-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: PPI Inflation Slowing

EXECUTIVE SUMMARY

US: Sharper Moderation In Core PPI Inflation

- PPI final demand ex fd & energy: -0.13% M/M (cons +0.2) in March but the miss is offset by prior upward revisions through Nov-Feb.

- PPI final demand ex food, energy & trade services: 0.07% M/M (cons 0.3) but with smaller upward revisions, with only really the Jan’23 of note at +0.1pp.

- The main takeaway is that PPI inflation has slowed more notably in the past two months, better reflecting the improvement in supply chain pressures although it hasn’t yet fully fed through to core CPI underlying goods – see chart.

US

FED: The Federal Reserve is nearly done raising interest rates because credit conditions are tightening after the recent bank turmoil, but officials will hold policy steady through the end of the year despite market expectations for cuts, former Fed Board Governor Randall Kroszner told MNI.

- “Powell has talked about this – he said in some sense the tightening of credit conditions is likely to help them not have to raise interest rates quite as much because it’s likely to lead to less credit creation, less investment, less employment growth,” Kroszner said in the latest episode of MNI's FedSpeak Podcast.

- “They’re pretty close to where they want to be (on rates). I think they want to get anything with a five handle, so it’ll be 5% to 5.25%. Then I think they’ll hold on for a while. But the markets don’t seem to believe that.”

- Kroszner said investors’ lack of faith in the Fed’s resolve to keep rates at cycle peaks stems from an entire generation of traders that has never actually seen policy so restrictive. For more see MNI Policy main wire at 0957ET.

EUROPE

EU/UK: The UK and the European Union will agree a Memorandum of Understanding on financial services cooperation in the coming weeks and months, but it will be years if ever before the City of London gains access to EU financial markets and the current exception made for clearing is unlikely to be extended when it expires, EU sources told MNI.

- Now that the UK and EU have resolved frictions over the Northern Ireland Protocol, the MoU will set out the basis for regulatory cooperation in the same way as for any third country, including information sharing and how often the two sides meet. But it will not approach so-called EU “equivalence” status for specific UK financial services sectors.

- One obstacle is the technical assessment and process involved in agreeing equivalence for each sector, but more important is the EU’s own political backdrop, which makes further market access for the City of London unlikely in the near term.

- “Politically, why would EU states and the European Parliament want to give the London this advantage post-Brexit. What do we get out of it?” one official said, noting that Paris, Frankfurt, Milan and Dublin have benefitted from business leaking away from the UK. For more see MNI Policy main wire at 1221ET.

US TSYS: Near Late Lows After Posting Strong Gains Post-PPI

- Treasury futures trading weaker but off lows after the bell, no obvious headline or block driver for the reversal. Treasury futures had rallied after PPI came out weaker than estimate: -0.5% vs. 0.0%, weekly claims higher than expected at 239K.

- The main takeaway is that PPI inflation has slowed more notably in the past two months, better reflecting the improvement in supply chain pressures although it hasn’t yet fully fed through to core CPI underlying goods.

- June 10Y futures marked session high of 116-03 by midmorning, 10Y yield low of 3.3681%, before retracing through the second half to 115-12.5 low and 3.4562% high yield. Curves maintained steeper profiles, however, as short end rates kept pace with the intermediates, 2s10s currently +4.905 at -52.444.

- Fed funds implied hike for May'23 held steady around 18.4bp, as well as Jun'23, while projected rate cuts later in the year have receded slightly from this morning's levels: Nov'23 cumulative -31.5bp to 4.511%, Dec'23 cumulative -49.5bp at 4.331. Fed Terminal currently at 5.01% in Jun'23.

- Friday focus: Fed Speak, Import/Export prices, Retail Sales, Industrial Production, Capacity Utilization and UofM sentiment.

OVERNIGHT DATA

- US MAR FINAL DEMAND PPI -0.5%, EX FOOD, ENERGY -0.1%

- US MAR FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.1%

- US MAR FINAL DEMAND PPI Y/Y +2.7%, EX FOOD, ENERGY Y/Y +3.4%

- US MAR PPI: FOOD +0.6%; ENERGY -6.4%

- US JOBLESS CLAIMS +11K TO 239K IN APR 08 WK

- US PREV JOBLESS CLAIMS REVISED TO 228K IN APR 01 WK

- US CONTINUING CLAIMS -0.013M to 1.810M IN APR 01 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 385.28 points (1.15%) at 34030.9

