-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

MNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI ASIA OPEN: Dovish View on Hawkish Fed Guidance

EXECUTIVE SUMMARY

US

FED: The Federal Reserve is far away from meeting its price stability goal, San Francisco Fed President Mary Daly said Friday, echoing Fed Chair Jerome Powell's remarks after the central bank raised rates half a percentage point earlier this week.

- "We see a slowdown coming in a way that would be predicted by raising interest rates, and we still have a long way to go," she told the American Enterprise Institute. Daly said she boosted her inflation projection in the Fed's dot plots largely because of the tight labor market, and also said that while goods inflation is slowing, core services prices will be more stubborn.

FED: The Federal Reserve may avoid hiking interest rates beyond 5% if inflation keeps slowing while resisting pressure to cut for longer than investors expect, former vice chairman Alan Blinder told MNI.

- Blinder sees continued tight policy even as he predicts most of the pain from rate hikes on the U.S. economy is still to come. That's because most of the inflation slowdown so far is from improving global supply chains rather than Fed action to create slack in the labor market, he said.

- "The first few points of inflation reduction the Fed gets almost for free," he said. "The part that is slack in the economy -- bringing down wage increases and service prices -- is the harder part. It will come slowly and gradually." For more see MNI Policy main wire at 1548ET.

- Per Lucian Kim at the Wilson Center, Sullivan said that the, "US role is to help put Ukraine in best position when time comes to negotiate. [but] That moment is not now."

- Sullivan: "Not to diminish war's human toll, where Ukraine is now in resisting Russian aggression would have been his wildly optimistic scenario at beginning of invasion."

- Kremlin spokesman Dmitry Peskov this week ruled out the prospect of a Christmas ceasefire: "No, no such offers have been received from anybody. This topic is not on the agenda."

- Reuters: "Military analysts say a winter deadlock could set in, even as fierce fighting continues especially in the eastern Ukrainian region of Donetsk, where Russian forces are pushing to capture the town of Bakhmut."

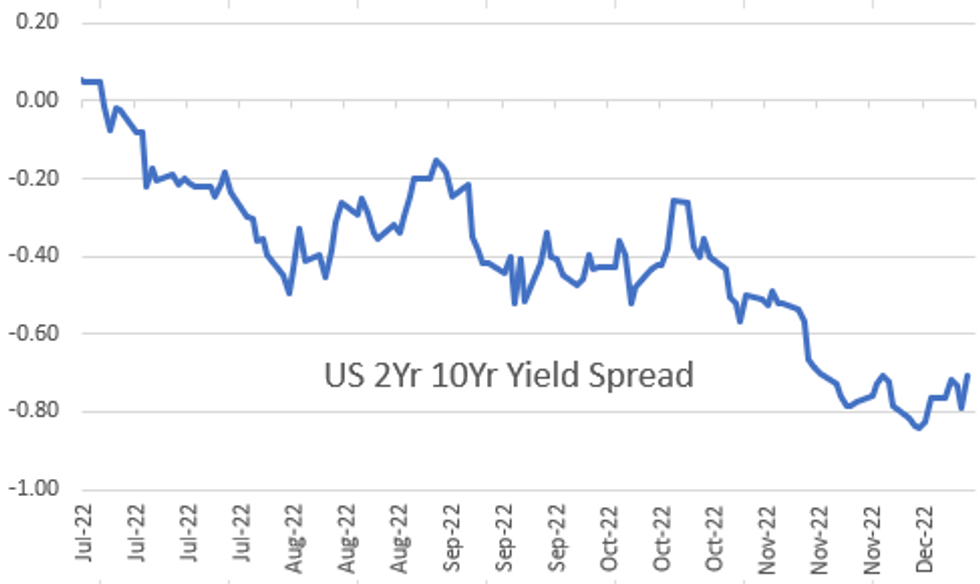

US TSYS: Yield Curves Bounce Back to Pre-FOMC Levels, 2Y Rally

Yield curves broadly steeper after the bell, short end lead rally off morning lows, 2YY at 4.1888% -.0475 after tapping 4.1531 low, 2s10s +8.518 at -70.892 -- back to pre-FOMC levels

- Market's way of discounting the week's hawkish Fed and ECB policy speak and forward guidance. Equities NOT taking a risk-on/dovish pricing view w/ SPX eminis -50.0 at 3877.25 (after bouncing off key support of 3855.13 50.0% - retracement of the Oct 13 - Dec 13 uptrend).

