes. Attention will then be on any revisions to Q1 growth data and US Core PCE Price Index data due later in the week.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/05/2023 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 24/05/2023 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 24/05/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 24/05/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 24/05/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/05/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 24/05/2023 | 0930/1030 |  | UK | BOE Bailey Keynote Speech at Mansion House Net Zero Summit | |

| 24/05/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/05/2023 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/05/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/05/2023 | 1300/1400 |  | UK | BOE Bailey Frieside Chat at WSJ CEO Council Summit | |

| 24/05/2023 | 1405/1005 |  | US | Treasury Secretary Janet Yellen | |

| 24/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 24/05/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/05/2023 | 1610/1210 |  | US | Fed Governor Christopher Waller | |

| 24/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 24/05/2023 | 1745/1945 |  | EU | ECB Lagarde Opens Anniversary of ECB Event | |

| 24/05/2023 | 1800/1400 | * |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.