-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Higher Terminal Rate? No Fed Pivot Here

EXECUTIVE SUMMARY

- MNI US Inflation Insight, Oct'22: Pushing The ‘Pivot’ Out Even Further?

- MNI: Bullard Says CPI Vindicates Fed Front-Loading Strategy

- MNI BRIEF: Fed's George - Terminal Rate May Have To Be Higher

- MNI INTERVIEW: BOE Hikes May Be Destabilizing-Blanchflower

- MNI INTERVIEW: ECB May Hike Above 4% - Ex-Stability Head

US

US: Core CPI inflation again came in much stronger than expected in September: core goods showed signs of deceleration from easing supply chains and USD strength, but underlying services surged even further.

- There was moderately less breadth to inflation than in August, but that’s only comparing to the strongest median sequential inflation of the cycle, whilst year-ago rates hit new cycle highs.

- A fourth 75bp hike was locked in for the Nov 2 FOMC with growing focus on the chance of the same in December, especially so after today’s surprise rise in U.Mich inflation expectations.

FED: St. Louis Fed President James Bullard said Saturday the stronger-than-expected CPI report released last week vindicates the central bank's front-loading strategy of raising rates in supersized moves, arguing that a new disinflationary dynamic could take hold later this year so that the central bank reaches 2% in relatively short order.

- "We have a very serious inflation problem,'" he said at a monetary policy panel on the sidelines of the International Monetary Fund and World Bank annual meetings in Washington. But the "front loading strategy is the right one," he said, adding that the central bank’s aggressive interest-rate hikes so far have made relatively small waves in financial markets.

- While he is hearing more from his contacts about liquidity issues and is attuned to the issue, Bullard said it is still early days and "way too early" to say the central bank would change its QT plans anytime soon. "I would like it to be in place for some time," he said about QT. For more see MNI Policy main wire on Saturday at 1743ET.

FED: Kansas City Fed President Esther George said Friday the terminal fed funds rate may have to be higher and stay there longer, but she is more cautious than others about how quickly to raise rates to get to that point.

- George said she is concerned with the supersized steps that will take time to work their way through the economy, but a higher savings buffer suggests the central bank may have to raise rates to a higher peak than would otherwise be the case.

- "I am more cautious than most," she said about the Fed's hiking pace. "I'd prefer a steadier path." Markets widely expect a fourth 75 basis point increase to take the fed fed rate to a 3.75%-4% range at next month's FOMC meeting. The most hawkish forecasts from officials last month had the terminal rate at 4.75%-5%. For more see MNI Policy main wire at 1055ET.

EUROPE

UK: Aggressive rate hikes from the Bank of England may heighten the risk of instability, former Monetary Policy Committee member David Blanchflower told MNI, adding the distress experienced by UK pension funds in a dysfunctional gilts market could easily spread to other parts of the global financial system.

- “Stability is much more fragile than everybody thought, including in the United States,” Blanchflower said in an interview. “If last Monday every pension fund in the UK was about to fold, why would you not think that that might affect Vanguard or Fidelity or Schwab? Why would you not think that there was some global thing to this?”

- The ex-central banker said this puts an already-challenged BOE in an even more tenuous position, as it tries to quell the pension crisis and proceed with plans to actively sell gilts amid political turmoil which has shaken both the pound and debt markets. For more see MNI Policy main wire at 0856ET.

EU: Eurozone interest rates may go above 4% as inflation stays high for longer than expected, former senior European Central Bank official Ignazio Angeloni told MNI.

- September’s Eurosystem projections putting 2022 inflation at 8.1% and 5.5% next year are more or less correct in the absence of any further shocks, Angeloni said in an interview, but cost pressures will remain elevated for two to three years, as the initial energy and food price shocks slowly trickle down through the price and wage chain (see MNI INTERVIEW: ECB Hikes May Be Closer Than Thought).

- Markets are currently pricing in a terminal rate for the ECB’s deposit facility of around 3% by September 2023, based in part on the assumption that the neutral or equilibrium rate is between 1 and 2%. But this is a poor indicator of where rates will end up, said Angeloni, who served as head of the ECB’s Financial Stability and Macroprudential Policy department. For more see MNI Policy main wire at 0856ET.

US TSYS: Early Bond Rout Levels Out, Inflation Concerns Remain

Tsys and equity markets extending session lows in late morning trade after posting decent gains on the open.

- Several factors contributing to early reversal off highs: bonds initially followed Gilts after UK PM Liz Truss televised conf re: mini-budget comments, reversing planned freeze on corporate tax, comments on sacking of Chancellor Kwarteng (more on that shortly).

