-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: PBOC Increases Gold Reserves

MNI BRIEF: Japan Q3 GDP Revised Up On Net Exports, Capex

MNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI ASIA OPEN: JOLTs Job Adds Miss Mark Ahead ADP/NFP

- MNI US DATA: Factory Momentum Remained Sluggish At Best Going Into Q2

- MNI US DATA: Job Market Tightness Fading As Openings Pull Back

US TSYS Trimming Gains Ahead ADP Private Jobs Data

- Treasury futures look to finish higher Tuesday, off session highs amid late position squaring ahead Wednesday's ADP private employment data risk, a precursor to Friday's headline employment report.

- Rates continued to extend week gains after this morning's lower than expected JOLTS Job Openings (8.059M vs. 8.350M est, 8.488M prior) -- lowest since Feb 2021. Meanwhile, Factory Orders little stronger (0.7% vs. 0.6% est, 0.8% prior rev), Ex Transportation (0.7% vs. 0.5% est, 0.4% prior rev); Durable Goods Orders in-line/firmer (0.6% vs. 0.7% est), Ex Transportation (0.4% vs. 0.4% est); Cap Goods Orders Nondef Ex Air softer (0.2% vs. 0.3% est).

- Rates had drifted higher after midday, through resistance at 110-04.5 (1.0% 10-dma envelope) to 110-05 high (+19). Sights now on 110-09, the May 16 high and bull trigger.

- Middle East tensions potential driver for the ongoing bid - but support cooled slightly after President Biden executive action to curb migrant crossings at the southern border.

- Cash yields are currently running mildly lower: 2s -.0377 at 4.7704%, 10s -.0547 at 4.3337%, 30s -.0557 at 4.4819%, while curves look mildly mixed: 2s10s -1.701 at -43.871, 5s30s +0. 058 at 12.985.

- Late year rate cut projections continue to gain vs. late Monday levels (*): June 2024 at -1.3% w/ cumulative rate cut -.3bp at 5.328%, July'24 at -16% w/ cumulative at -4.3bp at 5.288%, Sep'24 cumulative -19.3bp (-17.2bp), Nov'24 cumulative -27.8bp (-25.3bp), Dec'24 -44.3bp (-40.6bp).

NEWS

US (MNI): Biden To Sign Exec Order On Border Today:

President Biden will today sign an executive order allowing the White House to partially close the US-Mexico border if migrant crossings exceed a certain level - a play to neuter one of Biden’s most significant political vulnerabilities. With migrant crossings expected to rise again in the summer, it is imperative Biden has a concrete border deliverable to tout during the June 27 presidential debate with former President Donald Trump.

SECURITY (MNI): White House: Hamas Has Not Given Response To Hostage Deal:

Wires carrying comments from White House National Security Council spokesperson stating, “Hamas has not yet given response to Israeli proposal for hostage deal.” The comments are the latest in a back and forth between the US/Israel and Hamas, accusing the other of holding up the ceasefire deal.

US (MNI): Biden's EO On Border Security Could Neuter Trump's Strength On Immigration:

President Biden will today sign a long-signalled executive order (EO) allowing the White House to close the US-Mexico border if migrant crossings excede 2,500 a week.

UK (MNI): Labour Manifesto Launch Penciled In For 13 June:

Guido Fawkes reported earlier that according to its sources, the main opposition centre-left Labour party is looking to launch its election manifesto on Thursday 13 June. The right-leaning blog also reports that PM Rishi Sunak's Conservatives are looking to launch their manifesto between Monday 10 and Wednesday 12 June.

UKRAINE (MNI): BBG-Prospect Of Russian Involvement In Talks Raised In Swiss Summit Doc:

Bloomberg reporting that according to a draft document, the upcoming 15-16 June Ukraine peace summit in Switzerland "will aim to carve a path to involving Russian officials in future talks".

