-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN:Rate Cut Pricing Gathers Momentum Post Jobs Data

- MNI US FED: Fed: Policy Well Positioned To Respond To Risks

- MNI US DATA: Unemployment Rate Climbs Further On Supply Rebound

- MNI US DATA: Large Downward NFP Revisions

US

US FED (MNI): Fed: Policy Well Positioned To Respond To Risks

U.S. monetary policy is well-positioned to respond to persistent inflation on one side and a weaker-than-expected labor market on the other, and the central bank is still waiting for greater confidence that inflation is moving steadily toward its 2% goal before lowering interest rates, the Federal Reserve said in asemiannual reportto Congress on Friday.

- Inflation eased modestly so far this year, the Fed said, noting in particular a lack of further progress on disinflation in core non-housing services prices and higher energy prices amid concerns over conflicts in the Middle East and OPEC production cuts. Housing inflation also stayed high, but the Fed said market rent measures indicate it should return to pre-pandemic levels at some point. Softening labor demand and expanding supply also suggest disinflation will resume for nonhousing services, the Fed said.

- Simple monetary policy rules are currently calling for levels of the federal funds rate that are close to or below the current target range, the Fed also noted.

NEWS

US (MNI): Prominent Group Of Donors And Business Leaders Call On Biden To Withdraw:

A prominent group of, “political donors, civic leaders and business executives founded to protect the institutions of American democracy” have sent a letter to President Biden urging him to withdraw his bid for reelection, according to the Washington Post. The group writes: “We respectfully urge you to withdraw from being a candidate for reelection for the sake of our democracy and the future of our nation.”

UK (MNI): Sunak To Step Down As Conservative Leader; Change Of Gov't Taking Place:

Rishi Sunak has delivered his final address as PM from outside 10 Downing St following the historic loss for his Conservative party in the 4 July election. During his speech he apologised for the party's catastrophic performance, saying "I have heard your anger, disappointment and I take responsibility for this loss," He confirmed that he would resign as party leader, but not immediately.

IRAN (MNI): Presidential Run-Off Underway, Outcome On A Knife-Edge:

Iran's presidential run-off is underway, with reformist candidate Masoud Pezeshkian up against conservative hardliner Saeed Jalili. Turnout in the 28 June first round came in at a record low of 39.9%, down from 48.4% in 2021 and 73.3% in 2017, reflecting widespread voter disatissfaction with the country's economic situation but also the nature of the religious establishment led by Supreme Leader Ayatollah Ali Khamenei in charge of the country.

US TSYS Well Bid After Prior Jobs Gains Down Revised

- Treasury futures briefly gapped lower in response to mildly higher than expected June jobs gain of +206k vs. +190k est -- but quickly reversed course, extending session highs after prior jobs data was down revised.

- A small beat for NFP growth of 206k (cons 190k) but with a return of heavy downward revisions. Two-month -111k, split evenly over May and April. Private sees surprises lower though, 136k (cons 160k) along with a -86k two-month revision skewed a little more to April.

- The unemployment rate was stronger than expected as it increased to 4.05% in June (cons 4.0 with some skew to a 3.9 print). The 4.1 rounding on screens exaggerates the increase, but it's another 0.1pp increase from 3.96% in May and 3.86% in April.

- Tsy Sep'24 10Y futures traded down to 109-17.5 low before rebounding to 110-17.5 high. Late buying saw the contract trading 110-19 (+17.5). Technical resistance at 111-01 High Jun 14 and the bull trigger.

- Focus turns to June CPI next Thursday and PPI Friday. The latest equity earnings cycle kicks off next week Friday as well, banks headlining: Wells Fargo, Bank of NY Mellon, JP Morgan and Citigroup.

OVERNIGHT DATA

US DATA (MNI): Large Downward NFP Revisions

A small beat for NFP growth of 206k (cons 190k) but with a return of heavy downward revisions.

- Two-month -111k, split evenly over May and April. Private sees surprises lower though, 136k (cons 160k) along with a -86k two-month revision skewed a little more to April.

