-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA OPEN: Narrow FI Range Ahead Tuesday CPI

- MNI US CPI Preview: Health Insurance Update Adds To Uncertainty

- MNI INTERVIEW: Most Of Housing Effectively In Recession-Fannie

- MNI INTERVIEW: BOE To Look At Cutting Potential Growth In Feb

- MNI NY Fed Inflation Expectations Firmly At Odds With U.Mich Increase

US

US DATA: Consensus puts core CPI inflation at 0.3% M/M in October, a third month at 0.3 after two 0.16 readings at the start of summer. Our survey of analysts to 2.d.p suggests some mild upside skew.

- A health insurance reset adds to uncertainty in the initial reaction to the report, along with some previously large moves in the more familiar categories including a particularly sharp acceleration in OER last month.

- The "supercore" is seen moderating but to a still painful rate for the FOMC. It’s possible some of this strength is faded due to the health insurance reset but equally Chair Powell warning on not being misled by a few good months of data could see sensitivity to a strong print here.

- Further rate hikes are still seen with a high bar despite expectations rising post-Powell (to a cumulative 7bp of tightening over the next two meetings) before 80bp of cuts through 2024.

US: Most of the U.S. housing market is effectively in recession as existing home sales languish at their lowest levels since the global financial crisis and the recent spike in long-term Treasury yields puts additional pressure on new home sales, Fannie Mae chief economist Doug Duncan told MNI.

- New construction has been one portion of the market where activity remains brisk, but demand has fallen after 10-year Treasury yields surged to 16-year highs. “It has definitely slowed the sales pace on the new home side. The existing home side was so low that I don’t see it getting much lower,” said Duncan in an interview. “That is totally not normal. That part of the market is clearly in recession.”

- U.S. mortgage costs have nearly tripled to around 8% since the Federal Reserve signaled it would be raising interest rates aggressively to combat inflation. That means millions of homeowners who locked in ultralow mortgage rates are unlikely to move any time soon, he said.

UK

BOE: There is a significant risk that the Bank of England will early next year lower its estimate of the rate at which the UK can grow without feeding inflation, after revising down its near-term estimate of equilibrium growth in November, National Institute of Economic and Social Research deputy director and former senior BOE official Stephen Millard told MNI.

- A downwards revision could occur once the Bank completes its stock take of the UK economy’s supply side in February, Millard said.

- "They might go down, they certainly won't go up. In the next couple of years they have already taken it down," he said, after the Bank in November raised its estimate of the equilibrium unemployment rate (U*) to 4.5% from just above 4%. The increase in U* pushes down aggregate supply growth, which would slow from 1.5% currently to 0.75% next year before rising to around 1.25% in the medium term, the Bank said. (See MNI INTERVIEW:UK With Higher NAIRU More Prone To Wage Pressure)

- "They have made an adjustment in terms of what they think is possible for supply growth at the moment, to take it down below that 1.25%. Maybe that is a veiled way of saying we might take that 1.25% down," Millard added. For more see MNI Policy main wire at 1019ET.

US Tsys Short End Tsys Firm Ahead Tuesday CPI

- Treasury futures holding mixed levels after the bell, off midmorning lows to near top end of a narrow overnight range. Rather muted trade as accounts ply the sidelines ahead Tuesday mornings CPI inflation data.

- Curves mixed: 3M10Y -3.803 at -80.011 vs. -81.043 low, 2Y10Y +0.385 at -40.875 vs. -43.614 low. Dec 10Y futures above initial technical support: trading 107-14.5 last (+1), support below at 107-02.5 (Low Nov 2). Resistance well above at 108-25 (High Nov 3 and the next bull trigger).

- Projected rate cut chance into early 2024 steady/near recent lows: December at 3.6bp at 5.363%, January 2024 cumulative 7.1bp at 5.398%, while March 2024 pricing in -16.5% chance of a rate cut with cumulative at 3bp at 5.356%, May 2024 cumulative -6.2bp at 5.265%. Fed terminal at 5.395% in Feb'24.

- Main focus on CPI Tuesday morning, CPI MoM (0.4% prior, 0.1% est), YoY (3.7% prior, 3.3% est). Multiple Fed speakers on tap as well Tuesday: Richmond Fed Barkin economic outlook, no text, Q&A at 0830ET; Fed VC Barr oversight of financial regulators testimony at 1000ET; Chicago Fed Goolsbee on policy, eco outlook, text TBA, Q&A at 1245ET.

OVERNIGHT DATA

US DATA: The NY Fed consumer survey of inflation expectations in October showed no sign of the ramp up seen in the U.Mich survey for October and which continued into its preliminary November release last week.

- 1Y expectations dropped to 3.57% from 3.67%, just above the 3.55% of July otherwise the lowest since Apr’21.

- 3Y expectations held at 3.0% for the second month, although that's relatively high by recent month standards, prior to September last seen in May and then Dec’22.