- Tsys bounced off lows following PMI data: The Fed will be encouraged that the crucial theme of weakening demand in the economy - leading to more modest inflation - played out further in this morning's Nov prelim US PMIs.

- The activity data overall remain contractionary, and are deteriorating: Composite at 44.6, a 4-month low), Services at 44.4 (4-month low), and Manufacturing at 47.4. (a 31-month low).

- Demand is weakening, as evidenced by the fastest decline in new orders since May 2020 with "pressure on purchasing power among customers and company balance sheets".

- Fed speak: little market react from SF Fed Daly riffing on familiar theme: Fed Still Has a ‘Long Way’ to Go to Defeat Inflation. Cleveland Fed Mester: "leaving inflation at these levels for long is costly".

OVERNIGHT DATA

- US S&P GLOBAL DEC FLASH MANUF. PMI 46.2 (FCST 47.8); NOV 47.7

- US S&P GLOBAL DEC FLASH SERVICES PMI 44.4 (FCST 46.5); NOV 46.2

- US S&P GLOBAL DEC FLASH COMP. PMI 44.6 (FCST 46.9); NOV 46.4

MARKETS SNAPSHOT

Late key market levels:

- DJIA down 273.07 points (-0.82%) at 32941.94

- S&P E-Mini Future down 41.25 points (-1.05%) at 3886.75

- Nasdaq down 92.3 points (-0.9%) at 10721.73

- US 10-Yr yield is up 3.2 bps at 3.4786%

- US Mar 10-Yr futures are down 3.5/32 at 114-26

- EURUSD down 0.0025 (-0.24%) at 1.0602

- USDJPY down 1.25 (-0.91%) at 136.52

- WTI Crude Oil (front-month) down $1.9 (-2.5%) at $74.16

- Gold is up $17.03 (0.96%) at $1793.95

- EuroStoxx 50 down 31.68 points (-0.83%) at 3804.02

- FTSE 100 down 94.05 points (-1.27%) at 7332.12

- German DAX down 93.16 points (-0.67%) at 13893.07

- French CAC 40 down 70.14 points (-1.08%) at 6452.63

US TSY FUTURES CLOSE

- 3M10Y +5.447, -82.343 (L: -92.916 / H: -74.925)

- 2Y10Y +8.602, -70.808 (L: -79.243 / H: -68.988)

- 2Y30Y +9.369, -65.207 (L: -74.777 / H: -63.822)

- 5Y30Y +4.036, -8.445 (L: -13.533 / H: -8.059)

- Current futures levels:

- Mar 2-Yr futures up 3.375/32 at 103-2.25 (L: 102-27.625 / H: 103-04.25)

- Mar 5-Yr futures up 2/32 at 109-16 (L: 109-01 / H: 109-19.75)

- Mar 10-Yr futures down 4/32 at 114-25.5 (L: 114-06 / H: 114-30.5)

- Mar 30-Yr futures down 29/32 at 131-05 (L: 130-08 / H: 132-01)

- Dec Ultra futures down 1-02/32 at 143-24 (L: 142-21 / H: 144-09)

US 10YR FUTURE TECHS: (H3) Trend Needle Points North

- RES 4: 116-23+ 2.0% 10-dma envelope

- RES 3: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 2: 115-14 50% Aug - Oct Downleg

- RES 1: 115-11+ High Dec 13

- PRICE: 114-25+ @ 1515ET Dec 16

- SUP 1: 113-22+/113-10 Low Dec 12 / 50-day EMA

- SUP 2: 112-11+ Low Nov 21 and a key short-term support

- SUP 3: 112-05+ Low Nov 14

- SUP 4: 110-22 Low Nov 10

Treasury futures remain below Tuesday’s high. This week’s print above resistance at 115-06+, Dec 7 high and the bull trigger, is a positive development. A clear break of this hurdle would confirm a resumption of the current uptrend and pave the way for a climb towards 115-26, a Fibonacci projection. Key short-term support has been defined at 113-22+, Dec 12 low. A reversal lower and a break of this level would threaten bullish conditions.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.003 at 95.258

- Mar 23 +0.030 at 94.955

- Jun 23 +0.060 at 94.945

- Sep 23 +0.075 at 95.135

- Red Pack (Dec 23-Sep 24) +0.025 to +0.055

- Green Pack (Dec 24-Sep 25) -0.01 to +0.015

- Blue Pack (Dec 25-Sep 26) -0.04 to -0.015

- Gold Pack (Dec 26-Sep 27) -0.055 to -0.04

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00129 to 4.31700% (+0.49900/wk)