OVERNIGHT DATA

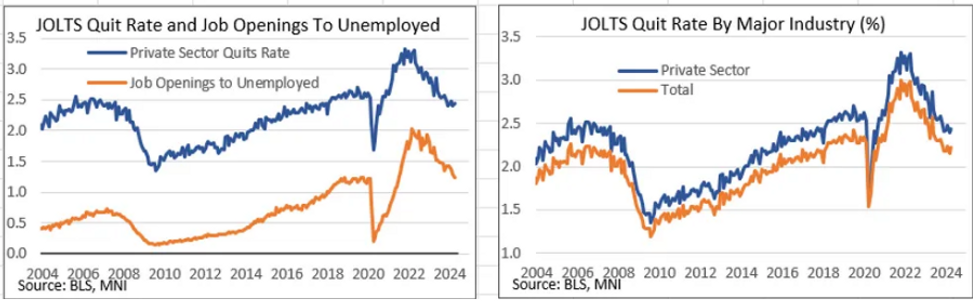

US DATA (MNI): Job Market Tightness Fading As Openings Pull Back: April's JOLTS report was softer than expected, showing the lowest number of job openings since February 2021, at 8.059m vs 8.355m in March (downwardly revised from 8.488m). That compares to a survey median 8.350m and represents a 2-month drop of over 750k.

- The ratio of job openings to unemployed fell to 1.24 from 1.30 prior (rev from 1.32), the lowest since September 2021. That figure averaged 1.19 in 2019, pre-pandemic.

- With March's quits rates upwardly revised by 0.1pp, the overall rate has been remarkably steady at 2.2% for 6 consecutive months; private sector quits were 2.4% for a 2nd month (had been 2.3% Mar prior to release), and the 4th month in the past 5.

US DATA (MNI): Factory Momentum Remained Sluggish At Best Going Into Q2: US factory orders growth was steady in April at 0.7% (vs 0.6% expected, 0.7% prior), with ex-transportation orders accelerating modestly at 0.7% (vs 0.5% expected, 0.4% prior).

- Meanwhile, April durable goods orders were revised down a touch at 0.6% in the final reading (0.7% prelim), with core capital goods orders (nondefense ex-aircraft) likewise down 0.1pp in the final to 0.2%.

- Core durable goods orders growth is running at 1.0% on a 3M/3M annualized rate, while factory orders are regaining a little momentum on that basis as very weak Dec/Jan readings drop out but are still running at a negative rate (-0.6% 3M/3M ann).

- Overall these data contained few surprised but showed a continued lack of momentum in the US manufacturing sector going into Q2 2024, with more recent survey evidence including May's MNI Chicago PMI and ISM Manufacturing suggesting no acceleration and potentially further deterioration going forward.

US REDBOOK: MAY STORE SALES +6.0% V YR AGO MO

US REDBOOK: STORE SALES +5.8% WK ENDED JUN 01 V YR AGO WK

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 86.65 points (0.22%) at 38660.26

- S&P E-Mini Future down 1 points (-0.02%) at 5296.5

- Nasdaq down 0.6 points (0%) at 16827.84

- US 10-Yr yield is down 5.5 bps at 4.3337%

- US Sep 10-Yr futures are up 14.5/32 at 110-0.5

- EURUSD down 0.0024 (-0.22%) at 1.088

- USDJPY down 1.36 (-0.87%) at 154.72

- WTI Crude Oil (front-month) down $0.92 (-1.24%) at $73.30

- Gold is down $23.87 (-1.02%) at $2326.90

- European bourses closing levels:

- EuroStoxx 50 down 50.17 points (-1%) at 4953.37

- FTSE 100 down 30.71 points (-0.37%) at 8232.04

- German DAX down 202.52 points (-1.09%) at 18405.64

- French CAC 40 down 60.12 points (-0.75%) at 7937.9

US TREASURY FUTURES CLOSE

- 3M10Y -5.163, -107.113 (L: -109.775 / H: -99.269)

- 2Y10Y -1.701, -43.871 (L: -44.261 / H: -41.264)

- 2Y30Y -1.802, -29.057 (L: -29.275 / H: -26.349)

- 5Y30Y +0.058, 12.985 (L: 12.44 / H: 14.582)

- Current futures levels:

- Sep 2-Yr futures up 3/32 at 102-3.125 (L: 101-31.25 / H: 102-04.5)

- Sep 5-Yr futures up 9.25/32 at 106-17.75 (L: 106-06.75 / H: 106-21)

- Sep 10-Yr futures up 14.5/32 at 110-0.5 (L: 109-15 / H: 110-05)

- Sep 30-Yr futures up 30/32 at 118-18 (L: 117-15 / H: 118-28)

