-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Job Gains, Unemployment Rate Rise Ahead FOMC

- MNI Fed Preview - Jun 2024: See You In September

- MNI FED: Jobs Report Shifts Balance Of Risks Further Toward 1-Cut 2024 Dot

- MNI US DATA: Key Stats Of Interest: Older Workers Leaving Workforce

- MNI US DATA: Key Stats Of Interest: Sharp Full-Time Job Drop, Part-Time Bounce

- MNI US DATA: Private Payrolls Impress In Solid Establishment Survey Beat

US

FED (MNI): Fed Preview - Jun 2024: See You In September: The FOMC will ensure a full year of the Fed funds rate remaining at 5.25-5.50% when it holds steady at the June 11-12 meeting, but focus remains firmly on what they signal for potential easing later this year.

NEWS

FED (MNI): Jobs Report Shifts Balance Of Risks Further Toward 1-Cut 2024 Dot

If you take the Establishment survey at face value, May's Employment Situation report was unambiguously strong and is the opposite of what the FOMC would need to see to bring forward its cutting timetable. The strong performance in private sector payrolls, especially in cyclical sectors that looked like they were fading (construction and various services jobs, and even transportation/warehousing), was particularly impressive. As the first key "hard" data for May, it makes April's softer data look like something of an anomaly.

US DATA (MNI): Weak Household Survey Continues To Tell Much More Pessimistic Story

The real question in May's employment report is: what is going on with the Household survey which showed unemployment picking up unexpectedly to 4.0% from 3.9% (recall that the unemployment rate is calculated from the Household survey, not the headline payrolls Establishment survey).

SECURITY (MNI): Biden Nuclear Advisor Hints At Expansion Of US Nuclear Inventory

Reuters carrying comments from Pranay Vaddi, Senior Director for Arms Control at the White House National Security Council, outlining a "more competitive approach" to arms control in a speech to the Arms Control Association and responding to hawkish remarks from Russian President Vladimir Putin on nuclear weapons today.

BELGIUM (MNI): Lengthy Coalition Building Period Could Be Needed After 9 June Election

Belgium holds its federal election on 9 June. Given Belgium's complex political system and plethora of parties representing French, Dutch, and German speaking communities, the election will not deliver a clear-cut answer as to which parties will form the next gov't.

US TSYS May Jobs Gain, Unemployment Rate Rise; Focus on CPI, FOMC Next Wed

- Broadly weaker after the bell, Treasuries have actually traded sideways since the initial gap sell-off following the higher than expected jobs gain of 272k (+180k est), offset slightly by -15k 2-month revisions.

- Amid the dip in 55+ labor market participation (0.2pp to 38.2%) which drove the overall unexpected dip in May: it was in turn driven by a drop in Male 55+ participation to 43.4% (43.7% prior), with female participation -0.1pp to 33.6%. That's the lowest 55+ male participation rate seen since 2005 - which will act as a constraint on labor supply, which may concern the FOMC.

- Treasury futures actually extended session highs briefly, Sep'24 10Y (TYU4) tapping 110-21 before falling to 109-09.5 -- the widest gap move since April's CPI release. The 10Y contract traded in a 7 tic range since the data, trades -1-02 at 109-09.5 after the bell.

- Cash yields are broadly higher: 2s +.1585 at 4.8826%, 10s +.1406 at 4.4276%, 30s +.1118 at 4.5470%, while curves are running flatter: 2s10s -1.381 at -45.498, 5s30s -4.450 at 8.974.

- Late year rate cut projections have receded vs. late Thursday levels (*): June 2024 at -1.3% w/ cumulative rate cut -.3bp at 5.328%, July'24 at -8% w/ cumulative at -2.3bp (-5.9bp) at 5.307%, Sep'24 cumulative -13.7bp (-21.3bp), Nov'24 cumulative -20.3bp (-30.7bp), Dec'24 -37.4bp (-49.7bp).

- Looking ahead, main focus is on CPI inflation data for May Wednesday morning, followed by the FOMC policy announcement at 1400ET that afternoon.

