-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Jan Jobs Surge Underscores Rate Cut High Bar

- MNI: Bowman Says Fed Not Yet At Point It Can Lower Rates

- MNI: US Jan Hiring, Wage Gains Rocket Above Expectations

- MNI US: Senator Murphy: Border Security Bill Out "This Weekend"

- MNI US DATA: AHE Surge Boosted By (Probably) A Weather-Induced Hours Work Slump

- MNI US DATA: Surprise Dip In Unemployment Rate As Participation Rate Almost Holds Steady

US

FED (MNI): Federal Reserve Governor Miki Bowman on Friday said a number of important inflation risks remain and the Fed should not yet lower the fed funds rate target range to prevent from overshooting.

"My baseline outlook is that inflation will decline further with the policy rate held at the current level," she said in prepared remarks for an unscheduled speech.

"Should the incoming data continue to indicate that inflation is moving sustainably toward our 2% goal, it will eventually become appropriate to gradually lower our policy rate to prevent monetary policy from becoming overly restrictive. In my view, we are not yet at that point." Bowman voted alongside her FOMC colleagues earlier this week to maintain the Fed's policy rate at its current level of 5.25% to 5.5%. (See: MNI INTERVIEW: Ex-Fed's Lockhart Sees No Rush To Cut In 1H)

NEWS

US (MNI): Senator Murphy: Border Security Bill Out "This Weekend"

Lead Democrat negotiator Chris Murphy (D-CT) has said in a statement on X, that the long-awaited bipartisan Senate bill to overhaul US-Mexico border security will be out "this weekend."

GLOBAL POLTICAL RISK (MNI): CMA CGM Suspends Transit Of Red Sea

Bloomberg reporting that French shipping group CMA CGM has suspended transit by its vessels of the Bab Al-Mandab strait, in and out of the Red Sea, after a period of CMA CGM ships trafficking the waterway under French navy escort.

RUSSIA (MNI): 'Anti-War' Candidate Could Be Blocked From Appearing On Ballot-RTRS

Reuters is reporting that according to state outlet Tass, the Russian Central Electoral Commission (CEC) has found irregularities in the signatures collected by presidential hopeful Boris Nadezhdin, seen as the 'anti-war' candidate, as he seeks to make it onto the ballot for the March 15-17 presidential election.

GERMANY (MNI): Bundestag Passes '24 Budget, But '25 Negotiations Loom Large

The German Bundestag has approved the 2024 budget following a difficult political process that was exacerbated by a ruling from the Constitutional Court in late-2023.

US TSYS January Jobs Surge Weighs on Projected Rate Cut pricing

Tsy futures gapped lower after broadly higher than expected Change in Nonfarm Payrolls of +353k vs 185k est (prior up-revised to 333k from 216k), Private Payrolls surge to +317k vs. 170k est. Unemployment Rate 3.7% vs. 3.8% est while Labor Force Participation Rate near steady at 62.5% vs. 62.6% est.

- Futures continued to extend lows after little initial react to UofM and Factory/Durables Order data

- U. of Mich. Sentiment (79.0 vs 78.9 est)

- U. of Mich. Current Conditions (81.9 vs. 83.5 est)

- U. of Mich. Expectations (77.1 vs. 76.0 est)

- U. of Mich. 1 Yr Inflation (2.9% vs. 2.9% est), 5-10 Yr (2.9% vs. 2.8% est)

- Mar'24 10Y futures currently trading -1-06.5 at 111-22. Technical support at 111-16/110-26 Low Feb 2 / Low Jan 19 and bear trigger. Curves remain flatter but well off lows: 2s10s -2.206 at -34.839 (-40.198 low), while 10Y yield remained above 4% at 4.0237% (+.1435) after starting the day around 3.8648%.

