-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Month End, Strong 7Y Note Sale Buoy Tsys

- MNI INTERVIEW: Home Sales To Rise Gradually As Fed Eases-MBA

- MNI US DATA: Mortgage Applications Tick Lower Again, Restrained By Higher Rates

US TSYS Near Week Highs, Month End, Strong 7Y Note Sale, Fed Waller Tonight

- Treasuries are trading higher after the bell, partially driven by month end extensions and result of strong 7Y auction. Futures actually climbed to the highest level since March 14 (TYH4 110-31.5 last - testing 50-day EMA resistance) after the $43B 7Y note auction (91282CKC4) stopped through with 4.185% high yield vs. 4.192% WI; 2.61x bid-to-cover vs. 2.58x last month.

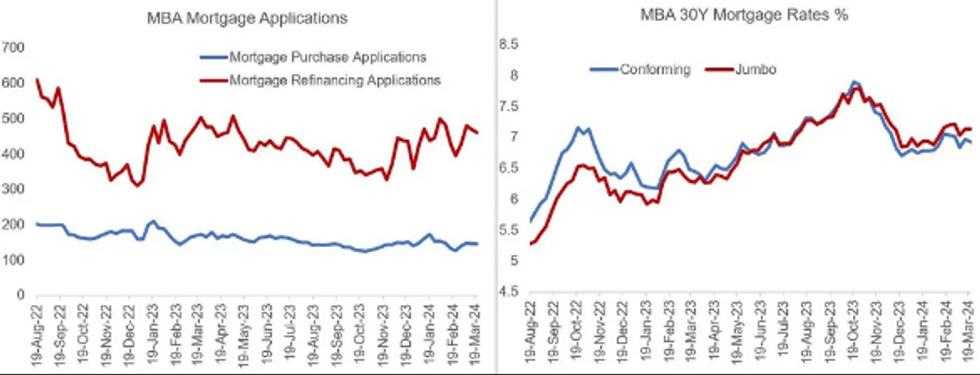

- Jun'24 10Y futures receded to 110-28.5 (+8) by the bell, rather modest volumes on the shortened Easter Holiday week. Sole data: MBA composite mortgage applications fell for the second consecutive week, by a seasonally adjusted -0.7% in the week to March 22, with purchases -0.2% and refis -1.6%.

- Fed Governor Christopher Waller will discuss his economic outlook at an event hosted by the Economic Club NY this evening at 1800ET, text and Q&A is expected.

- Focus on Thursday's Weekly Claims, GDP, PCE, PMI, UofM Sentiment.

US

INTERVIEW (MNI): Home Sales To Rise Gradually As Fed Eases-MBA: A U.S. mortgage market battered by high Federal Reserve interest rates will get some relief over the next couple of years as the central bank gradually reduces borrowing costs, reviving sales activity, Mortgage Bankers’ Association chief economist Michael Fratantoni told MNI.

- The Fed is likely to cut rates three times this year, which would probably leave the 10-year note a little bit below 4% and the 30-year mortgage rate, currently around 6.8%, close to 6% by the end of 2024.

- “We see a slow, uphill climb over the next couple of years, particularly rapid growth in new home sales, slower growth in existing home sales. We expect home prices are going to continue to grow because we’re just structurally undersupplied,” said Fratantoni in an interview.

NEWS

US (MNI): White House "Likely" To Tap Up Congress For Funds To Rebuild Key Bridge: US Secretary of Transport Pete Buttigieg has told reporters at the White House that the Biden administration is "likely" to turn to Congress in the coming days for supplemental funding to rebuild the Baltimore Francis Scott Key Bridge, which collapsed when a container ship struck a support structure on Tuesday morning.

CHINA (MNI): NETHERLANDS-Xi To Rutte: Creating Tech Barriers Leads To Confrontation: Wires reporting comments from Chinese state media following a meeting between President Xi Jinping and Dutch PM Mark Rutte. Reports Xi as stating that "China is ready to import more high-quality goods from the Netherlands [and] welcomes Dutch companies to invest in China."

PORTUGAL (MNI): Speaker Vote Chaos Potentially A Signal Of Future Gov't Instability: Just days into his tenure as PM, Luis Montenegro is having to deal with the reality of governing with such a small minority in the Assembly of the Republic.