- Sep Ultra futures up 1-10/32 at 125-29 (L: 124-12 / H: 126-10)

US 10Y FUTURE TECHS: (U4) Bull Cycle Extends

- RES 4: 110-17 High Apr 4

- RES 3: 110-09 High May 16 and the bull trigger

- RES 2: 110-04+ 1.0% 10-dma envelope

- RES 1: 110-02+ High Jun 4

- PRICE: 109-31+ @ 17:09 BST Jun 4

- SUP 1: 109-00+/107-31 20-day EMA / Low May 29

- SUP 2: 107-20+ Low May 29

- SUP 3: 107-12+ Low Apr 25 and the bear trigger

- SUP 4: 107-00 Round number support

Treasuries maintain a firmer short-term tone following the recovery from last week’s 107-31 low (May 29). The pair has again traded higher again Tuesday. Price is through the 50-day EMA at 109-12+ and the close above it on Monday, highlights a clear break and signals scope for a continuation higher near-term. Sights are on 110-09 next, the May 16 high and bull trigger. Any resumption of bearish activity would instead refocus attention on support at 107-31.

SOFR FUTURES CLOSE

- Jun 24 +0.003 at 94.670

- Sep 24 +0.025 at 94.870

- Dec 24 +0.040 at 95.125

- Mar 25 +0.060 at 95.385

- Red Pack (Jun 25-Mar 26) +0.070 to +0.075

- Green Pack (Jun 26-Mar 27) +0.080 to +0.085

- Blue Pack (Jun 27-Mar 28) +0.080 to +0.085

- Gold Pack (Jun 28-Mar 29) +0.075 to +0.085

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00063 to 5.32981 (+0.00203/wk)

- 3M -0.00324 to 5.34284 (-0.00004/wk)

- 6M -0.01146 to 5.31419 (-0.00215/wk)

- 12M -0.02604 to 5.20197 (+0.00168/Wk)

- Secured Overnight Financing Rate (SOFR): 5.35% (+0.01), volume: $1.912T

- Broad General Collateral Rate (BGCR): 5.32% (-0.01), volume: $781B

- Tri-Party General Collateral Rate (TGCR): 5.32% (-0.01), volume: $764B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $275B

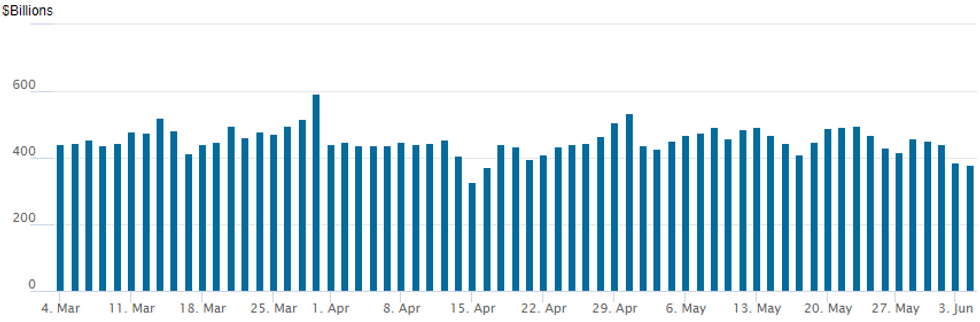

FED Reverse Repo Operation

NY Federal reserve/MNI

- RRP usage slips to $377.825B from $387.069B prior; number of counterparties rising to 77 from 63 prior. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE: $4B IDA 5Y SOFR Led Tuesday's Issuance

- Date $MM Issuer (Priced *, Launch #)

- 6/4 $4B *IDA 5Y SOFR+37

- 6/4 $2.5B #Citigroup 11NC10 +112.5

- 6/4 $2B *Provence of British Colombia 10Y SOFR+79

- 6/4 $1.25B *Kommunalbanken 2027 SOFR+32

- 6/4 $1B #Council of Europe Development Bank 3Y SOFR+24

- 6/4 $1B #Metropolitan Life $650M 3Y +55, $350M 3Y SOFR+70

- 6/4 $800M #Puget Sound WNG $400M 10Y +100, $400M 30Y +120

- 6/4 $600M #Becton Dickinson WNG 5Y +75

- 6/4 $600M #Brown & Brown 10Y +135

- 6/4 $500M #Suntory Holdings 5Y +77

- 6/4 $500M #Trane Technologies WNG 10Y +82

- 6/4 $Benchmark Serbia 10Y investor calls

- 6/4 $Benchmark Harley Davidson investor calls

- On tap for Wednesday:

- 6/5 $500M FMO (Nederlandse Financierings-Maatschappij) WNG 5Y +41a

EGBs-GILTS CASH CLOSE: Bull Flatter With ECB Still The Focal Point

The UK and German curves bull flattened Tuesday, though yields finished off lows.