- Factory Orders in-line w/ 0.2% vs. est, Ex Trans (0.4% vs. 0.2% vs. est)

- Durable Goods Orders in line w/ 0.0% vs. est, ex Trans (0.5% vs. 0.6% vs. est)

- SOFR futures gapped lower (SFRH4-SFRZ4 -0.080-0.210) while projected rate cut chances retreated: March 2024 chance of 25bp rate cut currently -22.2% vs. -38.7% pre-data w/ cumulative of -5.6bp at 5.263%, May 2024 at -70.6% vs. -90.8% w/ cumulative -23.2bp at 5.087%, while June 2024 at retreated to -87.9% vs. 105% w/ cumulative -45.2bp at 4.867%. Fed terminal at 5.3175% in Feb'24.

OVERNIGHT DATA

U.S. employers added 353,000 jobs in January and hiring for the last two months of 2023 were revised up another 126,000, nearly double what Wall Street analysts expected, while average hourly earnings also topped predictions, coming in at 0.553% in January compared to 0.38% in December, the Bureau of Labor Statistics said Friday. The unemployment rate stayed at 3.7%.

- The hot labor market data will make the Federal Reserve more comfortable about holding interest rates higher for longer. Treasury yields spiked and futures fell and the dollar strengthened, while the chance of March cut fell to 24% from 40% before the report. (See: MNI INTERVIEW: US Manufacturing Nearing Growth Phase, ISM Says)

- Job gains were led by professional and business services, which added 74,000 payrolls, much higher than the average monthly increase of 14,000 in 2023, the BLS said. Health care employment also rose 70,000. Average hourly earnings increased 4.5% over the year. Benchmark revisions contributed to the positive revisions for December and November and lifted the average monthly pace for private payroll gains to 170,000 in the second half of 2023 from 134,000 previously, the BLS said.

- AHE Unrounded - Jan'24 Far stronger than the 0.3% expected

- Total AHE:

- M/M (SA): 0.553% in Jan from 0.38% in Dec (initial 0.44%)

- Y/Y (SA): 4.475% in Jan from 4.311% in Dec

- AHE Non-Supervisory:

- M/M (SA): 0.440% in Jan from 0.374% in Dec (initial 0.341%)

- Y/Y (SA): 4.769% in Jan from 4.605% in Dec

US DATA (MNI) AHE growth obviously far stronger than expected in January at 0.55% M/M for total (cons 0.3) or 0.44% for non-supervisory.

- It’s the strongest M/M print since Mar’22 and annual revisions were also higher albeit back-loaded: stronger back in 1H23 (0.38% average vs 0.34% prior) but marginally softer in 2H23 (0.32 vs 0.33% prior).

- It was helped significantly by average weekly hours seeing a highly unusual 0.2pp drop to 34.1. It breaks the pattern of oscillating between 34.3-34.4 since Mar’23, and outside of Mar’20 was last lower in mid-2010.

- There’s a (possibly strong) argument that bad weather biased this lower. Hours are more prone to weather disruption than payroll estimates, and construction, transportation & warehousing, and leisure & hospitality saw the largest declines on the month (-0.4/-0.4/-0.5pps). Further adding to this argument, in the household survey, the 553k not at work due to bad weather was the highest for a January since 2011.

- Nevertheless, it’s still a stark surprise for hours worked, with no analysts forecasting a 34.1 (4 of 29 saw 34.2, 17 saw 34.3 and 8 saw 34.4). If it doesn’t bounce next month it would be a firmly dovish sign.

US DATA (MNI): Surprise Dip In Unemployment Rate As Participation Rate Almost Holds Steady

- Turning to the household survey, the u/e rate was lower than expected. We had indicated a skew lower from primary dealer analysts but even then the decline was large, nearly tilting into a rounded 3.6 with 3.66% after 3.74%.

- A -240k population control effect for household employment was surprisingly low to us, whilst excluding this effect it would have increased 239k for only limited bounce after December’s -683k.

- On the same basis, unemployment fell by -116k on the month when removing the population control effect after +6k in Dec.

US DEC FACTORY ORDERS +0.2%; EX-TRANSPORT NEW ORDERS +0.4%

US DEC DURABLE ORDERS +0.0%

US DEC NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.2%

US DATA: U.Mich 5-10Y Expectations Revise Away Latest Decline. U.Mich inflation expectations are unrevised for the near-term and revised higher for an unchanged monthly reading for the longer-term.