- 5Y expectations meanwhile dropped a tenth to 2.7% for their lowest since May. This compares notably with the 5-10Y U.Mich measure, which in October pushed back to 3.0% before increasing to 3.2% to break above its stable 2.9-3.1% range since 2021 for a highest since 2011.

- The readings appear to increase the possibility that the U.Mich survey is revised lower in the finalized November print.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 51.31 points (0.15%) at 34332.31

- S&P E-Mini Future down 2.25 points (-0.05%) at 4428.25

- Nasdaq down 13 points (-0.1%) at 13784.78

- US 10-Yr yield is down 2.4 bps at 4.628%

- US Dec 10-Yr futures are up 0.5/32 at 107-14

- EURUSD up 0.0013 (0.12%) at 1.0699

- USDJPY up 0.09 (0.06%) at 151.62

- WTI Crude Oil (front-month) up $1.2 (1.56%) at $78.33

- Gold is up $6.73 (0.35%) at $1946.89

- European bourses closing levels:

- EuroStoxx 50 up 34.83 points (0.83%) at 4232.19

- FTSE 100 up 65.28 points (0.89%) at 7425.83

- German DAX up 110.61 points (0.73%) at 15345

- French CAC 40 up 42.02 points (0.6%) at 7087.06

US TREASURY FUTURES CLOSE

- 3M10Y -3.605, -79.813 (L: -81.043 / H: -73.191)

- 2Y10Y +0.16, -41.1 (L: -43.614 / H: -38.539)

- 2Y30Y +0.379, -29.883 (L: -32.572 / H: -26.952)

- 5Y30Y +0.688, 8.124 (L: 6.925 / H: 10.001)

- Current futures levels:

- Dec 2-Yr futures up 1.25/32 at 101-8.375 (L: 101-05.875 / H: 101-08.375)

- Dec 5-Yr futures up 1.25/32 at 105-0.75 (L: 104-24 / H: 105-01)

- Dec 10-Yr futures up 1/32 at 107-14.5 (L: 107-00 / H: 107-15)

- Dec 30-Yr futures down 2/32 at 113-10 (L: 112-12 / H: 113-13)

- Dec Ultra futures down 5/32 at 117-12 (L: 116-04 / H: 117-17)

(Z3) Short-Term Trend Outlook Remains Bullish

- RES 4: 110-07+ High Sep 14

- RES 3: 110-00 Round number resistance

- RES 2: 109-20 High Sep 19

- RES 1: 108-25 High Nov 3 and the next bull trigger

- PRICE: 107-13+ @ 11:37 GMT Nov 13

- SUP 1: 107-02+ Low Nov 2

- SUP 2: 105-27+/105-10+ Low Nov 1 / Low Oct 19 and bear trigger

- SUP 3: 105-08+ 2.0% 10-dma envelope

- SUP 4: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

The short-term trend outlook in Treasuries is unchanged and conditions remain bullish. The recent move above the 50-day EMA, at 108-00, followed by the print above 108-16, the Oct 12 high and a key resistance, reinforces a bullish theme. A clear break of 108-16 would strengthen the case for bulls and signal scope for 109-20, the Sep 19 high. Initial support lies at 107-02+, the Nov 2 low.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 -0.013 at 94.583

- Mar 24 -0.010 at 94.650

- Jun 24 +0.020 at 94.885

- Sep 24 +0.030 at 95.160

- Red Pack (Dec 24-Sep 25) +0.020 to +0.040

- Green Pack (Dec 25-Sep 26) steady to +0.015

- Blue Pack (Dec 26-Sep 27) -0.01 to steady

- Gold Pack (Dec 27-Sep 28) -0.005 to steady

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00061 to 5.32291 (+0.00054 total last wk)

- 3M +0.00208 to 5.37972 (-0.00253 total last Wk)

- 6M +0.00477 to 5.41924 (-0.01142 total last wk)

- 12M +0.01773 to 5.33418 (-0.00945 total last Wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $106B

- Daily Overnight Bank Funding Rate: 5.32% volume: $242B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.469T

- Broad General Collateral Rate (BGCR): 5.30%, $586B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $575B

- (rate, volume levels reflect prior session)

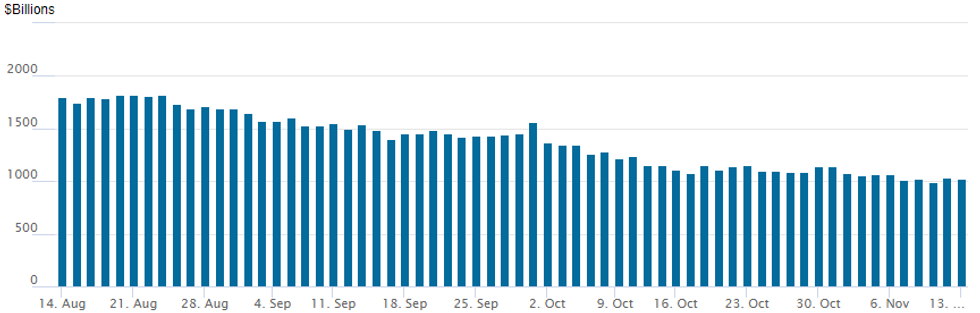

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage slips to $1,020.272B w/95 counterparties today vs. $1,032,720B in the prior session. Usage fell below $1T for the first time since August 2021 last week Thursday: $993.314B.

