-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Implied Rate Hike Steady at 25Bp

EXECUTIVE SUMMARY

US

FED: MNI expects the FOMC to hike the Funds rate by 25bp to 4.75-5.00% at the March meeting, with markets implying a 60% chance of a quarter-point raise and 40% of a pause.

- This will come alongside a new Dot Plot that raises the 2023 median rate expectation by 25bp to 5.4%, and tweak of the Statement's forward guidance to indicate that the terminal rate is nearing.

- Of the 28 analyst previews of the March FOMC decision whose previews MNI have seen, 23 expect a 25bp hike at the February FOMC. 4 see a pause, and 1 sees a cut.

- Recent banking sector volatility will probably result in a tightening of financial conditions that warrants a lower terminal Fed funds rate than may have been foreseen just a couple of weeks ago.

- That said, Powell’s task in the press conference will be to acknowledge risks stemming from banking sector uncertainty while emphasizing that the Fed’s primary focus is the fight against well-above-target inflation.

- Former policymakers told MNI a quarter-point hike taking the fed funds rate target to 4.75% to 5.0% is a likely outcome as the U.S. central bank signals it has other tools to shore up financial stability. Investors are pricing in a 75% chance of a 25 bp move, followed by several rate cuts starting in June.

- Pausing rate hikes with CPI at 6% would risk the Fed's inflation-fighting credibility and raise doubts about the effectiveness of its latest interventions, former Philadelphia Fed President Charles Plosser says. (See: MNI INTERVIEW: Fed Pause Would Undermine Credibility - Plosser)

- But former Boston Fed chief Eric Rosengren and others urge the Fed to take a wait-and-see stance to see how the crisis is hitting the real economy.

US TSYS: Yield Climb Amid Unwinds Ahead Wed's FOMC

- Front month Treasury futures are trading near session lows after the bell. maintaining a relatively narrow range in the second half. Treasuries had traded moderately firmer in early London trade, unwinding support amid various Central Bank efforts to stem regional bank panic.

- Risk improved briefly after liquidity operations via standing U.S. dollar liquidity swap line arrangements announced Sunday, while the SNB also announced UBS's $3.25B takeover of Credit Suisse.

- Concerns over credit risk remained after CS' AT1 bond rout with holders of $17B debt taking the loss in full. A distracting narrative ahead of this Wednesday's FOMC policy announcement, the collapse of Silicone Valley Bank and Signature Bank over a week ago continues to weigh on regional banks (FRC -40%).

- While the collapse in financial shares over the past week have loosened policy expectations from: how many 50bp rate hikes by year end, to how soon will the Fed cut rates (implied pricing targeting July this morning), short end rates are traded lower (2Y yield currently 3.9177% +.0803), yield curves bear flattened amid ongoing wide ranges: 2s10s tapped -53.105 low earlier, vs. -33.080 overnight.

OVERNIGHT DATA

No economic data released Monday, focus on the midweek FOMC policy announcement, 25bp hike anticipated.