OVERNIGHT DATA

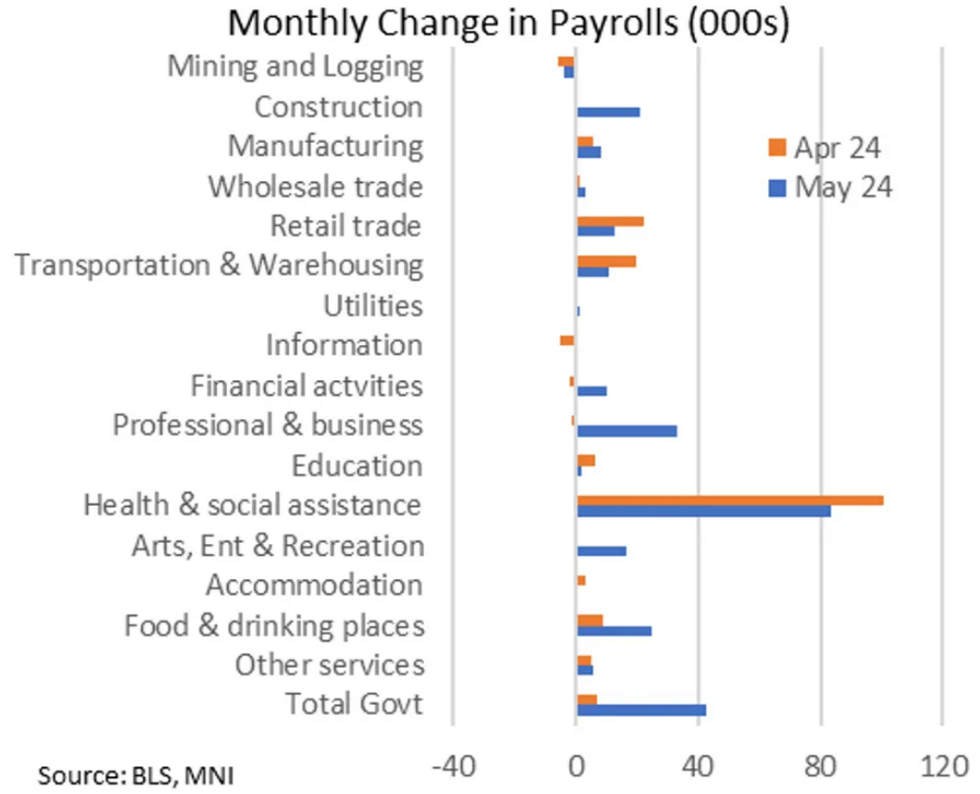

US DATA (MNI): Private Payrolls Impress In Solid Establishment Survey Beat: The Establishment survey in May's Employment Report is clearly much stronger than had been expected, with +272k representing a beat of 92k on headline expectations of +160k (offset slightly by -15k 2-month revisions) and 69k in private payrolls (which came in at +229k, albeit offset by 20k lower revisions).

- Gov't jobs rebounded from April's 7k (rev lower from 8k) but just to 43k (had averaged 67k in Q1), so as the arithmetic implies, the gains in the establishment survey were clearly private payroll-driven - which will be considered a more "solid" gain in terms of overall labor market dynamics.

- Gains picked up most notably in "professional & business" activity (+33k vs -1k prior) and "food & drink@ (+25k vs 9k prior), with health/social assistance still solid at +84k (+101k prior). Construction jobs also picked up to +21k (0k prior).

- April now looks clearly like a weak anomaly therefore, with services jobs performing solidly (private goods production sectors were relatively flat outside of Construction).

US DATA (MNI): Avg Hourly Earnings Unrounded - May '24: Upward revision to prior Avg Hourly earnings.

Solid unrounded and easy beat (4-month high in AHE) vs 0.3% M/M expected. Non-supervisory AHE soared to fastest growth since Mar 2023 - potentially minimum wage impacts as flagged by some analysts who looked for upside risks to the overall figure.

- Total AHE: M/M (SA): 0.403% in May from 0.231% in Apr (initial 0.202%);

- Y/Y (SA): 4.085% in May from 3.977% in April

- AHE Non-Supervisory: M/M (SA): 0.469% in May from 0.201% in Apr (initial 0.202%);

- Y/Y (SA): 4.168% in May from 4.079% in April

US DATA (MNI): Key Stats Of Interest: Older Workers Leaving Workforce: A few other statistics of interest in the Employment Report:

- The U-6 underemployment gauge was steady at 7.4% (same as April), still representing an uptick from earlier in the year (Dec '23 was 7.1%) and the joint-highest since November 2021, mirroring the overall unemployment rate.

- The employment-to-population ratio (Household survey) dipped to 60.1% from 60.2% prior - unrounded, that's the lowest unrounded figure since 59.9% in Nov 2022, with the labor force falling by 250k (biggest drop since Dec '23).

- Employment among the foreign-born rose 414k to 30.896m (though still below the Mar'24 high of 31.114m). with the number of native-born employed down 663k to 130.445m. Vs May 2023, those totals represent +637k (foreign) vs -229k (native-born).

- Amid the dip in 55+ labor market participation (0.2pp to 38.2%) which drove the overall unexpected dip in May: it was in turn driven by a drop in Male 55+ participation to 43.4% (43.7% prior), with female participation -0.1pp to 33.6%. That's the lowest 55+ male participation rate seen since 2005 - which will act as a constraint on labor supply, which may concern the FOMC.