- Total AHE: M/M (SA): 0.287% in Jun (cons 0.3) from 0.432% in May (initial 0.403%); Y/Y (SA): 3.858% in Jun from 4.055% in May

- AHE Non-Supervisory: M/M (SA): 0.334% in Jun from 0.402% in May (initial 0.469%); Y/Y (SA): 3.979% in Jun from 4.029% in May. Source: Bloomberg, MNI

US DATA (MNI): Unemployment Rate Climbs Further On Supply Rebound

The unemployment rate was stronger than expected as it increased to 4.05% in June (cons 4.0 with some skew to a 3.9 print). The 4.1 rounding on screens exaggerates the increase, but it's another 0.1pp increase from 3.96% in May and 3.86% in April.

- Household employment did indeed bounce, but only +116k after -408k. The labor force meanwhile +277k after -250k (all sa changes).

- The participation rate increased from 62.53 to 62.59% (as expected, cons 62.6) but it came with another fresh post-2002 high for prime age participation at 83.7%.

- Perhaps more surprisingly was no bounce in the 55+ cohort for participation, holds at a post-pandemic low for 2.1pps below pre-pandemic levels (although the continued climb in equities is certainly not hurting 401ks).

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 38.62 points (0.1%) at 39346.75

- S&P E-Mini Future up 28.5 points (0.51%) at 5618.75

- Nasdaq up 160.6 points (0.9%) at 18349.58

- US 10-Yr yield is down 8.6 bps at 4.2725%

- US Sep 10-Yr futures are up 17.5/32 at 110-19

- EURUSD up 0.0028 (0.26%) at 1.084

- USDJPY down 0.56 (-0.35%) at 160.72

- WTI Crude Oil (front-month) down $0.66 (-0.79%) at $83.22

- Gold is up $35.35 (1.5%) at $2391.99

- European bourses closing levels:

- EuroStoxx 50 down 8.09 points (-0.16%) at 4979.39

- FTSE 100 down 37.33 points (-0.45%) at 8203.93

- German DAX up 24.97 points (0.14%) at 18475.45

- French CAC 40 down 20.16 points (-0.26%) at 7675.62

US TREASURY FUTURES CLOSE

- 3M10Y -8.119, -111.534 (L: -111.924 / H: -100.558)

- 2Y10Y +2.449, -32.894 (L: -37.243 / H: -32.146)

- 2Y30Y +5.222, -13.211 (L: -18.596 / H: -12.36)

- 5Y30Y +4.711, 24.764 (L: 20.159 / H: 26.032)

- Current futures levels:

- Sep 2-Yr futures up 5.5/32 at 102-10.375 (L: 102-00.625 / H: 102-10.625)

- Sep 5-Yr futures up 12/32 at 107-0.75 (L: 106-10.5 / H: 107-01.75)

- Sep 10-Yr futures up 17.5/32 at 110-19 (L: 109-17.5 / H: 110-20)

- Sep 30-Yr futures up 25/32 at 118-25 (L: 117-02 / H: 118-30)

US 10YR FUTURE TECHS: (U4) Corrective Recovery Supported by NFP

- RES 4: 111-17+ 1.236 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 111-13 High Mar 25

- RES 2: 111-01 High Jun 14 and the bull trigger

- RES 1: 110-20 High Jul 05

- PRICE: 110-18 @ 1450 ET Jul 5

- SUP 1: 109-02+/109-00+ Low Jul 1 / Low Jun 10 and key support

- SUP 2: 108-27+ Low Jun 3

- SUP 3: 108-19 Trendline drawn from the Apr 25 low

- SUP 4: 107-31 Low May 29 and a key support

Treasuries recovered further off recent lows on the back of the soft NFP print, however the bounce stopped short of any meaningful test of the first resistance and bull trigger at 111-01 - the June 14th high. Despite the latest bounce, the contract remains vulnerable following recent weakness. The bearish breach of both the 20- and 50-day EMAs signals scope for a continuation lower near-term. Such a move would open 109-00+, the Jun 10 low as well as 108-19, a trendline drawn from the Apr 25 low.

