-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Stepdown Expected Wednesday

EXECUTIVE SUMMARY

US

FED: Federal Reserve officials are set to lift their benchmark fed funds rate by a quarter point to a 4.5% to 4.75% target range Wednesday, and may give fresh clues on how high to take borrowing costs in order to restrain demand and temper inflation.

- The move will take U.S. rates to their highest since 2007 and just 50 bps short of where the FOMC in December thought they ought to pause. The quarter point pace would also be a second straight downshift of the hiking speed as inflation shows signs of easing.

- The Fed's preferred measure of consumer inflation is off its summer peak, registering 5.0% in December and 4.4% excluding food and energy prices, but is still more than double the 2% target. Markets are more optimistic than the Fed that inflation will decline quickly, pricing in a below-5% peak and two quarter-point cuts by year-end.

- Chair Jerome Powell will likely push back against that sentiment to stop financial conditions from loosening further, making the Fed's job that much harder. While goods inflation has come down and housing cost pressures are expected to moderate, top officials have pointed to stickier services inflation as they argue rates must climb above 5% and remain there this year. For more see MNI Policy main wire at 1410ET.

- Treasury is assuming a cash balance of USD500 billion at the end of March. The increase in anticipated first quarter borrowing is due to a lower cash balance and projections showing lower receipts and higher outlays. For the second quarter, Treasury anticipates borrowing USD278 billion, assuming an end-of-June cash balance of USD550 billion. The Treasury's next quarterly refunding will be released at 8:30 a.m. February 1.

- The estimates are based upon current law and assume enactment of a debt limit suspension or increase. Treasury officials on a call warned constraints related to the debt limit could mean Treasury’s cash balance may be lower than assumed. If Treasury’s cash balance for the end of either quarter is lower than assumed, and assuming no changes in the forecast of fiscal activity, Treasury would expect that borrowing would be lower, officials said.

UK

BOE: The Bank of England would look at moving its estimates for future wage growth higher if as is likely it includes an upward revision of its view of the level of joblessness compatible with stable inflation in its latest forecast round to be released after this week’s monetary policy meeting, the deputy director of the National Institute of Economic and Social Research told MNI.

- A shift higher in the Bank’s view of the so-called non-accelerating inflation rate of unemployment, or NAIRU, could accompany a post-Covid labour market stock-take expected in Thursday’s February Monetary Policy Report, though Monetary Policy Committee members will have factored it into their own calculations for some time, said Stephen Millard, Deputy Director at the National Institute of Economic and Social Research and a former manager in the BOE's Monetary Analysis division.

- "I suspect that the MPC all have a view of the NAIRU in their heads. which they have probably adjusted up faster than the official Bank of England position. So in that sense the Bank staff are adjusting towards where the MPC already are," Millard said in an interview. For more see MNI Policy main wire at 1020ET.

Tsys Hold Narrow/Weaker Range Ahead Wed's FOMC

Tsys hold weaker, inside session range at midday, relative quiet start to a FOMC week. Higher than expected Spanish CPI/HICP inflation triggered selling across the board overnight, while Tsys see-sawed inside range with no substantive data to react to.

- Tsy 30YY currently 3.6545% (+.0355), yield curves flatter: 2s10s -0.915 at -70.091, 5s10s -2.337 at -13.184. Decent volumes (TYH3 >1M) with Asia back from Lunar New Year holidays.

- Fed funds implied hike for Feb'23 steady at 26.3bp ahead Wed's FOMC annc, Mar'23 cumulative 46.9bp to 4.798%, May'23 58.5bp to 4.914%, terminal at climbs to 4.925% in Jun'23.

- Additional policy/event risk with the BOE and ECB announcing this Thu. Participants plying the sidelines ahead Fri's Jan employment data (175k est vs. 223k prior).

- Eearnings annc pick up in earnest early Tue w/: International Paper (IP), Pfizer (PFE), Philips 66 (PSX), Pulte Grp (PHM), McDonalds (MCD), Marathon Petroleum (MPC), Corning (GLW), Sysco (SYY), UPS, GM, Caterpillar (CAT), Exxon (XOM).