US DATA (MNI): Key Stats Of Interest: Sharp Full-Time Job Drop, Part-Time Bounce: Elsewhere, of interest in the Employment Report:

- The 3M/3M annual run rate of average hourly earnings ticked up to 3.8% from 3.7% prior; for non-supervisory workers, was up to 3.6% from 3.5%. Both are well below 4+% rates seen in Q1 though and looking at a longer-term horizon the trend remains to the downside, albeit probably still too high to be of comfort to the FOMC.

- Average weekly hours were steady at 34.3 (same as April), exactly in line with the 12-month average.

- The Household survey showed full-time jobs dropped by 694k (+939k prior), with part-time jobs up 286k (-914k prior) - a significant role reversal vs last month, with no obvious explanation.

- Full-time jobs have dropped by 310k this year, vs +210k for part-timers.

- Multiple jobholders were basically steady at 8.399m.

- Temporary help services payrolls - considered by some as a forward looking indicator for full-time labor demand - contracted for the 4th month in a row, and the 25th month in 26.

CANADA Q1 INDUSTRIAL CAPACITY UTILIZATION RATE 78.5%

CANADA FACTORY CAPACITY UTILIZATION RATE 76.8%

CANADA DATA (MNI): Canada Jobs Rise More Than Expected, But Labour Conditions Weaken: Canada May employment increased +26.7K vs +20K expected. The increase was driven by part time employment at +62.5K, which offset the 35.6K drop in full time jobs.

- Unemployment rose by +0.1 pp to +6.2%, the eighth increase in 12M.

- Average hourly wages rose +5.1% in May compared to +4.7% the month before. The BoC has said wage pressures are easing.

- Signs of underlying labour market weakness include the involuntary part time rate rising +2.8 pp to +18.2% from a year before and long term unemployment +5 pp also to +18.2%. Hours worked were flat in May, +1.6% YOY.

- The employment rate was down -0.1 pp to 61.3% in May; YOY labour force +652K outpacing the +402K change in employment.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 56.3 points (-0.14%) at 38833.34

- S&P E-Mini Future down 5.25 points (-0.1%) at 5359.5

- Nasdaq down 37.7 points (-0.2%) at 17136.56

- US 10-Yr yield is up 14.3 bps at 4.4296%

- US Sep 10-Yr futures are down 34/32 at 109-9.5

- EURUSD down 0.0088 (-0.81%) at 1.0802

- USDJPY up 1.09 (0.7%) at 156.7

- WTI Crude Oil (front-month) down $0.29 (-0.38%) at $75.26

- Gold is down $84.37 (-3.55%) at $2292.10

- European bourses closing levels:

- EuroStoxx 50 down 17.78 points (-0.35%) at 5051.31

- FTSE 100 down 39.97 points (-0.48%) at 8245.37

- German DAX down 95.4 points (-0.51%) at 18557.27

- French CAC 40 down 38.32 points (-0.48%) at 8001.8

US TREASURY FUTRES CLOSE

- 3M10Y +13.71, -98.173 (L: -115.892 / H: -97.848)

- 2Y10Y -1.395, -45.512 (L: -46.652 / H: -42.545)

- 2Y30Y -4.282, -33.579 (L: -41.916 / H: -28.693)

- 5Y30Y -4.436, 8.988 (L: 1.418 / H: 13.827)

- Current futures levels:

- Sep 2-Yr futures down 10.375/32 at 101-28.375 (L: 101-28.25 / H: 102-08.125)

- Sep 5-Yr futures down 23.25/32 at 106-2.5 (L: 106-02 / H: 106-31.25)

- Sep 10-Yr futures down 34/32 at 109-9.5 (L: 109-09 / H: 110-21)

- Sep 30-Yr futures down 1-20/32 at 117-16 (L: 117-11 / H: 119-31)

- Sep Ultra futures down 2-18/32 at 124-15 (L: 124-10 / H: 127-20)

US 10Y FUTURE TECHS: (U4) Reversal Signal

- RES 4: 111-17+ 1.236 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 111-09 High Apr 1

- RES 2: 110-27+ 1.00 proj of the Apr 25 - May 16 - 29 price swing

- RES 1: 110-21 Intraday high

- PRICE: 109-10 @ 1410 ET Jun 7

- SUP 1: 109-10+/09+ 20-day EMA / Intraday low

- SUP 2: 108-27+ Low Jun 3

- SUP 3: 108-04+ Trendline drawn from the Apr low

- SUP 4: 107-31 Low May 29 and a key support

Treasuries have sold off following today’s employment report. The reversal lower undermines the recent bullish theme and highlights a potential bearish reversal. The contract has breached the 50-day EMA and pierced support at the 20-day EMA, at 109-10+. A clear breach of the average would strengthen bearish threat and open 108-27+, the Jun 3 low. Key short-term resistance is today’s high of 110-21, a break would reinstate the recent bullish theme.