- Bonds gapped lower/extend session lows after U-Mich 1Y inflation exp climbed to 5.1% vs. 4.6% est - first time since March. Yield curves bounced off deepest inversion since April 2000 (2s10s -55.877) briefly before short end support waned.

- Lead quarterly EDZ2 futures extending session lows (-0.055 at 94.900) as KC Fed George and VC Cook express need for ongoing rate hikes to combat inflation, SF Fed Daly sees Fed "likely to raise interest rates as high as 5% to tackle stubborn inflation and keep restrictive policy for some time, some of her most hawkish comments to date." Chances of 75bp hikes at both Nov and Dec FOMC meeting gaining.

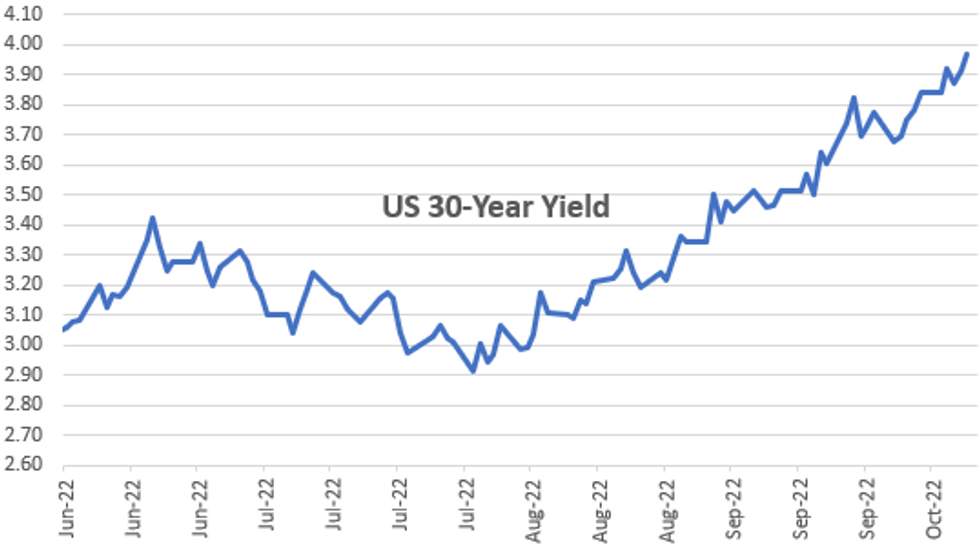

- Bond yields leveled out in the second half while equities continued to march lower. Currently, 2-Yr yield is up 3.5bps at 4.4981%, 5-Yr is up 6bps at 4.2606%, 10-Yr is up 5.8bps at 4.0019%, and 30-Yr is up 5.3bps at 3.9691%.

OVERNIGHT DATA

- US SEP RETAIL SALES +0.0%; EX-MOTOR VEH +0.1%

- US AUG RETAIL SALES REVISED +0.4%; EX-MV -0.1%

- SEP RETAIL SALES EX AUTO & GAS +0.3% M/M (FCST +0.2%)

- US SEP RET SALES EX GAS & MTR VEH & PARTS DEALERS +0.3% V AUG +0.6%

- US SEP RET SALES EX MTR VEH & PARTS DEALERS +0.1% V US SEP -0.1%

- US SEP RET SALES EX AUTO, BLDG MATL & GAS +0.4% V AUG +0.5%

- US SEP IMPORT PRICES -1.2%

- US SEP EXPORT PRICES -0.8%; NON-AG -0.9%; AGRICULTURE -1.0%

- MNI: US AUG BUSINESS INVENTORIES +0.8%; SALES +0.3%

- US AUG RETAIL INVENTORIES +1.3%

- MICHIGAN PRELIM. OCTOBER CONSUMER SENTIMENT AT 59.8; EST. 58.8

- MICHIGAN 1-YR INFLATION EXPECTATIONS RISES TO 5.1% FROM 4.7%

- MICHIGAN 5-YR INFLATION EXPECTATIONS RISES TO 2.9% AFTER 2.7%

- CANADA AUG WHOLESALE SALES +1.4%; EX-AUTOS +1.3%

- AUG WHOLESALE INVENTORIES +1.5%: STATISTICS CANADA

- CANADIAN AUG MANUFACTURING SALES -2.0% MOM

- CANADA AUG FACTORY INVENTORIES +1.3%; INVENTORY-SALES RATIO 1.7

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 371.69 points (-1.24%) at 29663.48

