-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk-Rally Amid UK Political Turmoil

EXECUTIVE SUMMARY

UK

BOE: UK: Spox Says Truss Not Resigning As Fourth Conservative MP Calls For PM To Go: Comments from UK PM Liz Truss' spokesman Max Blain hitting wires. Says that PM Truss is not resigning and that there are 'no plans' to change the windfall tax on energy. Comes as four Conservative MPs have now openly called for Truss to go:

- Spox: We believe economic stability is important, that's why we've made changes...the PM and chancellor still believe in the need to focus on economic growth...it is right to acknowledge the circumstances and to change course, no single factor prompted it.

BOE: Recent market turmoil means the Bank of England’s five-member Executive will need to consider pushing back the start of active gilt sales from Oct 31, though the initially positive reaction to government U-turns on tax cuts and fiscal support for higher energy prices may ease concerns over further delays to the plans.

- Members of the Executive, comprised of Governor Andrew Bailey and four deputy governors, must take an operational decision on whether to proceed with the sales, which were always contingent on market conditions and whose initial planned start date was postponed for a month on Sept 28. (See MNI INSIGHT: BOE's QT Pace Known, Terminal Point Unknowable)

- The BOE’s nine-member Monetary Policy Committee, in which all of the executive also sit, has already given the green light for gilt sales of around GBP10 billion a quarter. It is not involved in operational activities, though it was informed of the Sept 28 decisions, when the Bank was forced to intervene in gilt markets to assist distressed pension funds in the wake of Sept 23’s mini-budget fiscal giveaways. For more see MNI Policy main wire at 1212ET.

- Livestream: https://www.youtube.com/watch?v=jDtfioiaBMU

- Hunt: 'We are a country that funds our promises and pays our debts'.

- Hunt: 'We must take decisions of eye-watering difficulty if needed'.

- Hunt: "We need to do more, more quickly to give markets certainty'.

- Hunt: "UK economic volatility due to a lack of an OBR forecast related to the mini-budget, inflation, and interest pressures around the world'.

- Treasury tweets: "The repeals of the 2017 and 2021 reforms to the off-payroll working rules known as IR35 from April 2023 will no longer take place. This is worth around £2 billion a year."

CANADA

BOC: Bank of Canada surveys published Monday show consumers and executives see record high inflation even as they also predict a recession is coming in the next year, firming up the case for Governor Tiff Macklem to hike interest rates by at least another half percentage point next week.

- Inflation will be 7.1% a year from now, a record high in the Bank's quarterly survey of consumers, and close to the current rate of 7%. The current inflation rate was seen at 8%, in line with the four-decade high reached earlier this year. Households also said borrowing costs will be about 5.1% a year from now, versus the Bank's overnight policy rate of 3.25%. Survey results were gathered in August and September.

- Nearly four in five households also said the odds of a recession in the next year is at least 50%, citing wages that are lagging inflation and higher interest rates. Business owners also held similar views but about three-quarters of them said the recession would be caused by interest-rate hikes. For more see MNI Policy main wire at 1030ET.

US/UK

The US and the UK are set to announce a deepening on sanctions on Russia and countries seen as helping Moscow evade sanctions.

- According to the FT, a joint statement expected to be released today taking "colabortation to a new level."

- The statement reads: “We will identify opportunities to pool expertise, [...] to align the way we implement sanctions, and to assist our stakeholders...

US TSYS: Bonds Reverse Early UK-Tied Support

Tsy yield curves running steeper after the bell, short end outperforming, long end finishing near late session lows on modest volumes (TYZ2<1M). Market continues to weigh impact of reversal nearly all measures from UK 23 September mini-budget this morning.

- Officials say that PM Truss is not resigning and that there are 'no plans' to change the windfall tax on energy. Comes as four Conservative MPs have now openly called for Truss to go.

- Bonds lead the reversal off early session highs - no obvious headline driver. Any react to weaker-than-expected headline Empire number (-9.1 vs -4.3 survey and -1.5 prior) lost in the early morning shuffle.

- Data focus turns to IP/Cap-U, Net TIC flows on tap Tuesday.

- US Tsy auctions: No supply Tuesday.

- Fed speakers resume Tuesday:

- Atlanta Fed Bostic, mediated virtual discussion, no text at 1400ET

- MN Fed Kashkari on economy, moderated Q&A at 1730ET

OVERNIGHT DATA

NY FED'S EMPIRE STATE CURRENT BUSINESS CONDITIONS INDEX -9.1 IN OCTOBER VS -1.5 IN SEPTEMBER

NY Fed Data: Weaker-than-expected headline Empire number (-9.1 vs -4.3 survey and -1.5 prior), with the main forward-looking indicators (6-month General Business Conditions and New Orders) ticking lower though Capex looked strong

- Current employment was mixed (longer workweek, fewer employees) with prices received basically flat but prices paid higher. That said, forward expectations for prices and employment indicators were pretty flat.

