-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Former Fed Officials See Mid-Year Rate Cut

- MNI INTERVIEW: Fed Likely To Wait For June To Cut-Carpenter

- MNI INTERVIEW: Fed Can Wait Until Summer To Cut Rates-English

- MNI: BOC SAYS IT'S PREMATURE TO START TALKING ABOUT RATE CUTS

- MNI BOC WATCH: Macklem Says Debate Shifts To How Long To Hold

- MNI: EIA Sees Oil Stable Despite Middle East Tensions

- MNI US DATA: Purchase Mortgage Applications Highest Since Apr’23

US

FEDINTERVIEW (MNI): Fed Likely To Wait For June To Cut-Carpenter

Federal Reserve officials will probably wait until midyear before lowering interest rates despite market hopes for cuts as early as March, as inflation data stay choppy in coming months before resuming a downward trend, former Fed board economist Seth Carpenter told MNI.

FED INTERVIEW (MNI): Fed Can Wait Until Summer To Cut Rates-English

The Federal Reserve will likely wait until summer before cutting interest rates, but policymakers could adjust their post-meeting statement next week to open the door to a reduction in March should the economic data call for it, former Fed board economist William English told MNI.

NEWS

BOC WATCH (MNI): Macklem Says Debate Shifts To How Long To Hold

The Bank of Canada moved language about another potential interest-rate hike from the decision statement to press remarks by the Governor now being released at the same time, with Tiff Macklem also saying debate is shifting to how long the official rate should remain at the highest since 2001 at 5% amid stubborn core inflation and a sluggish economy that returns headline CPI to target next year.

BRIEF (MNI): BOC Says Premature To Discuss Rate Cuts

Bank of Canada Governor Tiff Macklem told reporters Wednesday that officials didn't actively discuss the potential for cutting interest rates, because the focus of their decision to hold borrowing costs was on inflation that remains elevated.

US ENERGY (MNI): EIA Sees Oil Stable Despite Middle East Tensions

The U.S. Energy Information Administration expects oil production to be relatively unfazed by Middle East tensions so far, but prices are still seen rising later this year before receding modestly in 2025, the agency told MNI.

UKRAINE (MNI): Senate Committee Advances Bill To Authorize Transfer Of Russian Assets

The Senate Foreign Relations Committee has advanced legislation (the REPO Act) which would authorize the president of the United States to seize frozen Russian sovereign assets and transfer them for the reconstruction of Ukraine. See earlier bullet for background.

UK (MNI): Former Minister Calls For Sunak's Removal, But No Critical Mass Yet

A former minister has called for the removal of PM Rishi Sunak as leader of the Conservative Party in a move that could spark a re-emergence of the internal divisions that are seen to have contributed to the incumbent party's polling slide.

MIDEAST (MNI): Iraqi PMO-US Strikes On Iran-Linked Militias 'Irresponsible Escalation'

The office of Iraqi Prime Minister Mohammed Shia' Al Sudani has called the US strikes on three facilities in Iraq linked to Iranian-backed militias an "irresponsible escalation".

NORTH KOREA (MNI): SK Defence Chief Warns Of 'End Of Kim Regime' If North Launches War

South Korea's Defence Minister Shin Won-sik gave a warning to an increasingly belligerent North Korea on 24 Jan saying to troops on a visit to Cheongju air base that "If the Kim Jong-un regime opts for the worst choice of waging war, you should be at the vanguard of removing the enemy's leadership at the earliest possible time and put an end to the regime,".

US TSYS Unwinding Early Risk-On Tone Ahead GDP Data Risk

- Tsys are trading near late session lows after the bell, as are stocks ahead Thursday's busy data calendar: GDP, PCE, Wkly Claims and Tsy Sec Yellen Outlook.

- Treasury futures had recovered from Tuesday's modest sell-off Wednesday, back near Monday's close (TYH4 currently +9 at 111-16, yield 4.0955%). Risk-on tone resumes as SPX Eminis climb to new contract highs (ESH4 4933.25) following strong gains in Asia/Europe overnight.

