-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Gov Waller Left Mark on Short End

- MNI FED POLICY: Fed's Rate Cut Timeline Shaken By Inflation Bumps

- MNI: Waller Says Fed May Need To Hold Rates Steady For Longer

- MNI: Canadian Economy Grows At The Fastest Pace In A Year

- MNI: Italy's Meloni Eyes League Downgrade After June- Sources

- MNI US DATA: UMich Survey: Consumers Think Inflation Has "Truly Turned A Corner"

- MNI US DATA: Growth Ended 2023 Very Strong, With GDI Impressing

US

FED POLICY (MNI): Fed's Rate Cut Timeline Shaken By Inflation Bumps: Sputtering progress on inflation so far this year is eroding the confidence of Federal Reserve officials and potentially nudging back the likely timing of the first interest rate cut beyond market expectations for June.

- Two months of hotter-than-expected consumer and producer price readings have raised eyebrows among policymakers seeking assurances that inflation is heading sustainably back to the 2% target. They will comb through the next couple of months of figures to see if the early-year signals were an aberration or the start of a new mini-trend. (See MNI INTERVIEW: Fed Can't Let Guard Down On Inflation-Weinberg)

- While the Fed’s latest rate projections still show a median of three cuts for this year, FOMC members generally penciled in fewer cuts for 2024 and subsequent years, even as they raised their year-end core PCE inflation view to 2.6% from 2.4%. Indeed the Fed’s “dots” essentially show a committee split between two and three cuts but increasingly leaning toward two.

FED (MNI): Waller Says Fed May Need To Hold Rates Steady For Longer: Federal Reserve Governor Christopher Waller said Wednesday the Fed should wait a "couple months" to get a better understanding of the trajectory of inflation, but he still expects the central bank to begin reducing the target range for the federal funds rate this year.

- "In my view, it is appropriate to reduce the overall number of rate cuts or push them further into the future in response to the recent data. This reflects the reality of managing an outlook in real time as data comes in," he said in prepared remarks. "Subsequent data may well alter this outlook again, but we shall see. Based on what we know now, there is no urgency in taking that step."

NEWS

WHITE HOUSE (MNI): Brainard: "Consumer Sentiment Has Turned A Corner": White House National Economic Council Director Lael Brainard has issued a statement on today's GDP report, noting a "turnaround" in consumer sentiment as Americans "feel good" about their personal finances.

SECURITY (MNI): US In Talks On Post-War Peacekeeping In Gaza - Politico: Politico reporting that Biden administration officials are involved in, "preliminary “conversations” about options for stabilizing post-war Gaza, including a proposal for the Pentagon to help fund either a multinational force or a Palestinian peacekeeping team."

CANADA (MNI): Canadian Economy Grows At The Fastest Pace In A Year: Canada's economy grew at the fastest pace in a year in January with gains across almost every industry and a flash estimate showed further growth in February, continuing a resilient trend that's kept the central bank from reducing the highest borrowing costs in decades.

UK (MNI): Election Date Still Uncertain As Summer Speculation Swirls: Speculation surrounding the potential date of the next general election continues to swirl amid the vacuum of an actual set date.

POLAND (MNI): Tusk Talks Up Potential Mirroring Of Romania Grain Plan: Wires carrying comments from Polish PM Donald Tusk regarding the tense situation between Ukraine and a number of eastern European EU member states over grain/food imports following a meeting with his Ukrainian counterparty Denys Shmyhal in Warsaw.

UKRAINE (MNI): South Africa Pres Tells Putin His Gov't Continues To Work On Peace Plan: The Kremlin has confirmed that President Vladimir Putin held a phone call with his South African counterpart Cyril Ramaphosa in which they discussed the situation in Ukraine.

ITALY (MNI): Italy's Meloni Eyes League Downgrade After June- Sources: Tensions between Italian Prime Minister Giorgia Meloni and Matteo Salvini are making a government reshuffle likely after European Parliamentary elections in June, with poor results at the ballot box likely to leave the deputy prime minister facing challenges to his leadership of the right-wing League as the PM seeks to consolidate her control over key economic roles, officials told MNI.

US TSYS Fed Gov Waller Left Mark on Short End, Rate Cut Projections Soft

- Treasury were modestly mixed into the early close: pit at 1300ET, cash closes an hour later at 1400ET while Globex closes at normal time of 1700ET. Carry-over weakness in the short end after Fed Gov Waller said late Wednesday the Fed should wait a "couple months" to get a better understanding of the trajectory of inflation. That said, Waller still expects the central bank to begin reducing the target range for the federal funds rate this year.

- Yields 5bp higher in the short end, curves bear flattening: 2s10s -4.182 at -42.381.