ISRAEL (MNI): Al-Akhbar-Egypt Sources: IDF Rafah Ground Op Planned Late Apr/Early May: Lebanese outlet Al-Akhbar is reporting that according to its Egyptian sources, the Israeli Defence Forces are planning a ground operation in the southern Gaza city of Rafah following the Eid al-Fitr celebrations marking the end of the holy month of Ramadan. This would put the date of the operation in mid-to-late April or early May.

OVERNIGHT DATA

US DATA (MNI): Mortgage Applications Tick Lower Again, Restrained By Higher Rates: MBA composite mortgage applications fell for the second consecutive week, by a seasonally adjusted -0.7% in the week to March 22, with purchases -0.2% and refis -1.6%.

- The pullback comes amid more elevated mortgage rates, with Jumbo 30Y rates at 7.14% (unch from the prior week) and conforming at 6.93% (down 4bp on the week but above the 6.84% two weeks earlier).

- Mortgage applications are up a little from recent lows, but but remain well below pre-pandemic levels.

- As to be expected, the uptick in mortgage rates to around 7% - after conforming 30Y rates had dipped as low as 6.71% in late December amid a more dovish outlook on Fed policy - continues to restrain overall mortgage activity.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 365.55 points (0.93%) at 39651

- S&P E-Mini Future up 25.25 points (0.48%) at 5290.5

- Nasdaq up 34.1 points (0.2%) at 16349.33

- US 10-Yr yield is down 3.9 bps at 4.1923%

- US Jun 10-Yr futures are up 8/32 at 110-28.5

- EURUSD down 0.0007 (-0.06%) at 1.0824

- USDJPY down 0.21 (-0.14%) at 151.35

- WTI Crude Oil (front-month) up $0.01 (0.01%) at $81.64

- Gold is up $12.21 (0.56%) at $2191.01

- European bourses closing levels:

- EuroStoxx 50 up 17.56 points (0.35%) at 5081.74

- FTSE 100 up 1.02 points (0.01%) at 7931.98

- German DAX up 92.74 points (0.5%) at 18477.09

- French CAC 40 up 20.06 points (0.25%) at 8204.81

US TREASURY FUTURES CLOSE

- 3M10Y -5.681, -119.61 (L: -120.592 / H: -113.579)

- 2Y10Y -1.448, -37.796 (L: -38.592 / H: -35.673)

- 2Y30Y -1.93, -21.525 (L: -22.067 / H: -18.817)

- 5Y30Y -0.549, 16.883 (L: 16.548 / H: 18.27)

- Current futures levels:

- Jun 2-Yr futures up 1.75/32 at 102-11.125 (L: 102-08.875 / H: 102-12)

- Jun 5-Yr futures up 4.75/32 at 107-4.25 (L: 106-30 / H: 107-06.5)

- Jun 10-Yr futures up 7.5/32 at 110-28 (L: 110-18 / H: 110-31.5)

- Jun 30-Yr futures up 19/32 at 120-7 (L: 119-16 / H: 120-12)

- Jun Ultra futures up 30/32 at 128-18 (L: 127-14 / H: 128-24)

US 10Y FUTURE TECHS: (M4) Resistance At The 50-Day EMA Remains Intact

- RES 4: 112-04+ High Mar 8 and bull trigger

- RES 3: 111-24 High Mar 12

- RES 2: 110-31 50-day EMA

- RES 1: 110-30 High Mar 25

- PRICE: 110-27 @ 16:26 GMT Mar 27

- SUP 1: 110-08+/109-24+ Low Mar 21 / 18 and the bear trigger

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

The latest move higher in Treasuries appears to be a correction. Key short-term resistance at the 50-day EMA, at 110-31, remains intact. A clear break of this average is required to suggest scope for a stronger recovery. This would open 111-24, the Mar 12 high. Moving average studies remain in a bear-mode position and this continues to highlight a downtrend. On the downside, the bear trigger is unchanged at 109-24+.

