MNI ASIA OPEN: Fed Gov Waller Invigorates Rate Cut Pricing

- MNI FED: Fed To Release Framework Review Details In Coming Months

- MNI FED BRIEF: Fed’s Waller-50BP Cut Reflects Rapid Inflation Drop

- MNI FED BRIEF: Bowman Warns On Declaring Early Victory In Inflation Battle

- MNI US DATA: Another Dip In The Share Of States Triggering Sahm Rule

US TSYS: Fed Gov Waller Buoys Rates, Inflation Undershoot Concers

- Treasuries looked to finish near session highs Friday, bouncing off late morning lows following dovish comments from Fed Gov Waller on CNBC, consistent with the Fed going 50bp at the next meeting in November.

- Gov Waller expressed concern with inflation undershooting, not overshooting, noting firms' limited pricing power and wage inflation coming down, and that inflation is potentially on a lower path that had previously been expected.

- Fed Governor Bowman (voter) has issued a statement explaining why she dissented against the FOMC’s decision to cut the Fed Funds target range by 50bps on Wednesday. Her comments are in firm contrast to Governor Waller’s recent CNBC interview which on the flip side seemed concerned with risks of inflation undershooting.

- Projected rate cuts into early 2025 bounced off early session lows, latest vs. late Thursday levels (*) as follows: Nov'24 cumulative -37.8bp (-35.9bp), Dec'24 -75.0bp (-72.4bp), Jan'25 -108.5bp (-106.5bp).

- Dec'24 10Y Tsy futures are currently +4 at 114-27.5 vs. 114-17 low, still well off initial technical resistance at 115-23.5 (High Sep 11 and the bull trigger). Curves bull steepened, 2s10s +2.480 at 15.242, 5s30s +2.052 at 58.677.

- Looking ahead to Monday brings more Fed speak from Bostic, Goolsbee and Kashkari, data includes flash PMI data from S&P Global.

US

FED (MNI): Fed To Release Framework Review Details In Coming Months

The Federal Reserve will announce the details of its upcoming review of the central bank's monetary policy framework "in coming months," the Fed said Friday. The Fed's board of governors will host its second Thomas Laubach Research conference, in honor of the late Fed economist, on May 15-16, and the event "is expected to provide timely academic perspectives for the monetary policy framework review that the Federal Reserve has committed to conduct every five years," the Fed said in a statement. "The first review was completed in 2020. Details about the next monetary policy framework review will be announced in the coming months."

FED BRIEF (MNI): Fed’s Waller-50BP Cut Reflects Rapid Inflation Drop

Federal Reserve Governor Christopher Waller said Friday the central bank's 50 basis point rate cut this week was justified by inflation falling faster than policymakers had foreseen, and said policymakers would not hesitate to keep cutting aggressively if the economy weakens.

- "Inflation is softening much faster than I thought it was going to," Waller told CNBC in an interview. "The economy is strong, inflation is coming down and therefore it’s time to cut. If the data starts coming in soft and continues to come in soft I would be much more willing to be aggressive on rate cuts to get inflation closer to our target of 2%."

FED BRIEF (MNI): Bowman Warns On Declaring Early Victory In Inflation Battle

Fed Governor Bowman (voter) has issued a statement explaining why she dissented against the FOMC’s decision to cut the Fed Funds target range by 50bps on Wednesday. Her comments are in firm contrast to Governor Waller’s recent CNBC interview which on the flip side seemed concerned with risks of inflation undershooting.

- "Although it is important to recognize that there has been meaningful progress on lowering inflation, while core inflation remains around or above 2.5%, I see the risk that the committee’s larger policy action could be interpreted as a premature declaration of victory on our price stability mandate. We have not yet achieved our inflation goal. I believe that moving at a measured pace toward a more neutral policy stance will ensure further progress in bringing inflation down to our 2% target. This approach would also avoid unnecessarily stoking demand."

NEWS

GERMANY (MNI): Brandenburg Election A Toss-Up As SPD Gains On AfD:

The 22 Sep Brandenburg state election has turned into a toss-up, with the centre-left Social Democrats (SPD) trailing the far-right Alternative for Germany (AfD) by just 1-3% according to the latest polling.