- Projected rate cut pricing retreats (post-Waller): May 2024 at -9.8bp from -15% late Wednesday w/ cumulative -2.5bp at 5.302%; June 2024 -56.9% vs. -63.1% w/ cumulative rate cut -16.7bp at 5.159%. July'24 cumulative at -26.4bp vs. -30.06bp, Sep'24 cumulative -43.9bp from -49.3bp.

- Mixed data did help rates pare losses on the day: TYM4 hitting session high of 110-28.5 just ahead of noon. Surprise March final UofM consumer survey release showed softer inflation expectations. Real GDP was revised up by 0.2pp in the final reading for 4Q23, with quarterly annualized growth of 3.4%. The internals of the revision were broad-based, including a very strong gross domestic income reading. The Chicago Business BarometerTM, produced with MNI declined 2.6 points to 41.4 in March.

- Despite tomorrow's close, there are several data points and Fed speakers scheduled: Personal Income/Spending, PCE Deflator, Adv Trade Balance, Retail/Wholesale Inventories, KC Fed Services. SF Fed Daly open remarks at policy conf at 1115ET while Fed Chairman Powell speaks at a moderated discussion at 1130ET.

- US markets resume normal trade Monday (Globex opens Sunday evening at 1800ET) while Europe markets closed for Easter Monday.

OVERNIGHT DATA

US DATA (MNI): Jobless Claims Remain Remarkably Steady: Initial jobless claims ticked slightly lower in the week to March 22, at 210k (vs 212k, upwardly revised up by 210k, meaning the net change was in line with consensus), maintaining a remarkable degree of steadiness at a relatively strong level.

- 7 of the last 8 weeks have printed between 210-213k, suggesting stability in the labor market. There was no change from the prior week in the non-seasonally adjusted series (192k).

- Continuing claims rose to 1,819k (from 1,795k, downwardly revised from 1,807k). That was a little higher than consensus but offset by the downward revision to prior, and hardly noteworthy versus the average of the previous 8 weeks (1,804k) - again remarkably flat after last week's annual revisions.

- NSA continuing claims data are still above 2022 and 2023 readings for this time of year but on the low side compared to pre-pandemic years.

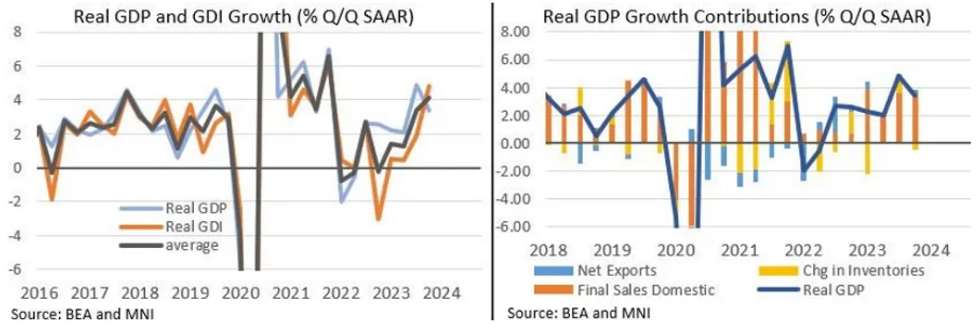

US DATA (MNI): Growth Ended 2023 Very Strong, With GDI Impressing: Real GDP was revised up by 0.2pp in the final reading for 4Q23, with quarterly annualized growth of 3.4%. The internals of the revision were broad-based, including a very strong gross domestic income reading.

- Private consumption and fixed investment each contributed an additional 0.2pp versus the previous estimate more than offsetting a bigger drag from inventories, and less of a contribution from net exports.

- The headline PCE price index was unrevised at 1.6%, but more attention was placed on the core PCE inflation reading which was revised down a tick to 2.0% from 2.1%.

- The figures still represent a slowdown from the 4.9% Q/Q SAAR print in 3Q, but the deceleration was a little less pronounced than previously estimated (and the final print was above the expectation of an unrevised 3.2% reading).

US DATA (MNI): UMich Survey: Consumers Think Inflation Has "Truly Turned A Corner": Softer inflation expectations are the story of March's final UMichigan consumer survey release.

- 1-year inflation expectations unexpectedly fell to 2.9% in the final report, from 3.0% in the prelim (and vs an expected rise to 3.1%). 5-10 year expectations dipped to 2.8% from 2.9% prior/prelim.

- That's the joint-lowest 1-year ahead inflation expectation in the survey since December 2020 (joint with Jan 2024), while the long-term inflation expectation was the joint-lowest since September 2022.

US DATA (MNI): Chicago Business Barometer™ - Declines to 41.4 in March: The Chicago Business BarometerTM, produced with MNI declined 2.6 points to 41.4 in March. This is the fourth consecutive monthly decrease, pushing the index further into contractionary territory, and marking the lowest print since May 2023. We also note that this print is 4 points below the 2023 average.