OVERNIGHT DATA

- US JAN. DALLAS FED MANUFACTURING INDEX AT -8.4 VS -20.0

- US JAN. DALLAS FED GENERAL BUSINESS ACTIVITY AT -8.4

- The Dallas Fed manufacturing index completes a mixed January for regional Fed mfg measures, with a stronger than expected bounce from -20 to -8.4 (cons -15.0).

- Philly, Kansas and Dallas saw improvements on the month whilst Richmond and most notably Empire (from -11 to -33) saw large decline to new recent lows.

- Ahead of ISM manufacturing on Wed, the combination leaves an average consistent with only marginally below consensus for 48.0 from 48.4 in Dec, having first fallen back below 50 in November.

- Next though is tomorrow's MNI Chicago PMI, which barring the November undershoot has had a better fit over the cycle.

MARKETS SNAPSHOT

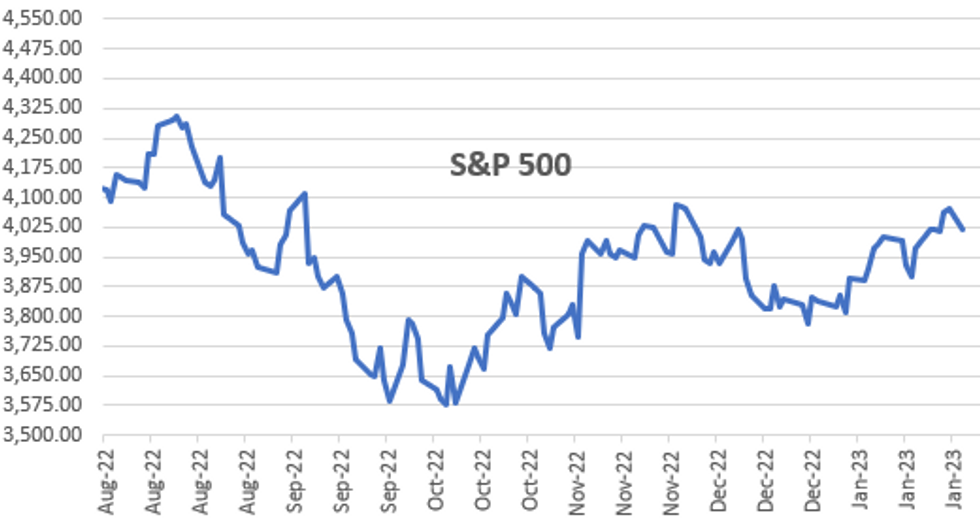

Key late session market levels:- DJIA down 271.65 points (-0.8%) at 33711.4

- S&P E-Mini Future down 52 points (-1.27%) at 4033

- Nasdaq down 222.8 points (-1.9%) at 11401.24

- US 10-Yr yield is up 4.6 bps at 3.5495%

- US Mar 10-Yr futures are down 9.5/32 at 114-10

- EURUSD down 0.0019 (-0.17%) at 1.0848

- USDJPY up 0.59 (0.45%) at 130.47

- WTI Crude Oil (front-month) down $1.93 (-2.42%) at $77.75

- Gold is down $6.47 (-0.34%) at $1921.55

- EuroStoxx 50 down 19.38 points (-0.46%) at 4158.63

- FTSE 100 up 19.72 points (0.25%) at 7784.87

- German DAX down 23.95 points (-0.16%) at 15126.08

- French CAC 40 down 15.2 points (-0.21%) at 7082.01

US TSY FUTURES CLOSE

- 3M10Y +6.036, -111.363 (L: -122.214 / H: -110.101)

- 2Y10Y -0.523, -70.699 (L: -72.877 / H: -68.557)

- 2Y30Y -0.813, -59.514 (L: -63.194 / H: -56.961)

- 5Y30Y -2.269, -1.814 (L: -4.488 / H: 1.558)

- Current futures levels:

- Mar 2-Yr futures down 3/32 at 102-23.75 (L: 102-22.625 / H: 102-27.375)

- Mar 5-Yr futures down 8.5/32 at 109-1.5 (L: 108-31.5 / H: 109-12.75)