SOFR FUTURES CLOSE

- Sep 24 +0.020 at 94.890

- Dec 24 +0.060 at 95.225

- Mar 25 +0.10 at 95.555

- Jun 25 +0.120 at 95.825

- Red Pack (Sep 25-Jun 26) +0.110 to +0.125

- Green Pack (Sep 26-Jun 27) +0.090 to +0.105

- Blue Pack (Sep 27-Jun 28) +0.075 to +0.085

- Gold Pack (Sep 28-Jun 29) +0.065 to +0.070

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00468 to 5.32743 (-0.00974/wk)

- 3M -0.00737 to 5.30689 (-0.01771/wk)

- 6M -0.01049 to 5.22647 (-0.02824/wk)

- 12M -0.01484 to 5.00549 (-0.03455/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (-0.02), volume: $2.007T

- Broad General Collateral Rate (BGCR): 5.32% (-0.01), volume: $756B

- Tri-Party General Collateral Rate (TGCR): 5.32% (-0.01), volume: $742B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $257B

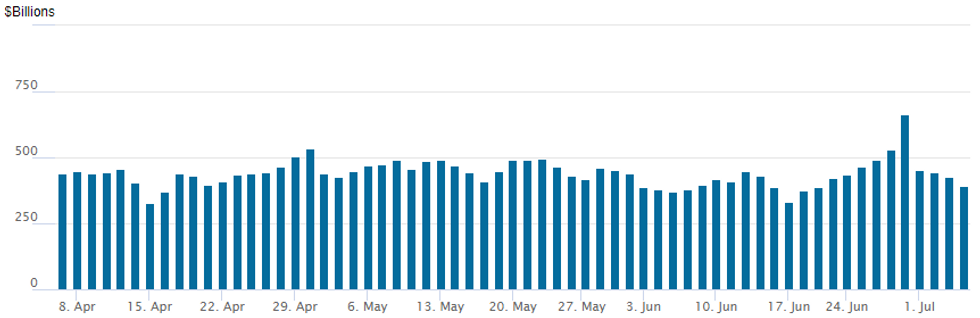

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage continues to recede with the latest read at $390,632B from $425.898B prior. Number of counterparties falls to 68 from 70 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

FOREX: Greenback Little Changed Following NFP, Moderate GBPUSD Strength Persists

- The greenback whipsawed in the aftermath of the US employment data on Friday, showed a small beat for NFP growth, but heavy 111k downward revisions to the two previous months. A very small upward revision to the unemployment rate leaves the USD index marginally in the red as we approach the close.

- USDJPY was the most volatile, briefly trading down to 160.35 and capitalising on an earlier yen rebound. However, markets lacked conviction following the US holiday and USDJPY whipped back above 161.00, a level at which the pair has been consolidating ahead of the weekend close.

- In contrast, EURUSD trade remained very subdued on Friday, keeping just a 38 pip range for the entire session. The mixed data kept fresh positioning in check, potentially exacerbated by the upcoming 2nd round election in France this weekend.

- UK election results came and went with little market reaction. As expected over the past few weeks and months, the opposition Labour party won a sizeable majority in the Commons, and will form the next government, displacing the Conservatives and ousting the PM Sunak. GBP initially proved relatively unresponsive, however, the firm footing for equity markets has helped GBPUSD rise 0.3% on Friday. This has also helped EURGBP edge further from well touted resistance at 0.8500, a level that held well earlier in the week.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/07/2024 | - |  | FR | Second round election | |

| 08/07/2024 | 2301/0001 | ** |  | UK | KPMG/REC Jobs Report |

| 08/07/2024 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 08/07/2024 | 0500/1400 |  | JP | Economy Watchers Survey | |

| 08/07/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 08/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 08/07/2024 | 1615/1715 |  | UK | BoE Haskel at ESCoE | |

| 08/07/2024 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.