- Early weakness in oil prices and softer-than-expected Swiss CPI helped underpin Bunds and Gilts early. German labour market data came in mixed.

- Most price action of note in the European afternoon stemmed from risk-off geopolitical newsflow and a weak US job openings figure which pushed core FI futures to session highs before fading into the cash close.

- Bunds modestly outperformed Gilts out to the 10Y segment of the curve. EGB periphery spreads widened, mirroring softness in equities.

- UK PM Sunak debates Labour leader Starmer after the market close.

- Wednesday's schedule brings final Service PMI data and Eurozone PPI, with focus for the week remaining firmly on Thursday's ECB decision (MNI's preview here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.5bps at 2.994%, 5-Yr is down 4.3bps at 2.576%, 10-Yr is down 4.6bps at 2.534%, and 30-Yr is down 3.7bps at 2.676%.

- UK: The 2-Yr yield is down 0.4bps at 4.353%, 5-Yr is down 3bps at 4.087%, 10-Yr is down 4.3bps at 4.178%, and 30-Yr is down 5.6bps at 4.611%.

- Italian BTP spread up 3.3bps at 133.5bps / Spanish up 2.2bps at 74.1bps

FOREX Japanese Yen Extends Recovery Amid Weak US JOLTS Data

- The dovish move in Fed pricing saw a modest extension on the back of the softer-than-expected JOLTS job opening print. Upward revisions to the quits rate data helped to temporarily counter the move, however, US yields have maintained their lower trajectory throughout the session. The narrowing yield differential dynamics have specifically boosted the likes of the JPY and CHF, the clear outperformers on Tuesday.

- USDJPY trades down 0.85% around 154.80, extending an impressive move from the 157.50 highs just yesterday. The latest pullback appears to be a correction - for now. However, the pair has breached the 20-day EMA and the continuation lower has exposed key support at 154.65, the 50-day EMA, and 153.81, a trendline drawn from the Dec 28 low.

- For EURJPY, the cross sits 1.05% in the red and is heading towards key trendline support drawn from the Dec 7 ‘23 low, at 167.05. A clear breach of this line would highlight a potential reversal. Concurrently, the 50-day EMA intersects at 167.14.

- The Swiss franc shrugged off a marginally softer-than-expected core CPI print to end significantly higher on the day. SNB’s Jordan made hawkish remarks last week and the dip lower in yields has helped exacerbate the correction lower for USDCHF, an impressive 2.85% below last week’s highs.

- Sharp downward pressure on crude futures has added headwinds to the Canadian dollar, with WTI extending the week’s decline to around 5.5%. Strong support around the 1.3600 handle keeps a bull trend intact for USDCAD ahead of tomorrow’s BOC decision, where the central bank is expected to initiate monetary easing.

- With the ECB also taking place this week, we recently noted EURCAD had broken above a cluster of highs around 1.4780. Exponential moving averages are also in a bull mode position and the cross printed as high as 1.4895, a fresh 6-month high. This closely respects the downtrend line from the July 2020 highs.

- Australian GDP crosses first on Wednesday, before US ADP, the BOC and ISM Services from the US. The ECB decision on Thursday and NFP Friday remain key event risks for the remainder of the week.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/06/2024 | 0130/1130 | *** |  | AU | Quarterly GDP |

| 05/06/2024 | 0645/0845 | * |  | FR | Industrial Production |

| 05/06/2024 | 0900/1100 | ** |  | EU | PPI |

| 05/06/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/06/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/06/2024 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/06/2024 | 1345/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 05/06/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/06/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 05/06/2024 | 1430/1030 |  | CA | BOC Governor Press Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.