SOFR FUTURES CLOSE

- Jun 24 -0.023 at 94.655

- Sep 24 -0.085 at 94.810

- Dec 24 -0.145 at 95.040

- Mar 25 -0.185 at 95.275

- Red Pack (Jun 25-Mar 26) -0.205 to -0.19

- Green Pack (Jun 26-Mar 27) -0.185 to -0.165

- Blue Pack (Jun 27-Mar 28) -0.16 to -0.155

- Gold Pack (Jun 28-Mar 29) -0.15 to -0.145

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00134 to 5.32764 (-0.00217/wk)

- 3M -0.00045 to 5.33399 (-0.00885/wk)

- 6M -0.00380 to 5.27129 (-0.04290/wk)

- 12M -0.02019 to 5.07210 (-0.12987/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.00), volume: $2.008T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $771B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $750B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $105B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $285B

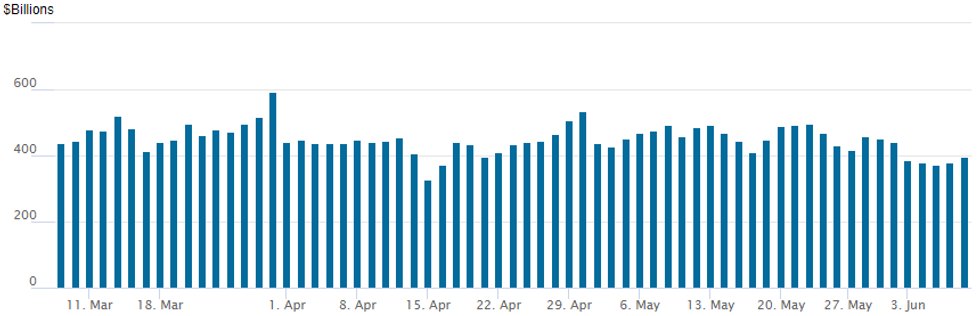

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $395.462B from $378.125B prior; number of counterparties slips to 69 from 72. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE Corporate Debt Issuance Roundup: Over $43B Issued This Week

No new issuance Friday after $7.4B Priced Thursday, $43.55B total for week:

- Date $MM Issuer (Priced *, Launch #)

- 6/6 $2.7B *John Deere $700M 3Y +45, $350M 3Y SOFR+60, $850M 5Y +60, $800M 10Y +80

- 6/6 $3.5B *Energy Transfer $1B 5Y +100, $1.25B 10Y +135, $1.25B 30Y +165

- 6/6 $500M *Harley Davidson 5Y +170

- 6/6 $700M *Applied Materials 5Y +55

FOREX: USD Rallies to Best Levels Since Early May Post-NFP

- US yields rose 10-15bps across the curve on the back of the stronger-than-expected US labour market report, prompting a ~0.8% rally in the BBDXY which reached its highest level since early May.

- The stronger parts of the survey dominated when it came to initial market reaction, with hawkish repricing driven by the much firmer-than-expected NFP release and strong wage numbers.

- USDJPY rallied as much as ~150pips, briefly piercing 157.00 to narrow the gap to key resistance at 157.71, the May 29 high. While we have moderately eased off the day’s best levels, price remains 0.6% higher and above the June 4 high.

- The kneejerk move lower in equities aided weakness in the likes of AUD and NZD, though the recovery in the major benchmarks to pre-data levels since then has not impeded downside momentum for the antipodeans. AUDUSD looks set to close below 0.66 for the first time since May 8, a handle whereby the 50-day EMA also closely intersects. A clear break here could signal scope for a deeper retracement to 0.6558, the May 8 low.

- NZD is the weakest performer in G10, closely followed by NOK and SEK which have each recorded losses of around 1.4% against the greenback.

- Price action in EURUSD has been comparatively more subdued, though the pair still sits 0.75% lower, just above the 1.08 handle at typing. Support to watch lies at 1.0788, the May 30 low, a breach of which may call into question the recent bull cycle.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/06/2024 | 2301/0001 | ** |  | UK | KPMG/REC Jobs Report |

| 10/06/2024 | 2350/0850 | ** |  | JP | GDP (r) |

| 10/06/2024 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 10/06/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 10/06/2024 | 0800/1000 | * |  | IT | Industrial Production |

| 10/06/2024 | - |  | JP | Economy Watchers Survey | |

| 10/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 10/06/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.