- S&P E-Mini Future up 54.75 points (1.33%) at 4173.75

- Nasdaq up 238 points (2%) at 12166.95

- US 10-Yr yield is up 6 bps at 3.4506%

- US Jun 10-Yr futures are down 7/32 at 115-15.5

- EURUSD up 0.0055 (0.5%) at 1.1047

- USDJPY down 0.41 (-0.31%) at 132.72

- WTI Crude Oil (front-month) down $1 (-1.2%) at $82.24

- Gold is up $22.75 (1.13%) at $2037.57

- EuroStoxx 50 up 29.21 points (0.67%) at 4363.24

- FTSE 100 up 18.54 points (0.24%) at 7843.38

- German DAX up 25.86 points (0.16%) at 15729.46

- French CAC 40 up 83.89 points (1.13%) at 7480.83

US TREASURY FUTURES CLOSE

- 3M10Y +7.111, -160.768 (L: -169.553 / H: -159.358)

- 2Y10Y +4.947, -52.402 (L: -58.402 / H: -50.787)

- 2Y30Y +5.194, -28.73 (L: -35.616 / H: -26.102)

- 5Y30Y +2.47, 18.357 (L: 15.04 / H: 20.556)

- Current futures levels:

- Jun 2-Yr futures down 0.25/32 at 103-12.5 (L: 103-11 / H: 103-17.75)

- Jun 5-Yr futures down 4.25/32 at 109-31.5 (L: 109-29.5 / H: 110-13.25)

- Jun 10-Yr futures down 7.5/32 at 115-15 (L: 115-12.5 / H: 116-03)

- Jun 30-Yr futures down 11/32 at 131-26 (L: 131-22 / H: 133-01)

- Jun Ultra futures down 22/32 at 141-13 (L: 141-09 / H: 143-08)

Watching Support At The 20-Day EMA

- RES 4: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 3: 117-01+ High Mar 24 and bull trigger

- RES 2: 116-30 High Apr 5 / 6

- RES 1: 116-08 High Apr 12

- PRICE: 115-23 @ 1220ET Apr 13

- SUP 1: 115-05 20-day EMA

- SUP 2: 114-18 Low Apr 3

- SUP 3: 114-13+ 50-day EMA

- SUP 4: 114-07 Low Mar 29 and 30 and a key support

Treasury futures remain below Wednesday’s high of 116-08. Initial support to watch lies at 115-05, the 20-day EMA. This average has recently provided support, however, a break would signal scope for a deeper retracement - down to 114-18 potentially, the Apr 3 low. For now, a bullish theme remains intact and moving average studies highlight an uptrend. Resistance at 117-01+, the Mar 24 high, is the bull trigger.

EURODOLLAR FUTURES CLOSE

- Jun 23 +0.010 at 94.735

- Sep 23 steady at 95.115

- Dec 23 steady at 95.480

- Mar 24 -0.005 at 95.930

- Red Pack (Jun 24-Mar 25) -0.03 to -0.005

- Green Pack (Jun 25-Mar 26) -0.045 to -0.03

- Blue Pack (Jun 26-Mar 27) -0.06 to -0.045

- Gold Pack (Jun 27-Mar 28) -0.06 to -0.055

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00835 to 4.88952

- 3M -0.00355 to 4.98632

- 6M -0.02473 to 4.96063

- 12M -0.04950 to 4.71602

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00272 to 4.81214% (+0.00243 total last wk)

- 1M +0.00200 to 4.94771% (+0.04742 total last wk)

- 3M +0.00900 to 5.26029% (+0.06243/wk)*/**

- 6M -0.03586 to 5.30614% (-0.10186 total last wk)

- 12M -0.08072 to 5.28571% (-0.21701 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.25129% on 4/12/23

- Daily Effective Fed Funds Rate: 4.83% volume: $114B

- Daily Overnight Bank Funding Rate: 4.82% volume: $283B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.358T

- Broad General Collateral Rate (BGCR): 4.77%, $527B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $523B

- (rate, volume levels reflect prior session)