CANADA DATA (MNI): Canada Jan GDP Growth Fastest In A Year: Flash Feb +0.4%. Canada Jan GDP +0.6% vs +0.4% expected and the fastest pace in a year.

- Jan growth was led by the education sector which rebounded by +6% after the end of strike activity. Statistics Canada's flash estimate says Feb GDP +0.4% with "broad-based" increases across sectors.

- In Jan, 18 of 20 sectors posted increases; goods producing industries +0.2% and service producing +0.7%.Dec GDP revised down to -0.1% from 0%. The growth in Jan and Feb could mean Q1 growth will be ahead of the BOC estimate of +0.5% annualized.

CANADA DATA (MNI): Canada Jan Payrolls: Payroll employment +0.2% or +39.8K from Dec, +1.2% YOY. Increase was led by retail, which posted the first increase after 4 consecutive declines; overall, 13 of 20 sectors increased employment.

- Hours worked +0.9% YOY. Average weekly earnings +0.7% in Jan after -0.4% in Dec; Jan earnings +3.9% YOY. Residential building construction employment -0.9%.

- Canada needs +3.5M homes by 2030 to meet demand. Job vacancies little changed on month and -26% YOY.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 31.29 points (0.08%) at 39792

- S&P E-Mini Future up 2.5 points (0.05%) at 5310.75

- Nasdaq down 14.8 points (-0.1%) at 16384.25

- US 10-Yr yield is up 1 bps at 4.2003%

- US Jun 10-Yr futures are down 4.5/32 at 110-23.5

- EURUSD down 0.0041 (-0.38%) at 1.0787

- USDJPY up 0.06 (0.04%) at 151.39

- WTI Crude Oil (front-month) up $1.77 (2.18%) at $83.12

- Gold is up $25.43 (1.16%) at $2220.22

- European bourses closing levels:

- EuroStoxx 50 up 1.68 points (0.03%) at 5083.42

- FTSE 100 up 20.64 points (0.26%) at 7952.62

- German DAX up 15.4 points (0.08%) at 18492.49

- French CAC 40 up 1 points (0.01%) at 8205.81

US TREASURY FUTURES CLOSE

- 3M10Y +1.314, -117.97 (L: -123.052 / H: -115.014)

- 2Y10Y -4.182, -42.381 (L: -42.785 / H: -39.298)

- 2Y30Y -5.732, -27.939 (L: -28.561 / H: -23.724)

- 5Y30Y -3.389, 12.844 (L: 12.273 / H: 15.417)

- Current futures levels:

- Jun 2-Yr futures down 3.75/32 at 102-7.25 (L: 102-06.6239999999998 / H: 102-11)

- Jun 5-Yr futures down 5/32 at 106-31.25 (L: 106-27.5 / H: 107-04.25)

- Jun 10-Yr futures down 4/32 at 110-24 (L: 110-17 / H: 110-28.5)

- Jun 30-Yr futures up 3/32 at 120-9 (L: 119-24 / H: 120-20)

- Jun Ultra futures up 6/32 at 128-23 (L: 128-03 / H: 129-07)

US 10Y FUTURE TECHS: (M4) Resistance At The 50-Day EMA Holds For Now

- RES 4: 112-04+ High Mar 8 and bull trigger

- RES 3: 111-24 High Mar 12

- RES 2: 111-10+ High Mar 13

- RES 1: 110-31/31+ 50-day EMA / High Mar 27

- PRICE: 110-25 @ 1315 ET Mar 27

- SUP 1: 110-08+/109-24+ Low Mar 21 / 18 and the bear trigger

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

The recent move higher in Treasuries appears to be a correction. Key short-term resistance at the 50-day EMA, at 110-31, remains intact. A clear break of this hurdle is required to suggest scope for a stronger recovery. This would open 111-24, the Mar 12 high. Moving average studies remain in a bear-mode position and this continues to highlight a downtrend. The bear trigger is unchanged at 109-24+, Mar 18 low.

SOFR FUTURES CLOSE

- Jun 24 -0.030 at 94.855

- Sep 24 -0.055 at 95.125

- Dec 24 -0.070 at 95.415

- Mar 25 -0.070 at 95.690

- Red Pack (Jun 25-Mar 26) -0.07 to -0.045

- Green Pack (Jun 26-Mar 27) -0.035 to -0.01

- Blue Pack (Jun 27-Mar 28) steady to +0.005

- Gold Pack (Jun 28-Mar 29) +0.010 to +0.015

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00140 to 5.32874 (+0.00003/wk)

- 3M -0.00368 to 5.29823 (-0.01425/wk)

- 6M -0.00623 to 5.21781 (-0.01119/wk)

- 12M -0.01232 to 4.99982 (-0.00396/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.01), volume: $1.807T

- Broad General Collateral Rate (BGCR): 5.33% (+0.02), volume: $656B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.02), volume: $644B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $82B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $218B