BOC OUTLOOK SURVEY: FUTURE SALES GROWTH BALANCE OF OPINION -18

- BANK OF CANADA BUSINESS OUTLOOK SURVEY OVERALL INDICATOR +1.69

- BOC: CONSUMERS SEE INFLATION AT 7.96% NOW, 7.11% IN 1 YEAR

- BOC: FIRMS SEEING +3% INFLATION IS 77% FROM RECORD 78%

- BOC: 76% OF FIRMS FACE CAPACITY CONSTRAINTS VS PRIOR 78%

- FUTURE SALES GROWTH BALANCE OF OPINION -18 VS PRIOR -26

- BOC: CONSUMER VIEW OF CURRENT CPI IS RECORD 8% FROM 6.1%

- BOC: CONSUMER VIEW OF INFLATION IN 1 YEAR 7.1% FROM 6.8%

- MAJORITY OF FIRMS SAY RECESSION LIKELY IN NEXT YEAR: BOC

MARKETS SNAPSHOT

Key late session market levels:

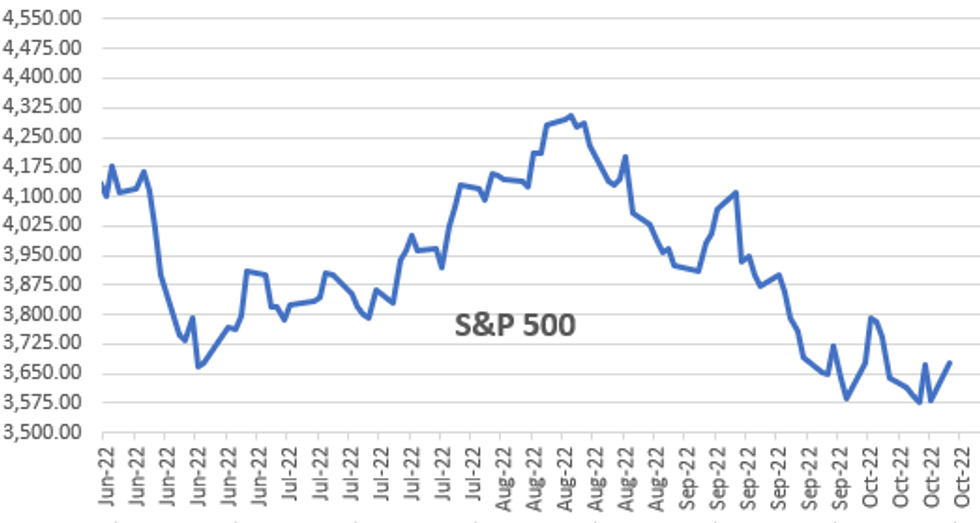

- DJIA up 536.05 points (1.81%) at 30173.91

- S&P E-Mini Future up 90.25 points (2.51%) at 3687.5

- Nasdaq up 342 points (3.3%) at 10664.32

- US 10-Yr yield is down 0.4 bps at 4.0145%

- US Dec 10Y are up 2.5/32 at 110-21.5

- EURUSD up 0.0116 (1.19%) at 0.9839

- USDJPY up 0.28 (0.19%) at 148.94

- WTI Crude Oil (front-month) down $0.07 (-0.08%) at $85.52

- Gold is up $5.35 (0.33%) at $1649.94

- EuroStoxx 50 up 59.91 points (1.77%) at 3441.64

- FTSE 100 up 61.45 points (0.9%) at 6920.24

- German DAX up 211.22 points (1.7%) at 12649.03

- French CAC 40 up 108.74 points (1.83%) at 6040.66

US TSY FUTURES CLOSE

- 3M10Y -5.246, 22.969 (L: 16.896 / H: 25.947)

- 2Y10Y +3.615, -44.355 (L: -52.082 / H: -44.132)

- 2Y30Y +6.364, -44.287 (L: -51.547 / H: -43.755)

- 5Y30Y +5.019, -22.77 (L: -27.703 / H: -21.377)

- Current futures levels:

- Dec 2Y up 3.75/32 at 102-8.625 (L: 102-04.125 / H: 102-11.875)

- Dec 5Y up 4.5/32 at 106-17.5 (L: 106-12.5 / H: 107-00)

- Dec 10Y up 2.5/32 at 110-21.5 (L: 110-18 / H: 111-13)

- Dec 30Y down 12/32 at 123-11 (L: 123-10 / H: 124-28)

- Dec Ultra 30Y down 25/32 at 131-9 (L: 131-07 / H: 133-10)

US 10Y FUTURE TECHS: : (Z2) Trend Conditions Remain Bearish

- RES 4: 115-13+ Low Sep 7

- RES 3: 114-31+ 38.2% retracement of the Aug 2 - Sep 28 bear leg

- RES 2: 112-14/113-30 20-day EMA / High Oct 4 and the bull trigger

- RES 1: 111-28+ High Oct 12

- PRICE: 110-24 @ 19:42 BST Oct 20

- SUP 1: 110-00 Psychological Support

- SUP 2: 109-23+ Low Nov 30 2007 (cont)