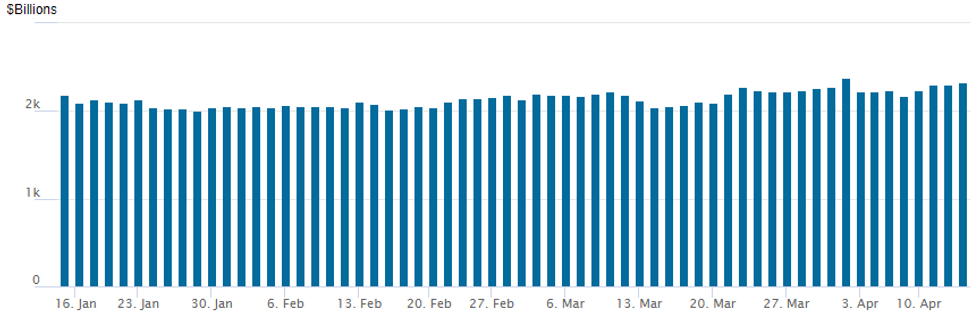

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,321.699B w/ 101 counterparties, compares to prior $2,303.862B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

PIPELINE: $1.5B American Honda 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 04/13 $1.5B #American Honda $800M 2Y +65, $700M 7Y +115

- 04/13 $1B *OMERS Finance Trust 5Y SOFR +83

EGBs-GILTS CASH CLOSE: Twist Steepening As Hike Expectations Retrace

The German and UK curves modestly twist steepened Thursday, with the short end benefiting from a retracement in central bank tightening expectations.

- Yields hit a session low in mid-afternoon as markets digested a softer-than-expected US producer price report, but edged back toward opening levels as equities picked up some steam toward the close.

- ECB implied rate pricing hit a session low early on after a Reuters sources story pointing to the Governing Council hiking 25bp at the May meeting vs the 50bp floated by Holzmann on Weds, remaining steady thereafter (peak depo down 6bp on the day, BoE's -4bp).

- BoE Chief Econ Pill told an MNI event that the UK could see a positive demand shock amid a strong labor market, but remained ambiguous on the outlook for rate hikes, saying there is scope to do too much as well as too little.

- Periphery EGB spreads widened slightly, with Greece underperforming.

- Friday's docket includes final French and Spanish CPI, with BOE's Tenreyro and ECB's Nagel scheduled to speak.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.7bps at 2.779%, 5-Yr is down 0.5bps at 2.392%, 10-Yr is up 0.2bps at 2.372%, and 30-Yr is up 1.7bps at 2.462%.

- UK: The 2-Yr yield is down 0.2bps at 3.517%, 5-Yr is up 0.1bps at 3.406%, 10-Yr is up 0.5bps at 3.575%, and 30-Yr is up 4.7bps at 3.942%.

- Italian BTP spread up 0.5bps at 185bps / Greek up 1.6bps at 189.4bps

FX: Firmer Risk Sentiment Weighs Further On Greenback, AUD & NZD Rise Over 1.5%

- Below-expectation US data and a strong recovery for major equity indices on Thursday further weighed on the US dollar, prompting the DXY (-0.52%) to narrow the gap significantly with the year’s lows at 100.82. The firmer risk backdrop underpinned an impressive rally for the likes of AUD & NZD, while the Swiss Franc extended its most recent upward trend.

- For AUDUSD, an additional tailwind was firmer jobs data overnight, with both the employment change and the unemployment rate coming in better than expectations. The continued strength has seen the pair rise to a new seven-week high of 0.6797.

- On the tech side, AUDUSD has topped the 50-day EMA convincingly on Thursday amid the widespread greenback weakness. This works against the broader downtrend and key short-term resistance at the April 04 high has been pierced. Attention now turns to 0.6824, the Feb 24 high.

- CHF again trades well, with USD/CHF through to new YTD lows as well as breaching the February 2021 low at 0.8871. The pair was yet to hit technically oversold levels, however, today’s price action could tip the 30-day RSI below 30 for the first time since November.

- Elsewhere in G10, EUR/USD now sits north of the noted 1.1033 resistance, while GBP/USD has made a new trend high above the bull trigger at 1.2525.

- USDJPY traded poorly following the US data, falling over a big figure from 133.17 to 132.02 lows. Despite the renewed weakness, the slightly higher US yields and the grind higher for stocks has seen the pair recover around 70 pips of the moves as we approach the APAC crossover.

- US retail sales and UMich sentiment and inflation expectations data headline Friday’s docket to finish the week.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/04/2023 | 0600/0800 | *** |  | SE | Inflation report |

| 14/04/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 14/04/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 14/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank Spring Meetings | |

| 14/04/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/04/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 14/04/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/04/2023 | 1245/0845 |  | US | Fed Governor Christopher Waller | |

| 14/04/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/04/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 14/04/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/04/2023 | 1400/1000 | * |  | US | Business Inventories |

| 14/04/2023 | 1600/1700 |  | UK | BOE Tenreyro Panellist at the IMF Meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.