-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: No Love For Targeted Relief

- MNI EXCLUSIVE: Fed May Shift QE Purchases Towards Long End

- MNI BRIEF: Permanent Job Loss Could Be Material Risk- Bostic

- MNI INTERVIEW: RBNZ Creating Housing Bubble-Ex-Chair Grimes

- US IMPOSES SANCTIONS ON CHINESE FOR TIES TO IRAN SHIPPING

- US SANCTIONS HONG KONG PERSONS FOR ACTIVITIES TIED TO IRAN

- DEMOCRATS SAY DISAGREEMENT ON STIMULUS LANGUAGE REMAIN, Bbg

- U.K. STILL BELIEVES THERE IS NO BASIS TO RESUME EU TRADE TALKS, Bbg

US

FED: The Federal Reserve may shift more of its bond-buying program towards the long end of the yield curve in order to keep up with Treasury issuance plans and as it awaits more clarity on the economic outlook before considering any increase in the amount of its purchases, former Fed officials told MNI.

- Officials have discussed both potentially increasing the pace of bond buys if conditions worsen or extending the current average maturity of purchases, the former officials said, adding that such a move could come as early as December or by the spring. The Fed is currently buying USD40 billion per month in MBS and USD80 billion in Treasuries, at an average duration of about 5.5 years while the Treasury's new issues have an average maturity closer to 7.5 years. For more, see 10/19 main wire at 1227ET.

ANTIPODEAN

RBNZ: A former chairman of the Reserve Bank of New Zealand has criticized the bank's low interest rate policy, telling MNI it is fueling financial instability by inflating a housing bubble. Arthur Grimes, chairman of the RBNZ from 2003 to 2013 after previously serving as chief economist, said "absurdly low" interest rates would increase social inequality and ultimately poverty. For more, see 10/19 main wire at 1237ET.

OVERNIGHT DATA

US NAHB HOUSING MARKET INDEX 85 IN OCT

US NAHB OCT SINGLE FAMILY SALES INDEX 90; NEXT 6-MO 88

- Fourth straight monthly gain to record CAD65.7b was led by building materials and autos

- July sales were also revised up to +5.2% from +4.3%

- MNI economist median was +0.15%

- Sales rose in 4 of 7 major categories; declines in household goods and food

- Auto sales remain 7.1% below pre-pandemic levels

- Inventories were little changed at CAD90b; inventory-sales ratio remained lowest in 2y at 1.37

- Statistics Canada to report flash Sept wholesales on Oct 23

BOC: BUSINESS OUTLOOK SURVEY OVERALL INDICATOR -2.21

BOC: OUTLOOK SURVEY FUTURE SALES GROWTH BALANCE OF OPINION +39

BOC: SURVEY 56% OF FIRMS SEE INFLATION OF 2% OR LESS OVER 2 YRS

BOC: CONSUMERS SEE INFLATION AT 2.03% NOW, 2.22% IN 1 YEAR

BOC: BUSINESS SURVEY INVESTMENT SPENDING PLANS BALANCE OF OPINION +2

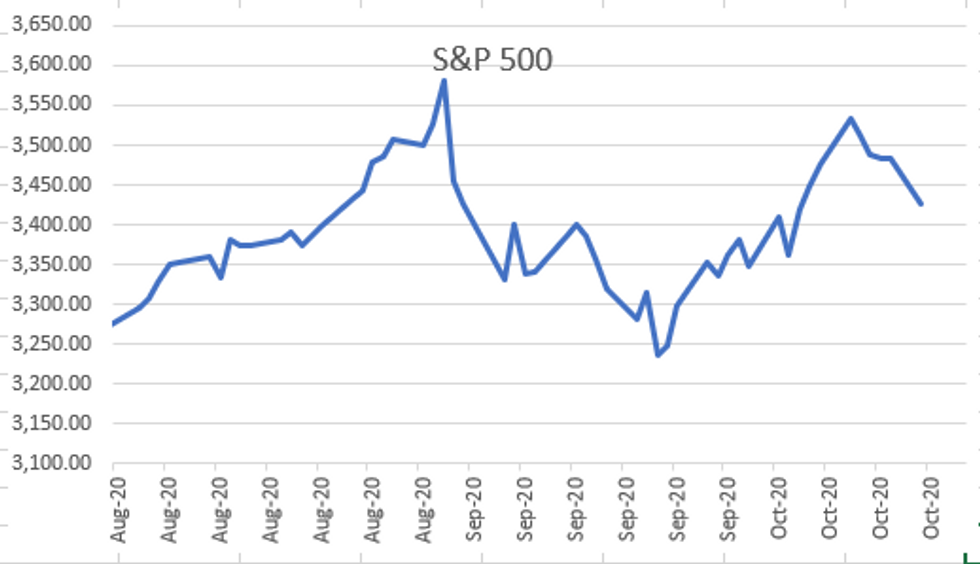

MARKETS SNAPSHOT

- DJIA down 447.29 points (-1.56%) at 28606.31

- S&P E-Mini Future down 47.25 points (-1.36%) at 3491.75

- Nasdaq down 188.8 points (-1.6%) at 11671.56

- US 10-Yr yield is up 1.5 bps at 0.7606%

- US Dec 10Y are down 5/32 at 138-29

- EURUSD up 0.0048 (0.41%) at 1.1763

- USDJPY up 0.04 (0.04%) at 105.37

- WTI Crude Oil (front-month) down $0.21 (-0.51%) at $40.64

- Gold is up $2.93 (0.15%) at $1913.84

- European bourses closing levels:

- EuroStoxx 50 down 2.96 points (-0.09%) at 3264.54

- FTSE 100 down 34.93 points (-0.59%) at 5911.16

- German DAX down 54.33 points (-0.42%) at 12911.61

- French CAC 40 down 6.59 points (-0.13%) at 4976.15

US TSY SUMMARY

Mkts kicked off new wk w/ concerted risk-on tone, Tsys broadly weaker w/ equities climbing early overnight and holding gains into midmorning. Risk appetite supported by hopes of bipartisan breakthrough on relief stimulus.

- Grudging reversal started around midmorning. While a "48 hour" deadline for stim-deal given to WH by House Sp Pelosi over weekend, Sen maj/ldr McConnell's insistence on targeted relief soured hopes (w/"PPP loans, creates liability protection, more unemployment benefits, forgiveness of postal service loan, education assistance")

- Tsys pared losses but remained weaker in second half even as equities continued to extend lows, likely reacting to Bbg headline: "DEMOCRATS SAY DISAGREEMENT ON STIMULUS LANGUAGE REMAINS".

- Markets showed little react to multiple Fed speakers (Fed chair Powell discussed digital currencies; Bostic, Clarida, Kashkari, Harker all hummed party line), while thorny BREXIT negotiations continued. No noticeable market react, but underscores second half risk-off theme: "US IMPOSES SANCTIONS ON CHINESE FOR TIES TO IRAN," Bbg

- The 2-Yr yield is up 0.2bps at 0.1451%, 5-Yr is up 0.8bps at 0.3297%, 10-Yr is up 1.3bps at 0.759%, and 30-Yr is up 1.6bps at 1.5442%.

US TSY FUTURES CLOSE: Weaker by the bell -- but well off midmorning lows on moderate volumes (TYZ>940k just after the bell). Rates reluctantly react to stimulus headlines (DEMOCRATS SAY DISAGREEMENT ON STIMULUS LANGUAGE REMAIN" Bbg) reversal in stocks (ESZ0 -45.0). Yld curves steeper but off highs. Update:

- 3M10Y +1.668, 66.596 (L: 64.999 / H: 68.176)

- 2Y10Y +1.464, 61.517 (L: 60.213 / H: 62.782)

- 2Y30Y +2.078, 140.444 (L: 138.902 / H: 141.933)

- 5Y30Y +1.479, 122.027 (L: 121.022 / H: 123.32)Current futures levels:

- Dec 2Y down 0.125/32 at 110-13.625 (L: 110-13.125 / H: 110-13.75)

- Dec 5Y down 2.25/32 at 125-24 (L: 125-22.25 / H: 125-26)

- Dec 10Y down 5.5/32 at 138-28.5 (L: 138-24 / H: 139-01.5)

- Dec 30Y down 16/32 at 174-13 (L: 173-30 / H: 174-27)

- Dec Ultra 30Y down 29/32 at 218-1 (L: 217-02 / H: 218-26)

US TSYS/SUPPLY: Preview this week's auctions:

- DATE TIME AMOUNT SECURITY (CUSIP)/ANNC

- 19-Oct 1130ET $54B 13W-Bill (9127963V9), 0.100%

- 19-Oct 1130ET $51B 26W-Bill (9127962Q1), 0.115%

- 20-Oct 1130ET $30B 42D-Bill CMB (912796TU3)

- 20-Oct 1130ET $30B 119D-Bill CMB (9127964D8)

- 21-Oct 1130ET TBA 105D Bill CMB 20-Oct

- 21-Oct 1130ET TBA 154D Bill CMB 20-Oct

- 21-Oct 1300ET $22B 20Y-bond/R/O (912810SQ2)

- 22-Oct 1130ET TBA 4W-Bill 20-Oct

- 22-Oct 1130ET TBA 8W-Bill 20-Oct

- 22-Oct 1300ET $17B 5Y-TIPS (91282CAQ4)

US EURODLR FUTURES CLOSE

Mostly weaker, steady/mixed in the short end. Lead quarterly gained since 3M LIBOR fell -0.00975 to new record low of 0.20863%** (-0.00575 last wk). Latest lvls:

- Dec 20 +0.005 at 99.765

- Mar 21 -0.005 at 99.790

- Jun 21 steady at 99.805

- Sep 21 steady at 99.805

- Red Pack (Dec 21-Sep 22) -0.01 to steady

- Green Pack (Dec 22-Sep 23) -0.02 to -0.01

- Blue Pack (Dec 23-Sep 24) -0.025

- Gold Pack (Dec 24-Sep 25) -0.03 to -0.025

- O/N -0.00025 at 0.08088% (-0.00062 last wk)

- 1 Month -0.00800 to 0.14338% (+0.00613 last wk)