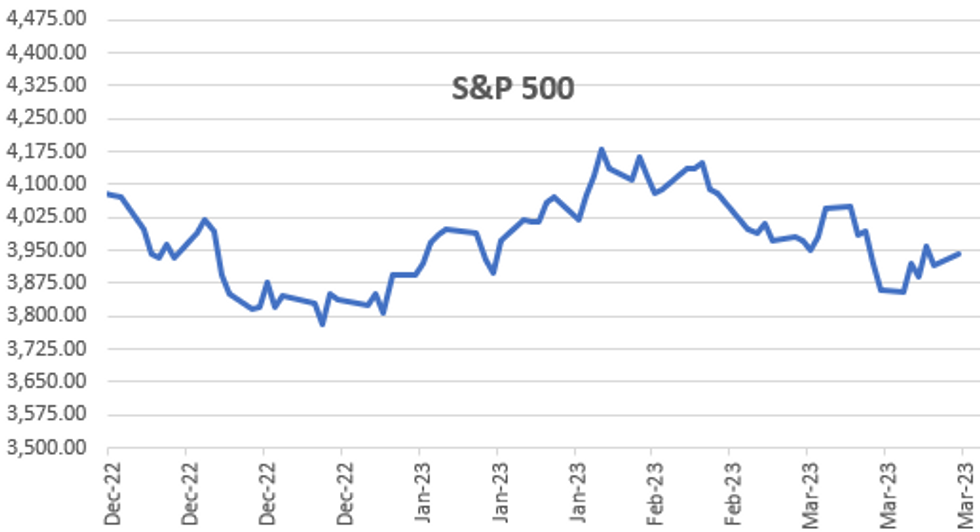

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA up 290.29 points (0.91%) at 32151.58

- S&P E-Mini Future up 25.75 points (0.65%) at 3972.5

- Nasdaq up 16.2 points (0.1%) at 11646.69

- US 10-Yr yield is up 5.2 bps at 3.4809%

- US Jun 10-Yr futures are down 23.5/32 at 115-2.5

- EURUSD up 0.005 (0.47%) at 1.072

- USDJPY down 0.43 (-0.33%) at 131.43

- WTI Crude Oil (front-month) up $0.64 (0.96%) at $67.38

- Gold is down $8.48 (-0.43%) at $1980.95

- European bourses closing levels:

- EuroStoxx 50 up 54.43 points (1.34%) at 4119.42

- FTSE 100 up 68.45 points (0.93%) at 7403.85

- German DAX up 165.18 points (1.12%) at 14933.38

- French CAC 40 up 87.74 points (1.27%) at 7013.14

US TREASURY FUTURES CLOSE

- 3M10Y -12.688, -115.374 (L: -126.417 / H: -102.355)

- 2Y10Y -4.84, -45.957 (L: -53.105 / H: -33.08)

- 2Y30Y -5.404, -28.009 (L: -36.262 / H: -7.912)

- 5Y30Y -3.641, 7.967 (L: 3.055 / H: 24.668)

- Current futures levels:

- Jun 2-Yr futures down 6/32 at 103-19.125 (L: 103-13.5 / H: 104-07.5)

- Jun 5-Yr futures down 16.75/32 at 109-22.5 (L: 109-13.75 / H: 110-31)

- Jun 10-Yr futures down 23.5/32 at 115-2.5 (L: 114-25 / H: 116-24)

- Jun 30-Yr futures down 1-08/32 at 131-15 (L: 131-05 / H: 133-29)

- Jun Ultra futures down 1-28/32 at 141-31 (L: 141-16 / H: 145-12)

US 10YR FUTURE TECHS: Key Resistance Remains Exposed

- RES 4: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 3: 117-00 61.8% of the Aug - Oct 2022 bear leg (cont)

- RES 2: 116-28+ High Jan 19 and key resistance

- RES 1: 116-24 Intraday high

- PRICE: 115-03 @ 1510ET Mar 20

- SUP 1: 114-25 Low Mar 20

- SUP 2: 114-01+ Low Mar 17

- SUP 3: 113-09+ 50-day EMA

- SUP 4: 112-21 Low Mar 13

Treasury futures are trading in a volatile manner rallying through 116.00 earlier Monday. A bullish short-term outlook remains intact. Key support to watch lies at 113-09+, the 50-day EMA and this level also represents a short-term pivot level.The focus is on 116-28+, the Jan 19 high and a key resistance. On the downside, a clear breach of the 50-day EMA would expose 112-21, the Mar 13 low.