- Treasury futures pared gains after larger than expected gains for S&P Global US PMIs for January: Mfg PMI (50.3 vs. 47.6 est, 47.9 prior); Services PMI (52.9 vs. 51.5 est, 51.4 prior); Composite PMI (52.3 vs. 51.0 est, 50.9 prior).

- Tsys gapped lower/tested lows (5Y yield climbs to 4.0671%) after $61B 5Y note auction (91282CJW2) tailed: 4.055% high yield vs. 4.035% WI; 2.31x bid-to-cover vs. 2.50x in the prior month.

- The rise in yields after the weak auction spilled over to equities as accounts took profits ahead Thursday's data. Reminder: several earnings announcements expected after the close: IBM, Seagate, Lam Research, Tesla, Raymond James and Crown Castle.

OVERNIGHT DATA

US JAN FLASH SERVICES PMI 52.9 (FCST 51.0); DEC 51.4

US JAN FLASH MANUFACTURING PMI 50.3 (FCST 47.7); DEC 47.9

US JAN FLASH COMPOSITE PMI 52.3 (FCST 51.0); DEC 50.9

US DATA: Purchase Mortgage Applications Highest Since Apr’23: MBA composite mortgage applications saw their third weekly seasonally adjusted gain in the week to Jan 19, rising 3.7% after two strong weeks for a cumulative 26% increase since year-end.

- Latest drivers were more mixed though, with purchase applications rising 7.5% but refis falling -7.0% after two very strong weeks. Purchase applications push to their highest since Apr’23 although remain more than 30% below pre-pandemic levels.

- The 30Y conforming rate increased 3bps to 6.78%, still close to the mid-Dec recent low of 6.71% and more than 110bps below the October peak.

- In a sign of continued tighter conditions, the spread to to jumbo loan rates remains negative at -16bps but is within ranges since November.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 4.75 points (0.01%) at 37906.69

- S&P E-Mini Future up 18 points (0.37%) at 4912.25

- Nasdaq up 108 points (0.7%) at 15532.08

- US 10-Yr yield is up 4.6 bps at 4.1742%

- US Mar 10-Yr futures are down 7.5/32 at 110-31.5

- EURUSD up 0.0035 (0.32%) at 1.0889

- USDJPY down 0.81 (-0.55%) at 147.54

- WTI Crude Oil (front-month) up $0.71 (0.95%) at $75.08

- Gold is down $16.06 (-0.79%) at $2013.15

- European bourses closing levels:

- EuroStoxx 50 up 98.2 points (2.2%) at 4564.11

- FTSE 100 up 41.94 points (0.56%) at 7527.67

- German DAX up 262.83 points (1.58%) at 16889.92

- French CAC 40 up 67.6 points (0.92%) at 7455.64

US TREASURY FUTURES CLOSE

- 3M10Y +4.427, -120.372 (L: -131.242 / H: -119.215)

- 2Y10Y +4.45, -20.149 (L: -24.557 / H: -19.776)

- 2Y30Y +4.549, 3.388 (L: -1.151 / H: 4.288)

- 5Y30Y +0.426, 32.472 (L: 31.65 / H: 34.037)

- Current futures levels:

- Mar 2-Yr futures down 1.75/32 at 102-17.875 (L: 102-17.375 / H: 102-23.375)

- Mar 5-Yr futures down 4.75/32 at 107-19.5 (L: 107-18.25 / H: 108-00.5)

- Mar 10-Yr futures down 7/32 at 111-0 (L: 110-29.5 / H: 111-19.5)

- Mar 30-Yr futures down 18/32 at 119-8 (L: 119-04 / H: 120-21)

- Mar Ultra futures down 18/32 at 124-31 (L: 124-23 / H: 126-22)

US 10Y FUTURE TECHS: (H4) Bear Threat Remains Present

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 111-23+/112-26+ 20-day EMA / High Jan 12

- PRICE: 111-14 @ 11:10 GMT Jan 24

- SUP 1: 110-26 Low Jan 19

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11 and a key short-term support

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

Treasuries are consolidating and short-term trend conditions remain bearish. The contract traded lower last week, to a low of 110-26 on Jan 19. Price has pierced the 50-day EMA, at 111-03+ and support at 111-06+, the Jan 5 low. A clear break of both levels would undermine the recent bullish theme and signal scope for a deeper pullback, to 110-16, Dec 13 low. Firm resistance is 112-26+, the Jan 12 high. Initial resistance is at 112-23+, the 20-day EMA.