- Mar 10-Yr futures down 9.5/32 at 114-10 (L: 114-05.5 / H: 114-25)

- Mar 30-Yr futures down 12/32 at 129-25 (L: 129-12 / H: 130-16)

- Mar Ultra futures down 20/32 at 141-26 (L: 141-10 / H: 142-29)

US 10YR FUTURE TECHS: (H3) Through Key Support

- RES 4: 117-00 High Sep 8 2022

- RES 3: 116-08 High Jan 19 and the bull trigger

- RES 2: 115-21 High Jan 20

- RES 1: 114-28/115-13 High Jan 27 / High Jan 25

- PRICE: 114-10 @ 1510ET Jan 30

- SUP 1: 114-05+ Low Jan 30

- SUP 2: 114-09+ Low Jan 17 and a key support

- SUP 3: 113-31+ 50-day EMA

- SUP 4: 113-17+ 61.8% retracement of the Dec 30 - Jan 19 bull leg

Treasury futures are trading to new lows Monday, taking out key support at the Jan 17 low of 114-09+. The break of this level undermines the recent bull theme and signals scope for a deeper retracement. Next support undercuts at the 50-day EMA, at 113-31+. The average represents an important short-term support. On the upside a key S/T resistance has been defined at 115-13, the Jan 25 high. A break would ease any developing bearish threat.

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.005 at 950

- Jun 23 -0.025 at 94.895

- Sep 23 -0.040 at 94.965

- Dec 23 -0.055 at 95.275

- Red Pack (Mar 24-Dec 24) -0.10 to -0.08

- Green Pack (Mar 25-Dec 25) -0.085 to -0.07

- Blue Pack (Mar 26-Dec 26) -0.065 to -0.05

- Gold Pack (Mar 27-Dec 27) -0.045 to -0.04

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00058 to 4.30529% (-0.000043 total last wk)

- 1M -0.00414 to 4.56557% (+0.04643 total last wk)

- 3M -0.01172 to 4.81357% (+0.00972 total last wk)*/**

- 6M -0.01072 to 5.09157% (+0.00029 total last wk)

- 12M +0.00986 to 5.32600% (-0.03114 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $120B

- Daily Overnight Bank Funding Rate: 4.32% volume: $304B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.165T

- Broad General Collateral Rate (BGCR): 4.27%, $472B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $454B

- (rate, volume levels reflect prior session)

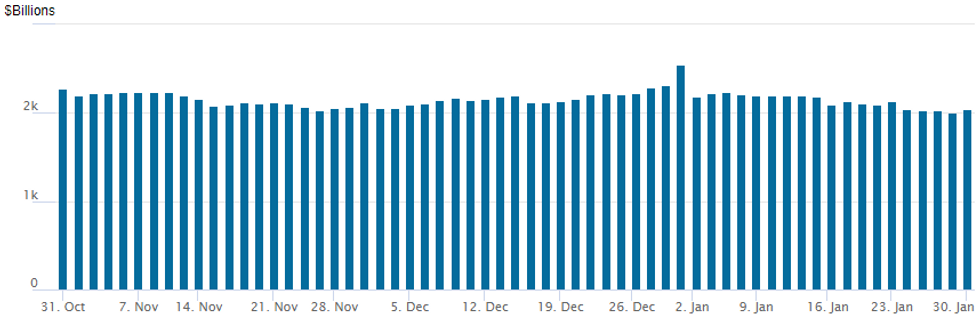

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebound to $2,048.714B w/ 106 counterparties vs. prior session's $2,003.634B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $3.25B IBM 4Pt Launched Late

- Date $MM Issuer (Priced *, Launch #)

- 01/30 $3.25B #IBM $850M 3Y +60, $1B 5Y +85, $750M 10Y +120, $650M 30Y +145

- 01/30 $1B Charter Comm's 8NC3 7.37%a

- 01/30 $850M #Bank of New Zealand 5Y +118

- 01/30 $750M #Synchrony Financial 10Y +375

- 01/30 $500M *Constellation Brands 3NC1 +110

- 01/30 $Benchmark Elevance Health 3NC1 +125a, 10Y +155a, 30Y +180a

- 01/30 $Benchmark Tyco Electronics 3Y +85a

- 01/30 $900M CI (Corp Nacional del Cobre de Chile) 10Y

- 01/30 $Benchmark Pemex investor calls

- Expected Tuesday:

- 01/31 $Benchmark CABEI (Central American Bank for Economic Integration) 3Y SOFR+130a

EGBs-GILTS CASH CLOSE: Inflation Concerns

The German curve bear steepened sharply Monday, underperforming Gilts as Thursday's ECB and BoE decisions came into closer focus.