EURODOLLAR FUTURES CLOSE

- Jun 23 -0.080 at 95.055

- Sep 23 -0.155 at 95.545

- Dec 23 -0.145 at 95.760

- Mar 24 -0.10 at 96.070

- Red Pack (Jun 24-Mar 25) -0.09 to -0.08

- Green Pack (Jun 25-Mar 26) -0.09 to -0.07

- Blue Pack (Jun 26-Mar 27) -0.13 to -0.10

- Gold Pack (Jun 27-Mar 28) -0.13 to -0.11

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00529 to 4.55557% (+0.00372 total last wk)

- 1M -0.02542 to 4.75229% (-0.02086 total last wk)

- 3M -0.05129 to 4.94714% (-0.13971 total last wk)*/**

- 6M -0.20358 to 4.84871% (-0.37600 total last wk)

- 12M -0.33071 to 4.70343% (-0.70400 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $85B

- Daily Overnight Bank Funding Rate: 4.57% volume: $269B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.265T

- Broad General Collateral Rate (BGCR): 4.53%, $500B

- Tri-Party General Collateral Rate (TGCR): 4.53%, $484B

- (rate, volume levels reflect prior session)

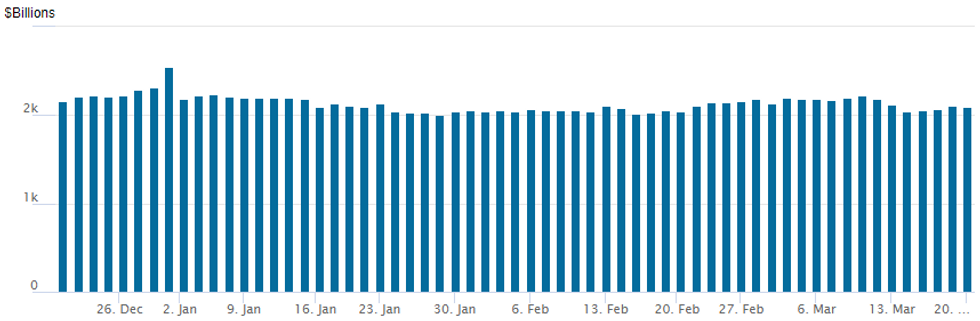

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,098.393B w/ 97 counterparties vs. prior session's $2,.106.166B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $900M CenterPoint Energy Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/20 $750M #Duke Energy Ohio $375M 10Y +175, $375M 30Y +2200

- 03/20 $900M #CenterPoint Energy Houston $600M 10Y +150, $300M 30Y +165

FOREX: Greenback Extends Weakness, USD Index To Fresh One-Month Low

- The USD index looks set to post a third consecutive losing session, declining 0.35% on Monday and falling below last week’s lows of 103.44 in the process. Despite an early sell-off across equity markets, the greenback failed to garner any upward momentum during European hours and the subsequent bounce for risk has in turn weighed consistently on the US dollar.

- GBPUSD (+0.85%) has outperformed on the session, second to only the Swedish Krona. The pair has been grinding consistently higher to breach the mid-Feb resistance of 1.2269. A close and break above this mark would be a bullish development in the near-term, but the more solid upside level crosses at the Dec/Jan highs of 1.2446/48. GBP/JPY has also traded back into positive territory and has seen a near 1.5% recovery off the 158.97 session lows.

- In similar vein, the likes of the Euro and the Canadian dollar are making advances of around 0.5% amid the improved risk backdrop and market calm following the CS/UBS tie-up and the associated headlines concerning a write-down for Credit Suisse AT1 holders. Conversely, the Swiss Franc does remain under pressure with notable 0.75% gains for EURCHF, extending the bounce from last week’s lows and narrowing the gap with parity once more.

- RBA minutes and Canadian CPI highlight Tuesday’s docket. Focus the turns to Wednesday’s FOMC decision/statement. There aren't many sell-side analysts calling for a Fed hold this week, however of 25 FOMC previews we've reviewed so far (and only taking into account those written/updated at the end of last week or today, given how quickly events have moved), four see a pause, with the rest eyeing a 25bp hike.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/03/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 21/03/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2023 | 1230/0830 | *** |  | CA | CPI |

| 21/03/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/03/2023 | 1230/1330 |  | EU | ECB Lagarde Panellist at BIS Summit | |

| 21/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/03/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.