FRANCE (MNI): Signs Of Division Evident Within Potential Gov't Before Cabinet Announced:

Even before PM Michel Barnier announces his cabinet of ministers, there are signs of friction within the potential coalition of gov't parties. Speculation that Senators Laurence Garnier and Bruno Retailleau (both from the conservative Les Republicains) could take ministerial positions has seen, according to Le Figaro, 80% of deputies from the centrist MoDem say they would not back such a gov't.

HUNGARY (MNI): Foreign Min-EU Sanctions On Russia 'Simply Not Working':

Wires carrying comments from Foreign Minister Peter Szijjarto regarding Hungary-Russia relations and sanctions. Says that 'We do not agree with EU sanctions and in areas not affected by the sanctions our interest is to develop economic cooperation with Russia'. Adds the view that EU sanctions on Russia are "simply not working."

MIDEAST (MNI): IDF Targets 'Top Hezbollah Military Commander' In Beirut Airstrike:

Wires reporting that according to two Israeli security sources, the IDF has carried out a sizeable airstrike on the Dahiya neighbourhood in southern Beirut. The target is supposedly a top Hezbollah military commander.

OVERNIGHT DATA

US DATA (MNI): Another Dip In The Share Of States Triggering Sahm Rule

Friday's state household survey data offered further pushback on previous attention on the climb in the share of states that had triggered the Sahm rule. Another state no longer triggered the rule, which meant the share fell to 28% as it continues to decline following its quick climbed to circa 40% in late 2023. We regularly note that there are issues with looking at this metric beyond a national level, not least as different states receive differing levels of immigration with differing impacts on labor supply, but it nevertheless receives attention.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 61.6 points (0.15%) at 42083.84

- S&P E-Mini Future down 9.75 points (-0.17%) at 5768.25

- Nasdaq down 17.7 points (-0.1%) at 17997.14

- US 10-Yr yield is up 0.9 bps at 3.7224%

- US Dec 10-Yr futures are up 4/32 at 114-27.5

- EURUSD up 0.0003 (0.03%) at 1.1165

- USDJPY up 1.16 (0.81%) at 143.8

- WTI Crude Oil (front-month) down $0.03 (-0.04%) at $71.92

- Gold is up $35.83 (1.39%) at $2622.57

- European bourses closing levels:

- EuroStoxx 50 down 71.84 points (-1.45%) at 4871.54

- FTSE 100 down 98.73 points (-1.19%) at 8229.99

- German DAX down 282.37 points (-1.49%) at 18720.01

- French CAC 40 down 115.15 points (-1.51%) at 7500.26

US TREASURY FUTURES CLOSE

- 3M10Y +5.969, -95.31 (L: -104.596 / H: -94.636)

- 2Y10Y +2.249, 15.011 (L: 10.888 / H: 15.851)

- 2Y30Y +2.9, 49.395 (L: 43.613 / H: 50.291)

- 5Y30Y +1.968, 58.593 (L: 54.643 / H: 59.468)

- Current futures levels:

- Dec 2-Yr futures up 1.5/32 at 104-11.25 (L: 104-06.5 / H: 104-12)

- Dec 5-Yr futures up 2.75/32 at 110-10.75 (L: 110-02.25 / H: 110-13)

- Dec 10-Yr futures up 4.5/32 at 114-28 (L: 114-17 / H: 115-00)

- Dec 30-Yr futures up 6/32 at 125-10 (L: 124-26 / H: 125-23)

- Dec Ultra futures up 2/32 at 134-17 (L: 134-01 / H: 135-11)

US 10YR FUTURE TECHS: (Z4) Pullback Appears Corrective

- RES 4: 116-07 1.764 proj of the Aug 8 - 21 - Sep 3

- RES 3: 116-00 Round number resistance

- RES 2: 115-31 1.618 proj of the Aug 8 - 21 - Sep 3

- RES 1: 115-23+ High Sep 11 and the bull trigger

- PRICE: 114-26+ @ 11:13 BST Sep 20

- SUP 1: 114-23/16 20-day EMA / Low Sep 19

- SUP 2: 114-00+ Low Sep 4

- SUP 3: 113-20 50-day EMA

- SUP 4: 113-12 Low Sep 3

Treasuries maintain a bullish theme and the latest pullback appears to be a correction - for now. Firm support is seen at 114-23, the 20-day EMA. This average has been pierced but remains intact for now. A clear break would signal scope for a deeper retracement towards 113-20, the 50-day EMA. For bulls, a resumption of gains would refocus attention on 115-23+, the Sep 11 high and a bull trigger. A break would open 115-31, a Fibonacci projection.