SOFR FUTURES CLOSE

- Jun 24 +0.005 at 94.890

- Sep 24 +0.010 at 95.180

- Dec 24 +0.020 at 95.485

- Mar 25 +0.025 at 95.760

- Red Pack (Jun 25-Mar 26) +0.040 to +0.045

- Green Pack (Jun 26-Mar 27) +0.045 to +0.050

- Blue Pack (Jun 27-Mar 28) +0.040 to +0.045

- Gold Pack (Jun 28-Mar 29) +0.040 to +0.040

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00282 to 5.32734 (-0.00137/wk)

- 3M -0.00751 to 5.30191 (-0.01057/wk)

- 6M -0.00109 to 5.22404 (-0.00496/wk)

- 12M +0.00224 to 5.01214 (+0.00836/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.849T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $664B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $656B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $238B

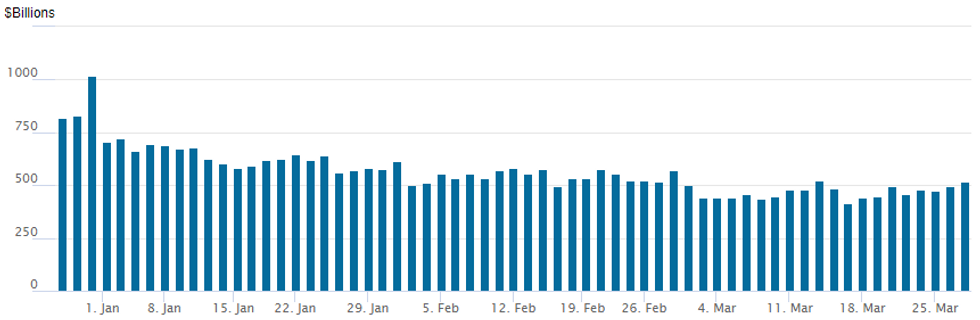

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbed back over $500B hurdle to $518.357B today vs. $496.062B on Tuesday. Compares to Friday, March 15 when usage fell to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties climbed to 83 vs. 73 yesterday (compares to 65 on January 16, the lowest since July 7, 2021)

March Corporate Issuance Over $183B vs. $122B in March 2023

Pace of corporate bond issuance is slowing down heading into month end. Total for the month of March (including foreign corporate and supra sovereigns) is over $183B at the moment - compares to March '23 of $122.05B.

- Date $MM Issuer (Priced *, Launch #)

- 3/27 $1.2B #New York Life $600M 3Y +55, $600M 3Y SOFR+67

- 3/27 $750M #Swiss Re 11NC10 +150

- 3/27 $700M #Blue Owl Tech 5Y +285

- 3/27 $500M #St Marys Cement Inc Canada 10Y +170

- $20.1B Priced Tuesday, $31.15B/wk

- 3/26 $4B *Glencore Funding $800M 3Y +95, $350M 3Y SOFR+106, $1.1B 5Y +115, $1.25B 10Y +140, $500M 30Y +150

- 3/26 $3.75B *Quebec 5Y SOFR+50

- 3/26 $2.75B *Smurfit Kappa $750M +5Y +100, $1B 10Y +120, $1B 30Y +137.5

- 3/26 $2.25B *TD Bank $850M 3Y +60, $500M 3Y SOFR+73, $900M 5Y +78

- 3/26 $1.5B *SMBC Aviation Capital $650M 5Y +108, $850M 10Y +135

- 3/26 $1.25B *CSL $600M 10Y +87, $600M 30Y +102

- 3/26 $1.2B #Marathon Oil $600M 5Y +112, $600M 10Y +147

- 3/26 $1.15B *Algonquin Power WNG 2Y +150a

- 3/26 $1B *AIA 10Y +125

- 3/26 $750M *CQB (The Commercial Bank, Qatar) 5Y +5.375%

- 3/26 $500M *Yapi Kredi PerpNC5.25 9.75%

EGBs-GILTS CASH CLOSE: Further Gains Going Into Month/Quarter-End

Bunds and Gilts rallied again Wednesday, with gains extending toward the close.

- With an eye on month/quarter-end Thursday (markets are closed Friday), rebalancing dynamics were seen as positive for global core bonds.

- A positive tone was set early in the session with modestly below-consensus inflation data from Spain, which was the first glimpse of the flash March round that ends next Wednesday.