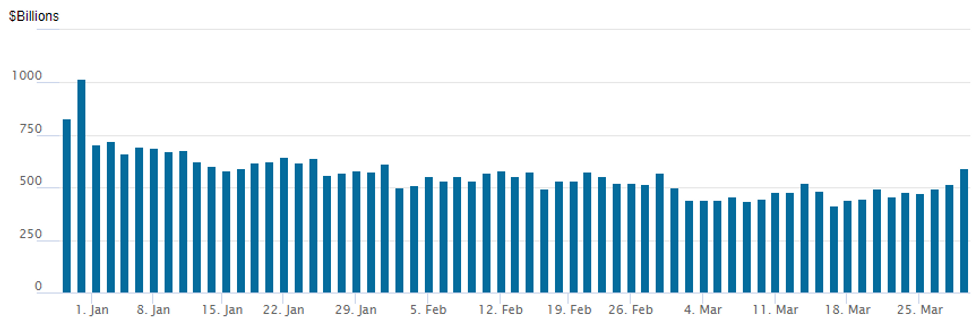

FED Reverse Repo Operation: Usage Surge to Nearly $600B

NY Federal Reserve/MNI

- RRP usage surged to nearly $600B today: $594.428B today vs. $518.357B on Wednesday. Compares to Friday, March 15 when usage fell to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties climbed to 90 vs. 83 yesterday (compares to 65 on January 16, the lowest since July 7, 2021)

PIPELINE

Pace of corporate bond issuance is slowed into month end. Total for the month of March (including foreign corporate and supra sovereigns) is over $186.625B - compares to March '23 of $122.05B.

EGBs-GILTS CASH CLOSE: Peripheries Underperform To Conclude Short Week

European FI closed a holiday-shortened week Thursday with a flat-to-softer performance in which periphery spreads noticeably widened.

- Hawkish commentary from the Fed's Waller and BoE's Haskel set a negative tone for global core FI, and helped spur underperformance in periphery EGBs.

- Bunds and Gilts pared losses in the afternoon, helped by softer-than-expected US data (including MNI Chicago PMI), with some support potentially coming from month-end extensions.

- The German curve twist flattened on the day, with the UK's bear flattening.

- 10Y BTP spreads to Bunds closed at their widest level in 3 weeks, having now widened by over 21bp from the March lows.

- While markets are closed Friday, there are still key data releases, namely flash March inflation prints for France and Italy, ahead of next week's German and Eurozone-wide reports.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.9bps at 2.848%, 5-Yr is up 0.8bps at 2.321%, 10-Yr is up 0.6bps at 2.298%, and 30-Yr is down 0.1bps at 2.455%.

- UK: The 2-Yr yield is up 2.8bps at 4.172%, 5-Yr is up 0.6bps at 3.823%, 10-Yr is up 0.1bps at 3.933%, and 30-Yr is up 0.2bps at 4.424%.

- Italian BTP spread up 6.2bps at 138.3bps / Spanish bond up 2.1bps at 86.4bps

FOREX CAD Rebuffs S/T Bearish Theme, as GDP Lends Support

- Both CAD and CHF pushed back against previous bearish price action to trade higher through the Thursday close, as window-dressing and month-end flows worked against S/T trends evident in the price action across the past two weeks.

- USD/CAD headed through the London close at the session's lowest levels, extending the post-GDP data losses and pushing back against the bullish outlook. For now, the outlook remains positive above first support at 1.3456 and the bear trigger at 1.3420.

- Key short-term resistance is at 1.3614, the Mar 19 high and a recent congestion level. A clear break of this hurdle would confirm a resumption of the uptrend that began on Dec 27. This would expose 1.3623, a Fibonacci retracement, and 1.3661, the Nov 27 high.

- The USD Index started the Thursday session among the session's best performer, before giving back gains across US hours. Most sell-side models had seen moderate dollar sales as part of month-end rebalancing flow - and a small part of these flows may have played out, with modestly soft Q4 PCE numbers adding to the weight on the currency.

- Focus in the coming week turns to Eurozone inflation numbers, the 1-yr, 3-yr inflation expectations survey as well as the March jobs report rounding off the week on Friday. Markets currently expect the US to have added 215k jobs over March, down from 275k in February.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/03/2024 | 0745/0845 | *** |  | FR | HICP (p) |

| 29/03/2024 | 0745/0845 | ** |  | FR | PPI |

| 29/03/2024 | 0745/0845 | ** |  | FR | Consumer Spending |

| 29/03/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 29/03/2024 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/03/2024 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 29/03/2024 | 1515/1115 |  | US | San Francisco Fed's Mary Daly | |

| 29/03/2024 | 1530/1130 |  | US | Fed Chair Jerome Powell | |

| 29/03/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.