SOFR FUTURES CLOSE

- Dec 24 +0.025 at 96.035

- Mar 25 +0.030 at 96.625

- Jun 25 +0.035 at 96.940

- Sep 25 +0.035 at 97.070

- Red Pack (Dec 25-Sep 26) +0.005 to +0.025

- Green Pack (Dec 26-Sep 27) +0.005 to +0.005

- Blue Pack (Dec 27-Sep 28) +0.005 to +0.015

- Gold Pack (Dec 28-Sep 29) +0.015 to +0.025

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.06269 to 4.85722 (-0.22551/wk)

- 3M -0.06202 to 4.69125 (-0.24993/wk)

- 6M -0.04204 to 4.35139 (-0.22753/wk)

- 12M -0.02253 to 3.83149 (-0.16036/wk)

- Secured Overnight Financing Rate (SOFR): 4.82% (-0.51), volume: $2.378T

- Broad General Collateral Rate (BGCR): 4.81% (-0.51), volume: $844B

- Tri-Party General Collateral Rate (TGCR): 4.81% (-0.51), volume: $815B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 4.83% (-0.50), volume: $90B

- Daily Overnight Bank Funding Rate: 4.83% (-0.50), volume: $281B

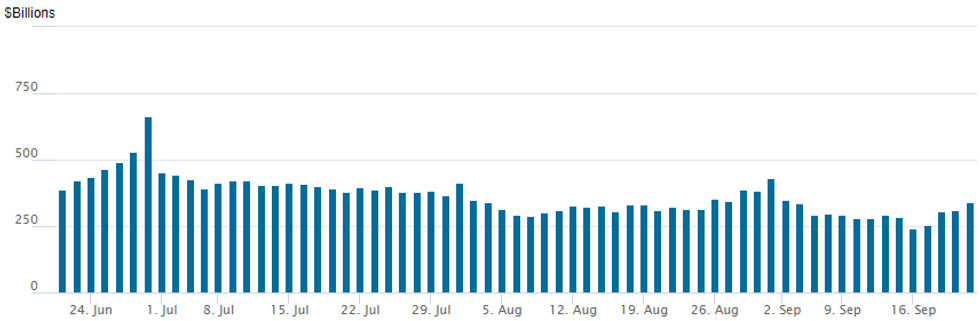

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs to $339.316B this afternoon from $311.777B yesterday. This after usage fell to $239.386B Monday -- the lowest level since early May 2021. Number of counterparties climbs to 52 from 63 on Wednesday.

PIPELINE: Corporate Bond Issuance Roundup

$5.95B Priced Thursday, $21.1B total for week

- Date $MM Issuer (Priced *, Launch #)

- 9/19 $2.15B *Romania 10.5Y +210, in addition to Euro denominated 7-, 20Y debt

- 9/19 $2B *Goldman Sachs PerpNC10 6.125%

- 9/19 $1B *Alpha Generation 8NC3 6.75%

- 9/19 $800M *Nordea PerpNC7.5Y 6.3%

BONDS: EGBs-GILTS CASH CLOSE: OATs Underperform On Fiscal Concerns

Core European FI weakened slightly Friday, with OATs underperforming.

- Yields fell early in the session as equities pulled back. But they rose over most of the rest of the session, led by weakening OATs amid reports of negative fiscal developments in France.

- Yields closed off the highs on dovish comments by Fed Gov Waller just prior to the European cash close.

- BoE's Mann, a hawk, notably said that she contemplated a cut at August's meeting.

- In data, German PPI, Eurozone consumer confidence, and UK retail sales / public sector borrowing were all higher than consensus - no significant market impact however.

- The German and UK curves leaned bear steeper, but segments overall were mixed. OATs underperformed (10Y 2.1bp wider to Bunds). Periphery EGB spreads tightened modestly.

- Next week opens with flash September PMIs on Monday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.8bps at 2.23%, 5-Yr is up 1.3bps at 2.067%, 10-Yr is up 1bps at 2.208%, and 30-Yr is up 0.8bps at 2.509%.