- S&P E-Mini Future down 80.75 points (-2.19%) at 3601

- Nasdaq down 295 points (-2.8%) at 10353.97

- US 10-Yr yield is up 5.8 bps at 4.0019%

- US Dec 10Y are down 13/32 at 110-19.5

- EURUSD down 0.0055 (-0.56%) at 0.9721

- USDJPY up 1.54 (1.05%) at 148.66

- WTI Crude Oil (front-month) down $3.3 (-3.7%) at $85.76

- Gold is down $25.8 (-1.55%) at $1640.44

- EuroStoxx 50 up 19.33 points (0.57%) at 3381.73

- FTSE 100 up 8.52 points (0.12%) at 6858.79

- German DAX up 82.23 points (0.67%) at 12437.81

- French CAC 40 up 52.73 points (0.9%) at 5931.92

US TSY FUTURES CLOSE

- 3M10Y +4.147, 27.081 (L: 12.771 / H: 29.402)

- 2Y10Y +2.172, -50.043 (L: -55.877 / H: -45.72)

- 2Y30Y +1.501, -53.42 (L: -56.334 / H: -45.662)

- 5Y30Y -0.954, -29.426 (L: -30.558 / H: -21.701)

- Current futures levels:

- Dec 2Y down 2.25/32 at 102-5.375 (L: 102-04.125 / H: 102-11.625)

- Dec 5Y down 8.5/32 at 106-13.75 (L: 106-10 / H: 107-03.75)

- Dec 10Y down 12.5/32 at 110-20 (L: 110-14 / H: 111-23)

- Dec 30Y down 25/32 at 123-25 (L: 123-14 / H: 125-31)

- Dec Ultra 30Y down 22/32 at 132-7 (L: 131-15 / H: 134-24)

US 10Y FUTURE TECHS: (Z2) Remains Vulnerable

- RES 4: 115-13+ Low Sep 7

- RES 3: 114-31+ 38.2% retracement of the Aug 2 - Sep 28 bear leg

- RES 2: 112-20/113-30 20-day EMA / High Oct 4 and the bull trigger

- RES 1: 111-28+ High Oct 12

- PRICE: 110-15+ @ 17:59 BST Oct 14

- SUP 1: 110-00 Psychological Support

- SUP 2: 109-23+ Low Nov 30 2007 (cont)

- SUP 3: 108.23 3.0% 10-dma envelope

- SUP 4: 108-18+ 1.00 projection of the Oct 4 - 11 - 13 price swing

Treasuries breached 110-19 on Thursday, the Sep 28 low and bear trigger. This resulted in a break out of this week’s consolidative range and confirms a resumption of the downtrend plus maintains the trend sequence of lower and lower highs. The focus is on 110.00 where a break would further reinforce bearish conditions. Initial key resistance is at 112-20, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.055 at 94.90

- Mar 23 -0.105 at 94.765

- Jun 23 -0.105 at 94.815

- Sep 23 -0.080 at 94.980

- Red Pack (Dec 23-Sep 24) -0.075 to -0.06

- Green Pack (Dec 24-Sep 25) -0.055 to -0.045

- Blue Pack (Dec 25-Sep 26) -0.045 to -0.04

- Gold Pack (Dec 26-Sep 27) -0.04 to -0.04

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00443 to 3.06614% (-0.01043/wk)

- 1M +0.03086 to 3.44300% (+0.12943/wk)

- 3M +0.11457 to 4.19371% (+0.28814/wk) * / **

- 6M +0.14672 to 4.68529% (+0.30058/wk)

- 12M +0.17714 to 5.28314% (+0.28685/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.19371% on 10/14/22

- Daily Effective Fed Funds Rate: 3.08% volume: $110B

- Daily Overnight Bank Funding Rate: 3.07% volume: $285B

- Secured Overnight Financing Rate (SOFR): 3.04%, $1.0T

- Broad General Collateral Rate (BGCR): 3.00%, $398B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $378B

- (rate, volume levels reflect prior session)

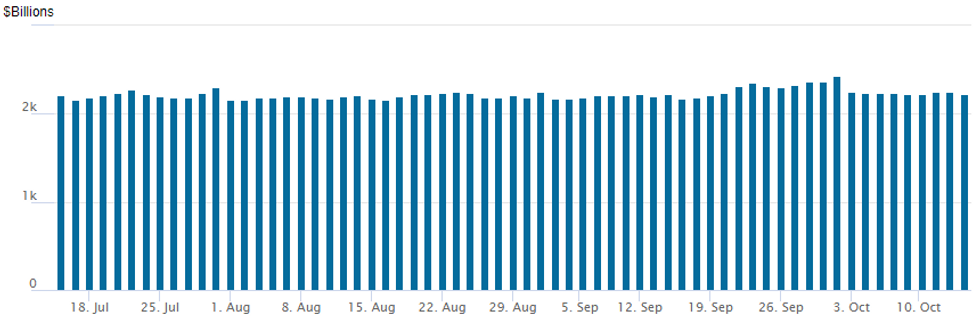

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,222.052B w/ 95 counterparties vs. $2,244.100B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $6.5B Morgan Stanley 3Pt Launched

Corporate bond issuance - largely absent this month due to market volatility and habit to not issue ahead of earnings w/latest cycle underway - takes a big step forward with $6B Morgan Stanley 3Pt issuance - the largest since $6.25B CS issuance on August 8.