- 1M +0.01372 to 4.35286% (+0.08257/wk)

- 3M +0.00815 to 4.74586% (+0.01372/wk)*/**

- 6M +0.03457 to 5.18686% (+0.04715/wk)

- 12M +0.01157 to 5.47886% (-0.02057/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $104B

- Daily Overnight Bank Funding Rate: 4.32% volume: $279B

- Secured Overnight Financing Rate (SOFR): 4.32%, $1.144T

- Broad General Collateral Rate (BGCR): 4.27%, $417B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $400B

- (rate, volume levels reflect prior session)

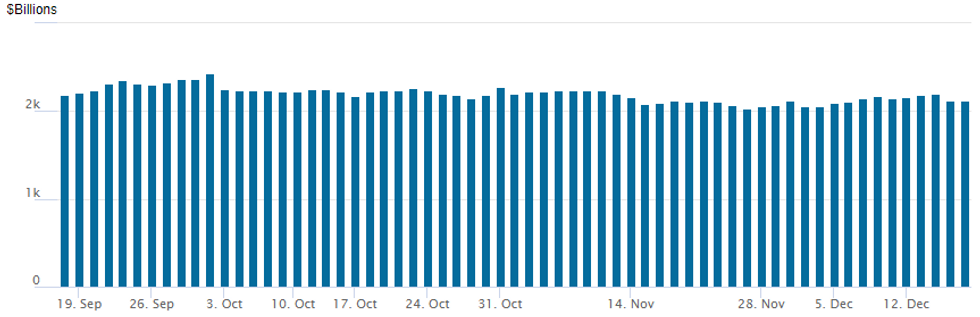

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,126.540B w/ 100 counterparties vs. $2,123.995B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EGBs-GILTS CASH CLOSE: Yields Close Off Highs, But ECB Hawks Take Toll

European yields fell back from double-digit basis point rises seen earlier in the session, but remained sharply higher for the second consecutive session as ECB hawkishness continued to be digested.

- Yields continued rising through the morning as ECB hawks reinforced Thursday's message (Holzmann, Rehn) and mostly encouraging prelim PMI data, though fell back in the afternoon, partly after a very weak US PMI print.

- The German curve bear steepened, while the UK's bear flattened.

- Tracking a rise (and end-of-day pullback) in ECB terminal rates which soared to 3.40% vs 3% prior to the ECB meeting, periphery spreads continued widening but pulled back from the session's widest levels.

- Monday's schedule includes German IFO data and appearances by ECB's de Guindos and Simkus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.8bps at 2.425%, 5-Yr is up 6bps at 2.22%, 10-Yr is up 6.9bps at 2.152%, and 30-Yr is up 9.7bps at 1.987%.

- UK: The 2-Yr yield is up 9.1bps at 3.487%, 5-Yr is up 7.7bps at 3.308%, 10-Yr is up 8.5bps at 3.329%, and 30-Yr is up 2.3bps at 3.672%.

- Italian BTP spread up 6.2bps at 214.5bps / Greek up 7.1bps at 216.6bps

FOREX: AUDNZD Extends 2022 Lows, JPY Outperforms

- The USD Index is close to unchanged on Friday as global currency markets take a breather after a busy week of inflation data and major central bank policy decisions.

- Generally mixed performance across G10 with the notable move occurring in the Japanese Yen which unwound a healthy portion of Thursday’s decline, rising 1% against the greenback amid the general risk off tone and further weakness in equities.

- USDJPY tested resistance at 138.02, the 20-day EMA but has since reversed and continued to grind lower throughout Friday trade. On the downside, 134.54 (the Dec 14 low) remains the first notable support and the bear trigger remains at 133.63.

- AUD/USD has underperformed, likely weighed by lower iron ore prices, after China announced a new state-run buyer will launch in 2023 and that it will seek a discount from miners.

- Additionally, AUDNZD has now extended to fresh 2022 lows with the cross now below 1.05 for the first time since December 2021. NZD bulls will now look for the move opening up a target at the 2021 low of 1.0280 with rate differentials continuing to point to further downside for the pair.

- A lighter calendar next week as we approach the holiday season. Monday will bring German IFO data before Tuesday’s Bank of Japan meeting.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/12/2022 | 0800/0900 |  | EU | ECB de Guindos Speech at Economia Forum | |

| 19/12/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 19/12/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 19/12/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 19/12/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/12/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 19/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 19/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.