- While futures volumes were relatively limited for most of the session, strength was evident across both the German and UK curves, with bellies outperforming.

- Periphery EGB spreads widened slightly, though no particular catalyst was evident.

- Eurozone data Thursday includes flash Portuguese and Belgian inflation, with German labour market indicators and retail sales also of interest - and appearances by ECB's Panetta and Villeroy.

- UK data to end the shortened week consists of final Q4 GDP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.3bps at 2.829%, 5-Yr is down 5.8bps at 2.313%, 10-Yr is down 5.8bps at 2.292%, and 30-Yr is down 5.1bps at 2.456%.

- UK: The 2-Yr yield is down 3.7bps at 4.144%, 5-Yr is down 4bps at 3.817%, 10-Yr is down 3.9bps at 3.932%, and 30-Yr is down 3.4bps at 4.422%.

- Italian BTP spread up 1.8bps at 132.1bps / Spanish bond spread up 1.2bps at 84.3bps

FOREX JPY Moves Contained Despite Strengthening Rhetoric, USDMXN Selloff Extends

- The Japanese yen was in focus Wednesday, as Bank of Japan, Ministry of Finance and FSA officials met to discuss financial markets, raising speculation that currency market intervention could be imminent.

- USDJPY traded as low as 151.03 amid firmer language on speculative weakening in the yen and the ability to counteract these moves. Earlier on Wednesday, USDJPY traded to the highest level since 1990 at 151.97. Subsequently, MOF Kanda’s press conference failed to spark a further correction lower for USDJPY and the pair has since traded in a tight range between 151.20-40 as markets contemplate the developments ahead of the long holiday weekend.

- Diverging monetary policy trajectories and this verbal intervention could place CHF in a particularly vulnerable position to further yen strength at this juncture, corroborated by CHFJPY (-0.35%) trading below 167.00 this morning, and printing a fresh three-month low for the cross.

- Elsewhere in G10, major currency pairs and the dollar index held very narrow ranges. Both EURUSD and GBPUSD extremes are roughly 30 pips apart.

- Perhaps most the interesting development occurred in emerging markets with USDMXN breaking key support and trading at the lowest level since 2015. The next target for the selloff resides at 16.4218, a Fibonacci projection.

- Initial easing from the central bank has not weighed on the MXN, as analysts have highlighted there remains room for carry compression without a negative impact on the currency. Furthermore, the low vol environment remains supportive for high carry FX, local fundamentals remain solid and election risk premium remains low.

- Australia MI Inflation Expectations and February retail sales data are highlights overnight on Thursday, before German retail sales figures. Later in the day, final readings for Q4 US GDP, initial jobless claims, MNI Chicago PMI and pending home sales are all scheduled, alongside Canada January GDP.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/03/2024 | 0030/1130 | ** |  | AU | Retail Trade |

| 28/03/2024 | 0700/0700 | *** |  | UK | GDP Second Estimate |

| 28/03/2024 | 0700/0700 | * |  | UK | Quarterly current account balance |

| 28/03/2024 | 0700/0800 | ** |  | DE | Retail Sales |

| 28/03/2024 | 0700/0800 | ** |  | SE | Retail Sales |

| 28/03/2024 | 0800/0900 | ** |  | CH | KOF Economic Barometer |

| 28/03/2024 | 0855/0955 | ** |  | DE | Unemployment |

| 28/03/2024 | 0900/1000 | ** |  | EU | M3 |

| 28/03/2024 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/03/2024 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/03/2024 | 1100/1200 | ** |  | IT | PPI |

| 28/03/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 28/03/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/03/2024 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/03/2024 | 1230/0830 | * |  | CA | Payroll employment |

| 28/03/2024 | 1230/0830 | *** |  | US | GDP |

| 28/03/2024 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 28/03/2024 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 28/03/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 28/03/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/03/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 28/03/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/03/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/03/2024 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 28/03/2024 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 29/03/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 29/03/2024 | 2330/0830 | * |  | JP | Labor Force Survey |

| 29/03/2024 | 2350/0850 | * |  | JP | Retail Sales (p) |

| 29/03/2024 | 2350/0850 | ** |  | JP | Industrial Production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.