- SUP 3: 108-18+ 1.00 projection of the Oct 4 - 11 - 13 price swing

- SUP 4: 108.14 3.0% 10-dma envelope

Treasuries remain vulnerable. Last week, the contract breached 110-19, the Sep 28 low and bear trigger. This resulted in a break out of the recent consolidative range and highlights a resumption of the downtrend plus maintains the price sequence of lower and lower highs. The focus is on 110.00, a break would strengthen bearish conditions. Initial key resistance is at 112-14, the 20-day EMA. Gains would be considered corrective.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.015 at 94.910

- Mar 23 +0.030 at 94.790

- Jun 23 +0.045 at 94.855

- Sep 23 +0.050 at 95.020

- Red Pack (Dec 23-Sep 24) +0.055 to +0.060

- Green Pack (Dec 24-Sep 25) +0.030 to +0.045

- Blue Pack (Dec 25-Sep 26) +0.010 to +0.025

- Gold Pack (Dec 26-Sep 27) -0.005 to +0.010

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00528 to 3.06086% (-0.01043 total last wk)

- 1M +0.03686 to 3.47986% (+0.12943 total last wk)

- 3M +0.03286 to 4.22657% (+0.28814 total last wk) * / **

- 6M -0.01158 to 4.67371% (+0.30058 total last wk)

- 12M +0.02930 to 5.31244% (+0.28685 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.19371% on 10/14/22

- Daily Effective Fed Funds Rate: 3.08% volume: $110B

- Daily Overnight Bank Funding Rate: 3.07% volume: $287B

- Secured Overnight Financing Rate (SOFR): 3.04%, $958B

- Broad General Collateral Rate (BGCR): 3.00%, $387B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $370B

- (rate, volume levels reflect prior session)

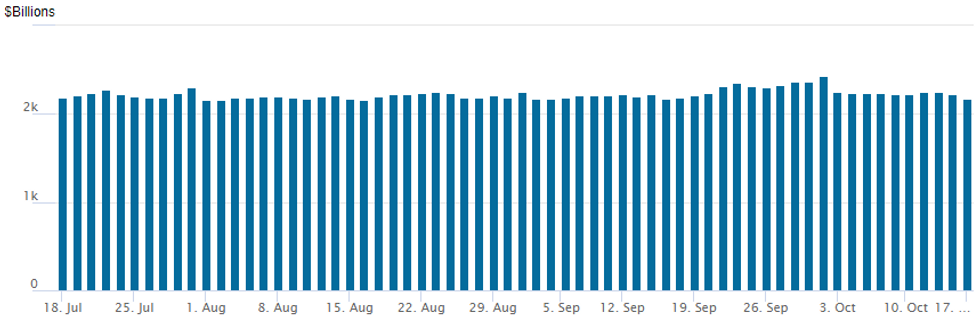

FED Reverse Repo Operation

NY Ferderal Reserve/MNI

NY Fed reverse repo usage recedes to $2,172.301B w/ 98 counterparties vs. $2,222.052B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $3.85B To Price Monday

- Still waiting on Kommunalbanken (KBN) to launch, however:

- Date $MM Issuer (Priced *, Launch #)

- 10/17 $1.1B #Diamondback Energy (FANG) +10Y +230

- 10/17 $1B Kommunalbanken (KBN) 3Y SPOFR+43a

- 10/17 $750M #Bank of Nova Scotia 60NC5 8.625%

- 10/17 $400M #Nevada Power 30Y +190

- 10/17 $600M #BAT Capital 10Y +380

- 10/17 $Benchmark OPEC Fund investor call

- 10/?? $1B Export Finance Australia 5Y this week

EGBs-GILTS CASH CLOSE: Rally As UK Gov't Follows Through With U-Turn

The UK curve saw massive bull flattening Monday, with Gilts easily outperforming their global counterparts as the government followed through with the anticipated "U-turn" on its fiscal programme.

- 10Y Gilt yields saw the 2nd biggest drop since 1992 (only September 28th's 49bp drop surpassed it).

- Terminal BoE pricing fell by over 50bp (now seen around 5.1-5.2% in mid-2023, vs 100bp above that as recently as late September).

- German yields saw a solid drop with bull flattening as well, but unremarkable in comparison with the UK move.

- Periphery EGB spreads mostly narrowed in a risk-on session.

- ECB's Nagel speaks after the market close.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 0.2bps at 1.954%, 5-Yr is down 3.4bps at 2.08%, 10-Yr is down 7.7bps at 2.269%, and 30-Yr is down 10.5bps at 2.294%.

- UK: The 2-Yr yield is down 32.7bps at 3.589%, 5-Yr is down 37.6bps at 3.942%, 10-Yr is down 35.8bps at 3.977%, and 30-Yr is down 40.6bps at 4.378%.

- Italian BTP spread down 5.6bps at 238.8bps / Greek up 6.9bps at 267bps

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/10/2022 | 0030/1130 |  | AU | RBA policy meeting minutes | |

| 18/10/2022 | 0800/1000 |  | IT | Trade Balance | |

| 18/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/10/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/10/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 18/10/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/10/2022 | 1600/1800 |  | EU | ECB Schnabel Alumni Event at Uni Mannheim | |

| 18/10/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/10/2022 | 2000/1600 | ** |  | US | TICS |

| 18/10/2022 | 2130/1730 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.