- Date $MM Issuer (Priced *, Launch #)

- 10/14 $6.5B #Morgan Stanley $1.25B 4NC3 +165, $2.25B 6NC5 +205, $3B 11NC10 +235

EQUITIES: Preview: First Half Next Wk's Earnings Annc

Preview of salient earnings announcements for the first half of next week:- Monday:

- Bank of NY Mellon (BK) $1.01 est,

- Bank of America (BAC) $0.779 est and

- Charles Schwab (SCHW) $1.054 est

- Tuesday:

- Truist Financial (TFC) $1.231 est

- Signature Bank, NY (SBNY) $5.40 est

- Goldman Sachs (GS) $7.746 est

- State Street Corp (STT) $1.781 est

- Interactive Brokers (IBKR) $0.953 est

- Non-banks: Netflix (NFLX) $2.12 est; United Air (UAL) $$2.271 est;

- Wednesday:

- M&T Bank (MTB) $4.243 est

- Ally Financial (ALLY) $1.697 est

- Non-Banks: Abbott Labs (ABT) $$0.947; Baker Hughes (BKR) $0.246; Nasdaq $0.649 est; Proctor & Gamble (PG) $1.550 est; IBM $1.810 est; American Airlines (AA) $0.059 est, Tesla (TSLA) $1.02 est; Crown Castle (CCI) $1.918 est.

EGBs-GILTS CASH CLOSE: Weaker After Intraday Reversal

A volatile week closed with a characteristically volatile session, with early gains fully reversed across EGBs and Gilts, and bear steepening across the space.

- Once again, US data and UK politics were the driver. Gilts rallied in the morning as news filtered in that Chancellor Kwarteng would be replaced and a fiscal "U-Turn" announced.

- But yields reversed higher in the afternoon in a combination of "buy the rumour, sell the fact" and profit-taking, with robust US retail sales and surprisingly high UMichigan inflation expectations adding fuel to the fire.

- Though short-end yields remained relatively anchored (next BoE pricing remained around 100bp), long-end Gilts underperformed, with 30Y yields jumping 60bp off the lows.

- Bunds outperformed Gilts easily, while BTP spreads widened sharply in the afternoon after the US data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 3.5bps at 1.956%, 5-Yr is up 3.3bps at 2.114%, 10-Yr is up 5.9bps at 2.346%, and 30-Yr is up 9.8bps at 2.399%.

- UK: The 2-Yr yield is up 11.6bps at 3.916%, 5-Yr is up 7.4bps at 4.318%, 10-Yr is up 13.7bps at 4.335%, and 30-Yr is up 23.4bps at 4.784%.

- Italian BTP spread up 5.1bps at 244.4bps / Spanish up 1.2bps at 117.1bps

FOREX: Tsy Sec Yellen Says Market-Determined FX is Best for Dollar

Treasury Secretary Janet Yellen said Friday the appreciation of the dollar this year is a reflection of economic fundamentals and market-determined exchange rates are best for the dollar.

- "My position would be that market-determined exchange rates are the best regime for the dollar," said Yellen, a former chair of the Federal Reserve. "I think that exchange rate movements by and large have been a response to economic shocks and other fundamentals. Nevertheless, there are spillovers from tightening monetary policy." Earlier this week the G7 issued a statement recognizing that many currencies have moved significantly this year with increased volatility, and reaffirmed its exchange rate commitments as elaborated in May 2017. (See: MNI SOURCES: G7 To Repeat Commitment To Market-Determined FX).

- The IMF earlier in the day, however, said in a blog the strengthening of the dollar in a matter of months has sizable macroeconomic implications for almost all countries, given the U.S. currency's dominance in international trade and finance. The international body said temporary foreign exchange intervention may be appropriate in some instances to help prevent adverse financial amplification if a large depreciation increases financial stability risks.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/10/2022 | 2301/0001 | * |  | UK | Rightmove House Prices Index |

| 17/10/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/10/2022 | 0800/1000 |  | EU | ECB de Guindos Speaks on Euro Anniversary | |

| 17/10/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/10/2022 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 17/10/2022 | 1500/1700 |  | EU | ECB Lane at Bocconi Uni & Deutsche Bank Roundtable | |

| 17/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/10/2022 | 2000/1600 |  | CA | BOC Deputy Rogers panel talk at Toronto Centre |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.