- 1Y: 2.9% (prelim 2.9, cons 2.9) in Jan after 3.1% in Dec.

- 5-10Y: 2.9% (prelim 2.8, cons 2.8) in Jan after 2.9% in Dec.

- It means 5-10Y inflation expectations didn’t actually drop out of the 2.9-3.1% range seen in all but two months lower and one month higher since Aug’21.

- Whilst down from a recent high of 3.2% in Nov (highest since 2011), it doesn’t match the moderation seen in the NY Fed’s 3Y and 5Y measures of 2.6% and 2.5% in December.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 249.01 points (0.65%) at 38769.08

- S&P E-Mini Future up 66.75 points (1.35%) at 4995.25

- Nasdaq up 293.4 points (1.9%) at 15655.44

- US 10-Yr yield is up 14.9 bps at 4.0294%

- US Mar 10-Yr futures are down 39.5/32 at 111-21

- EURUSD down 0.0076 (-0.7%) at 1.0796

- USDJPY up 1.85 (1.26%) at 148.28

- WTI Crude Oil (front-month) down $1.75 (-2.37%) at $72.07

- Gold is down $17.16 (-0.84%) at $2037.74

- European bourses closing levels:

- EuroStoxx 50 up 15.95 points (0.34%) at 4654.55

- FTSE 100 down 6.62 points (-0.09%) at 7615.54

- German DAX up 59.17 points (0.35%) at 16918.21

- French CAC 40 up 3.51 points (0.05%) at 7592.26

US TREASURY FUTURES CLOSE

- 3M10Y +14.372, -134.8 (L: -153.201 / H: -133.03)

- 2Y10Y -1.634, -34.267 (L: -40.198 / H: -31.863)

- 2Y30Y -5.962, -14.808 (L: -20.426 / H: -7.753)

- 5Y30Y -7.246, 23.109 (L: 21.734 / H: 31.3)

- Current futures levels:

- Mar 2-Yr futures down 11.125/32 at 102-17.125 (L: 102-14.875 / H: 102-27.875)

- Mar 5-Yr futures down 27.5/32 at 107-27 (L: 107-23 / H: 108-21.5)

- Mar 10-Yr futures down 39.5/32 at 111-21 (L: 111-16 / H: 112-27.5)

- Mar 30-Yr futures down 67/32 at 121-30 (L: 121-19 / H: 124-00)

- Mar Ultra futures down 87/32 at 128-31 (L: 128-17 / H: 131-24)

US 10Y FUTURE TECHS: (H4) Trades Through The 20-Day EMA

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 113-06+ High Feb 1

- PRICE: 111-21+ @ 19:00 GMT Feb 02

- SUP 1: 111-16/110-26 Low Feb 2 / Low Jan 19 and bear trigger

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11 and a key short-term support

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

Treasuries have pulled back sharply, following today’s labour report. The move lower defines an initial key resistance at 113-06+, the Feb 1 high, where a break is required to reinstate a bullish theme and expose the bull trigger at 113-12, the Dec 27 high. Today’s sell-off has resulted in a break of the 20-day EMA, at 111-24+. A continuation lower would strengthen the bearish threat and expose 110-26, the Jan 19 low and bear trigger.

SOFR FUTURES CLOSE

- Mar 24 -0.085 at 94.805

- Jun 24 -0.195 at 95.185

- Sep 24 -0.230 at 95.590

- Dec 24 -0.235 at 95.955

- Red Pack (Mar 25-Dec 25) -0.235 to -0.205

- Green Pack (Mar 26-Dec 26) -0.195 to -0.19

- Blue Pack (Mar 27-Dec 27) -0.185 to -0.18

- Gold Pack (Mar 28-Dec 28) -0.175 to -0.17

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00141 to 5.32211 (-0.01436/wk)

- 3M +0.01788 to 5.29046 (-0.02697/wk)

- 6M +0.01227 to 5.0961 (-0.06130/wk)

- 12M -0.00974 to 4.69280 (-0.10618/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.897T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $703B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $689B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $81B