- Stronger-than-expected Spanish Jan flash inflation data was followed later by robust Belgian CPI data. Despite methodological questions as to how representative those releases were for the Eurozone as a whole, there is no doubt they set a bearish tone for European rates.

- But Wednesday's Eurozone CPI data was clouded further as Germany postponed its scheduled Tuesday release, meaning the Eurozone data will use only an estimation of German data.

- Nonetheless, today's CPI data further cemented pricing for a 50bp ECB hike Thursday; we published our meeting preview today.

- BTP spreads widened modestly. Greek bonds outperformed the space overall, following their ratings upgrade from Fitch after Friday's close.

- With German CPI delayed, attention early Tuesday is on French inflation.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.9bps at 2.679%, 5-Yr is up 9.5bps at 2.353%, 10-Yr is up 7.9bps at 2.318%, and 30-Yr is up 4.9bps at 2.244%.

- UK: The 2-Yr yield is down 0.3bps at 3.471%, 5-Yr is up 1.9bps at 3.22%, 10-Yr is up 1.3bps at 3.336%, and 30-Yr is up 1bps at 3.691%.

- Italian BTP spread up 2.3bps at 188.1bps / Greek down 1.9bps at 199.7bps

FOREX: Greenback Trades Steadily North Amid Higher Core Yields

- Higher-than-expected inflation readings from both Spain and Belgium set a bearish tone for European rates early Monday and this sentiment benefitted the single currency, seeing EURUSD pop back above 1.09, weighing on the broad dollar index. However, higher core yields and the more cautious tone in equity markets eventually filtered through to a more supportive backdrop for the US dollar and the greenback has reversed steadily higher throughout Monday, extending on session highs in recent trade.

- All other G10 currencies are now in the red against the USD with dampened sentiment and lower commodity prices especially weighing on the likes of AUD and CAD, which have both shed around 0.5% to start the week. In the same vein, both SEK and NOK are the worst performers, dropping just shy of 1%.

- USDJPY has posted an impressive turnaround amid the higher yields. After printing lows of 129.21 on the back of a publication from Japan that noted the BoJ and government should commit to longer-term policy objectives around inflation, the pair has been stubbornly bid and now trades above 130.50 approaching the APAC crossover. On the topside, clearance of 131.58 would be required to indicate a meaningful bullish technical development, signalling a short-term reversal and opening 133.64, the 50-day EMA.

- Worth noting month-end tomorrow, where Barclays’ passive rebalancing model points to strong USD selling against all majors except the EUR where the signal is moderate.

- All the focus remains on major central bank decisions from the Fed, the ECB and BOE later this week.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/01/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 31/01/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/01/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/01/2023 | 0630/0730 | ** |  | FR | Consumer Spending |

| 31/01/2023 | 0630/0730 | *** |  | FR | GDP (p) |

| 31/01/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/01/2023 | 0730/0830 | ** |  | CH | retail sales |

| 31/01/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 31/01/2023 | 0745/0845 | ** |  | FR | PPI |

| 31/01/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 31/01/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 31/01/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/01/2023 | 1000/1100 | *** |  | IT | GDP (p) |

| 31/01/2023 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 31/01/2023 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 31/01/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 31/01/2023 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/01/2023 | 1330/0830 | ** |  | US | Employment Cost Index |

| 31/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/01/2023 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 31/01/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 31/01/2023 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 31/01/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 31/01/2023 | 1500/1000 | ** |  | US | housing vacancies |

| 31/01/2023 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 01/02/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.