- 3 Month -0.00975 to 0.20863%** (-0.00575 last wk)

- 6 Month -0.00325 to 0.25425% (+0.01175 last wk)

- 1 Year +0.00475 to 0.33975% (-0.01263 last wk)

- ** 3M New record Low

US TSYS

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $59B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $159B

- Secured Overnight Financing Rate (SOFR): 0.09%, $914B

- Broad General Collateral Rate (BGCR): 0.06%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $325B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $3.847B submission

- Next scheduled purchase:

- Tue 10/20 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

PIPELINE: T-Mobile Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/19 $4.75B #T-Mobile $1B 11Y +148, $1.25B tap 3% 20Y +160, $1.5B tap 3.3% 30Y +190, $1B 40Y +210 (adds to $4B on Jun 18: $1B +5Y+120, $1.25B +7Y+155, $1.75B +10Y +187.5)

- 10/19 $1.5B *China Development Bank $1B 5Y +75, $500M 10Y +95

- 10/19 $1B *American Honda $450M 1.25Y FRN L+12, $550M 2Y +27 (issued $1.75B on Jan 7: $850M 3Y +40, $400M 3Y FRN +37, $500M 7Y +63)

- 10/19 $1B *Ross Stores $500M +5Y +65, $500M +10Y +115

- 10/19 $1B *KDB $500M 3Y +40, $500M 5.5Y +52.5

- 10/19 $750M *Penske Trucking Leasing +90

- 10/19 $500M #CIBC WNG 5Y Green +63

- On tap for Tuesday

- 10/20 $Benchmark Denmark 2Y +5a

- 10/20 $3B United Airlines 4.1Y EETC deal (enhanced equipment trust certificates, corporate debt securities

FOREX

Strong Single Currency Results in USD Nearing Last Week's Lows Deal-making was once again the focus for the session, with market prices hinging on negotiations taking place in both Washington DC and Brussels/London. A near-term fiscal deal struck between the White House and Nancy Pelosi looking slightly more unlikely ahead of Pelosi's self-imposed Tuesday deadline. The prospects of a Brexit deal looked more favorable, with the EU releasing a statement of intent suggesting both sides will 'intensify' their contacts and the political will remains to strike a compromise. As a result, GBP outperformed, with GBP/USD trading either side of the 1.30 handle and the 1.3015 50-dma at the close.

- The USD was weaker, with the USD index narrowing the gap with last week's lows at 93.005.

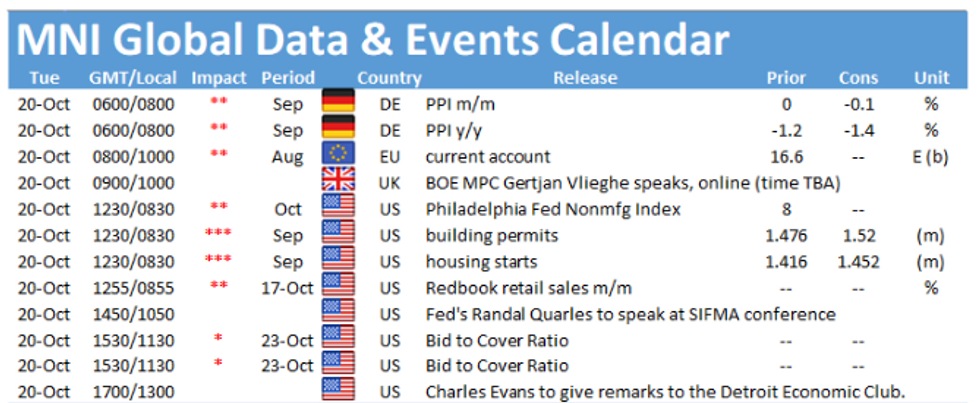

- Focus Tuesday turns to US housing starts & building permits data, as well as speeches from BoE's Vlieghe, ECB's de Cos and four different Fed speakers. The RBA minutes are also on the docket.

EGB: Risk Appetite Recedes

Periphery spreads widened and Bunds/Gilts gained as equities reversed a strong start over the course of Monday's session.

- Brexit headlines featured (esp early as reports suggested the UK gov't could rewrite the contentious Internal Market Bill), with comments from Barnier/Gove in the afternoon pointing to a slim path to a deal. Otherwise, concerns over European recession due to COVID lockdowns weighed on risk.

- Tuesday, BoE's Vlieghe speaks; German Schatz and UK linker sales too. Thin on data

- Closing levels/10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 1.2bps at -0.787%, 5-Yr is down 1.3bps at -0.814%, 10-Yr is down 0.6bps at -0.628%, and 30-Yr is down 1bps at -0.212%.

- UK: The 2-Yr yield is down 1.8bps at -0.073%, 5-Yr is down 1.2bps at -0.088%, 10-Yr is down 1.3bps at 0.169%, and 30-Yr is down 1.9bps at 0.71%.

- Italian BTP spread up 7.5bps at 134.8bps

- Spanish bond spread up 4.1bps at 78.7bps

- Portuguese PGB spread up 3.2bps at 76.8bps

- Greek bond spread up 4bps at 144.9bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.