- Daily Overnight Bank Funding Rate: 5.3-% (-0.01), volume: $254B

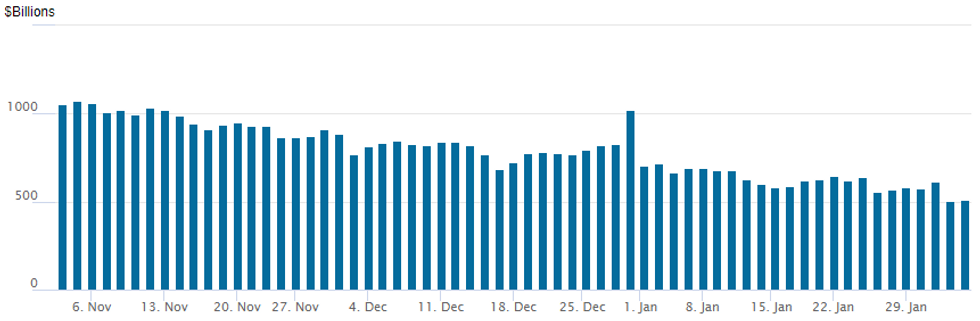

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $513.422B vs. $503.548B yesterday, the lowest level since mid-2021. Compares to prior low of $557.687B on Thursday, January 25.

- Meanwhile, the number of counterparties back up to 80 from 74 Thursday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE

No new US$ corporate issuance Friday after $1B priced Thursday.

- Date $MM Issuer (Priced *, Launch #

- 2/1 $1B *Alexandria Real Estate $400M 12Y +140, $600M 30Y +150

- 2/1 $Benchmark Korean Development Bank (KDB) 3Y, 5Y investor calls

- 2/1 $Benchmark Republic of Benin 14Y investor calls

- 2/1 $500M Allied Universal Holdco 7NC3 investor calls

FOREX USD Surges Higher Following Bumper Payrolls Data, JPY & NZD Pressured

- A much higher-than-expected increase in nonfarm payrolls, a dip in the unemployment rate and a boost for average hourly earnings contributed to a sharp move higher for both US yields and the greenback on Friday. An initial gap higher for the USD index (+0.85%) extended into late session trade, and looks set to close around 104.00, the highest level since mid-December.

- Continued sensitivity to core rates leaves the Japanese yen as the joint poorest performer in G10 on Friday, alongside the New Zealand dollar. USDJPY’s impressive 150-pip jump in the aftermath of the US data was briefly capped around the 148.00 figure, however, the pullback remained very shallow, and the pair then extended gains above the figure in mid0afternoon trade.

- Price action sees USDJPY rise 1.28% on the session, narrowing the gap with the January highs which reside at 148.80, closely followed by 149.16, a Fibonacci retracement. The trend outlook is unchanged and remains bullish, moving average studies have recently crossed and are now in a bull-mode set-up. This reinforces the current trend condition and highlights positive market sentiment. For reference, notable levels further out include 149.75 and 150.78, the November 22 and 17 highs respectively.

- For Kiwi, bearish price action across January was re-established with the 20 and 50-day EMA acting as solid resistance overall in NZDUSD. The pair made a new low on the year by 3 pips, reaching the 100-day SMA in late trade.

- Overall, the greenback had some volatile swings this week. Initial weak US data and regional bank concerns weighed before being trumped by a moderately hawkish Fed, who appeared to set a high bar to a March cut, and then by the much firmer-than-expected employment data.

- China Caixin Services PMI headlines the APAC docket on Monday before the focus turns to US Services PMI data, scheduled later in the session.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/02/2024 | 0030/1130 | ** |  | AU | Trade Balance |

| 05/02/2024 | 0700/0800 | ** |  | DE | Trade Balance |

| 05/02/2024 | 0700/0200 | * |  | TR | Turkey CPI |

| 05/02/2024 | 1000/1100 | ** |  | EU | PPI |

| 05/02/2024 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/02/2024 | 1530/1030 |  | CA | BOC quarterly Market Participants Survey | |

| 05/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 05/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/02/2024 | 1900/1400 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.