PIPELINE: $2B Brazil 7Y US$ Issuance Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/13 $2B #Brazil +7Y 6.5%

- 11/13 $800M #American Honda 5Y +125a

- 11/13 $750M #O'Reilly Automotive 3Y +95

- 11/13 $Benchmark Bayer investor calls

- Expected later in week:

- 11/?? $600M Veritiv Corp 7NC3

EGBs-GILTS CASH CLOSE: Gilts Outperform Ahead Of Key Data Points

Gilts outperformed Bunds Monday in a mixed session for core FI, with the German curve twist flattening and the UK's bull flattening.

- After a weak cash open gave way to a modest decline, European yields drifted up to hit session highs in mid-afternoon on speculation that the Japanese authorities had intervened to support the yen, though the move faded as that speculation died down. Trade was within last week's ranges.

- The German short-end underperformed, with ECB cut pricing pared slightly, though no particular catalyst.

- Largely unmoved by political developments (cabinet reshuffle) Gilt yields ticked above Friday's highs briefly before pulling back ahead of two key days of data ahead (labour market, CPI).

- BTP spreads tightened on the day but were buffeted by a couple of factors. These included a tightening move on the open as Fitch affirmed Italy's BBB/stable rating on Friday, and some modest widening on a BBG sources piece that noted Rome could have difficulty accessing a large chunk of EU recovery funds.

- Tuesday's busier docket includes UK labour market data, central bank speakers (ECB-speak from Lane and Villeroy, with BOE"s Dhingra and Pill also appearing)supply (EU syndication announced today, Schatz auction), Eurozone GDP and employment data, German ZEW, and the session's highlight: US CPI.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.5bps at 3.081%, 5-Yr is up 0.9bps at 2.664%, 10-Yr is down 0.4bps at 2.713%, and 30-Yr is down 1.8bps at 2.911%.

- UK: The 2-Yr yield is down 1bps at 4.661%, 5-Yr is down 0.4bps at 4.323%, 10-Yr is down 2.2bps at 4.314%, and 30-Yr is down 4.6bps at 4.735%.

- Italian BTP spread down 0.9bps at 185bps / Spanish / down 0.2bps at 105.4bps

FOREX USDJPY Price Extremes Prompt Volatility/Intervention Speculation

- Overall, G10 ranges have remained broadly contained on Monday as markets prepare for tomorrow’s key US CPI release. Slightly lower US yields and a mid-session pullback for USDJPY tilts the USD index into moderate negative territory as we approach the APAC crossover.

- The Japanese Yen was the key focal point for currencies on Monday, with USDJPY spending the majority of the session inching towards the 2022 highs at 151.95. Trading within 4 pips of the level, the pair saw a rapid pullback during US hours, printing a session low of 151.21 in just a few minutes. Intervention speculation occurred but there is no evidence to back this up.

- Today's volume spike on the move was actually considerably smaller relative to similar spikes in JPY on Oct26 (~10k contracts) and Oct17 (just over 20k contracts). As a reminder the BOJ confirmed at the end of October that no FX intervention had taken place across the month-ending Oct27 in its official FX reserves data (next released on Nov30), so today's smaller move likely more of the same.

- Elsewhere, more risk sensitive currencies have outperformed on Monday with AUD and GBP rising just over 0.35%. The moves have been underpinned by major equity benchmarks consolidating the impressive recovery late Friday, providing a stable risk sentiment backdrop.

- The greenback will eagerly await the US inflation report tomorrow. Consensus puts US core CPI inflation at 0.3% M/M in October. Our survey of analysts to 2.d.p suggests some mild upside skew for the result.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/11/2023 | 0700/0800 | *** |  | SE | Inflation Report |

| 14/11/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/11/2023 | 0800/0900 |  | EU | ECB's Lane participates in SNB-FRB-BIS Conference | |

| 14/11/2023 | 0800/0300 |  | US | New York Fed's John Williams | |

| 14/11/2023 | 1000/1100 | *** |  | EU | GDP (p) |

| 14/11/2023 | 1000/1100 | * |  | EU | Employment |

| 14/11/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 14/11/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 14/11/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/11/2023 | 1200/1200 |  | UK | BOE's Dhingra panellist at Festival of Economics | |

| 14/11/2023 | 1330/0830 | *** |  | US | CPI |

| 14/11/2023 | 1345/1345 |  | UK | BOE's Pill speech at the Festival of Economics | |

| 14/11/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/11/2023 | 1500/1000 |  | US | Fed Vice Chair Michael Barr | |

| 14/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 14/11/2023 | 1745/1245 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.