- UK: The 2-Yr yield is up 0.5bps at 3.925%, 5-Yr is down 0.1bps at 3.744%, 10-Yr is up 1.2bps at 3.903%, and 30-Yr is up 0.9bps at 4.47%.

- Italian BTP spread down 1.2bps at 134.7bps / Spanish down 0.7bps at 78.9bps

FOREX: USDJPY Rises 1% on Cautious BOJ, Set to Close Around 144.00

- As expectations shifted towards the Fed potentially cutting by 50bps, lower core yields helped USDJPY trade below 140.00 on Monday, a new 14-month low for the pair. However, the ongoing positive sentiment for equities and a lack of momentum on the break of this psychological point prompted a firm recovery across the week. This culminated with the Bank of Japan decision on Friday, where Governor Ueda said the BOJ will be patient when adjusting policy. Accordingly, USDJPY rose back to a weekly high of 144.49 and trades around 144.00 as we approach the close.

- The dollar index trades moderately in the green Friday, however is half a percent lower on the week, broadly reflective of the FOMC’s bold 50bp rate cut, and an extension of the broader bearish technical trend seen across much of July and August. Bolstering this theme, positive sentiment in equity markets continues to weigh on the greenback.

- EURUSD has risen roughly 0.9% this week, on the back of the softer US dollar and the single currency’s large weighting within the dollar index. While the ECB have left all options on the table, markets are tilting heavily towards the central bank only cutting at a quarterly pace. This caution is underpinning the renewed bid for EURUSD, alongside the positive sentiment for risk overall. 1.1202, the Aug 26 high and the technical bull trigger are yet to be tested.

- A busy week for the pound where inflation data and the Bank of England decision were in focus. There was a marginally hawkish outcome with the MPC vote split and an ongoing cautious approach to the easing cycle has been underpinning GBP this week, which remains the best performing currency against the dollar this year. Stronger than expected retail sales data on Friday saw GBPUSD rise to 1.3340, a fresh trend high, and the highest level since March 2022.

- Eurozone PMI's kick off next week's economic calendar.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 23/09/2024 | 2300/0900 | *** |  | Judo Bank Flash Australia PMI |

| 23/09/2024 | 0645/0845 |  | ECB's Elderson at Real Estate summit | |

| 23/09/2024 | 0715/0915 | ** |  | S&P Global Services PMI (p) |

| 23/09/2024 | 0715/0915 | ** |  | S&P Global Manufacturing PMI (p) |

| 23/09/2024 | 0730/0930 | ** |  | S&P Global Services PMI (p) |

| 23/09/2024 | 0730/0930 | ** |  | S&P Global Manufacturing PMI (p) |

| 23/09/2024 | 0800/1000 | ** |  | S&P Global Services PMI (p) |

| 23/09/2024 | 0800/1000 | ** |  | S&P Global Manufacturing PMI (p) |

| 23/09/2024 | 0800/1000 | ** |  | S&P Global Composite PMI (p) |

| 23/09/2024 | 0830/0930 | *** |  | S&P Global Manufacturing PMI flash |

| 23/09/2024 | 0830/0930 | *** |  | S&P Global Services PMI flash |

| 23/09/2024 | 0830/0930 | *** |  | S&P Global Composite PMI flash |

| 23/09/2024 | 1000/1100 | ** |  | CBI Industrial Trends |

| 23/09/2024 | 1200/0800 |  | Atlanta Fed's Raphael Bostic | |

| 23/09/2024 | 1300/1500 |  | ECB's Cipollone statement on digital euro at Hearing | |

| 23/09/2024 | 1345/0945 | *** |  | S&P Global Manufacturing Index (Flash) |

| 23/09/2024 | 1345/0945 | *** |  | S&P Global Services Index (flash) |

| 23/09/2024 | 1415/1015 |  | Chicago Fed's Austan Goolsbee | |

| 23/09/2024 | 1530/1730 |  | ECB's Cipollone in panel discussion at House of the euros | |

| 23/09/2024 | 1530/1130 | * |  | US Treasury Auction Result for 26 Week Bill |

| 23/09/2024 | 1530/1130 | * |  | US Treasury Auction Result for 13 Week Bill |