SOFR FUTURES CLOSE

- Mar 24 -0.020 at 94.840

- Jun 24 -0.020 at 95.255

- Sep 24 -0.015 at 95.670

- Dec 24 -0.020 at 96.020

- Red Pack (Mar 25-Dec 25) -0.035 to -0.025

- Green Pack (Mar 26-Dec 26) -0.04 to -0.035

- Blue Pack (Mar 27-Dec 27) -0.045 to -0.045

- Gold Pack (Mar 28-Dec 28) -0.05 to -0.045

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00078 to 5.33664 (+0.00070/wk)

- 3M -0.00062 to 5.32405 (+0.00887/wk)

- 6M +0.00136 to 5.18796 (+0.02863/wk)

- 12M +0.01193 to 4.84692 (+0.04843/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.686T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $668B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $658B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $97B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $269B

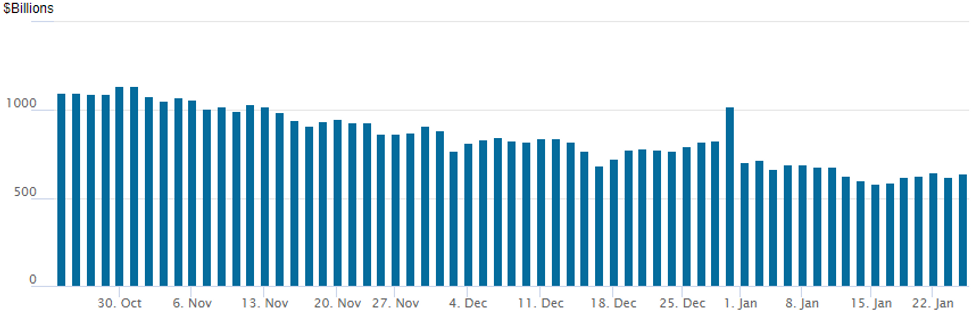

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $639.560B vs. $621.195B Tuesday. Compares to $583.103B on Tuesday, January 16 - the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties at 83 vs. 82 Tuesday (65 Tuesday last Tuesday, the lowest since July 7, 2021)

PIPELINE High-Grade Corporate Debt Over $43B on Week

$9.5B to Price Wednesday, $43.45B/wk- Date $MM Issuer (Priced *, Launch #

- 1/24 $1.85B #National Rural Utilities $600M 3Y +62.5, $300M 3Y SOFR+80, $500M 5Y +77, $450M 7Y +90

- 1/24 $1.5B Ceasars Entertainment 8NC3 6.6255%

- 1/24 $1.5B #State Street PerpNC5 6.7%

- 1/24 $1.5B *MuniFin 5Y SOFR+47

- 1/24 $1.35B Procter & Gamble $600M 5Y +27, $750M 10Y +37

- 1/24 $1.2B *Kepco 3Y +115

- 1/24 $600M #PACCAR 5Y +55

- Expected Thursday:

- 1/25 $Benchmark Swedish Export Credit 5Y SOFR+53a

- 1/25 $Benchmark Hyundai Capital investor calls

EGBs-GILTS CASH CLOSE: Contrasting PMIs See Bunds Outperform Gilts

Bunds outperformed Gilts Wednesday as Eurozone flash PMIs disappointed, while their UK counterpart showed unexpected strength.

- In data that can best be described as "stagflationary", services PMIs came in low for both Germany and France (and consequently the Eurozone), but the survey internals showed continued price pressures and manufacturing concerns over Red Sea shipping developments.

- In contrast, UK services (and manufacturing) PMIs were above-expected, though similarly, higher cost pressures were noted.

- Later in the session, US PMI data came in strong, weighing on Bunds and Gilts into the cash close.

- The higher inflation pressures evident in the PMIs helped limit the upside to core EGBs from the weak activity implied, and the German curve bull flattened on the day, with the UK's bear flattening.

- Periphery spreads finished flat/tighter, mirroring a rally in equities.

- Thursday's highlight is the ECB decision - MNI's preview is here. The overall message will be that the ECB is getting closer to easing policy, but it is not there yet.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.5bps at 2.709%, 5-Yr is down 1bps at 2.257%, 10-Yr is down 1bps at 2.342%, and 30-Yr is down 1.6bps at 2.522%.

- UK: The 2-Yr yield is up 4.4bps at 4.419%, 5-Yr is up 2.8bps at 3.958%, 10-Yr is up 2.4bps at 4.01%, and 30-Yr is up 2.4bps at 4.607%.

- Italian BTP spread down 0.7bps at 155.9bps / Spanish unchanged at 91.8bps

FOREX USD Index Retreat Halted By Stronger US Data

- The Dollar Index spent the first half of Wednesday’s session on the retreat as global risk sentiment was lifted by news of the 50bp RRR cut in China. However, firmer-than-expected US PMI data provided some late support for the greenback, with the DXY’s decline moderating to just 0.5% as we approach the APAC crossover. The pullback comes ahead of key US growth data on Thursday, the final major release before the January FOMC meeting.

- Volatility for the Japanese Yen in the aftermath of the Bank of Japan decision on Tuesday continued, with USDJPY establishing a 174-pip range today. Largely shadowing the moves in the broader dollar index, lows of 146.66 were put in shortly before the US PMIs before consolidating to levels around 147.40 at typing. Key short-term support has been defined at 144.36, the Jan 12 low and clearance of this level would be required to signal a top.

- The Swiss Franc is another notable performer on the session, rising 0.81% against the greenback, dragging EURCHF down back down to the prior breakout level around 0.9400.

- As noted on Tuesday, HSBC recently put out a note stating that the SNB's language around the currency has become more balanced, and some data points might be signalling a return to FX reserves accumulation. However, HSBC note a shift away from a "strong franc" policy does not automatically mean a preference for a "weak franc". They continue to see EUR-CHF grinding slightly lower in 2024 to 0.93.

- A slightly less hawkish Bank of Canada prompted the Canadian dollar to underperform its peers. The combination of the BOC developments and the stronger US data saw USDCAD rise around 60 points to 1.3500.

- Overall USDCAD maintains a firmer tone, working in favour of the latest shallow pullback proving technically corrective. Last week’s gains resulted in a move above the 50-day EMA, at 1.3459, confirming an extension of the bull cycle that started Dec 27. This opens 1.3538, 50.0% of the Nov 1 - Dec 27 bear leg.

- Both Norges Bank and ECB meetings take focus on Thursday. The US sees the Q4 advance release for GDP before the monthly PCE report for December on Friday.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/01/2024 | 0700/0800 | ** |  | SE | PPI |

| 25/01/2024 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/01/2024 | 0800/0900 | ** |  | ES | PPI |

| 25/01/2024 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 25/01/2024 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/01/2024 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 25/01/2024 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 25/01/2024 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 25/01/2024 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 25/01/2024 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 25/01/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 25/01/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/01/2024 | 1330/0830 | *** |  | US | GDP |

| 25/01/2024 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 25/01/2024 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 25/01/2024 | 1345/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 25/01/2024 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/01/2024 | 1500/1000 | * |  | CA | Payroll employment |

| 25/01/2024 | 1500/1000 | *** |  | US | New Home Sales |

| 25/01/2024 | 1515/1615 |  | EU | ECB's Lagarde ECB Podcast - latest monetary policy decisions | |

| 25/01/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 25/01/2024 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/01/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/01/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/01/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 26/01/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.